Block 1: Key news

- JPMorgan expands its tokenization services

JPMorgan has launched a new blockchain-based service called the Tokenized Collateral Network (TCN), which simplifies and speeds up collateral exchanges by tokenizing them. Influential companies such as BlackRock and Goldman Sachs are already customers of the service, according to Bloomberg. Specifically, TCN enables operators to use various assets as collateral and transfer ownership of this collateral without moving the actual assets. The service is said to significantly reduce operational friction, enabling collateral transfers to be almost instantaneous, compared with traditional methods which can take up to 24 hours.

- Ethereum Foundation sells $2.7 million worth of ETH

The Ethereum Foundation sold 1,700 ETH, equivalent to $2.7 million at the time of sale on October 9, converted into USDC on Uniswap. Historically, such sales by the Foundation are sometimes followed by declines in the ETH price. However, the current sale is relatively modest compared with previous transactions, such as the one last May when $28.5 million in ETH was transferred. No reason was given for the October ETH sale.

- 14 years ago, the first bitcoin transaction was carried out

On October 12, 2009, the first Bitcoin (BTC) sale was carried out by Martti Malmi, where 5050 BTC - which today would be worth over $130 million - were sold for just $5.02 via PayPal. At the time, one BTC was worth $0.001. Since then, the value of BTC has climbed exponentially, with one bitcoin today equivalent to $26,760, multiplying the initial value by more than 26.9 million times.

- Kraken proliferates in Europe

Kraken, a cryptocurrency exchange, has announced the acquisition of Coin Meester BV (BCM), a Netherlands-based crypto broker, as part of its European expansion plans. The acquisition, which comes after the recent registration of Kraken in Spain, is strategic in view of the upcoming MiCA regulation in Europe. BCM, launched in 2017, offers trading in over 170 cryptocurrencies, and its integration will strengthen Kraken's presence in the Netherlands, a key market characterized by high cryptocurrency adoption compared to other European countries.

Block 2: Crypto Analysis of the week

Former Alameda Research director Caroline Ellison just spoke in a courtroom full of anticipation and scrutinizing glances. As a reminder, Alameda Research, founded by SBF in 2017, was operated as a cryptocurrency hedge fund by conducting, often covertly, the purchase and sale of various digital currencies on the FTX exchange platform.

In a testimony eagerly awaited by both the media and the court, Ms. Ellison, barely 28 years old and a former romantic partner of SBF, stated that she had committed financial offences with the former FTX CEO, and that he had ordered Alameda to "borrow as much as possible".

Ellison's testimony lived up to the hype. She accurately described the channels through which billions of FTX customer funds flowed into the arteries of the defunct cryptocurrency platform.

Cameras are not allowed inside the courtroom, which means Bankman-Fried and Caroline Ellison's appearance can only be gleaned from courtroom sketches.

In particular, Ellison said she was already concerned in 2020 about the use of FTX customer funds through the $65 billion line of credit Alameda had contracted with FTX, because "it was something that customers weren't aware of and wouldn't have appreciated if they had known about it". She says she raised these concerns with Mr. Bankman-Fried, including in 2020, asking him if the credit line would appear in an FTX audit. He replied, "No, don't worry, the auditors won't be looking at that".

In addition, the former Alameda CEO claimed that the fund had knowingly manipulated its balance sheet at SBF's behest to appear "less risky in the eyes of investors". Ms. Ellison also stated that Alameda had effectively stolen billions of dollars from FTX clients to finance "doomed investments and buy influence with politicians."

Ellison testified that she prepared seven different balance sheets when the markets crashed in June 2022, which Bankman-Fried reviewed, for lenders as they began recalling their loans to Alameda. He chose one of the options that didn't show that Alameda had borrowed $10 billion in FTX customer funds, Bloomberg reported.

Sam Bankman-Fried considered closing his hedge fund Alameda Research in 2022 due to concerns over its "harmful trading activity" and over-leveraged position on FTX, according to an unpublished blog post presented at the trial. Mr. Ellison revealed that SBF was in talks with Saudi Prince Mohammed Bin Salman about covering FTX's losses, and that it was regularly informed of the amount of money Alameda had taken from FTX's customers.

Finally, Caroline Ellison also revealed that the RobinHood shares held by SBF had been purchased with Alameda's funds. However, SBF wished to repatriate them to FTX for reputational reasons.

SBF's defense lawyers argued that Ellison was a negligent Alameda manager who ignored Bankman-Fried's instructions to "cover" losses, thus contributing to the companies' collapse. Bankman-Fried's lawyers argued that he had not committed fraud, had no intention of doing so and had acted in "good faith" while running FTX. The defense has indicated that it will cross-examine Caroline Ellison once the prosecutors have completed their examination.

The former director of Alameda Research is expected to take the stand again today. But there's more to come. Prosecutors intend to call Christian Drappi, a former Alameda software engineer, and Zac Prince, founder and CEO of failed cryptocurrency lending company BlockFi, as their next witnesses this week. BlockFi was a major lender to Alameda and tapped into a $400 million line of credit from FTX after the cryptocurrency exchange supposedly bailed it out last summer.

The court has given an updated timetable for the case and expects it to be completed as early as October 26 or 27. A 31-year-old man could well be locked up in a federal penitentiary for more than 100 years when the case closes. To be continued.

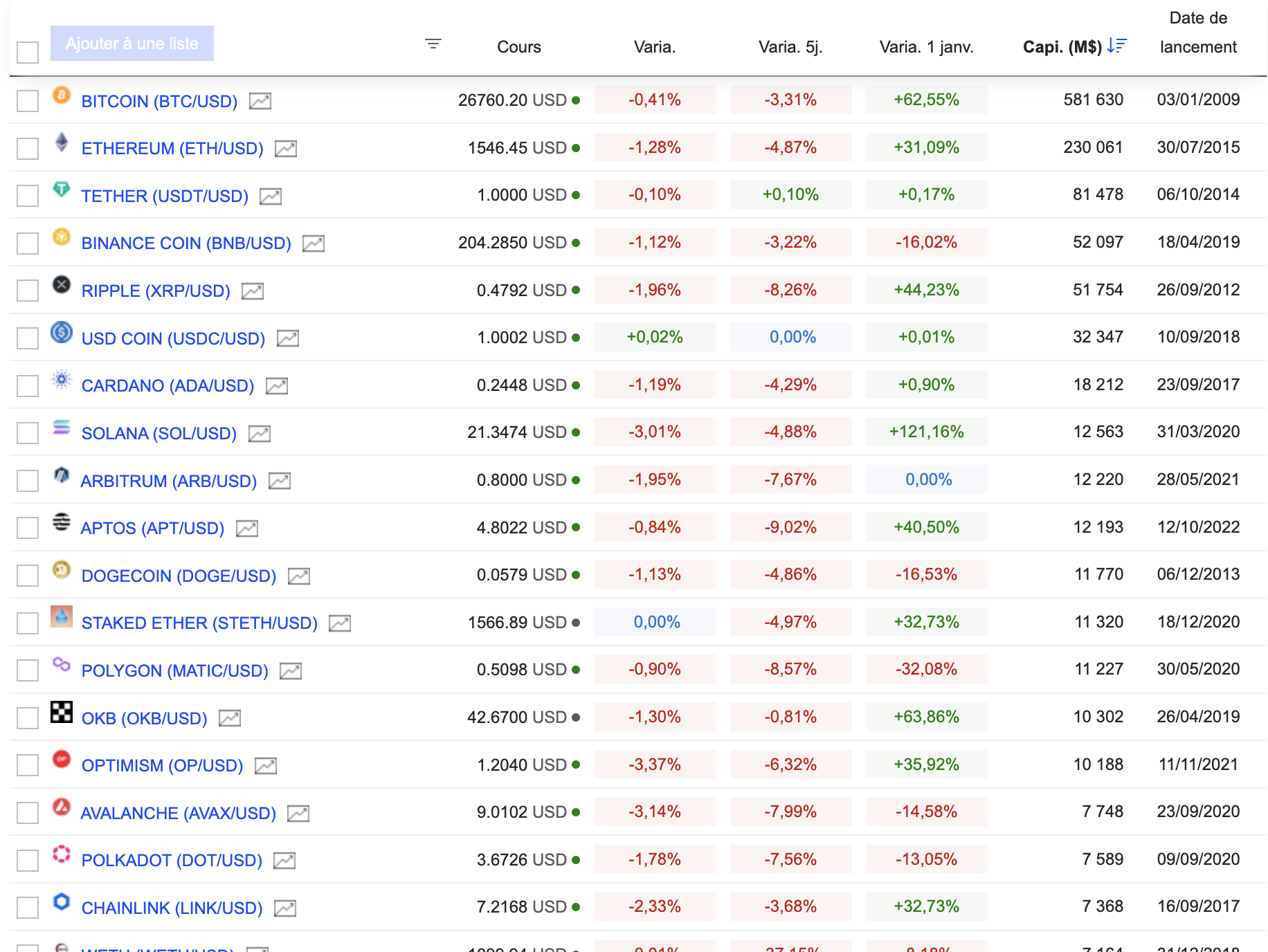

Block 3: Gainers & Losers

Cryptocurrency chart

(Click to enlarge)

Block 4: A few things to read:

The journalist and the fallen billionaire (The Atlantic)

Satoshi Sophon: Destroyer of BRC-20 (Bitcoin Magazine)

New evidence suggests stolen FTX funds went to Russian money launderers (Wired)

By

By