Next Monday, the amount of BTC issued as a reward to the miners will be slashed in half. This event, known as halving, defines the whole crypto market cycle: Bitcoin becomes an increasingly scarcer asset, pushing the prices up.

The pre-halving rally carried bitcoin price from $27,000 to an all-time high of $74,000 in just 5 months, registering an impressive 170% gain. After such performance, it would be reasonable to assume that the halving is already priced in, and the “sell the news” logic should kick in.

The CPI (Consumer Price Index) announced today by the US Bureau of Labor Statistics should also calm investing urges: 3.5% vs 3.2% last month suggests that the Fed won’t be cutting interest rates any time soon.

At the time of writing, Bitcoin price is correcting to below $68,000, and the markets are wondering how low it can fall, and how soon can the bull run resume – if it will resume, of course.

Looking closely at the new market structure, as well as on-chain indicators can give us valuable data to try and answer these questions.

Is the halving priced in?

If the past is anything to go by, the period around the actual halving event has always been shaky for the BTC price. Market participants had bought the rumor and were selling the news.

However, this cycle can mark the departure from the traditional dynamics, notably due to the entry of big traditional finance players and their spot ETFs. In this situation, we can assume that not every ETF buyer is well aware of the meaning of the halving, or the historical price action around it. These new investors may behave unlike the usual Bitcoin crowd. It is possible that for them, macroeconomic conditions, together with the tax season now unfolding in the US (the period that typically removes liquidity from financial markets), are more important than the programmed change in the Bitcoin protocol.

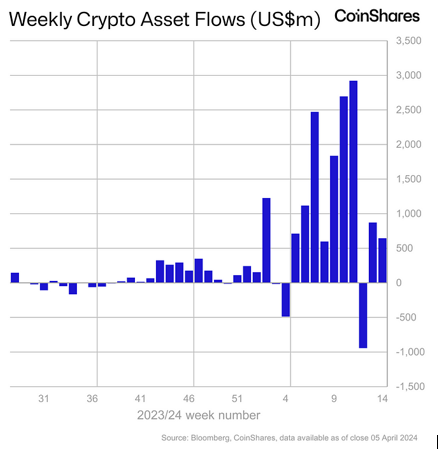

Speaking of TradFi investors, spot Bitcoin ETFs continue their impressive accomplishments (albeit at a slower pace). According to Coinshares, last week registered $663 million of inflows, while short-bitcoin investment products saw outflows for the 3rd week in a row totaling US$9.5m. On the Chicago Mercantile Exchange, BTC futures traded with an annualized premium of 13.5% on Monday.

Source: Coinshares

The best is yet to come

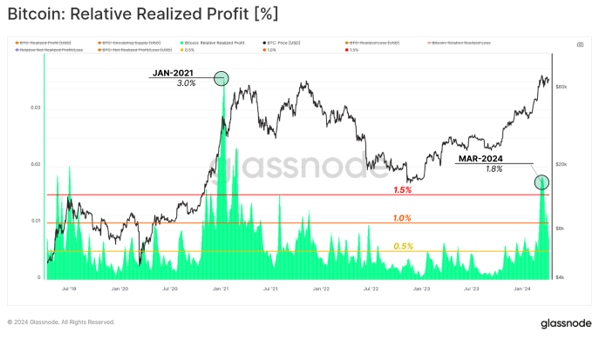

Seasoned Bitcoin investors know its cycles well, and the recent all-time high triggered significant profit-taking by long-term holders.

Glassnode’s chart shows that a month ago, 1.8% of the market cap was locked in as profit over a 7-day period. It was an important spike, but still much lower than the profit-taking intensity of 3% registered during the 2021 rally, indicating that this bull run is yet to show its horns.

Also, we can note that local and global market peaks are typically set after major profit-taking events, which gives us a positive outlook for the near future.

Another interesting observation is just how “gentle” market drawbacks have been during this period. This is particularly interesting considering the large-scale profit-taking. Previous bull runs saw numerous price drops of 10-30%, while this cycle has only registered three drawbacks so far, the biggest hitting -17%.

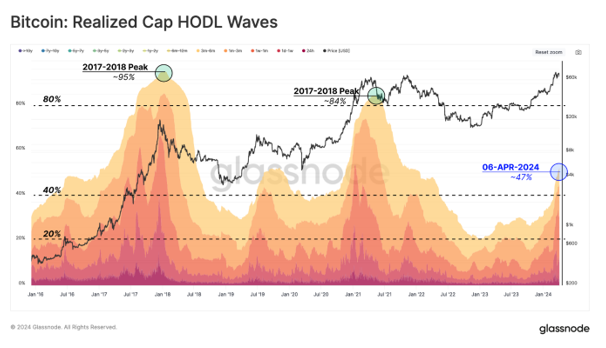

When analyzing graphs, it is worth remembering that there are always two sides to a market. Profit taken by one investor is matched by inflowing demand from the buying party on the other side.

According to Glassnode, during the last two bull markets, the aggregate share of newcomers’ wealth (coins younger than 6 months) reached between 84% and 95% at the market peaks. This is indicative of a massive influx of newer holders who could not resist the FOMO and ended up buying the top. This index is now at the 47% mark, showing that the capital held within the Bitcoin holder base is roughly balanced between long-term holders and new demand – a sign that the bull run is still in the early stages from a historical perspective.

Finally, despite the new all-time high, one could argue that we haven’t yet seen a massive retail interest in Bitcoin, comparable to the previous cycle. The Google search trend for “Bitcoin” is currently only slightly higher than the average, and far below the peak of 2021 (relative value of 31 vs 100).

Hold on, the bull run is far from over.

By

By