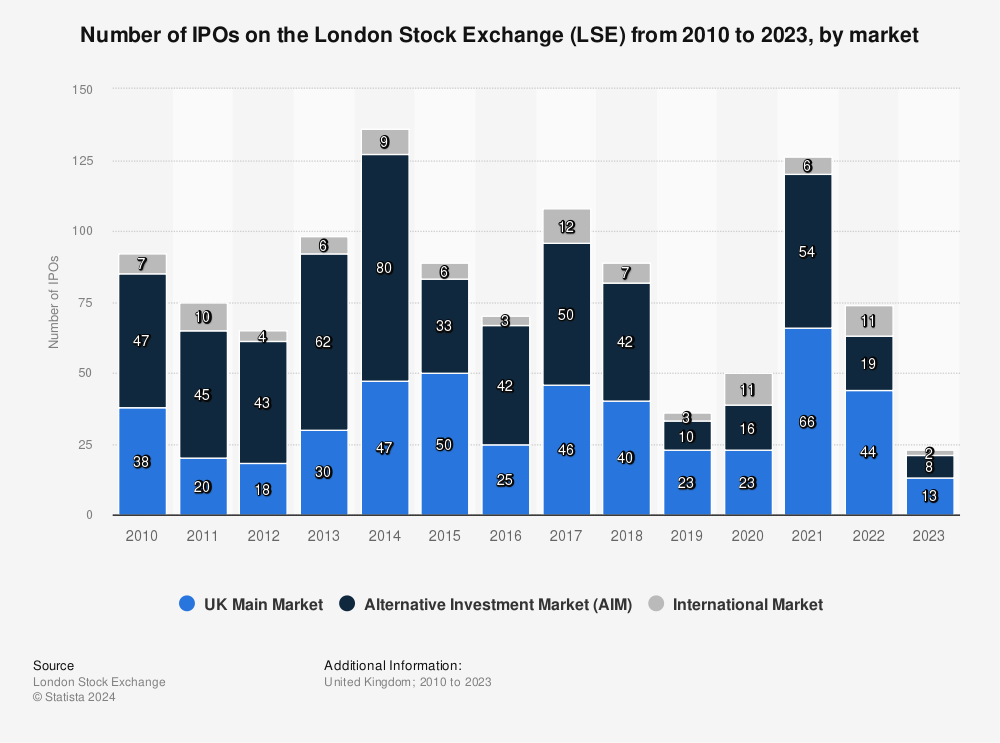

The years 2022 and 2023 had everything going for them: rising interest rates, geopolitical instability, high inflation, global slowdown and fears of recession. The LSE's IPO figures bear witness to this.

2024 should put a smile back on operators' faces. Thanks to strong stock markets, record highs for major indices on both sides of the Atlantic, hopes of rate cuts, low volatility, normalizing inflation and relatively healthy consumer indicators.

In the US, there were already 33 IPOs at the start of the year, 22% more than at the same time last year (27 IPOs as at March 12).

Among the IPOs eagerly awaited by investors this year:

- Reddit, the social media company specializing in forums, which is expecting a $6.5 billion valuation.

- Shein, China's new fast-fashion giant, is aiming for a valuation of up to $90 billion.

- Stripe, the fintech valued at at least $50 billion.

- Panera Brands, owner of food brands Caribou Coffee and Einstein Bros Bagels.

- Skims, the inclusive clothing brand co-founded by Kim Kardashian, valued at $4 billion.

- UL solutions, a security testing and certification specialist, seeking a valuation of at least $5 billion.

- Chime, a fintech banking services company.

- Fanatics, a sportswear manufacturer, currently valued at $31 billion.

- and the popular social network Discord.

In Europe, the start of the year is already tinged with optimism. Companies have raised $3.2 billion since January, more than double last year's figure and the best start since 2021, and since 2015 if we exclude 2021.

Among the most eagerly awaited IPOs this year are :

- Douglas, the German beauty retailer, is to list in Frankfurt, raising 1.1 billion euros for an expected valuation of 6 billion euros.

- Galderma , the French dermatology group, has opted for an IPO in Switzerland, aiming to raise 2.5 billion euros.

- Golden Goose, the Italian brand of luxury sports shoes, is targeting the Milan stock exchange and an IPO of at least 1 billion euros.

- Puig, the Spanish beauty and fashion group, which could be valued at over 10 billion euros.

- CVC, the private equity group that has delayed its plans to 2023, is considering Amsterdam with a valuation that could reach 15 billion euros.

- Flix, the German transportation start-up and owner of the Greyhound brand in the U.S., has chosen Germany, with a valuation of around 4 billion euros.

- Klarna , the fintech superstar from Sweden, may choose to list in the USA, and could reach a valuation of $20 billion (after reaching $45.6 billion in 2021).

By

By