Another blow to Russian exports. The US and UK governments have banned the London Metal Exchange (LME), the Chicago Mercantile Exchange (CME) and other global exchanges from accepting Russian-produced aluminum, copper and nickel. They have also banned imports of these metals into their countries. 6% of world nickel production, 5% of aluminum and 4% of copper come from Russia, but existing stocks will be exempt from the bans.

This healthy state of black gold, combined with the restrictive measures that have given a boost to LME prices, which serve as a global benchmark, have consequently rekindled the strength of the Footsie in recent days, 23% of which is made up of stocks linked to oil and mining.

By the end of 2023, energy accounted for 13% of the FTSE and materials for over 9%. Mining giants include Rio Tinto, Glencore, Fresnillo and Antofagasta. On the energy side, the giant BP Plc and, on the bangs, gas distributor Centrica.

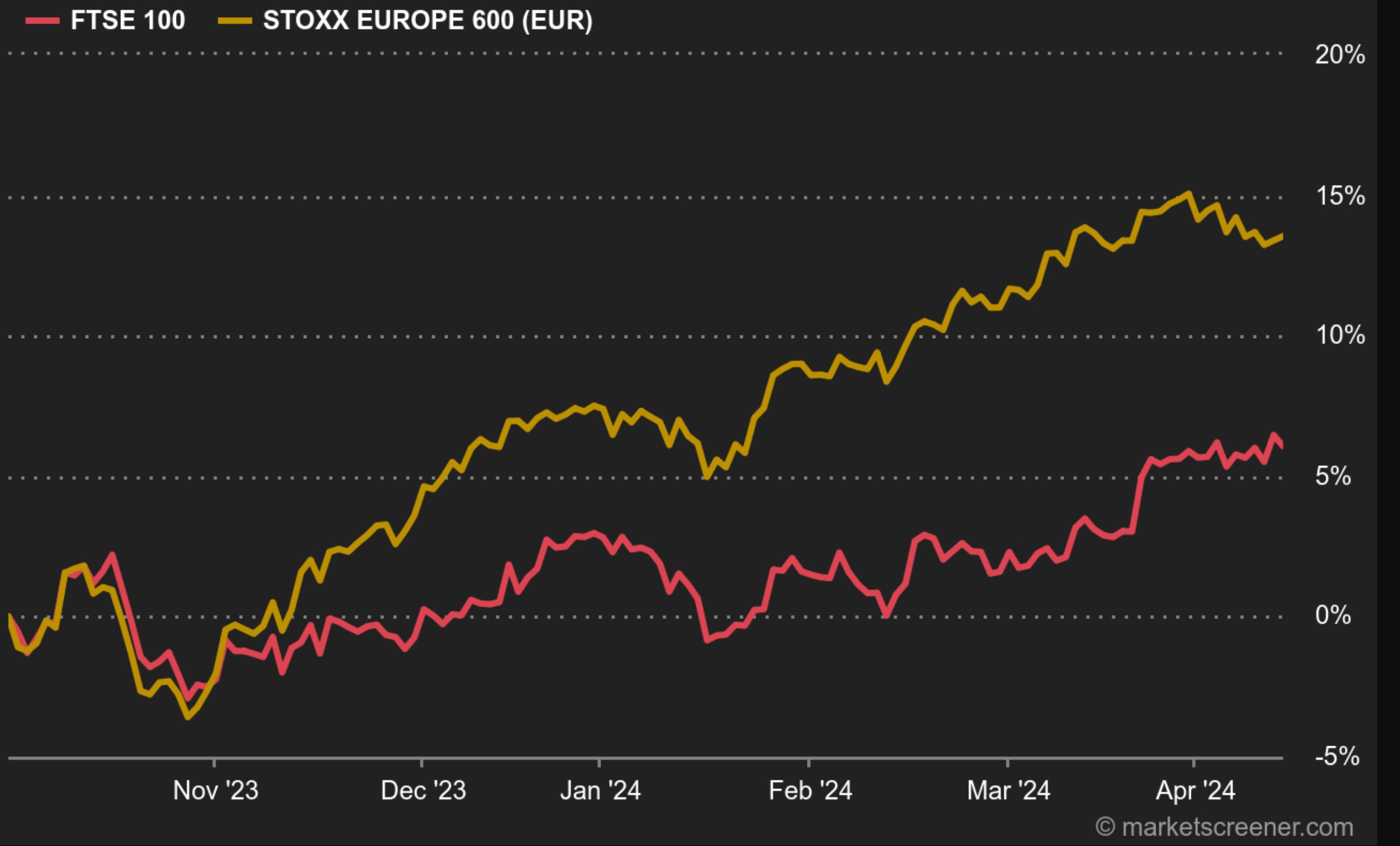

The London index had been lagging for some time, and its revival was long overdue. Joachim Klement of Liberum noted in a recent note that "last month, the sector discount of UK equities to US equities reached a new all-time high of 31.4%". He added that this discount was particularly marked for pharmaceuticals and mining stocks.

By the end of March, however, buoyed by hopes of a Bank of England rate cut this summer, the FTSE was back on track. Thanks to the rebound in industrial metals, it continues to quiver upwards. Whether this trend is sustainable remains to be seen.

By

By