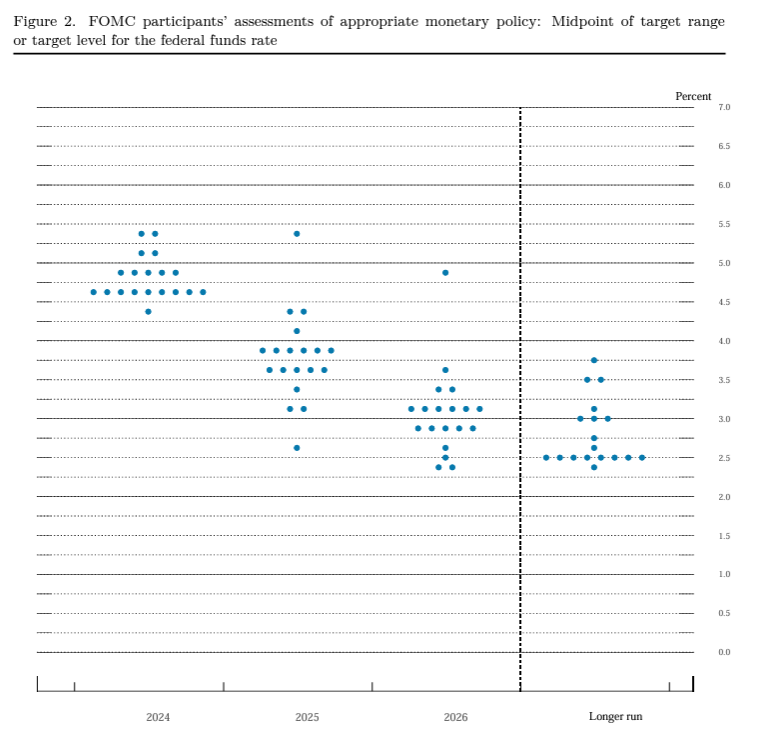

Jerome Powell will not have played havoc with the bullish rally in the equity markets. Inflation assumptions have been revised upwards, but so have growth prospects, against a backdrop of solid economic conditions. The dot-plot shows that there should be three rate cuts this year in the US, a scenario in line with market expectations.

Thus, the prospects of a rate cut as early as June have been reinforced: according to CME's Fedwatch tool, the probability of an easing has risen by 15 points to over 75%, fueling the fall in bond yields. The US 10-year is currently stumbling over its February highs at 4.35%, after holding above 4.07%. A break of this support will confirm the end of the recovery since the end of December 2023.

Elsewhere in the news, the Bank of Japan's dogmatic shift away from negative key interest rates is particularly noteworthy. Looking at the market's reaction, investors seem far from impressed. The yield on the Japanese 10-year note has stalled at 0.80%, and could well reach 0.64% if the 0.71% mark is breached.

For its part, the Swiss National Bank took the market by storm by cutting its key rate by 25 basis points to 1.50%. This easing was made possible because "the fight against inflation over the last five half-years has been effective".

By

By