Key players in the sector include:

- Shimano: no need to introduce the Japanese group, whose modules have been omnipresent on bikes for a long time. Derailleurs, brakes, wheels... Shimano is everywhere and even plays the challenger in electric motors.

- Yamaha Motor: known for its motorcycles, the Japanese company is also one of the two main suppliers of electric bike motors on the planet, in competition with Bosch.

- Giant Manufacturing: the Taiwanese is the world's leading bicycle manufacturer. The group started as a third-party manufacturer before launching its range in 1981.

- Fox Factory: the company operates in motorsports, but it's hard to miss its well-known forks.

- Merida: Less well known than Giant, the other Taiwanese bike star is its global runner-up. It owns just under half of the capital of the American brand Specialized.

- Vista Outdoor: the Minnesota company owns dozens of brands, some of which are very well known in the cycling world: Giro and Bell helmets, Blackburn, Copilot or Raskullz accessories. It also specializes in hunting, but that's another story.

- Accell: back in Europe with the Dutch company, better known through its brands Lapierre, Haibike, Koga, Raleigh or Ghost (to name a few), or its XLC accessories. A pure-player that has long been in MarketScreener's Europe portfolio.

- MIPS: this discreet Swedish company is known for its head protection system during falls, licensed to many helmet brands. It is now also developing its own ranges.

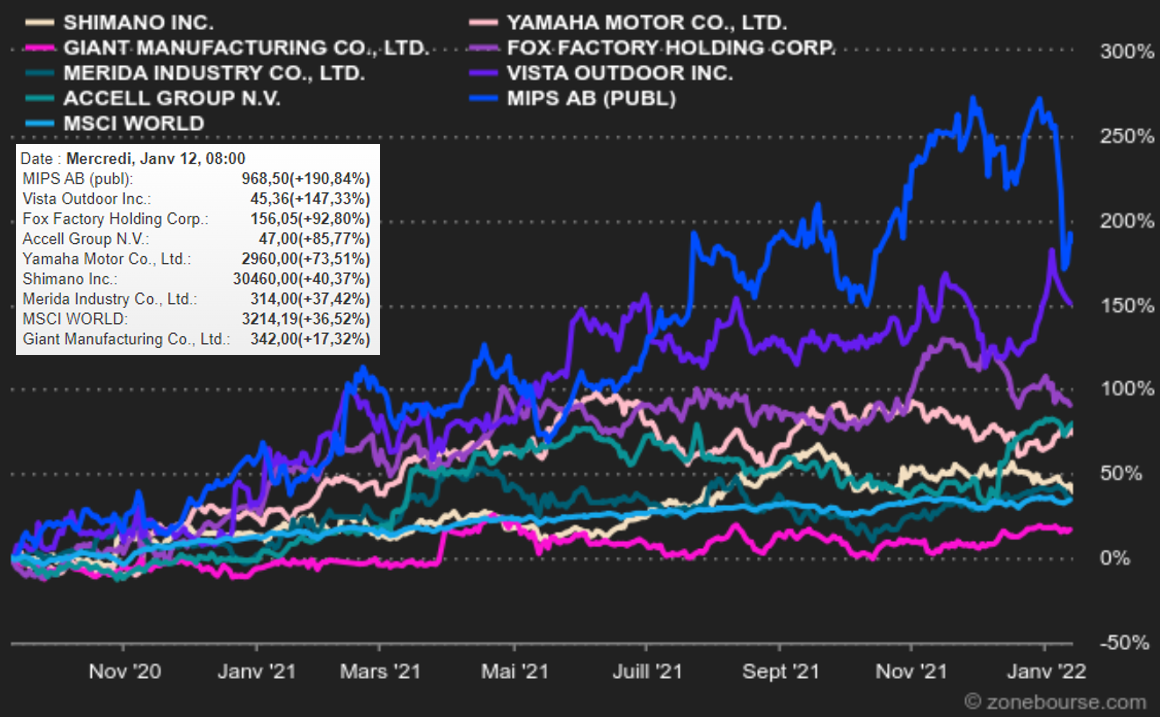

In the meantime, here are the performances of the aforementioned stocks since September 9, 2020. They have been compared to the MSCI World Index, which is credited with a 36.5% gain in the meantime

.

Only Giant Manufacturing lagged, up 17%. Merida did slightly better than the index (37.5%), behind Shimano (40.5%) and Yamaha Motor (73%). Accell (86%) and Fox Factory (93%) generated extremely high returns. But the most breathtaking performances are to be credited to Vista Outdoor (147%) and MIPS (190%), even if both stocks have suffered since the beginning of the year. Note that valuations are particularly disparate in the sector, and now a bit crazy for some players:

It looks like investing in the bicycle industry was a very good idea. It allowed us at MarketScreener to outperform the already rising indexes.

By

By