Momentum is an investment vision that favors stocks that have been trending positively over the past six and twelve months. At MarketScreener, momentum certainly includes data on the positive trend of the stock in the short, medium and long term, but above all, analysts' revisions of earnings and sales in the very short term (7 days), medium term (4 months) and long term (12 months), weighted by the visibility of the analysts' business model and the divergence of their estimates, on the assumption that analysts are rather conservative in their revisions.

In our previous selection, we chose Sanderson Farms, Broadcom, Mitsui & Co, Westlake Corporation and Pason Systems at the end of March 2022. A portfolio weighted on these five positions would have generated a return of -8.29% against -16.60% for the MSCI World and -17.69% for the S&P 500 (the latter being our reference benchmark for the selection, over the period from 31/03/2022 to 30/06/2022). This outperformance of +9.40% compared to the S&P 500 is explained by the inflation-proof nature of most of the stocks, which directly benefits from the economic situation for Westlake Corporation, Sanderson or Pason, or which limits margin losses compared to the rest of the market with Broadcom and Mitsui. The American semiconductor manufacturer Broadcom is the worst performer, losing 22.95%, while the portfolio is driven by the food company Sanderson Farms, which posted a 16.64% gain in the second quarter.

Let's take a closer look at the five U.S. stocks selected for the third quarter of 2022 (July to September).

Our "momentum" selection for the next three months:

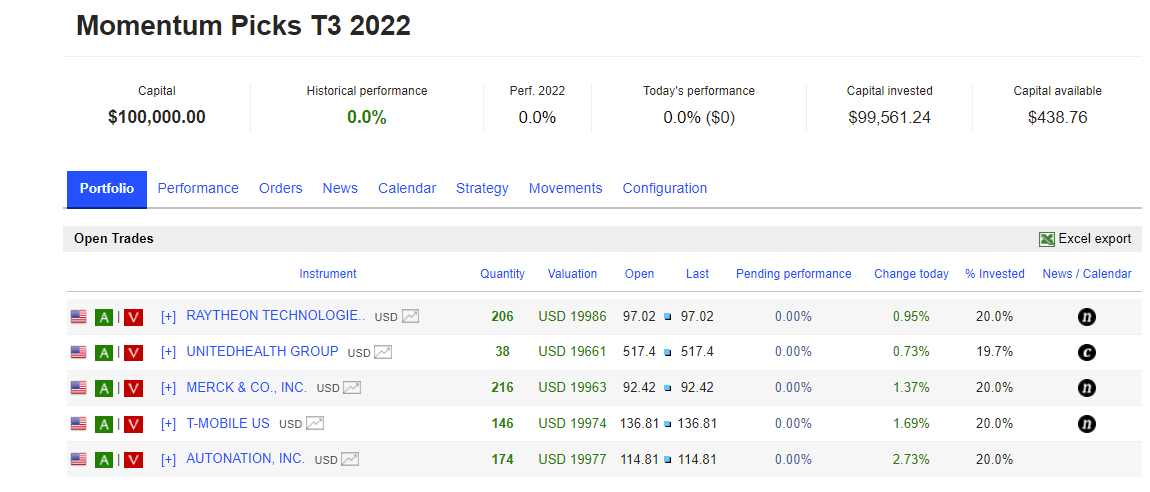

Here is the display in the virtual portfolio tool:

UnitedHealth (UNH)

UnitedHealth Group is among the top U.S. providers of healthcare products and services. Revenues are split between health insurance (59.3% of sales), managed care benefits (37.5%) and IT services (3.2%). The stock of the largest U.S. health insurer has had an incredible run on the stock market over the past ten years, with the stock rising 25% per year since 2012 (including dividends). This feat has been achieved by a nice increase in margins and revenues coupled with a well-controlled acquisition policy.

The group has a leadership position in this market. The company is in line with the US government's desire to reduce healthcare costs for the general public. However, United has strong pricing power. History has shown that health care is the sector that offers the most recurring results even during major financial crises (2000 and 2008) and during inflationary peaks. A resilient sector, therefore, that declines less during crises and also outperforms in bull markets.

Revenues were up 14% year-over-year in the Q1 2022 release. Every earnings reports in the last 16 quarters has been above analyst expectations. Its operating cash flow has reached $5.3 billion, enough to cushion the blow in a recession. The disciplined execution of the group's long-term strategy, combined with its demonstrated track record of stable results The disciplined execution of the group's long-term strategy, combined with its clear qualities of earnings stability - as we continue to heal even in a recession - make it a defensive stock of choice.

Merck & Co (MRK)

Merck & Co is one of the world's largest pharmaceutical companies. Pharmaceutical stocks are particularly sought after in these troubled times of pressure on corporate margins. They offer visibility through recurring revenues and pricing power over their customers to maintain stable margins. Operating margins have been rising slightly and above 30% for years.

Merck recently released its quarterly results and the market was pleased. Revenue was $15.9 billion, including $3.2 billion in sales of Molnupiravir, the company's COVID-19 pill. Strength was seen across Merck's drug portfolio. Excluding Molnupiravir, revenue was up 19% from the first quarter of 2021.

While Molnupiravir is a rising star with uncertain long-term potential, the cash cow of Merck's portfolio remains Keytruda, used to treat many tumors. Recent acquisitions (Pandion Therapeutics and Acceleron Pharma in 2021) will allow the company to accelerate in key markets for autoimmune diseases and heart and lung diseases. The company offers a dividend of 3% per year, a security for investors who are increasingly looking for dividend stocks with the uncertainty of the macroeconomic environment. The positive momentum could continue on this defensive stock.

T-Mobile (TMUS)

Another defensive stock with recurring results but this time in telecoms: T-Mobile. The sector has been favored by operators lately because of its defensive character linked to the stability of its results over time as well as the payment of copious dividends that reassure investors who thus receive income. T-Mobile is the third largest mobile operator in the US, just behind AT&T and Verizon.

The telecom business is certainly an infrastructure-heavy business but with a high moat due to the massive capex spending to compete. Even if sales growth should slow down now that the group has acquired a near-leading position in the US, cash profits should continue to climb at a decent pace. Dividends paid out should be relatively high.

Raytheon Technologies (RTX)

Raytheon is the world's largest capitalization in the defense and aerospace sector. It is not a pure-player as the company generates 27.4% of its turnover in air navigation systems through its subsidiary Collins Aerospatial, 27% in aeronautics through Pratt & Whitney, and the rest in the aerospace sector.27% in aeronautics via Pratt & Whitney, which manufactures civil and military aircraft engines, and 23.1% in missiles and integrated air defense systems. In particular, they manufacture the Stinger anti-aircraft missile, and with Lockheed Martin they co-produce the Javelin anti-tank missile, two of the most formidable weapons that the West is sending to Ukraine.

The defense sector is just beginning to revise upwards (analysts are adjusting their sales and earnings per share revisions) and the trend is likely to continue according to our estimates. The war in Ukraine has changed the security situation. Most European countries are not meeting the original target of 2% of GDP spent on defense. This readjustment to 2% alone would lead to a 25% increase in the global defense budget. The whole sector should therefore benefit greatly from these favorable policies.

AutoNation (AN)

AutoNation is an automotive retailer in the United States that sells new and used vehicles as well as parts, repair services, auto maintenance, and auto financing and insurance products.

If you look at inflation, it doesn't look like it's going to abate just yet. In this environment, AutoNation is the kind of value inflation proof as explained in this article. In addition, its large share of aftermarket sales (30%) benefits from shortages of certain new car parts, which provides an edging cushion in the event of a sharp recession. The stock should fare better than other players in the sector.

By

By