Methodology

The hardest part may not be finding long-term winners, but finding winners that will perform well over the next three months, especially when you can't sell them along the way. The aim here is to build a high-performance, resilient selection. To achieve this, I rely on Evidence Based Investing, i.e. scientific research that has proven the relevance of certain investment strategies over time. This highly rational investment process has highlighted the relevance of certain investment factors.

The Momentum Picks selection is based primarily on two of these factors: Quality and Momentum.

- Momentum: In the classic sense of the term, momentum is an investment approach that favors stocks that have been on an upward trend over the past six and twelve months. At MarketScreener, momentum includes not only data on the stock's positive trend over the short (3 months), medium (6 months) and longer term (12 months), a so-called "technical" momentum, but also analysts' revisions of net earnings per share and sales over the short and long term, weighted by the number of shares in issue. This is more "fundamental" momentum, based on the assumption that analysts are rather conservative in their revisions.

- Quality: The quality factor favors companies with solid fundamentals, i.e. good profitability, high return on equity, a solid balance sheet, low margin volatility, a good track record of earnings releases and good visibility on future results.

The selection is designed to generate the best possible risk/reward given its limited composition. However, a selection of just five stocks does not constitute a sufficiently diversified portfolio. Rather, Momentum Picks should be seen as a complement to an already diversified portfolio.

Analysis of past performance

In our previous selection, we chose Booking Holdings, Paccar, Molina Healthcare, Berkshire Hathaway (class B) and ON Semiconductor. A portfolio weighted equally on these five positions would have generated a return of 6.35% versus 11.24% for our benchmark, the S&P 500 index, over the fourth quarter of 2023 (from 09/30/2023 to 12/31/2023), i.e. an underperformance of 4.89%. At the individual level, Booking Holdings gained +15.02% over the quarter, Paccar +14.86%, Molina Healthcare +10.19%, Berkshire Hathaway lost 1.48% and ON Semiconductor lost 10.13% after a publication that fell short of expectations.

The Momentum Picks selection , which began on December 31, 2021, achieved a cumulative return of 26.27%, compared with 0.08% for our benchmark, the broad US S&P 500 index, representing an outperformance of +26.19% in 2 years. To cite a few other indices, the Nasdaq-100 returned 3.10% over the same period, the MSCI World -1.94% and the Stoxx Europe 600 -1.80%. What's more, Momentum Picks' performance does not include the payment of dividends to shareholders over the period, so actual performance is even higher than these figures.

Performance by quarter

.png)

Cumulative performance

.png)

The new selection

Let's take a closer look at the five US stocks selected for the first quarter of 2024 (January to March).

Equal weighted Momentum Picks Q1 2024

Brown & Brown is an American insurance brokerage firm based in Tampa, Florida. It is the fifth largest independent insurance brokerage firm in the United States. It employs over 16,000 people. It operates mainly in the United States, but also in Canada, the United Kingdom and Western Europe.

The company's revenues are derived primarily from the commissions it receives as an intermediary between insurance companies and their customers. These commissions are generally a percentage of the insurance premium paid by the customer. They may also earn income from fees for specific services, such as claims handling, risk consulting, and other related services.

Brown & Brown operates in the insurance industry, a sector known for its resilience in times of economic downturn. Demand for insurance services is relatively inelastic, which means that the company's revenues are less likely to be affected by economic cycles. In addition, the diversification of its services into property insurance, liability insurance and risk consulting services provides further stability.

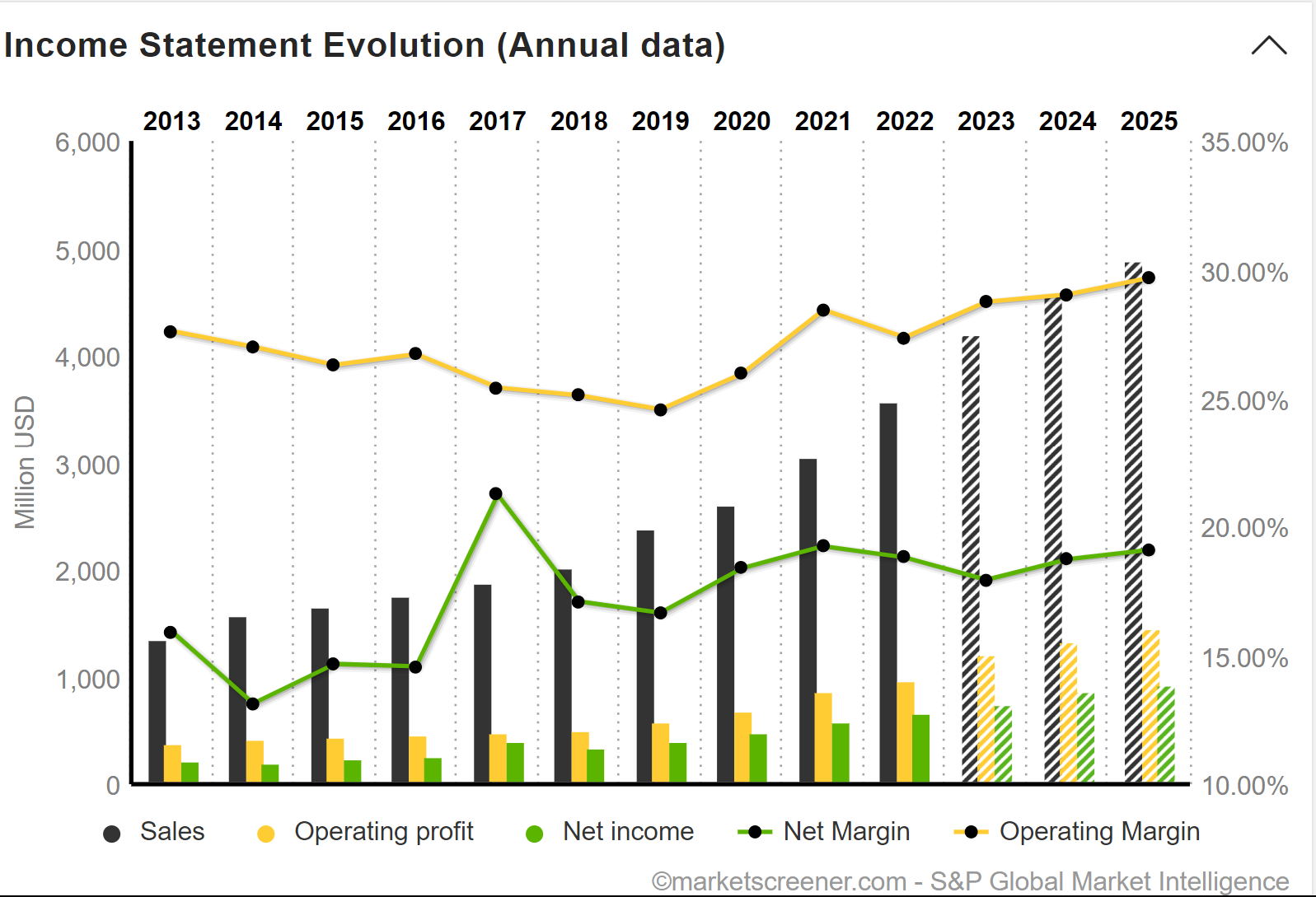

The company has demonstrated an exceptional ability to grow both organically and through a strategy of targeted acquisitions. Brown & Brown has a track record of steady revenue and EBITDA growth, which is a strong indicator of its efficient management and ability to integrate new businesses into its portfolio. This growth is underpinned by a strong corporate culture and prudent risk management.

Brown & Brown 's enviable profit margins testify to its operational efficiency and ability to manage costs. The company also benefits from a solid financial structure, with a reasonable level of debt and good liquidity, enabling it to pursue its investments and withstand periods of financial stress.

For investors looking for regular income, Brown & Brown is an attractive option. The company has a history of paying consistent and growing dividends, which is a sign of confidence in the sustainability of its financial performance. In addition, the dividend yield, while modest, is supported by a conservative payout ratio, leaving room for future increases.

Finally, Brown & Brown's corporate governance is a key factor in our investment decision. With an experienced board and management committed to best corporate practice, investors can be assured that the company is managed in the long-term interests of its shareholders.

Brown & Brown represents an investment opportunity well positioned to navigate the sometimes tumultuous waters of the financial markets. With its balanced growth strategy, financial stability and commitment to shareholders, the company is well equipped to offer attractive risk-adjusted returns.

Source : MarketScreener

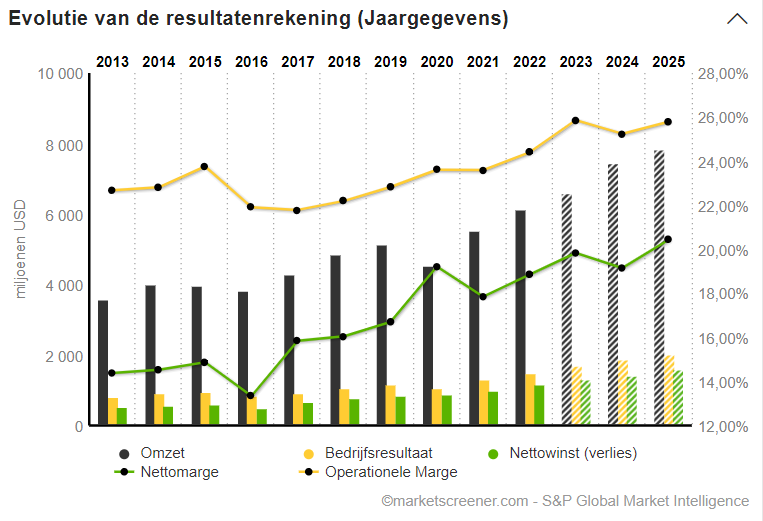

Ametek is a global manufacturer of electronic instruments and electromechanical devices, distinguished by its commitment to innovation and product diversification. With a portfolio that spans many industrial sectors, including aerospace, defense, and medical, Ametek has demonstrated its ability to adapt and respond to the changing needs of its customers.

It's a company with impressive performance and capital allocation. With steady revenue growth, high profit margins and robust free cash flow generation, Ametek presents the characteristics of a financially solid company. This financial strength gives the company the flexibility to pursue growth opportunities, including strategic acquisitions that have historically generated shareholder value.

It has a proven growth strategy focused on targeted acquisitions. The company has a history of successfully integrating complementary businesses, which has enabled it to broaden its product base and penetrate new markets. This strategy has contributed to organic growth and operating margin expansion, which is a positive indicator for potential investors.

A crucial aspect of our analysis is the assessment of a company's financial health, and Ametek excels in this area. With a healthy balance sheet characterized by manageable debt and sufficient liquidity, Ametek is well positioned to navigate uncertain economic environments while investing in growth opportunities.

Ametek is well positioned in growth markets such as energy efficiency, environmental technologies and healthcare, which should benefit from favorable macroeconomic trends and sustained R&D spending.

Source : MarketScreener

The COVID-19 pandemic was a test of resilience for the hotel industry. Marriott International demonstrated an exceptional ability to adapt to rapid market changes. As travel restrictions eased and global tourism recovered, Marriott positioned itself well by capitalizing on pent-up demand. The company has also accelerated the deployment of contactless technologies and enhanced cleaning protocols, increasing consumer confidence and positioning the brand as a leader in safety and comfort.

It has a diversified portfolio of brands covering different market segments, from luxury hotels to more affordable options. This diversification enables Marriott to target a wide range of customers, reduce the risks associated with economic fluctuations and maximize revenues through different channels.

The group continues to pursue a judicious international expansion strategy, opening new hotels in emerging markets and consolidating its presence in key regions. The focus on high-growth markets, such as Asia-Pacific, offers Marriott a significant opportunity to increase its market share and generate additional revenues.

Marriott's financial management has been prudent and efficient, enabling the company to maintain a strong balance sheet despite economic challenges. It has also shown discipline in cost management, which is essential to maintaining profitability in a sector where margins can be tight.

With the travel sector continuing to recover, the share price growth potential is significant, making it an attractive investment. The investment in Marriott International represents a strategic opportunity for investors looking to capitalize on the post-pandemic recovery of the hotel sector. The combination of the company's resilience, brand diversification, strategic expansion, solid financial management and attractive shareholder returns makes Marriott a wise choice for our Momentum Picks T1 2024 selection.

Source : Marketscreener

Blackstone is a leading player in private equity, and the change of direction in the Fed's monetary policy towards key rates could be a fair wind for this sector.

It has proven its ability to navigate through economic cycles thanks to its asset diversification and strategic risk management. With a broad range of products including real estate, private equity, credit and hedge funds, Blackstone is well positioned to capitalize on different market conditions. This diversification helps mitigate sector-specific risks and provides a stable income stream.

The company has consistently showed superior management performance, generating attractive returns for its investors. Blackstone has leveraged its expertise to identify unique investment opportunities and execute strategies that maximize long-term value. This skill is essential to generating risk-adjusted returns that outperform the market.

It continues to expand its global presence and assets under management (AUM) portfolio. The company has enjoyed impressive AUM growth in recent years, thanks to a combination of strategic acquisitions and successful fundraising. This trend is likely to continue, underpinned by growing demand for alternative investments and a proven ability to raise significant capital.

Blackstone's fee structure is a key factor in its successful business model. With fixed management fees and performance fees that reward outperformance, it benefits from a predictable revenue stream and an alignment of interests with its clients. This translates into robust and predictable cash flow generation, an attractive feature for investors seeking stability.

Blackstone is well placed to take advantage of macro-economic trends, such as rising global wealth and the search for yield in a low interest rate environment. In addition, the company can benefit from market volatility by acquiring undervalued assets and actively managing them to create value.

It deserves its place in Momentum Picks this quarter. It represents a strategic investment due to its asset diversification, superior management performance, growth potential, advantageous fee structure and favorable positioning to capitalize on macroeconomic trends.

Source : MarketScreener

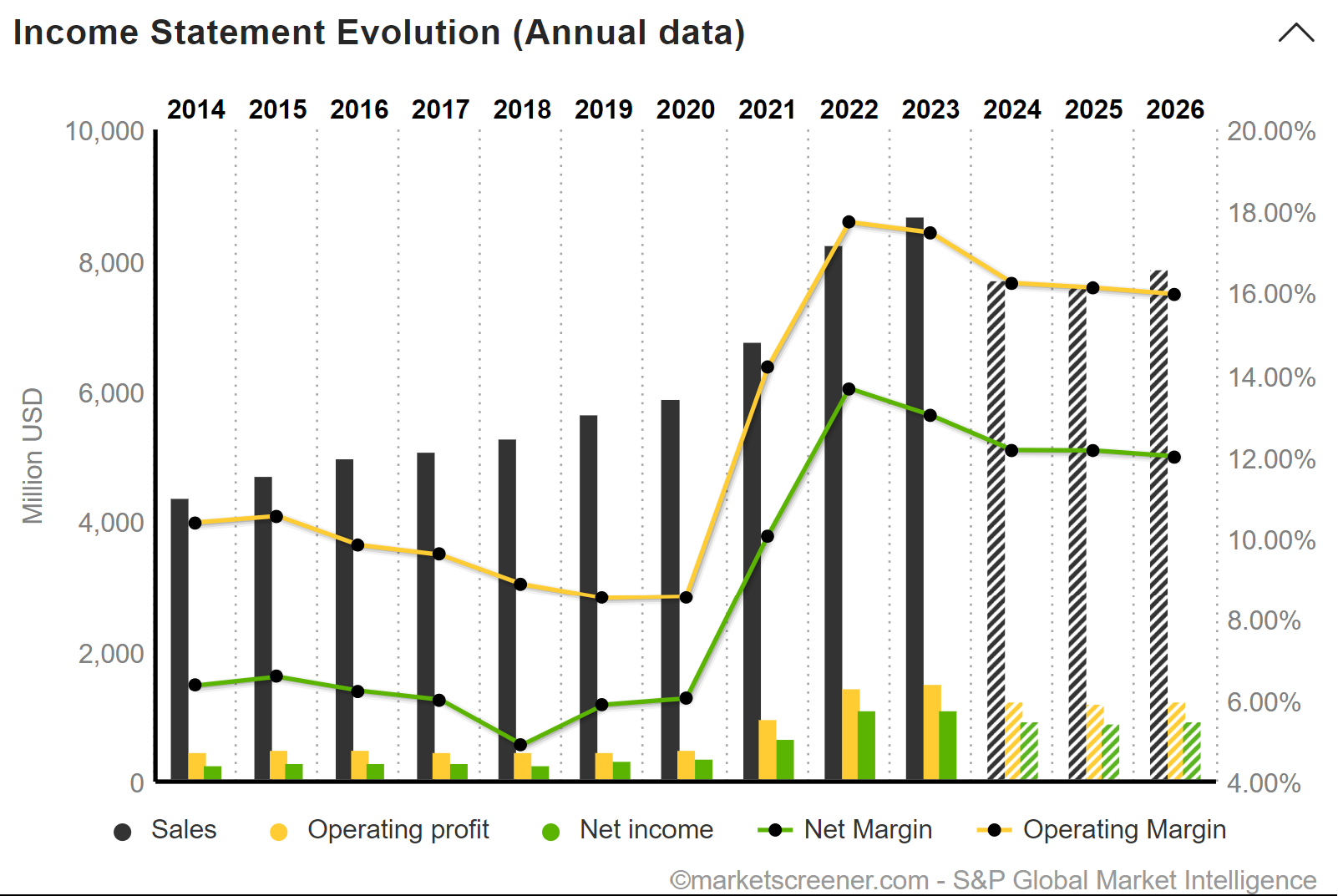

US kitchen equipment retailer Williams-Sonoma, renowned for its warmly appointed stores, is the final stock selected for this quarter's Momentum Picks.

The latest results are very good, breaking new records. It's hard to find a comparable with such profitable operations among the other major US retailers. The usual benchmarks among large, well-managed chains, such as Home Depot or TJX, remain several hundred basis points below. Williams-Sonoma reminds me of AutoZone. Williams and AutoZone share a similar strategy: highly lucrative own-brands, no acquisitions, management totally focused on returns of capital to shareholders. At both companies, the number of shares outstanding has fallen by a third over the last decade. In the light of AutoZone's exceptional stock market performance, we can assume that Williams shareholders are delighted with the program.

The company continues to innovate, expanding its product range to include eco-responsible items and developing partnerships with renowned designers. This strategy of constant innovation enables Williams-Sonoma to remain relevant and capture new market segments. It has implemented an effective omnichannel strategy, seamlessly integrating its online and in-store sales channels. This has not only enhanced the customer experience, but also increased operational efficiency, reducing costs and boosting margins. With strong brand recognition and a loyal customer base, Williams-Sonoma enjoys an enviable market position. Word-of-mouth and customer loyalty are valuable assets that contribute to the company's revenue stability.

In the shorter term, upward earnings revisions are driving the share price, and momentum is favorable.

Source : MarketScreener

Disclaimer : The information, analyses, charts, figures, opinions and comments provided in this article are intended for investors with the knowledge and experience required to understand and appreciate the information developed. This information is provided for information purposes only, and does not represent an investment obligation or an offer or solicitation to buy or sell financial products or services. It does not constitute investment advice. The investor is solely responsible for the use of the information provided, without recourse against MarketScreener or the author of this article, who are not liable in the event of error, omission, inappropriate investment or unfavorable market trends. Investing in the stock market is risky. You may incur losses. Past performance is not a guide to future performance, is not constant over time, and is not a guarantee of future performance or capital.

By

By