Methodology

The hardest part may not be finding long-term winners, but finding winners that will perform well over the next three months, especially when you can't sell them along the way. The aim here is to build a high-performance, resilient selection. To achieve this, I rely on Evidence Based Investing, i.e. scientific research that has proven the relevance of certain investment strategies over time. This highly rational investment process has highlighted the relevance of certain investment factors.

The Momentum Picks selection is based primarily on two of these factors: Quality and Momentum.

- Momentum: In the classic sense of the term, momentum is an investment approach that favors stocks that have been on an upward trend over the past six and twelve months. At MarketScreener, momentum includes not only data on the stock's positive trend over the short (3 months), medium (6 months) and longer term (12 months), a so-called "technical" momentum, but also analysts' revisions to net earnings per share and sales over the short and long term, weighted by the number of shares in issue. This is more "fundamental" momentum, based on the assumption that analysts are rather conservative in their revisions.

- Quality: The quality factor favors companies with solid fundamentals, i.e. good profitability, strong balance sheets, low margin volatility, a good track record of earnings releases and good visibility on future results.

Another advantage of the Momentum Picks selection is that every quarter, we reset our thinking. I start from scratch to create the best possible selection. This constant rethinking avoids clinging to old ideas that might not work as well. Having been a behavioral psychology enthusiast since my university days, I make a point of integrating mental models into my management process, so as to avoid being led astray by my cognitive biases as much as possible.

The selection is designed to generate the best possible risk/reward given its limited composition. However, a selection of just five stocks does not constitute a sufficiently diversified portfolio. Rather, Momentum Picks should be seen as a complement to an already diversified portfolio.

Analysis of past performance

In our previous selection, we chose Williams-Sonoma, Brown & Brown, Ametek, Marriott International and Blackstone. All stocks were in the green at the end of the quarter. A portfolio weighted equally on these five positions would have generated a return of 20.72% versus 10.16% for our benchmark, the S&P 500 index, over the first quarter of 2024 (from 12/31/2023 to 03/31/2024), i.e. an outperformance of 10.56%. At the individual level, Williams-Sonoma gained +57.36% over the quarter, Brown & Brown +23.11%, Marriott International +11.87%, Ametek +10.92%, and Blackstone gained a meager +0.34%.

The Momentum Picks selection , which began on December 31, 2021, achieved a cumulative performance of 52.44%, compared with 10.25% for our benchmark, the broad US S&P 500 index, representing an outperformance of 42.19% in 27 months (2 years and 3 months). To cite a few other indices, the Nasdaq-100 posted a cumulative performance of 11.85% over the same period, the MSCI World 6.38% and the Stoxx Europe 600 5.10%. What's more, Momentum Picks' performance does not include the payment of dividends to shareholders over the period, so actual performance is even higher than these figures.

Despite these very encouraging performances from our selection and management process, we must remain humble in the face of the market. I agree with François Rochon of Giverny Capital on the famous rule of three. One year out of three, the stock market will fall by at least 10%. One stock out of three will be a disappointment. One quarter out of three, the Momentum Picks selection will underperform the market. This is not a foregone conclusion, but rather an objective way of looking at stock market reality. There's always an element of chance. It's essential to be aware of this in order to prepare psychologically for the inevitable periods when the selection will underperform our benchmark.

Performance by quarter :

.png)

Cumulative performance :

.png)

The new selection

Let's take a closer look at the five US stocks selected for the second quarter of 2024 (April to June).

Equal weighted Momentum Picks Q2 2024 :

The first stock featured in this quarterly selection, Heico Corporation rarely makes the headlines, unlike Nvidia or Novo Nordisk, but its track record is just as extraordinary as theirs. From a small supplier of spare parts for the aerospace industry, Heico has become a major and well-established player in the aviation, aerospace and defense industries, and is also present in the medical, telecommunications and electronics sectors. Heico designs, produces and distributes niche products and services for airlines, overhaul shops and numerous small companies, as well as military defense and space agencies worldwide, in addition to medical, telecommunications and electronics equipment manufacturers. In particular, it is the world's largest manufacturer of spare parts for FAA (Federal Aviation Administration) approved jet engines and aircraft components. The company was founded in 1957 as a holding company, bringing together a number of subsidiaries. Heico operates through two main segments: the Flight Support Group (FSG) and the Electronic Technologies Group (ETG). The FSG, which accounts for around 50% of sales and 35% of operating income, specializes in the design and manufacture of spare parts for jet engines and other aircraft components. ETG, on the other hand, generates 50% of sales and 65% of operating income, and focuses on the design and manufacture of critical subcomponents for military and space applications. Heico represents an exceptional investment case, with compound annual sales growth of 15% over the past 33 years. It has generated a total shareholder return of 21.2% per annum over the same period. Heico has leveraged its expertise in reverse engineering and its ability to rapidly obtain Federal Aviation Administration (FAA) approval for its spare parts, giving it an edge over its competitors. Heico has adopted an aggressive pricing strategy, offering spare parts at lower costs than original equipment manufacturers (OEMs), without the associated R&D costs, while maintaining a reasonable margin. As a result, it has become an indispensable supplier for most of its customers. The Mendelson family, which owns the company, holds around 19% of the shares and favors a long-term vision. Heico also encourages employee participation in the company's capital, thus aligning the interests of all stakeholders. The aviation aftermarket is estimated to be worth $14 billion by 2026, with a compound annual growth rate of 4.7%. Heico also has the potential to expand geographically thanks to bilateral aviation safety agreements (BASAs). The pandemic has highlighted Heico's resilience and could offer growth opportunities as airlines seek to cut costs, potentially turning to alternative parts suppliers. Heico represents a strategic investment in the aerospace and military sector thanks to its robust business model, distinct competitive advantage, long-term corporate culture and significant growth potential.

Universal Health Services is the most defensive of the five stocks presented today. The company specializes in the ownership and management of healthcare centers. The group offers general and specialized surgery, internal medicine, obstetrics, emergency room care, radiology, oncology, diagnostic care, coronary care, pediatrics, pharmacy and/or behavioral health services. The company is listed on the NYSE under the symbol UHS and is headquartered in King of Prussia, Pennsylvania. Acute hospital services account for 54.8% of its sales, while behavioral health services contribute 45.1%. The majority of its revenues come from the United States (94.67%), with a presence in the UK (5.33%). Universal Health Services is positioned in a competitive market, but its track record of success over the last three decades and its reputation help it to position itself well in this market. UHS has demonstrated steady sales growth, with an increase of 6.8% per year over the last 10 years. The company's profitability is underlined by a gross margin of 39%, an operating margin of 8% and a net margin of 5% by 2023. The financial situation is borderline acceptable, with leverage (debt/EBITDA) of 2.75x in 2023. The company's management is experienced, with Marc Miller as CEO and founder Alan Miller playing an active role as a director. Good visibility on its activities and positive EPS revisions following good publications should continue to push the stock to new heights. The share price is trading on its all-time highs. What's more, the company has a good track record in terms of publications, often exceeding analysts' expectations. Universal Health Services presents an attractive investment opportunity for those looking to get involved in the healthcare sector. With stable growth, good visibility and experienced management, UHS could be a valuable addition to a diversified portfolio.

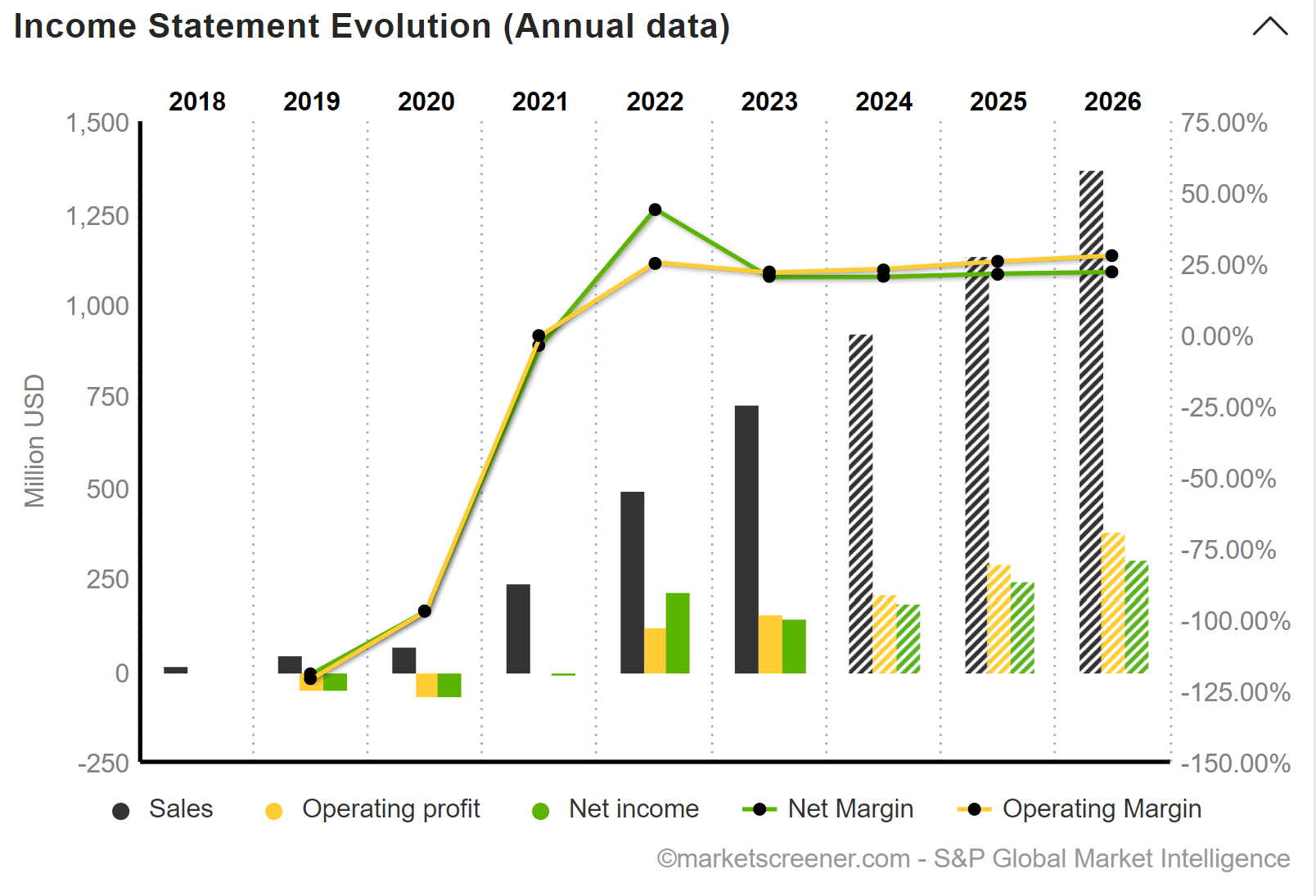

Palo Alto-based AppLovin Corporation is strategically positioned in the fast-growing mobile application ecosystem. The mobile applications market is in constant growth. According to market studies, the sector could reach a valuation of $674 billion by 2027. AppLovin, with its diversified portfolio of games and its AXON AI-based recommendation engine, is well placed to capitalize on this growth. Its AXON recommendation engine optimizes the match between ads and users. This machine learning technology increases ad click-through rates, generating more revenue for app developers and advertisers. The main source of revenue for mobile applications is advertising. AppLovin's technology plays a crucial role in optimizing these revenues. The company's portfolio includes over 350 free-to-play mobile games, covering a wide range of game genres. The company has demonstrated its ability to maintain high margins, with a gross margin of around 67.7% and an operating margin of 19.7%. This testifies to the effectiveness of its business model and operational management. Although the market has already priced in some of AppLovin's growth potential, the company continues to offer attractive upside potential. AppLovin's management team, led by founder Andrew Karam and CEO Adam Foroughi, has significant experience in the technology sector. AppLovin has announced its intention to re-evaluate its application portfolio, which could lead to divestments and increased focus on its software business. This could also lead to improved margins and a higher valuation in the long term. AppLovin presents an good investment profile thanks to its attractive positioning in a growth sector, its advanced technology, and a resilient business model even in a cyclical sector like advertising.

Shockwave Medical is a company that stands out in the medical equipment sector, in particular with its innovative approach to the treatment of calcified cardiovascular disease. The company focuses on intravascular lithotripsy (IVL), a technology that uses sonic pressure waves to treat calcifications in the arteries. Shockwave's flagship products include the Shockwave M5, M5+, S4, L6, C2 and C2+ IVL catheters, each designed for specific vessel diameters. The medical equipment market is growing steadily, due to the increase in chronic diseases and the aging of the world's population. Shockwave Medical is positioning itself in this market with innovative products that meet an unmet clinical need, particularly for patients who are not good candidates for traditional procedures due to severe arterial calcifications. Shockwave has succeeded in setting itself apart thanks to its unique approach and convincing clinical results. In terms of historical growth, Shockwave Medical has seen impressive revenue growth from $42.9 million in 2019 to $730.2 million in 2023, reflecting the increasing adoption of its technologies. I expect sales to approach $930 million this year. The company has also demonstrated an ability to innovate with new products and expand its presence in international markets, notably in Europe and Japan. Shockwave's profitability is also noteworthy, with stable gross margins of around 88% and a significant increase in adjusted EBITDA from USD 56.6 million in 2022 to USD 242.7 million in 2023. Cash conversion is excellent at over 88% of EBITDA. Profitability is also good, with a return on equity of 25%. The company's financial position is solid, with cash and cash equivalents of 990.6 million USD at the end of 2023. Shockwave Medical's management team has considerable experience in the medical device sector, which is an asset for the company. The CEO, Douglas Godshall, has extensive experience in leading medical device companies, and the management team is complemented by experts in the financial, operational, technical and R&D fields. Although the stock is currently heavily valued, Shockwave Medical still offers potential for further appreciation, given the rapid adoption of its products.

Already present in the first-quarter 2024 selection, Brown & Brown still deserves its place in the second-quarter selection. The latest earnings report confirms my view that the insurance broker still has some way to go. As a reminder, Brown & Brown is the fifth largest independent insurance brokerage in the United States. It employs over 16,000 people. It operates mainly in the United States, but also in Canada, the United Kingdom and Western Europe. The company's revenues are derived primarily from the commissions it receives as an intermediary between insurance companies and their customers. These commissions are generally a percentage of the insurance premium paid by the customer. They may also earn income from fees for specific services, such as claims handling, risk consulting, and other related services. Brown & Brown operates in the insurance industry, a sector known for its resilience in times of economic downturn. Demand for insurance services is relatively inelastic, which means that the company's revenues are less likely to be affected by economic cycles. In addition, the diversification of its services into property insurance, liability insurance and risk consulting services provides further stability. The company has demonstrated an exceptional ability to grow both organically and through a strategy of targeted acquisitions. Brown & Brown has a track record of steady revenue and EBITDA growth, which is a strong indicator of its efficient management and ability to integrate new businesses into its portfolio. This growth is underpinned by a strong corporate culture and prudent risk management. Brown & Brown 's enviable profit margins testify to its operational efficiency and ability to manage costs. The company also benefits from a solid financial structure, with a reasonable level of debt and good liquidity, enabling it to pursue its investments and withstand periods of financial stress. For investors looking for regular income, Brown & Brown is an attractive option. The company has a history of paying consistent and growing dividends, which is a sign of confidence in the sustainability of its financial performance. In addition, the dividend yield, while modest, is supported by a conservative payout ratio, leaving room for future increases. Finally, Brown & Brown's corporate governance is a key factor in our investment decision. With an experienced board and management committed to best corporate practice, investors can be assured that the company is managed in the long-term interests of its shareholders. Brown & Brown represents an investment opportunity well positioned to navigate the sometimes tumultuous waters of the financial markets. With its balanced growth strategy, financial stability and commitment to shareholders, the company is well equipped to offer attractive risk-adjusted returns.

Find previous picks here:

- Momentum Picks Q1 2024 - 5 stocks for winter

- Momentum Picks Q4 2023 - 5 stocks for autumn

- Momentum Picks Q3 2023 - 5 stocks for summer

- Momentum Picks Q2 2023 - 5 stocks for spring

Disclaimer : The information, analyses, charts, figures, opinions and comments provided in this article are intended for investors with the knowledge and experience required to understand and appreciate the information developed. This information is provided for information purposes only, and does not represent an investment obligation or an offer or solicitation to buy or sell financial products or services. It does not constitute investment advice. The investor is solely responsible for the use of the information provided, without recourse against MarketScreener or the author of this article, who are not liable in the event of error, omission, inappropriate investment or unfavorable market trends. Performance figures do not include brokerage fees. Investing in the stock market is risky. You may incur losses. Past performance is not a guide to future performance, is not constant over time and is not a guarantee of future performance or capital.

By

By