Block 1: Key news

Binance soon to have its own headquarters

Binance, the largest cryptocurrency exchange platform, will soon announce the location of its headquarters. Under the leadership of new pro-regulation CEO Richard Teng, the company is preparing to select a location, taking into account various factors that have yet to be detailed in order to comply with regulatory requirements. The move comes after regulatory problems for the platform under ex-CEO Changpeng Zhao, and aims to improve relations with regulators and burnish its image, particularly in the US, where Binance has been criticized by the US Securities and Exchange Commission (SEC) in recent months.

Bitcoin Spot ETF: Hong Kong follows in the America's footsteps

Harvest Fund and China Southern Fund, two major Chinese asset managers, have proposed to create Bitcoin Spot ETFs in Hong Kong, hoping for approval in the second quarter of 2024. The move follows the success of Bitcoin Spot ETFs in the US, and could mark the start of competition between Asia and the West in the cryptocurrency space. Naturally, the introduction of these ETFs in Hong Kong is aimed at attracting Asian investment into Bitcoin, despite China's restrictive stance towards cryptocurrencies, in contrast to Hong Kong, which is more welcoming towards the sector.

Tokenization: central banks get involved

The Bank for International Settlements (BIS), in collaboration with seven major central banks including the Banque de France and the U.S. Federal Reserve, has launched the Agorá project to explore the tokenization of fiat currencies to improve international trade. The project focuses on the use of blockchain technology, renamed "unified ledger" by the BIS, to optimize financial transactions and integrate smart contracts, in particular to overcome "the inefficiencies of current monetary systems".

Do Kwon condemned

Terraform Labs and co-founder Do Kwon was found guilty of fraud by a New York court, accused of misleading investors about their UST stablecoin and lying about Chai's integration of their technology. The collapse of UST and the LUNA token in May 2022 resulted in the loss of $40 billion from various investors, which, at the time, marked the start of a prolonged bear market. Despite their bankruptcy filing, Terraform Labs plans to contest the verdict, while the SEC maintains its stance on the need for compliance to protect investors.

Block 2: Crypto Analysis of the Week

Toncoin (TON), the cryptocurrency of the must-have messaging platform Telegram, has literally exploded upwards since the beginning of March, rising by over 180% since March 1. This meteoric rise has propelled TON into the exclusive league of the top 10 cryptocurrencies by market capitalization, shattering its all-time peaks. It even has the luxury of overtaking the cryptocurrency ADA (Cardano) in terms of valuation, hovering around $23.7 billion in market capitalization.

This soaring performance naturally begs the question: what lies behind this remarkable growth? Let's start with the basics.

The genesis of TON began in 2018, when the creators of Telegram wanted to compete with Ethereum. However, its journey hit a dramatic snag in 2020 when the SEC intervened, challenging Telegram's $1.7 billion fundraising as an unauthorized securities sale, leading Telegram to withdraw from the project.

In the aftermath, a group of independent developers formed what is now known as the TON Foundation, taking over the project's assets and launching The Open Network and its associated coin, Toncoin (TON), in 2021.

Despite a lacklustre performance in a bullish atmosphere since the start of the year, when the value of TON fell by 70% against BTC, the cryptocurrency made a strong comeback in March, seeing its value climb by over 180% in the space of just five weeks.

Its return to grace last September, which was initially spurred by Telegram's announcement to develop a cryptocurrency wallet for The Open Network, saw a real turning point last month. The market became aware of the implications of Telegram's integration after the company announced on March 31 that it would allow the purchase of ads using Toncoins. This announcement followed on from the one in February, in which Telegram pledged to redistribute 50% of advertising revenues from monetized channels to creators via TON.

"To ensure ad payments and withdrawals are fast and secure, we will exclusively use the TON blockchain. Similar to our approach with Telegram usernames on Fragment, we will sell ads and share revenue with channel owners in Toncoin." @durov#TON ? pic.twitter.com/c6c46adOV1

- TON ? (@ton_blockchain) February 28, 2024

The TON Foundation has launched ambitious initiatives to strengthen the usefulness of Toncoin. The Open League, which kicks off in April, aims to disburse 30 million TON (worth around $204 million) to boost app and user engagement. A further million TON is being allocated to boost participation in HumanCode, its innovative proof-of-personality protocol. These initiatives have significantly boosted the network, with the number of wallets doubling and the total value locked (TVL) on the network increasing six-fold since the beginning of March.

Although application development on the TON blockchain is relatively recent compared with more established chains such as Ethereum and Solana, the market is optimistic about its potential. At least, speculation is running riot regarding the latest developments, as evidenced by the surge in the cryptocurrency's valuation. This optimism is largely attributed to TON's close ties with Telegram and advertising-led business model, as well as the redistribution of tokens for contributors.

Block 3: Gainers & Losers

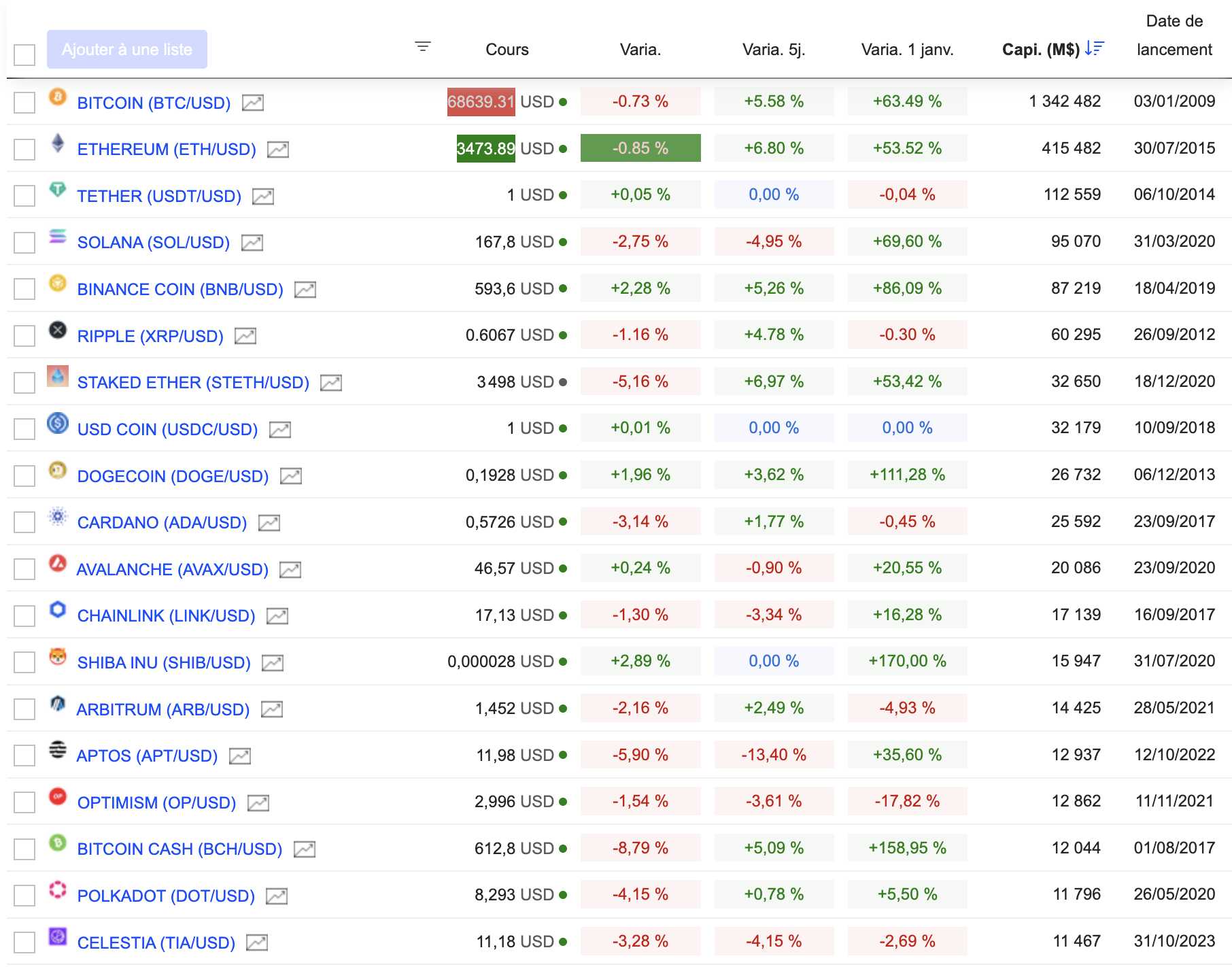

Cryptocurrency chart (Click to enlarge)

Block 4: Things to read this week

The sarcophagus is a dead man's switch for your crypto wallet (Wired)

Do Kwon convicted of multi-billion dollar fraud (Wired).

Sam Bankman-Fried's losing game (Project Syndicate)

Decentralization and localized manufacturing: Bitcoin, AI and 3D printing (Bitcoin Magazine)

By

By