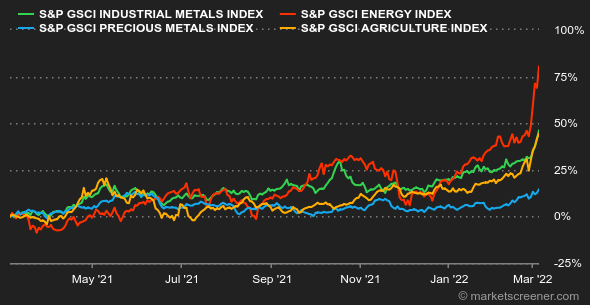

Commodity prices continue to soar, an environment of high prices that is commensurate with the geopolitical risks caused by the Russian threat. In this respect, it is interesting to take a look at the configuration of the futures prices of the main commodities (oil, copper, wheat etc.), which almost all have in common a so-called backwardation structure, i.e. cash prices (short maturity) higher than futures prices (longer maturity). End users are therefore willing to pay a high price to be supplied immediately, which perfectly illustrates the availability problems in certain sectors due to the boycott of Russian supply.

Let's stay on the topic of boycott, with oil. Buyers are particularly reluctant to buy Russian oil. This mistrust, which is taking on the appearance of a self-sanction, is causing the price of Russian references to fall in relation to Brent (by almost USD 20), but even with this discount, buyers are becoming scarce. This phenomenon increases the upward pressure on the prices of the two main world benchmarks, Brent and WTI, which are now trading around USD 112 and USD 110. Clearly, these prices are making OPEC+ members (outside of Russia) happy, as they have made the decision to stick to their roadmap of increasing production by 400,000 barrels per day in April, while avoiding the hot topic of the war in Ukraine. Finally, according to some market sources, an agreement is imminent on the Iranian nuclear issue.

Still on the energy front, a wind of panic is blowing on gas prices in Europe but also on the price of thermal coal in Asia (Russia is also a major coal exporter). Prices have reached record highs, with the Dutch TTF at EUR 183/MWh and the Asian coal benchmark (Newcastle high-quality thermal coal) at over EUR 400 per tonne.

As concerns grow, the ounce of gold is gaining momentum to slowly but surely move towards the USD 2000 mark. With rising inflation, geopolitical frictions and risk aversion, the planets are aligning for the barbaric relic, which climbed to USD 1950, despite the rising greenback. However, the real star of the precious metals world is none other than palladium, whose price is returning to near its historic high (close to USD 3000). Remember that Russia accounts for one-third of the world's palladium production.

Industrial metal prices continue to rise. Geopolitical frictions and Western sanctions are leading to a disruption of supplies. Shipping companies, such as the Danish giant Moller-Maersk, are temporarily suspending their services to Russian ports, while some exports are suspended altogether, such as steel from Severstal. As a result, prices continue to soar. Copper is reaching USD 10,470 per ton, aluminum is trading at USD 3,730 and nickel is trading at USD 28,800 on the LME.

Let's finish this commodity round-up with agricultural products, which have seen a sharp rise in prices in Chicago. The situation is deteriorating in the Black Sea, where two cargo ships were sunk off Odessa, the largest Ukrainian port. Many shipping companies have suspended shipments to Black Sea ports, disrupting wheat and corn supplies. This disruption is pushing major importers to quickly secure supplies from other countries, an unprecedented demand shock that is further fueling price pressure. The price of wheat has risen by 40% in five sessions in Chicago, to 1200 cents per bushel. Remember that Ukraine and Russia together account for nearly 30% of world wheat exports and about 15% of corn exports.

|

By

By