|

|

| This week's gainers and losers |

| Gainers: Digital World -DJT (+57%), Reddit (+26%), Astera (+14%): The latest IPOs on the US market are pulverizing their records, behaving like meme stocks. On Tuesday, the company that hosts Donald Trump's social network made a sensational debut, buoyed by the former president's supporters. Reddit was also able to count on the support of its aficionados this week. Astera Labs continues to ride the wave of artificial intelligence euphoria, and at the margin, a recommendation upgrade from some analysts. Krispy Kreme (+23%): The famous doughnut maker has opened up a huge boulevard for itself. After a highly successful test in 160 restaurants, McDonald's announced that it will distribute the pastries in all its establishments by the end of 2026. Krispy Kreme, which has 14,000 points of sale worldwide, is set to double its distribution outlets. The company also entered the French market at the end of 2023. Big potential ahead. Viking Therapeutics (+20%): Focus on slimming to boost your capitalization! The US biopharma has entered the hotly contested (and lucrative) market for anti-obesity drugs, and this week unveiled positive results in a Phase 1 clinical trial for its oral tablet VK2735. A new competitor for champions Novo Nordisk, Eli Lilly and Zealand Pharma? JD Sports Fashion (+16%): The British sporting goods retailer is rebuilding its reputation, following a severe slump at the start of the year. Despite a sluggish economic environment, sales are up, with full-year profits in line with its January forecasts and encouraging prospects for fiscal 2025. Shockwave Medical (+15%): Consolidation in the pharmaceutical and healthcare sector continues! The American company specializing in medical equipment for the treatment of cardiovascular disease has received a takeover offer from the behemoth Johnson & Johnson, which is looking to strengthen its position in the devices sector. The target is showing strong growth, with annual revenues set to rise by almost 50% by 2023, and a share price that has risen by 69% since the start of the year. Robinhood markets (+9%): The trading app announced this week the launch of a credit card, available to the company's Gold customers, to expand its activities in the personal finance market and protect itself from market movements. The group also boasts an increase in retail trader activity, driven by the recovery in financial markets and crypto-currencies. The share price has grown by over 58% since the beginning of the year. Losers: Flutter Entertainment (-6%): The British online gambling and betting group did not disappoint. Its annual sales were up by almost 25%, and it announced an encouraging outlook for the current financial year, with core earnings expected to rise by 30%, boosted by its American brand Fanduel. But investors focused on the Group's annual loss, which widened by 183%, weighed down by higher marketing expenses, as well as general and administrative costs. ARM Holdings (-6%): The British semiconductor group, listed in the United States, is hampered by the trade war between China and the United States. This week, Beijing announced a ban on Intel and AMD microprocessors in government computers and servers. ARM's architecture is used by these American manufacturers, who will have to do without a colossal market. UPS (-6%): UPS unveiled its financial outlook for 2026, which was encouraging and better than analysts' forecasts, thanks to its rationalization program. It should be noted, however, that the carrier, like its US peers, is likely to be impacted by the collapse of the Francis Scott Key Bridge this week in Baltimore. Baltimore is one of the largest ports in the USA, and the bridge in question is a major route between Washington and Philadelphia, and the blockages caused by the accident are likely to force logistics companies to review some of their routes. |

|

| Commodities |

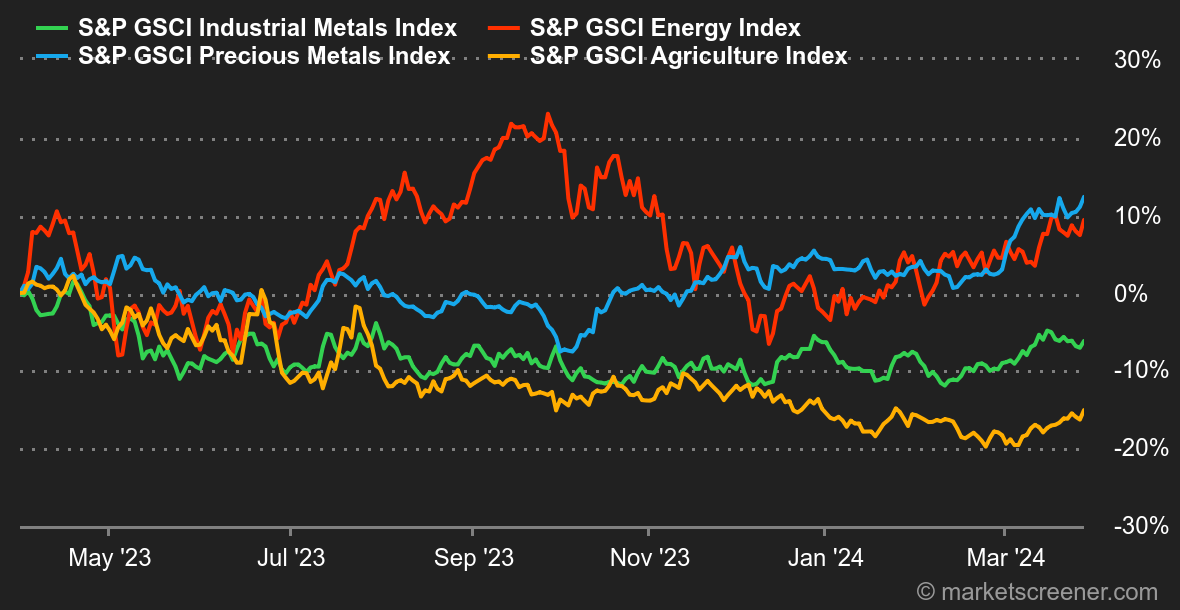

| Energy: Oil is rising slowly but steadily, buoyed by the prospect of a tighter market this year. Against this backdrop, geopolitical frictions are adding further leverage to the buying flow. The European benchmark, Brent, is advancing to USD 86.30, as is US light crude, WTI, which is back above USD 82 a barrel. However, the latest US inventory report was mixed, with crude inventories up by 3.2 million barrels, whereas the consensus was for a decline. The explanation lies in US imports, which have risen over the past 5 days. It should also be noted that OPEC will be holding a meeting on April 3 to define its policy. Metals: It's still time for a pause in the base metals segment, with copper and aluminum continuing their lateralisation sequence in London, at USD 8690 and 2238 respectively. Zinc and lead are showing a little more weakness, losing ground at 2366 and 1968 USD respectively. There's not much more to say, as traders are opting for a pause while awaiting the next catalyst, which will be the Chinese manufacturing PMI compiled by Caixin, to be unveiled on April 1. On the other hand, the mood is still festive for gold, which is once again attempting to close above USD 2,200 an ounce. The precious metal has gained around 7% since January 1. Agricultural products: It's hard to miss cocoa, which is monopolizing attention in the agricultural commodities segment. Its price briefly exceeded the USD 10,000/ton mark, a surge probably linked to unfulfilled margin calls on futures contracts. The cocoa market is likely to experience a further deficit this year, of between 400,000 and 500,000 tonnes. As for cereals, there's still no improvement in sight for corn, which is trading at around 430 cents a bushel. Wheat stagnated at 550 cents. |

|

| Macroeconomics |

| Not a Friday off. Financial markets continue on their upward trajectory, and nothing seems to be stopping them from closing at all-time highs. Managers, who are already having enough trouble keeping up with the benchmark, are making end-of-quarter adjustments: this is helping to prop up the market. We'll have to wait until Monday to assess the impact of Friday's Core PCE (US personal consumption expenditures). For the record, economists are forecasting +0.3% growth in February, after +0.4% in January. While the equity markets are closed, the same cannot be said for bonds, which will continue to trade. Their reaction to the publication will be interesting to watch, and could also set the tone for next Monday's session. A stronger-than-expected PCE should translate into higher yields and could, in turn, weigh on equities. We'll be keeping an eye on resistance at 4.35% on the US 10-year yield. A breach of this threshold would probably be viewed negatively, while a break of 4.07% would fuel prospects of a first rate cut in June. Crypto: Bitcoin retreated sharply this week, dropping more than 7% to around $63,000. After rising 43% in February, and 48% since January 1, a correction and profit-taking were expected. Bitcoin Spot ETFs, which have made a major contribution to BTC's rise in the early part of the year, have posted four consecutive days of net outflows for the first time. In total, since Monday, $863 million in net outflows have been recorded, which has naturally contributed to the selling pressure on the crypto-asset's price. Despite this, the ten Bitcoin Spot ETFs still hold a cumulative $53.76 billion in assets under management, or 4.18% of bitcoins in circulation. Unsurprisingly, this fall in BTC has triggered a general decline in the main cryptocurrencies, with Ether (ETH) down 9% to $3310, Binance Coin (BNB) down 4% to around $545, and Solana (SOL) down 16% to around $168. |

|

|

| Things to read this week | ||||||

|

|

*The weekly movements of indexes and stocks displayed on the dashboard are related to the period ranging from the open on Monday to the sending time of this newsletter on Friday. The weekly movements of commodities, precious metals and currencies displayed on the dashboard are related to a 7-day rolling period from Friday to Friday, until the sending time of this newsletter. These assets continue to quote on weekends. |

By

By