Since 2006, Credit Suisse's research team has been studying listed, owner-managed family businesses. Their annual objective is to examine whether these companies present a particular business model and whether they offer added value to shareholders, including those outside the family. To this end, the analysts have compiled a database called "Family 1000 ", comprising 1,000 large family-owned companies in America, Europe and Asia-Pacific, the latter accounting for more than half of the companies listed. Among the oldest family companies in the selection are Orkla (founded 1654), Merck KGaA (1668), Wendel (1704), Jose Cuervo (1758), Molson Coors Beverage Company (1786) and Jeronimo Martins (1792). Among the largest companies are Alphabet ($1797 billion), Meta Platforms ($1234 bn), Berkshire Hathaway ($903 bn), Tesla ($611 bn), Walmart ($471 bn), LVMH ($461 bn), Samsung Electronics ($366 bn), L'Oréal ($261 bn), Hermès ($261 bn), Reliance Industries ($229 bn), Roche Holdings ($212 bn). In their latest report, they update their study universe and re-examine the operational and stock market performance of listed family businesses.

Based on the findings of this Credit Suisse study, we can identify the four main characteristics of family businesses that help explain their performance.

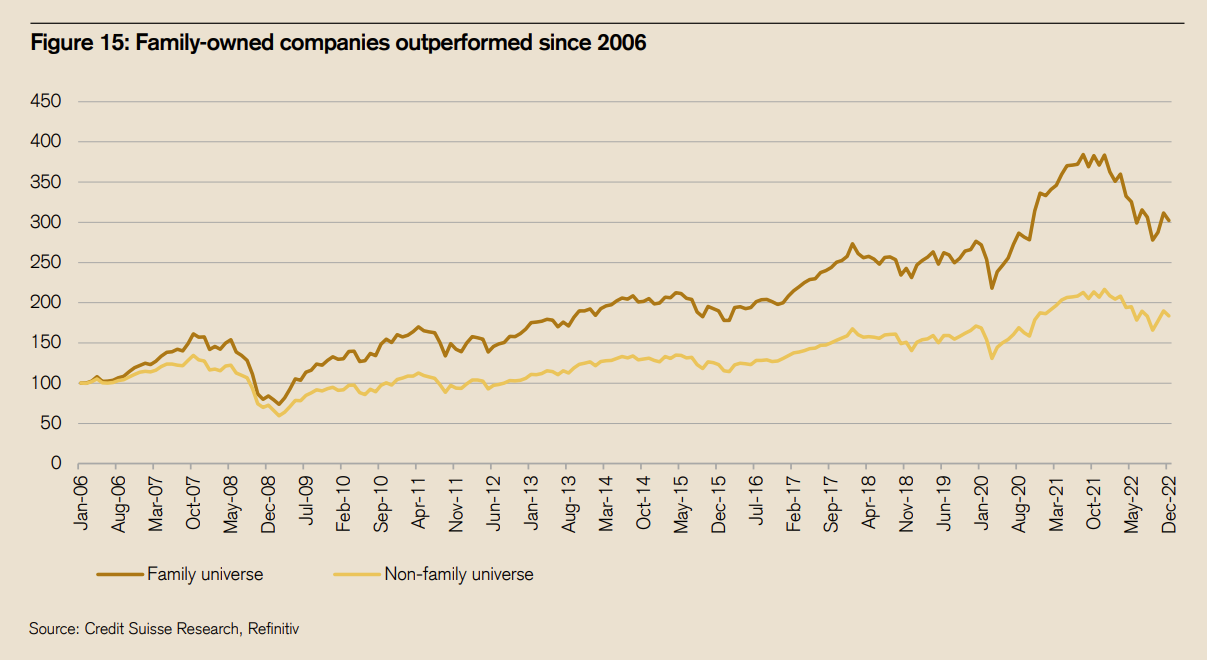

Entrepreneurial culture: Family businesses often focus on profitable growth, which translates into superior development quality and positive results both operationally and on the stock market. According to a Credit Suisse study, companies in the "Family 1000" group generated superior returns, as shown in the following graph. This graph compares the long-term stock performance of family businesses with that of non-family businesses. It is important to note that the data is adjusted for market capitalization and industry sector. Stock analysis reveals a consistent pattern of outperformance over the long term. Based on data collected since 2006, family-owned companies have outperformed non-family-owned companies by an average of 3% per year (an annual difference of 300 basis points).

Source: Crédit Suisse

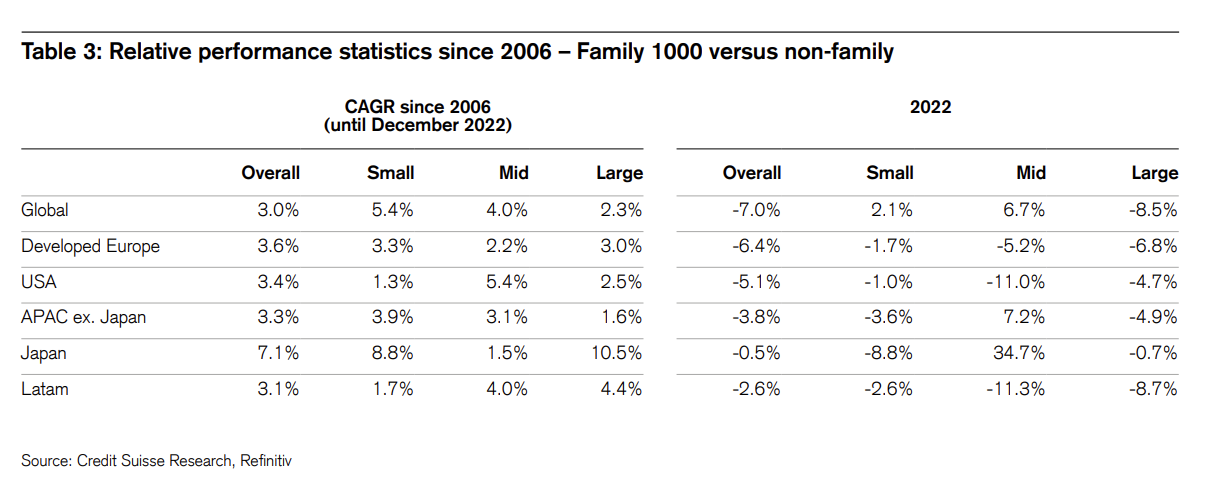

This performance gap is even more pronounced in Japan and in the small & mid caps segment, as shown in the table below:

Source: Crédit Suisse

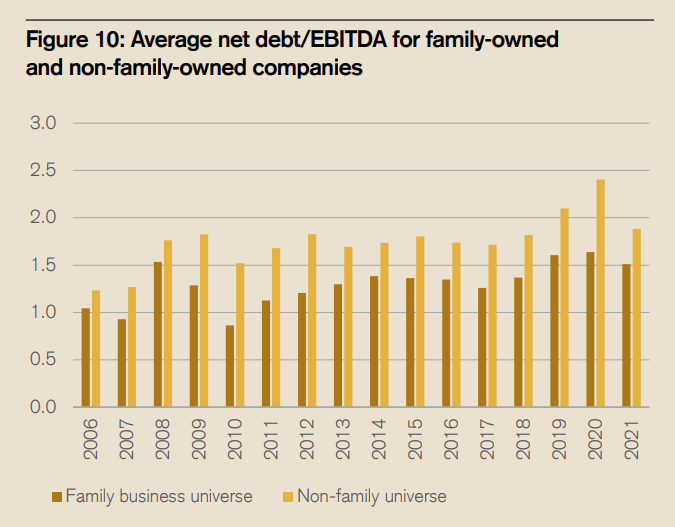

Prudent management of financial resources: A company's capital represents a significant part of the family estate. As a result, managers are very active in their operations and manage their assets with the utmost rigor. Family businesses are generally more conservatively financed, which translates into lower financial leverage. In terms of leverage, the researchers observe a more conservative approach to debt on the part of family businesses, with a net debt/EBITDA ratio 25% lower on average over time.

Source : Crédit Suisse

Companies that choose to minimize their debt often do so to protect their long-term viability and independence. Managers, especially those who own and manage their companies, are generally more attentive to this strategy. By limiting debt, they reduce risk and rely less on external financing, whether loans or equity contributions. This approach helps to maintain decisive control over the long-term direction of the company.

A conservative approach to innovation: Family businesses tend to invest less in research and development (R&D) than non-family businesses. However, they can be more efficient in using their resources for innovation. The managers of these companies, often members of the owning family, make decisions with prudence and strict control over spending. This tight management can reduce governance costs and enable a more judicious use of funds allocated to innovation. Although they invest less in R&D, family businesses often have superior human and social capital. Employees tend to be more loyal and industry relationships stronger. Social capital, which includes in-depth knowledge of the company and the sector, as well as close ties, fosters innovation. It creates a network of advice and communication that supports the development of new ideas. Network partners can point out emerging trends and offer constructive feedback, which can reduce costs and accelerate product or service development. Family businesses use these assets, often absent in non-family businesses, to achieve more innovation with fewer financial resources.

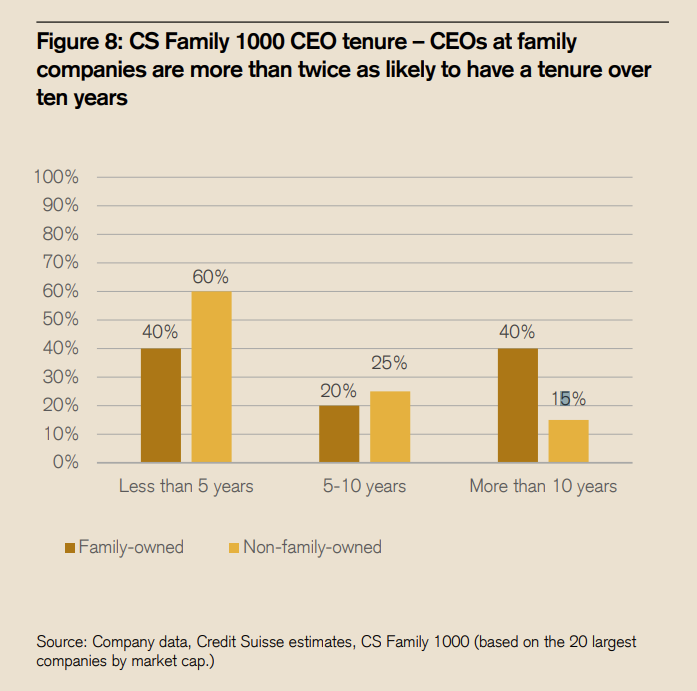

A long-term view of business: Family businesses uphold strong values that give them the ability to meet the challenges they face. The family also invests with a view to passing on capital to the next generation. Adopting a long-term vision also means building employee loyalty through greater recognition. The strategic choices made by the founding shareholders are therefore driven by a long-term structural vision, a guarantee of the company's durability. As we can see from the graph below, CEOs of family businesses are more than twice as likely to have a mandate of more than ten years. Family businesses seek to retain control The desire to retain family control in family businesses is often at the heart of the decision-making process, and can therefore influence the willingness to take risks. Any business decision that might dilute or threaten family control is likely to be avoided. This consideration does not arise in non-family business decision-making, where the objective is to maximize shareholder returns, not just those of the family. According to Cucculelli, Breton-Miller and Miller (2016), family governance inhibits new product development.

Source: Credit Suisse

Family businesses are distinguished by greater loyalty and longer service from their employees, including within their management. Looking at the 20 largest companies in the CS Family 1000 in terms of market capitalization, we see that 40% of them have had a CEO in post for more than ten years, compared with just 15% of non-family businesses. What's more, 40% of family businesses have had a CEO in post for less than five years, compared with 60% of non-family businesses. This stability at management level may encourage a higher rate of innovation in family businesses. Indeed, internal collaboration is often stronger, and there are generally fewer obstacles to implementing new projects.

In conclusion, this Crédit Suisse study explains the characteristics of family-owned companies that corroborate their operational and stock market outperformance compared with non-family-owned companies.The performance factors highlighted include the importance of a long-term perspective in creating shareholder value, the maintenance of an entrepreneurial culture, more conservative management of debt and innovation, high employee loyalty and longer tenure, commitment and an acute awareness of the importance of best practices.

To find out more, discover a thematic list of family businesses.

*The illustration in this article was generated by AI.

By

By