LATEST

Spirits valuations are appealing but this is a reflection of the downside risks. Within the industry, Remy Cointreau stands out as the most attractive since its PE premium to the sector has halved. For now, Pernod is preferred relative to Diageo owing to its lower exposure to the US and its ability to capitalize on the potential rebound in China. Campari is not worth the effort.

FACT

In this spirits’ sector note, we take a close look at the current industry challenges and opportunities

ANALYSIS

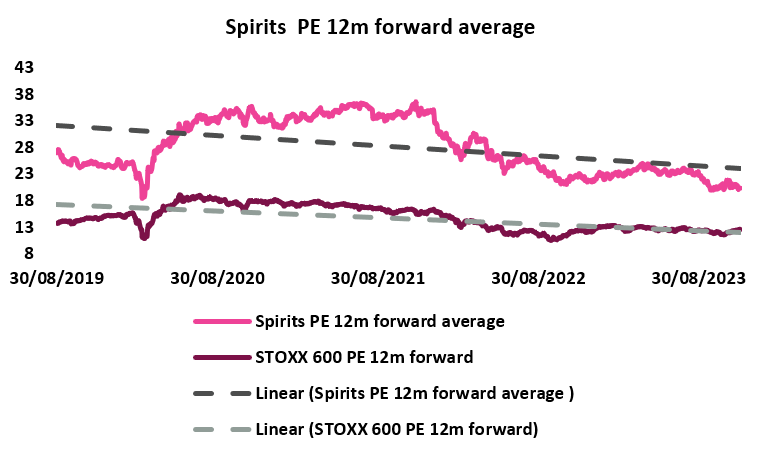

Although the COVID era was a golden age for spirits companies, the industry has somewhat sobered up since the beginning of the year with profit warnings from Remy Cointreau and Diageo, and Pernod Ricard and Campari missing expectations. Furthermore, the recent months have seen pressure on spirits stocks due to apprehension about GLP-1 treatments. Currently, our spirits coverage trades at 20.4x the 12m forward PE, or a 27.6% discount vs. the past decade. Additionally, Beverages share prices have underperformed the STOXX 600 by 24% YTD (chart below).

Source: AlphaValue Analysis, Bloomberg data

Source: AlphaValue Analysis, Bloomberg data

While we remain optimistic about the industry’s long-term prospects there are still too many downside risks that lead us to err on the side of caution about spirits in the short term, despite their compelling valuations.

US reverts to pre-Covid consumption patterns: Following the stellar performance during Covid (lockdowns and stimulus cheques) driven by premiumization, consumption remains heavily impacted by the reversal to pre-Covid consumption patterns amplified by the macroeconomic headwinds. Elevated inventory levels and the absence of a clear outlook are ongoing concerns for the industry. This reversal is impacting all alcohol categories with the cognac market experiencing specific shifts: i) consumers switching to more affordable bottles, propelled by heightened promotional strategies among certain players, favouring the VS category, and ii) a gradual erosion of market share to tequila. Does this deceleration in Cognac indicate a lasting change? We do not take this view; historically, the Cognac sector has endured rocky periods only to see renewed growth. Most industry research underscores the segment’s robust underpinnings, highlighting the substantial appeal for Cognac, particularly for select brands like Remy Martin.

China plays a critical role in spirits demand: China had been expected to be a major growth catalyst but its GDP recovery is proving slower than expected. Although in recent weeks there’s been more of a stabilization trend in consumption than a decline (an improvement noticed in both the off-trade and on-trade, with the latter facing more challenges), the possibility of a full-on rebound remains fragile for now. The real estate crisis and high unemployment rates in the country continue to impact consumer confidence.

In Europe: consumers continue to face challenges due to a deteriorating macroeconomic landscape.

Best spirit picks?In our view it is still too early to dive into Spirits, but below we give an overview of the four beverage stocks with our take on the current headwinds and the potential share price catalysts.

Diageo: BUY recommendation – 42.6% upside potentialThe recent downward revision of the MT organic operating profit growth outlook, announced during the profit warning and confirmed in the CMD two weeks ago, doesn’t alter our long-term conviction on this blue chip company. Operating profit is now expected to grow by +5% to +7% (vs. +6% to +9% previously), roughly in line with the organic top-line growth (through a combination of +2% volume, +1% to +2% pricing and, +2% to 3% of mix premiumization). The revised outlook appears more effectively to reflect the prevailing macroeconomic challenges. As inflation falls and aligns with projected productivity savings of $2bn spanning from FY 2025 to FY 2027 (derived from COGS improvements, enhanced marketing efficiency and streamlined overheads), Diageo’s organic operating profit is expected to outpace revenue growth in the long run. However, the company has refrained from committing to a specific timeline. Additionally, Diageo has unveiled its intentions to bolster A&P investments, aiming at augmenting brand value, potentially by concentrating efforts on the US market, where the company has seen a decline in its market share.

The profit warning impacting Diageo’s outlook has carried significant weight: despite being the No.1 worldwide – with its best-in-class mix, geographical diversification and strong portfolio – Diageo is not immune to the industry challenges. Despite the management’s reassurance, uncertainties persist regarding consumer circumstances and the lack of visibility surrounding inventories held by retailers and wholesalers across the LatAm region. Consequently, we eagerly await the H1 results for further insights.

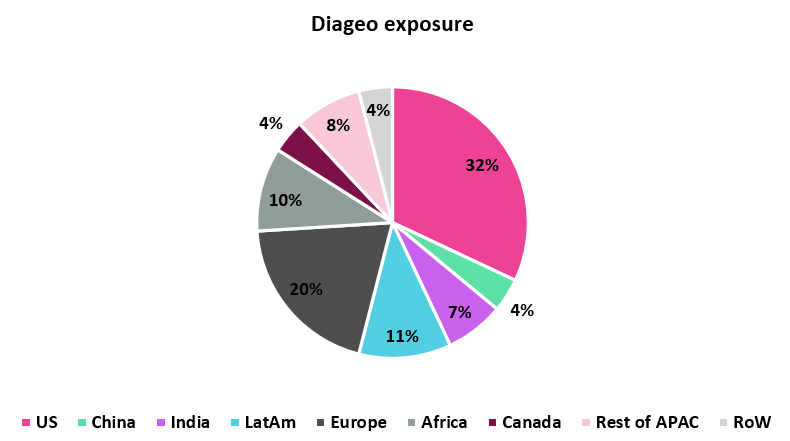

During the recent CMD, the company highlighted a positive trend in holiday spending in the US; the management expects a sequential improvement for H1 FY 2024 vs. H2 FY 2023 (AVe: +1.0% yoy). However, the lack of positive comments from the entire industry in the region, along with the high level of inventory and the ongoing rapid normalization, was not reassuring. Additionally, with its low exposure to China (4% of the group’s top line), Diageo cannot bank on a Chinese rebound to partly offset the US slowdown.

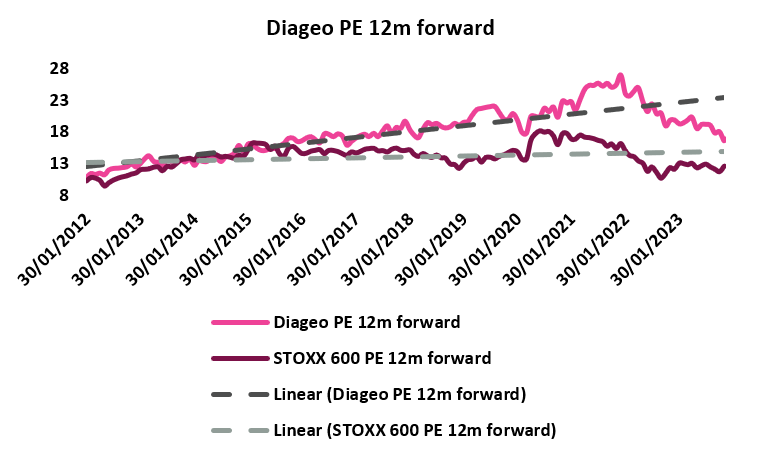

Our take – Like all the other spirits companies, Diageo’s 12m forward PE (chart below) is trading at a discount vs. its 10y average (5.9% discount). However, Diageo is currently trading at a 16.7% discount vs. our spirits coverage whereas, over the last decade, the company traded at a 20.3% discount. We are inclined to stay away at least until the H1 report (release date: 30/1/2024). Positive developments in the US towards normalization would be beneficial for the whole industry. This would nonetheless serve as a key driver for Diageo, which derives roughly 50% of its EBIT from this country. Further details on the LatAm developments would help.

Source: AlphaValue Analysis, Bloomberg data

Source: AlphaValue Analysis, Bloomberg data

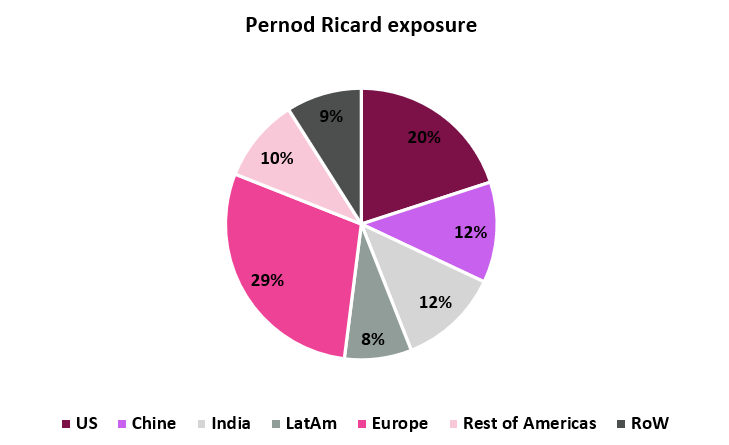

While the company has confirmed its FY 2024 outlook in the US (around +2% yoy, with the help of low comps for H2) and provided encouraging news from China, its share price has underperformed the STOXX 600 by -10% since its Q1 results on 19/10/2023 (while outperforming our spirits coverage by +4.8%). The primary reasons behind this are the subdued conditions in the US and the hesitant recovery observed in China. Additionally, the modest performance in India can be attributed, for the most part, to the suspension of the company’s license in New Delhi. While there is no new information on the situation, the license was suspended in Q1 last year, therefore the remainder of FY 2024 will not be impacted.

While Pernod Ricard is less premium than Diageo (and is thus less likely to be affected by consumer downtrading), the read-across from Diageo’s profit warning could result in similar weaknesses for the French group (c.7.5% of the group’s top line vs. 11% for Diageo in LatAm). Although none of this was disclosed during the H1 results one month ago, it’s possible that the bad news might come out during the Q2.

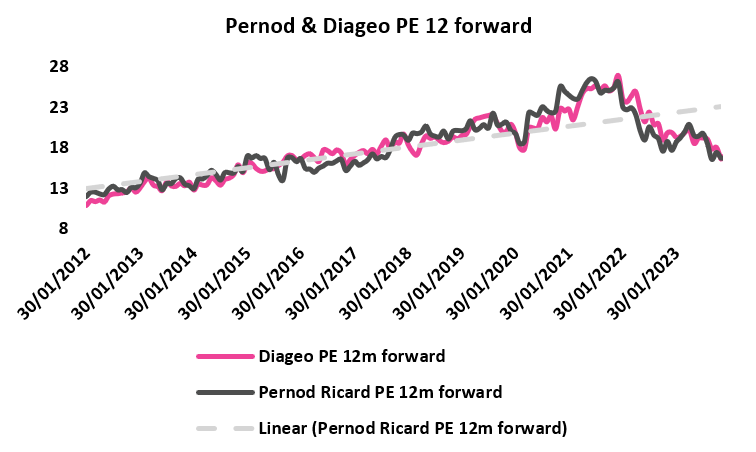

Our take – There is currently neither a premium nor a discount (chart below) on Pernod’s 12m forward PE vs. Diageo, its closest peer (17.0x). This is consistent with the trend observed in the last 10 years and 4 years (18.1x and 21.7x respectively). Although we prefer the Diageo equity story, Pernod Ricard remains our top pick in the short-term: i) with 12% of Pernod’s top line (vs. 4% for Diageo) coming from China, the company will enjoy easy comps. driving growth and above all, might provide leverage on a potential full recovery within the country ii) considering the lack of positive news coming from the US, its lower exposure to the country vs. Diageo is an advantage in the short term iii) the Indian fundamentals remain very strong, gaining market share (c.12% of Pernod’s top line vs. c.7% for Diageo).

Source: AlphaValue Analysis, Bloomberg data

Source: AlphaValue Analysis, Bloomberg data

Following two exceptional years (+74% cumulative organic growth between FY 2022 and FY 2023), Remy Cointreau is amongst the spirits companies to have struggled most YTD (having underperformed by -15% and -36% our spirits coverage and the STOXX 600 index respectively). The company has been hit hard by the reversal to pre Covid. The market didn’t react well to i) its initial announcement of flat organic sales growth for FY 2024 and, ii) later in the year, when it issued a profit warning and slashed its 2024 outlook from flat organic sales growth to -15% to -20%. After experiencing a significant drop in sales, Remy has disclosed a €100m cost-cutting program aimed at safeguarding its profitability. The program involves 60% one-off savings, including approximately €33m from A&P and €27m from overhead costs, while the remaining 40% represents structural savings, with around €16m attributed to A&P and €24m to overheads. Over the H1, the company achieved approximately €25m in cost savings, primarily stemming from reduced manufacturing, industrial and logistics expenses. Despite facing challenging times, Remy’s commendable level of transparency and information dissemination deserves recognition.

While during the H1 results last week some news from the US had been expected (the hottest topic for Remy), the market didn’t get much to sink its teeth into. The challenges in the US are threefold: of the -33% Q2 Cognac depletions i) -20% is related to normalization destocking, cash tension (both wholesalers and retailers) and lower consumer purchasing power ii) -8% decrease is linked to promotional activities, especially by Moët Hennessy, a strategy Remy largely avoids iii) the remaining -5% is attributed to Tequila and RTD market share gains (although those trends are easing). The Remy Martin VSOP bottle, which serves as an entry point for the Remy Martin brand (priced higher than competitor VS bottles), is encountering the most significant impact within the current landscape. This bottle has higher exposure to the Black/African demographic, which is experiencing notable challenges within the prevailing environment. Despite the slight improvement observed by the management in the short term, a return to sales growth for this product isn’t anticipated until FY 2025.

With approximately 27% of the group’s total revenue generated in China, the recent uptick in some sales is an encouraging sign although the recovery remains insufficiently robust. On one hand, the younger population is showing a more selective approach, targeting diverse occasions. On the other, consumers of the Louis XIII bottle tend to be older (between 50-60 years old), often successful real estate players who have been significantly affected by the current economic environment.

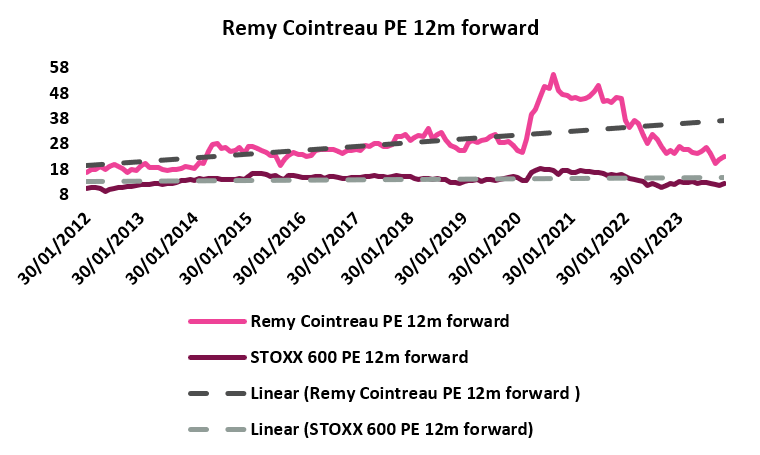

Our take – Although there are potential downside risks for Remy, the current valuation offers an attractive entry point for a stock with solid fundamentals. Remy is currently trading at a 23.0× 12m forward PE, a premium of 13.2% vs. our spirits coverage while, over the last decade, Remy traded at a 26% premium (chart below). Whereas the three other spirits companies are currently trading at a 12m forward PE multiple discount of around 5-6% vs. the 10y average, Remy is trading at a -20% discount. Similarly to Pernod, a solid recovery in China would be advantageous for the company. Data indicating a stabilization in the market share of Cognac vs. Tequila would also be viewed positively. Lastly, the ongoing ramp-up phase of the L&S division should be appreciated by the market.

Source: AlphaValue Analysis, Bloomberg data

Source: AlphaValue Analysis, Bloomberg data

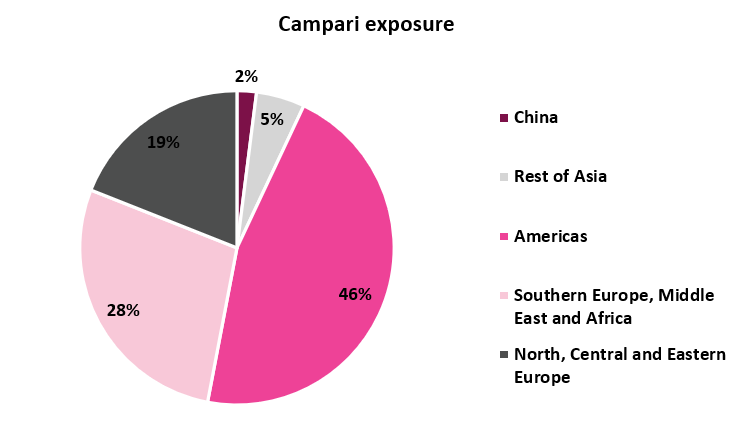

Despite a disappointing Q3, largely attributed to adverse weather conditions in Europe, consumer pressure in the region and a number of one-off events, Campari has shown greater resilience within the prevailing context. Indeed, since the beginning of the year Campari has outperformed our Spirits coverage by 28% and is currently trading at a 12m forward PE multiple premium of 21.5% vs. our spirits coverage, while over the last 10y the company traded at a 14.6% premium (chart below). This is primarily attributed to its distinctive profile and its emphasis on liqueurs/aperitifs (constituting approximately 60% of the group’s revenue). These beverages, frequently enjoyed in cocktails, are preferred by a younger urban demographic seeking to sustain their lifestyle, which appears to have been less affected by the economic circumstances. Over the last two years in the US for instance, the average monthly growth rate in retail value of cocktail consumption has been around 30% (vs. 17% for Tequila and 3.0%-4.0% for the other spirits category). Secondly, its exposure to Tequila in the US (around 25% of the US group’s top line) acts as a shield vs. normalization, as this category has continued to outperform the spirits industry. Lastly, although the company is ramping up its investment in aged spirits (cf. last idea kicker on Campari), its hitherto lower exposure has also shielded it from being as affected by this slowdown.

The upcoming retirement of the iconic Bob Kunze-Concewitz in April 2024, to be succeeded by Matteo Fantacchiotti, should see little change in the company’s strategy. On the contrary, appointing the former Managing Director of the APAC region indicates the company’s dedication to further fortifying its presence in this area. Matteo possesses a keen understanding of the APAC landscape and has been instrumental in enabling Campari to enhance its presence in key markets like India, Japan, South Korea and China.

Nevertheless, the company’s limited exposure to APAC restrains its ability to capitalize on the robust fundamentals of India and on the anticipated full recovery in China. Additionally, the ongoing conditions in China have further delayed the launch of Aperol on the Chinese market. This launch had already been postponed due to COVID-19 and the subsequent lockdowns.

Our take – Campari’s unique profile likely presents fewer downside risks than its industry. However, the company is offering a symmetric limited upside in the short term. Its low exposure to China and aged spirits has proved to be a strength during this turbulent period but, once the trend reverses, these two factors might turn into weaknesses. From this perspective, we prefer Remy Cointreau.

Source: AlphaValue Analysis, Bloomberg data

Source: AlphaValue Analysis, Bloomberg data