While 500 more sanctions have now been placed on Russia, uranium imports are not included.

-No sanctions of Russian uranium exports

-Congress yet to make a decision

-Spot price suffers from lack of buyers

-Paladin Energy reverses an impairment

Following the death of Aleksey Navalny, the US government has levied additional sanctions on over 500 Russian individuals and businesses.

This latest round of sanctions targets Russia's financial system, its military supply complex, and other "entities and individuals, including those engaged in sanctions evasion and circumvention, and those bolstering Russia's future energy and metals and mining production", uranium industry consultant TradeTech reports.

The sanctions, however, stop short of targeting Russia's nuclear fuel or reactor technology exports. While Rosatom is named in the revised sanctions protocol, and this represents the sixth time the state-owned nuclear technology company has faced sanctions, the latest restrictions are aimed at the company's units "supporting Russia's development of the Arctic region, future business development, and an enterprise of Russia's nuclear weapons complex".

The US House Foreign Affairs Committee was scheduled to hold hearings last week on possible sanctions to be imposed on Rosatom and Russian uranium imports. However, having refused to put a new Ukraine/Israel aid package, passed by the Senate, to the House, Speaker Mike Johnson then called a two-week recess, which meant Congress will have two days to negotiate to avoid a government shutdown.

The hearing on Russian imports is expected to rescheduled in the coming weeks.

The Market

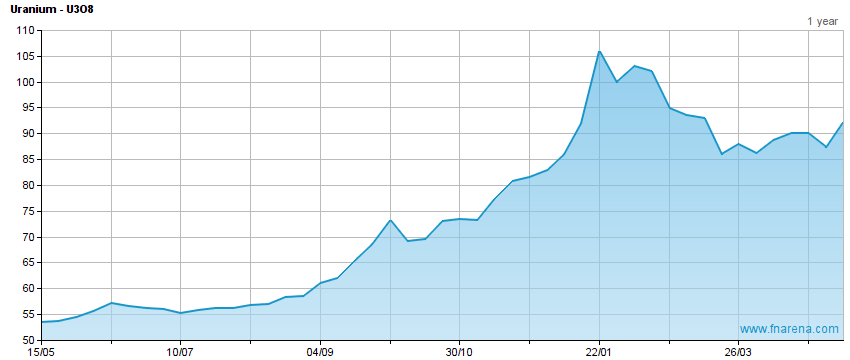

A long weekend in both the US and Canada last week helped to reduce activity in the uranium spot market, and hotter than expected US inflation data kept buyers at bay, TradeTech notes.

While to date sellers have been stubbornly holding out for higher prices, as the spot price has wavered above US$100/lb sellers have become more anxious. Now the buyers have the upper hand.

TradeTech's weekly spot price indicator fell -US$7.00 to US$95.00/lb.

Yet underlying market fundamentals, which today are characterised by increasing policy support on the demand side and under-supply on the supply side, remain largely unaffected by the discrete events that drive week-to-week variations in the price, TradeTech notes.

Although buyers were less active in the uranium spot market this week, long-term uranium demand remains strong.

TradeTech's term price indicators remain at US$103/lb (mid-term) and US$72/lb (long).

Paladin Energy

Australian-listed Paladin Energy ((PDN)) reported its first half financial results this week. Paladin is still in spending mode ahead of the restart of its Langer Heinrich uranium mine in Namibia in the September quarter, but the result was boosted by the reversal of an impairment originally taken against difficult economic conditions and a weak uranium price, which no longer apply.

There are four brokers monitored daily by FNArena and all have a Buy or equivalent ratings on the stock. Their consensus target suggests 27% share price upside.

Uranium companies listed on the ASX:

| ASX CODE | DATE | LAST PRICE | WEEKLY % MOVE | 52WK HIGH | 52WK LOW | P/E | CONSENSUS TARGET | UPSIDE/DOWNSIDE |

|---|

| 1AE | 26/02/2024 | 0.1200 |  -14.29% -14.29% | $0.19 | $0.05 | | | |

| AGE | 26/02/2024 | 0.0600 |  -10.77% -10.77% | $0.08 | $0.03 | | $0.100 |  66.7% 66.7% |

| BKY | 26/02/2024 | 0.2800 |  - 1.72% - 1.72% | $0.80 | $0.26 | | | |

| BMN | 26/02/2024 | 3.0400 |  -10.00% -10.00% | $3.99 | $1.19 | | $7.040 |  131.6% 131.6% |

| BOE | 26/02/2024 | 4.7500 |  - 8.43% - 8.43% | $6.12 | $2.02 | 162.9 | $5.720 |  20.4% 20.4% |

| DYL | 26/02/2024 | 1.2600 |  -14.24% -14.24% | $1.76 | $0.48 | | $1.640 |  30.2% 30.2% |

| EL8 | 26/02/2024 | 0.4800 |  -17.86% -17.86% | $0.68 | $0.27 | | | |

| ERA | 26/02/2024 | 0.0500 |  -15.25% -15.25% | $0.23 | $0.03 | | | |

| LOT | 26/02/2024 | 0.3200 |  1.56% 1.56% | $0.38 | $0.15 | | $0.610 |  90.6% 90.6% |

| NXG | 26/02/2024 | 10.7100 |  -10.06% -10.06% | $12.99 | $5.11 | | | |

| PDN | 26/02/2024 | 1.1700 |  - 8.84% - 8.84% | $1.46 | $0.52 | 372.1 | $1.513 |  29.3% 29.3% |

| PEN | 26/02/2024 | 0.1100 |  - 8.33% - 8.33% | $0.20 | $0.08 | | $0.340 |  209.1% 209.1% |

| SLX | 26/02/2024 | 4.5400 |  - 7.22% - 7.22% | $5.78 | $2.92 | | $7.600 |  67.4% 67.4% |

FNArena is proud about its track record and past achievements: Ten Years On

All material published by FN Arena is the copyright of the publisher, unless otherwise stated. Reproduction in whole or in part is not permitted without written permission of the publisher.

© 2024 Acquisdata Pty Ltd., source FN Arena

-14.29%

-14.29% -10.77%

-10.77% 66.7%

66.7% - 1.72%

- 1.72% -10.00%

-10.00% 131.6%

131.6% - 8.43%

- 8.43% 20.4%

20.4% -14.24%

-14.24% 30.2%

30.2% -17.86%

-17.86% -15.25%

-15.25% 1.56%

1.56% 90.6%

90.6% -10.06%

-10.06% - 8.84%

- 8.84% 29.3%

29.3% - 8.33%

- 8.33% 209.1%

209.1% - 7.22%

- 7.22% 67.4%

67.4%