Innovation is never far from the de-risking market

2023 was yet another year of de-risking industry firsts, with WTW leading the first ever superfund transaction between Clara-Pensions ("Clara") and Sears Retail Pension Scheme. While the pension trade press, and many mainstream media outlets, lit up at the announcement evidencing the launch of another viable de-risking avenue for

It is no coincidence that 2023 was the year that superfunds finally moved from being a "great idea" into "tangible reality", as with a government backdrop of consolidation, productive finance and governance reform, Clara found itself ready to play very supportively to the tune of the political day. I have no doubt that over the coming years consolidation will remain a key focus and we will see Clara building its pipeline and scale, alongside the government's intention to establish a public sector consolidator by 2026, which is aimed at schemes (likely the smallest) that are unattractive to commercial providers, such as Clara.

What is a superfund?

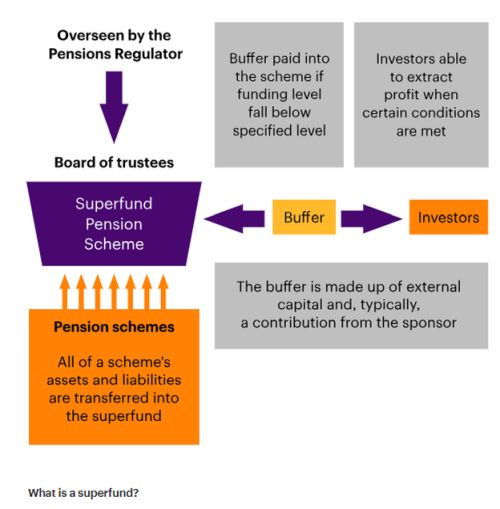

A superfund is a pension scheme set up to receive bulk transfers of assets and liabilities from other pension schemes with a view to achieving efficiencies through consolidation. Once a trustee has decided to transfer their pension scheme assets and liabilities to a superfund, the existing employer covenant can be removed and replaced by the security of a funded capital buffer. The buffer is funded by the superfund's capital providers and may be supported by a lump sum contribution from the outgoing sponsor. The buffer provides additional security to members and would be called upon if the superfund needed to top up the funding level in future.

Superfunds offer promised benefits at a cost that is lower than that of an insurance buyout - but also with slightly more attaching risk as members' benefits remain within the pension scheme world rather than the highly capitalised and regulated insurance world.

A superfund is a for-profit entity, so investors will expect to make a profit in return for putting up the buffer capital.

What was the Clara/

The Ł590m transaction between Sears Retail Pension Scheme and Clara announced in

What are the implications for trustees, sponsors and the insurance market?

The

While the

It will be interesting to see how bulk annuity insurance companies react in response as Clara, or other superfunds, start to build scale. For example, might bulk annuity insurers see 2024/25 as a final opportunity to squeeze out the new kids on the block, by offering improved price propositions to marginalise the likes of Clara, or will the level of activity in the bulk annuity market expected over 2024/25 mean these insurers pay little attention to another playing on their turf because there is more than enough business to go around? And of course, Clara is a "route to buyout" superfund so is expecting to ultimately provide new business to the insurers, although future superfunds may not always have this model which may change the insurers' attitudes.

How can a scheme enter into a superfund?

Before any pension scheme can enter into a superfund, it must first satisfy the three gateway principles set out in the current Pension Regulator Guidance. These being:

- The scheme should not view buyout as accessible now

- It has no realistic prospect of buyout in the foreseeable future, given potential sponsor cash contributions and the insolvency risk of the sponsor

- It must improve the likelihood of members receiving full benefits

Given these gateway tests we consider that schemes that could consider a superfund would be:

-

Funded between c90-95% on buyout with uncertain or no covenant; or

- Funded between c70-90% on buyout and a sponsor contribution can be made to facilitate superfund entry.

- Firstly, it is essential that the team advising has ready and deep access to live bulk annuity insurer pricing, this will allow you to easily fast track entry to superfund, without the need to circle round seeking quotes from insurers in the market risking losing a superfund deal that might be in your grasp.

- Secondly, select an adviser that has deep understanding of bulk annuity transactions, as the negotiated "Bulk Transfer Agreement" executed between the Sponsor, Trustees and Clara is similar to a buy-in contract with an insurer, so a detailed knowledge of the commercials negotiated on insurer transactions is key to good negotiation outcomes, as is knowing the art of the possible with both Clara and the Pensions Regulator.

- Finally, schemes should choose an adviser that has a track record of the oversight needed for such risk transfer deal execution.

The Sears Scheme found itself in very much the "sweet spot" in terms of funding levels for a transfer to a superfund, reasonably well funded, but too far from buyout to say with any degree of certainty this would be achieved in the future. This, coupled with the fact that for more than two decades the Company had no trading businesses to support the Scheme, left the Scheme in a position where there was no doubt that all three gateway principles were comfortably met.

As well as leading the transactions advice and project management, WTW also led the liaison with the

Key takeaways for schemes considering a superfund transaction

Wider implications and what next?

Turning to the wider implications, here are my key reflections:

01

Superfund transactions are now a real alternative

No longer just a "good idea", the fact a scheme has gone through the robust Regulator Clearance process and come out the other side, with fully executed transaction with Clara, evidences it can be done. This is undoubtedly a significant step forward for the superfund market and represents a key leap forward for Clara as they aim to scale their proposition.

02

This transaction raises interesting questions for many trustees and sponsors

It will pave the way for other schemes to follow-suit. It opens-up another viable de-risking option for schemes where buyout is out of reach. In some cases, the merits of a superfund transaction will be finely balanced against the potential for greater financial support from the sponsor in future. However, in other circumstances, the merits of a superfund transaction will be clearer cut. Engaging early with your transaction advisers can help you explore the full range of de-risking solutions available and consider whether a superfund is a viable alternative.

03

Will additional investors be attracted to the superfund space?

A range of superfund providers would be a sign of a healthy industry. It would lead to more innovation in the space and provide greater choice for the trustees and sponsors considering superfunds, ensuring that they can find the best solution for their members. However, as it stands, it may be a challenging business case to sign off. The barriers to entry may just be too high at this stage and there is still no permanent legislation in place, albeit the noises around it are getting louder. While the Government has trailed that the permanent regime will be directionally well aligned, it's not clear how well aligned and how the requirements will differ - this includes a superfund's ability to extract profit and so the timeline for investors to get a return on their capital.

So, no doubt there will be more to come from Clara and the superfund market across 2024, the only question in my mind is what scale of transactions we will see them executing over the year.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

WTW

EC3M 7DQ

© Mondaq Ltd, 2024 - Tel. +44 (0)20 8544 8300 - http://www.mondaq.com, source