- Setups in focus ahead off key event risk this week

- Updated targets & invalidation levels

- Check out FXCM’s Forex Trading Contest

We’re on the lookout for possible near-term exhaustion in the greenback early in the week with the Dow Jones FXCM U.S. Dollar Index (Ticker: USDOLLAR) within striking distance of confluence resistance into the 2016 open at 12131. The long-bias is at risk heading into this region as we await the FOMC interest rate decision on Wednesday.

Beyond the Fed, the release of Australia CPI, UK GDP, the BoJ interest rate decision and U.S. 2Q GDP will be of particular interest this week. Keep in mind we are heading into the close of July trade and added caution is warranted as end-of-month flows can often prompt unexpected intraday volatility.

Key levels discussed on USDOLLAR, USDCAD, AUDJPY, EURUSD, EURJPY, GBPCAD, GBPJPY, Crude Oil & Gold. Continue tracking these setups and more throughout the week- Subscribe to SB Trade Desk and take advantage of the DailyFX New Subscriber Discount.

Check out SSI to see how retail crowds are positioned as well as open interest heading into the close of June trade.

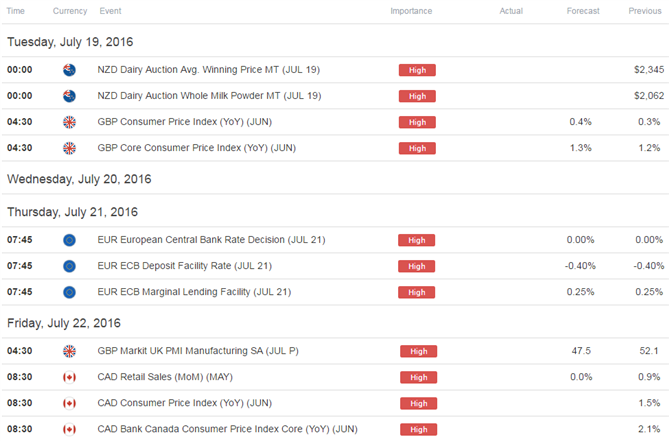

Relevant Data Releases

Help fine-tune you entries, click here to learn more about the DailyFX Grid Sight Index (GSI)

Other Setups in Play:

- USD/CAD Eyes Key Resistance Hurdle Ahead of Canada Retail Sales/CPI

- AUD/JPY- View Weakness as an Opportunity

- EUR/USD Battle Lines Drawn Ahead of ECB- Levels To Know

- GBP/JPY at Brexit Levels- Elevated Risk for Declines on UK Employment

Looking for trade ideas? Review DailyFX’s 2016 2Q Projections!

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFX and Tuesday, Wednesday & Thursday’s on SB Trade Desk at 12:30 GMT (8:30ET)

original source