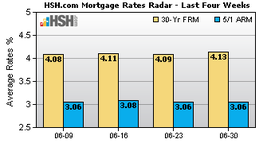

FOSTER CITY, Calif., July 1, 2015 (GLOBE NEWSWIRE) -- Rates on the most popular types of mortgages inched their way to fresh highs or held firm this week, according to HSH.com's Weekly Mortgage Rates Radar. The average rate for conforming 30-year fixed-rate mortgages rose by four basis points (0.04 percent) to 4.13 percent. Conforming 5/1 Hybrid ARM rates remained unchanged from last week, closing the Wednesday-to-Tuesday wraparound weekly survey at an average of 3.06 percent.

"The Greek debt mess is roiling markets, but we haven't seen much effect on mortgage rates as of yet," said Keith Gumbinger, vice president of HSH.com. "Our daily surveys over the last five days show that rates have been pretty flat despite a dip in influential 10-year U.S. Treasury yields. Fixed mortgage rates usually track this indicator well, but it would seem that government-backed bonds are more in favor than Mortgage-Backed Securities as investors look to get cash out of harm's way."

Although Greece is still negotiating with its creditors on a new set of supports, no agreement has been reached. Creditors hope to see needed financial reforms and indications that Greece can and will make payments on its existing loans. Defaulting on their obligations could see Greece exit using the Euro as a currency, which could destabilize the Euro and have other far-reaching effects on financial markets. To preserve cash, earlier this week the Greek government ordered banks closed for six days and has limited withdrawals.

"The saga continues," adds Gumbinger. "We may see some fallout and effect on interest rates here. For most of the last couple of years, financial troubles overseas have been the mortgage shopper's best friend, but at least the initial indication is that the impact on rates is limited, but we'll know more in the coming days."

Average mortgage rates and points for conforming residential mortgages for the week ending June 30, according to HSH.com:

Conforming 30-year fixed-rate mortgage

- Average Rate: 4.13 percent

- Average Points: 0.17

| |||||

Conforming 5/1-year adjustable-rate mortgage

- Average Rate: 3.06 percent

- Average Points: 0.08

Average mortgage rates and points for conforming residential mortgages for the previous week ending June 23 were, according to HSH.com:

Conforming 30-year fixed-rate mortgage

- Average Rate: 4.09 percent

- Average Points: 0.21

Conforming 5/1-year adjustable-rate mortgage

- Average Rate: 3.06 percent

- Average Points: 0.11

Methodology

The Weekly Mortgage Rates Radar reports the average rates and points offered on conforming 30-year fixed-rate mortgages and conforming 5/1 ARMs. The weekly mortgage rate survey covers a large sample of mortgage lenders and is conducted over a Wednesday-to-Tuesday cycle, with data released every Wednesday. HSH.com's survey helps consumers find the best rates on home loans in changing market conditions. Unlike mortgage rate surveys that report average rates only, the Weekly Mortgage Rates Radar's inclusion of both average rates and average points provides a more accurate view of mortgage terms currently offered by lenders.

Every week, HSH.com conducts a survey of mortgage rate data for a wide range of consumer mortgage products including ARMs, FHA-backed and jumbo mortgages, as well as home equity loans and lines of credit from hundreds of direct lenders in the U.S. For information on additional loan products, visit HSH.com.

About HSH.com

HSH.com is a trusted source of mortgage data, trends, news and analysis. Since 1979, HSH's market research and commentary has helped homeowners, buyers and sellers make smart financial choices and save money on mortgage and home equity products. HSH.com, of Riverdale, N.J., is owned and operated by QuinStreet, Inc. (NASDAQ:QNST), one of the largest Internet marketing and media companies in the world. QuinStreet is committed to providing consumers and businesses with the information they need to research, find and select the products, services and brands that best meet their needs. The company is a leader in ethical marketing practices. For more information, please visit QuinStreet.com.

A photo accompanying this release is available at:

http://www.globenewswire.com/newsroom/prs/?pkgid=34176

CONTACT: Alex H. Bryant

212-863-4753

abryant(at)quinstreet(dot)com