Talking Points

- GBPUSD near-term rally at risk ahead of UK CPI

- Near-term outlook constructive while above 1.4175/77

- Updated targets & invalidation levels

GBPUSD 30min

Chart Created Using FXCM Marketscope 2.0

Technical Outlook: Sterling broke above the upper median-line parallel extending off the May 30th high last night with the rally testing confluence resistance at the 61.8% retracement of the decline and the 50-line of the proposed median-line formation off the lows, at 1.4285. Heading into tomorrow’s inflation print, the near-term focus remains weighted to the topside while above 1.4175/77 where the lower median-line parallel converges on a Fibonacci confluence and we will retain this level as our near-term bullish invalidation.

A topside breach targets subsequent resistance objectives at the 1.4350, the upper median-line parallel of the ascending structure off the lows and the 88.6% retracement at 1.4406. Continue tracking this setup and more throughout the week- Subscribe to SB Trade Desk and take advantage of the DailyFX New Subscriber Discount!

Avoid the pitfalls of near-term trading strategies by steering clear of classic mistakes. Review these principles in the "Traits of SuccessfulTraders” series.

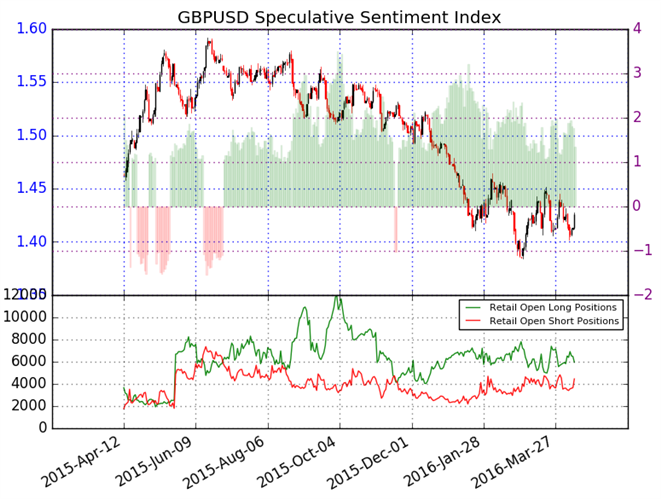

- The DailyFX Speculative Sentiment Index (SSI) has remained net-long the pound since late November with the ratio standing at +1.45 (57% of traders are long- 12.4% lower than the previous day)

- Short positions are 20.3% higher than yesterday and 13.6% above levels seen last week.

- Open interest is 1.0% lower than yesterday and 1.9% above its monthly average

- The decline in long positioning suggests that the retail long-bias may be waning (bullish near-term)

Why and how do we use the SSI in trading? View our video and download the free indicator here

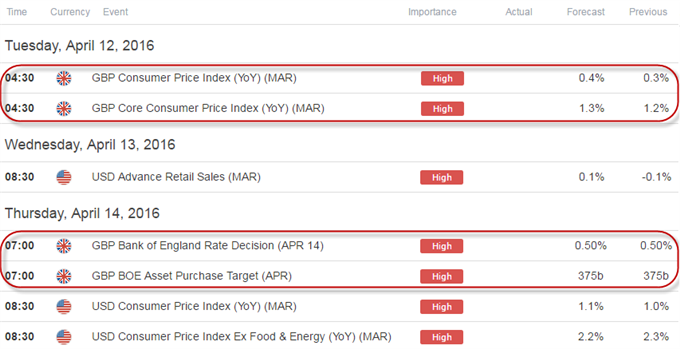

Relevant Data Releases This Week

Other Setups in Play:

- Webinar: USD in Free Fall- Key Crosses in Focus this Week

- USD/CAD Scalp Targets Ahead of Jobs- Key Support 1.2965

- GBP/USD 1.4175 is Near-Term Bull/Bear Dividing Line

- AUD/JPY Game Plan: Sell the Bounce- Bearish Invalidation 84.82

- CAD/JPY Reversal Approaching Initial Support - Bearish Sub-86.53

Looking for more trade ideas? Review DailyFX’s Top Trading Opportunity of 2016

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFX and Tuesday, Wednesday & Thursday’s on SB Trade Deskat 12:30 GMT (8:30ET)

original source