Talking Points:

- GBP/USD trading around 1.3150 after finding some support below the 1.31 handle

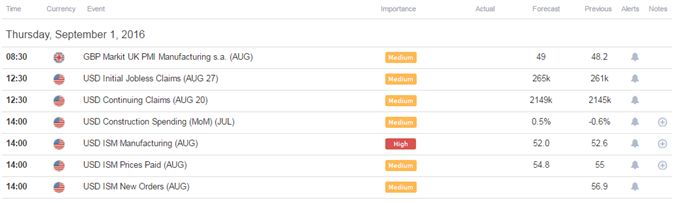

- UK Markit PMIs in focus on Brexit impact, US ISM numbers ahead as well

- Weak NFPs might be able to push GBP/USD out of a daily wedge formation

The GBP/USD is trading around 1.3150 after the pair found support below the 1.31 handle, following the recent run of US Dollar strength.

Fed rate hike expectations are at center stage as we approach Friday’s NFPs, but today’s event risk could prove influential as well.

This puts the spotlight on the UK Markit Manufacturing PMI and the US ISM figures.

Against this backdrop we will form our outlook and look to find short term trading opportunities using different tools such as the Grid Sight Index (GSI) indicator.

Click Here for the DailyFX Calendar

Markit August UK Manufacturing PMI headlines the economic docket in European trading hours.

The diffusion index is expected to slightly improve for a 49.0 print from the prior 48.2 number.

The figures today are of high importance in the context of the Brexit situation. The initial indications from the UK’s economy has shown a mixed bag of readings, with businesses arguably showing more signs of post-Brexit jitters than UK’s private consumer.

A big deviation from expectations could prove market moving, with a straight-forward response, as further deterioration could be interpreted as adding to a more dovish BOE posture, and vice-versa.

US ISM Manufacturing is on tap as well, with the index expected to slow for a 52.0 print from the prior 52.6 figure.

The ISM numbers do have the capabilities introduce some volatility, even with the NFPs tomorrow. If these numbers come out better than expected, this could add to the overall positive shift in the US Dollar, potentially prompting the market to position for a favorable NFP report.

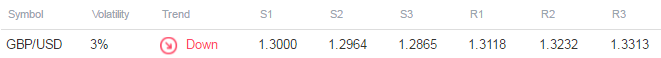

GBP/USD Technical Levels:

Click here for the DailyFX Support & Resistance tool

We use volatility measures as a way to better fit our strategy to market conditions. The British Pound is expected to be more volatile than most majors versus the US Dollar based on 1-week implied volatility measures (onlly Yen more).

With that said, volatility has been subdued lately with 20-day ATR measures sitting near 2016 lows.

In turn, this may suggest that key technical levels might be able to hold in the short term, potentially offering range trading plays after outsized jumps on today’s data prints, with the NFPs on Friday an obvious candidate for a big fundamental shift.

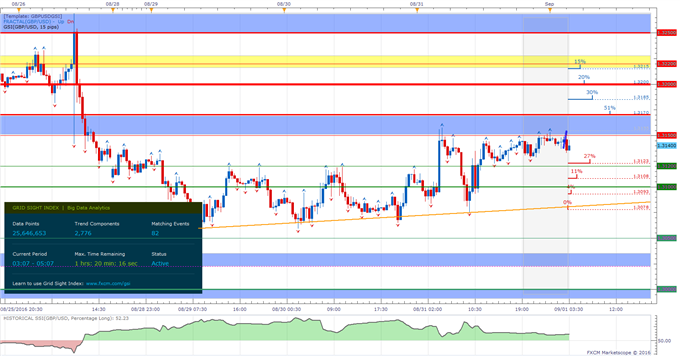

GBP/USD 30-Min Chart (With the GSI Indicator): September 1, 2016

(Click to Enlarge)

The GBP/USD is trading below an area of resistance above 1.3150, with GSI calculating higher percentages of past movement to the upside in the short term.

The GSI indicator above calculates the distribution of past event outcomes given certain momentum patterns. By matching events in the past, GSI describes how often the price moved in a certain direction.

You can learn more about the GSI here, and download the Trade Station version here.

Further levels of resistance might be 1.3200, 1.3220 and the area above 1.3250.

Levels of support may be 1.3120, 1.3100, 1.3050, a zone above 1.3020 and the big 1.30 figure.

We generally want to see GSI with the historical patterns significantly shifted in one direction, which alongside a pre-determined bias and other technical tools could provide a solid trading idea that offer a proper way to define risk.

We studied over 43 million real trades and found that traders who successfully define risk were three times more likely to turn a profit.

Read more on the “Traits of Successful Traders” research.

Meanwhile, the DailyFX Speculative Sentiment Index (SSI) is showing that about 52.3% of FXCM’s traders are long the GBP/USD at the time of writing, offering a slight short bias on a contrarian basis.

You can find more info about the DailyFX SSI indicator here

--- Written by Oded Shimoni, Junior Currency Analyst for DailyFX.com

To contact Oded Shimoni, e-mail oshimoni@dailyfx.com

Follow him on Twitter at @OdedShimoni

original source