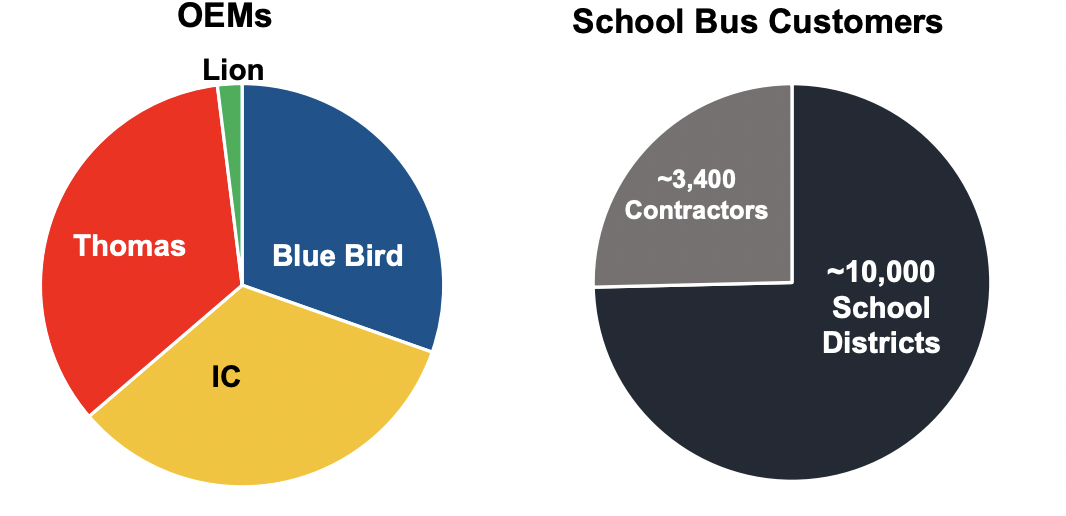

Founded in 1927, Blue Bird has dedicated itself to creating and providing school buses that meet the specific needs and expectations of its customers, prioritizing the safety of schoolchildren. The company specializes in the design, engineering, production, and sale of school buses and holds a prominent position in the North American market, competing with other key players like Thomas, Lion and IC.

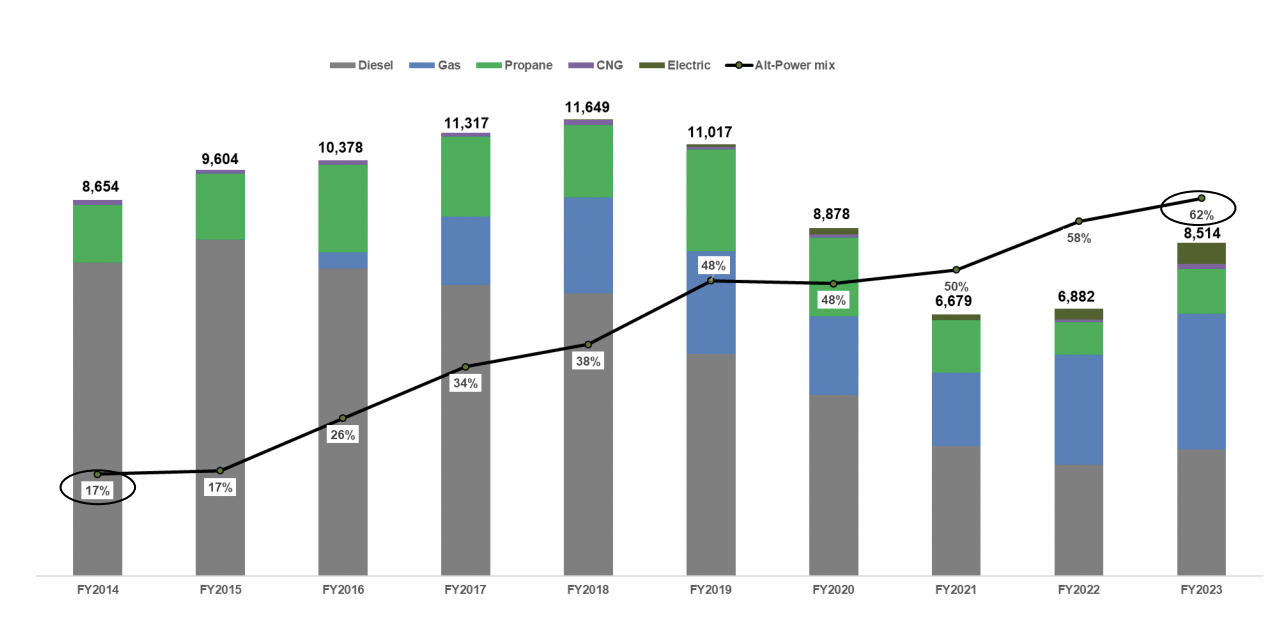

The company is headquartered in Macon, Georgia, and holds a leading position in the electric and propane school bus market, with over 60% of its sales coming from non-diesel buses, compared to less than 10-20% for its competitors. Blue Bird has established a dealer network consisting of more than 50 dealers and operates over 250 service centers.

Operating within an industry characterized by high entry barriers due to the need for highly specialized products and adherence to complex state and customer specifications, Blue Bird serves around 10,000 school districts and works with 3,400 contractors.

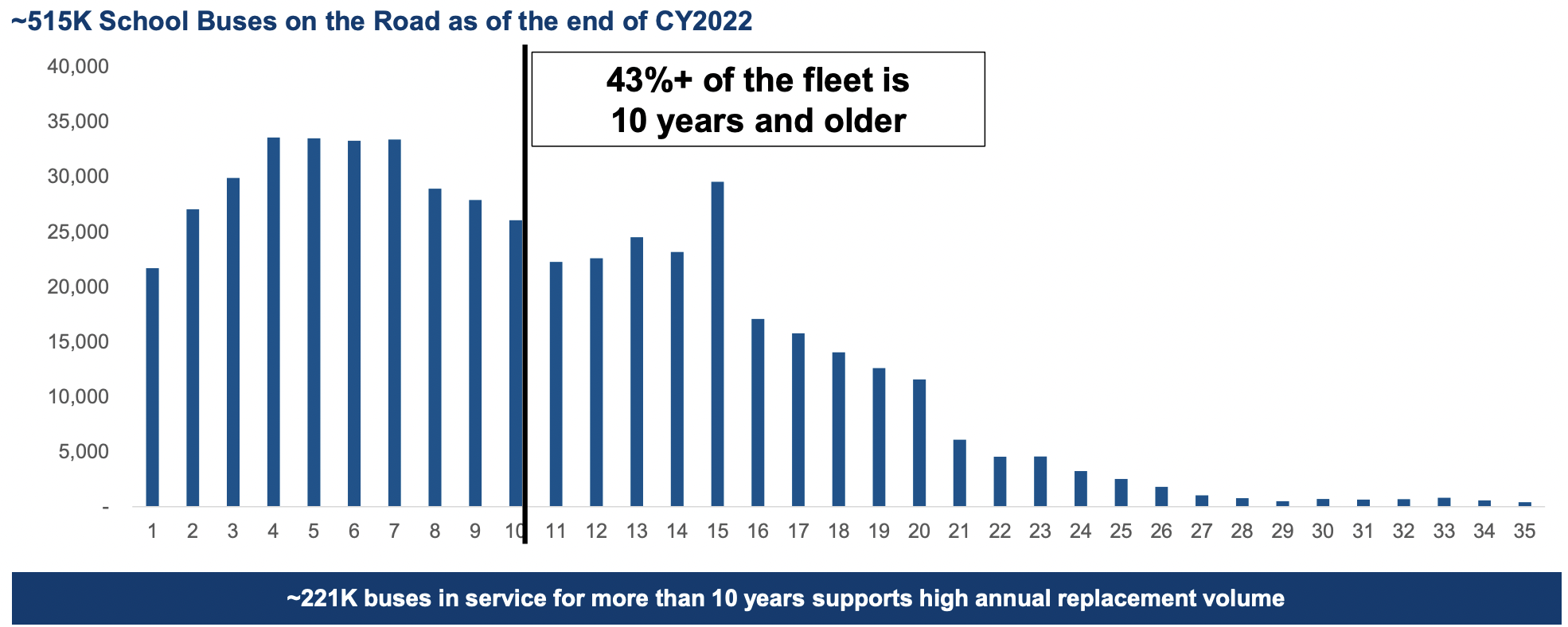

In the school bus industry, there is an annual introduction of approximately 30,500 new units, contributing to a total fleet of about 515,000 buses. These vehicles are essential for transporting 26 million children to school each day, with the fleet's average age being around 10 years. The industry's dynamics are influenced by several key factors, including the number of school-aged children, the age of the existing fleet (with a general replacement target of 15 years set by most states), average ridership per bus, and available funding, which is primarily sourced from property taxes.

Over the past few years, Blue Bird has navigated challenges stemming from the Covid-19 pandemic and a broader pattern of reduced financial expenditure in the US. The demand for school buses saw a decline after the Global Financial Crisis, experienced a brief resurgence, and then fell again with the pandemic's impact. This period has been difficult for the company. However, the aging of the US school bus fleet, with approximately 43% of buses now over 10 years old, suggests that there may be an upcoming need for increased capital expenditures for bus replacements. This, along with potential demographic growth, indicates a forthcoming period where demand could naturally increase.

The trajectory of Blue Bird Corporation is shaped by several pivotal factors:

Transition to Electric Vehicles (EVs): It is advancing towards electric school buses, facing challenges like high initial costs, scarce charging infrastructure, and the need for strong financial incentives for adoption. Despite these hurdles, the company anticipates significant long-term benefits exceeding $1 billion from this shift, alongside exploring new revenue streams from electric vehicle adoption.

Alternative Fuel Challenges: Its pursuit of alternative fuel options reflects a commitment to sustainability. However, integrating these technologies faces hurdles related to economic feasibility and the existing infrastructure's compatibility, presenting obstacles to their widespread implementation.

Reliance on Government Funding: Company's operations heavily depend on government contracts and funding for school transportation, making it vulnerable to changes in policy, budget reductions, or delays in the allocation of funds. Such uncertainties can significantly affect the company's revenue streams and opportunities for growth.

Long Replacement Cycles: The school bus sector is marked by lengthy replacement cycles, often resulting in school districts delaying the purchase of new buses. This behavior can dampen growth prospects for manufacturers like Blue Bird. Despite this, there's an expectation that the industry may be at the beginning of a positive cycle, suggesting potential for growth in the long term.

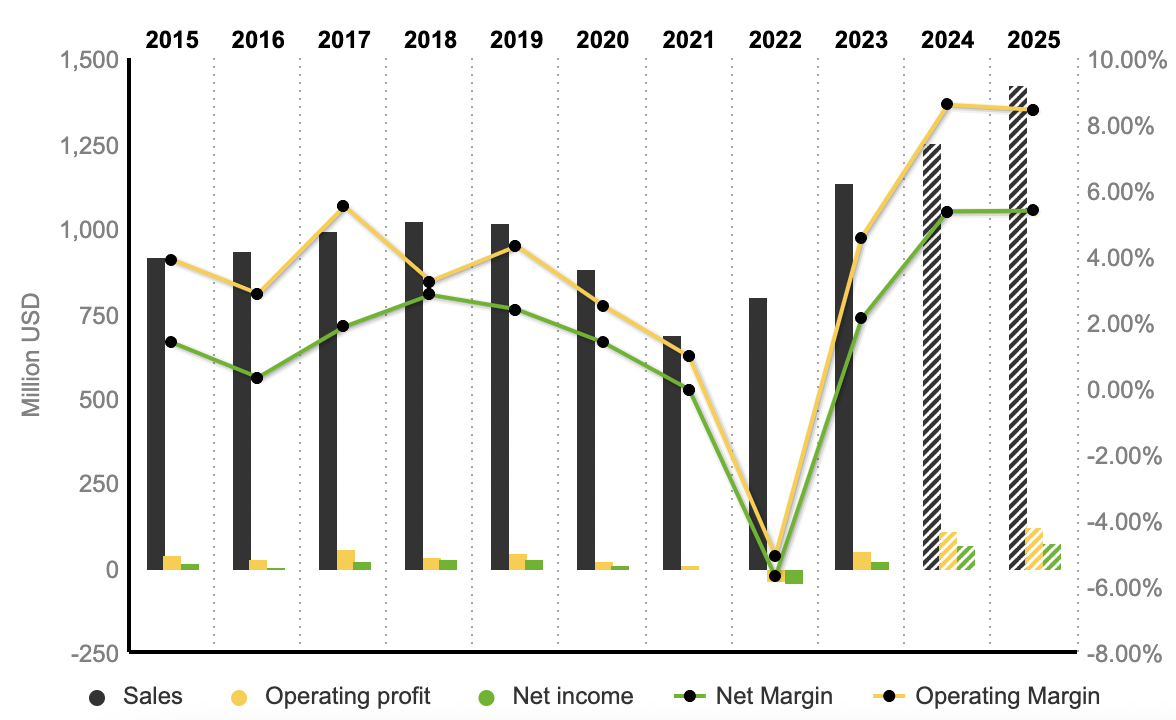

Blue Bird Corporation, despite its leading position in the market, has experienced a consistent decline in margins over the last decade, a trend that has notably accelerated in recent years. This decline is attributed to competitive pressures and a decrease in demand driven by budgetary constraints, which have restricted the company's ability to improve its margins effectively. These challenges have made it difficult for the company to enhance its profitability in a significant manner.

However, following a restructuring exercise and benefiting from favorable industry trends, there is an optimistic outlook for the company's margin improvement soon. Analysts predict a notable increase in operating margins, expected to rise from 4.56% in 2023 to 8.58% in 2024, and slightly adjusting to 8.43% in 2025. Similarly, net margins are also anticipated to improve, with projections indicating an increase from 2.1% in 2023 to 5.36% in 2024 and maintaining a similar level at 5.37% in 2025. These improvements suggest a positive shift in the company's financial health and efficiency post-restructuring.

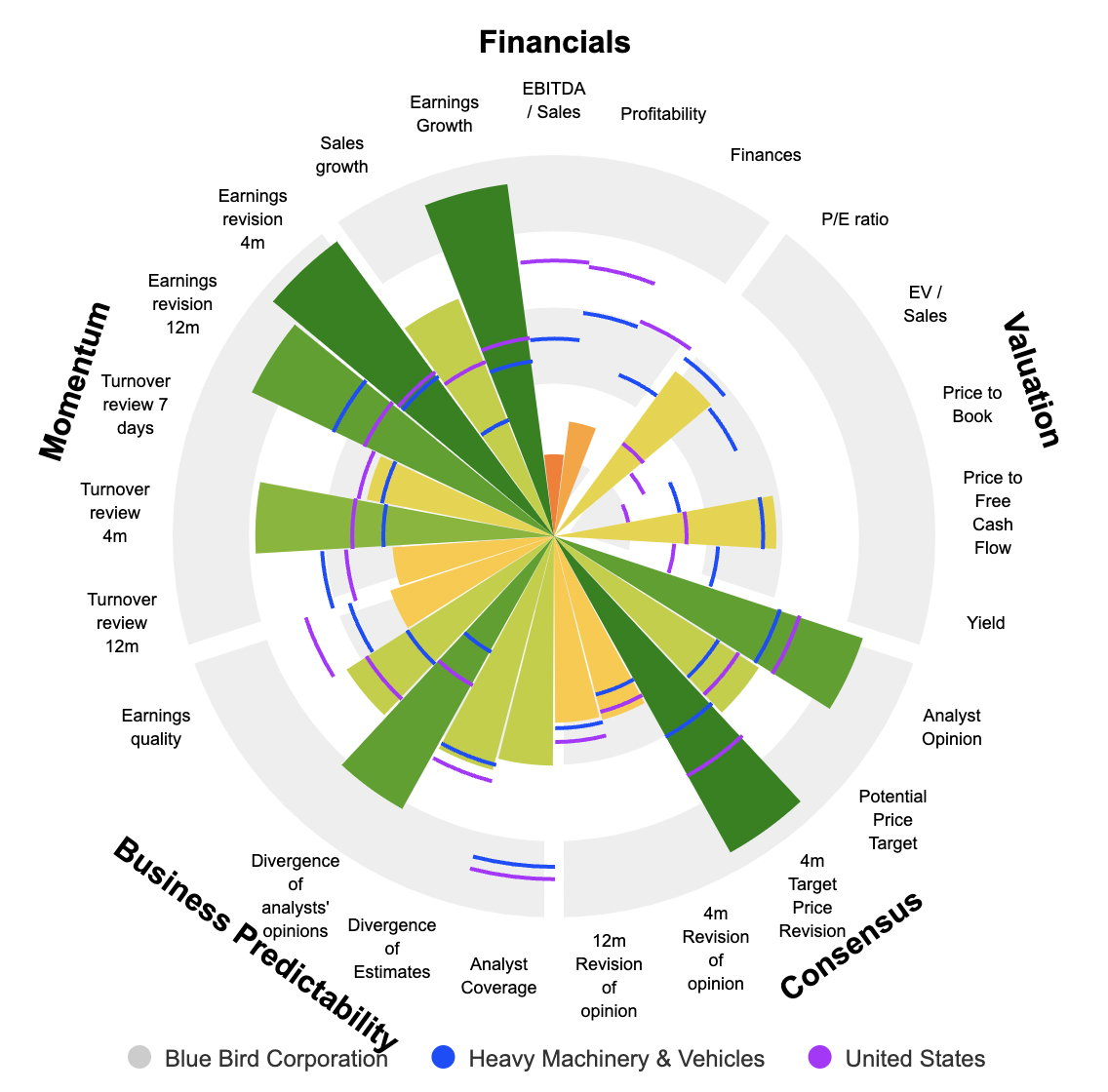

On the revenue front, the company's sales growth has been modest, moving from $919 million in 2015 to $1.133 billion in 2023. EBITDA and EBIT have seen a slight increase during this period, from $69.82 million to $87.93 million and from $35.83 million to $51.66 million, respectively. The company's engagement in government contracts to supply school buses has been a stable source of revenue, contributing to operational stability. Despite these financial results, the company's stock valuation appears to be high, with an average P/E ratio of 35.5x over the past seven years, for a stock that has seen a 184% increase over eight years but has not delivered high returns to shareholders, significant margin growth, or robust sales growth.

The company possesses a considerable market share, supported by extensive expertise and operational capabilities. Given the aging population of buses in the US and the impending industry-wide shift towards electric buses in the next decade, a significant increase in demand is anticipated. This situation is also expected to enhance Blue Bird's bargaining power, potentially leading to improved unit economics. Despite the company releasing strong financial results in the last quarter, its current valuation is considered high and does not appear to be in alignment with its projected growth.

By

By