CDW is one of the leading multi-brand suppliers of IT products. The company supplies a wide range of products, including hardware, software, integrated solutions and customer support services. CDW's customer base comprises 41.9% of medium-sized and large companies with over 250 employees. CDW also serves the education sector (15.3% of sales), government bodies (12.5%), the healthcare sector (10.7%) and small businesses (7.4%). The remainder (12.1%) represents the company's activities in the UK and Canada.

This breakdown of sales by end-customer is no mere coincidence, and has proved very meticulous during periods of economic shock and crisis. A case in point is the great recession of 2008/09, when demand from large and small businesses dropped by 22% and 18% respectively, mainly due to reduced budgets and investments, and apprehension about the times ahead in times of crisis. Meanwhile, the education and government segments recorded sales growth of 3% and 11% respectively. Demand in these segments is generally less correlated with the economic situation. In 2020, the year of the pandemic, a similar trend was observed: large and small businesses, as well as healthcare, recorded declines of 9%, 7%, and 12% respectively, while growth in government entities and education climbed by 18% and 43%. As a result, sales and margins rose in 2020, and modest though this was, it was well above market expectations.

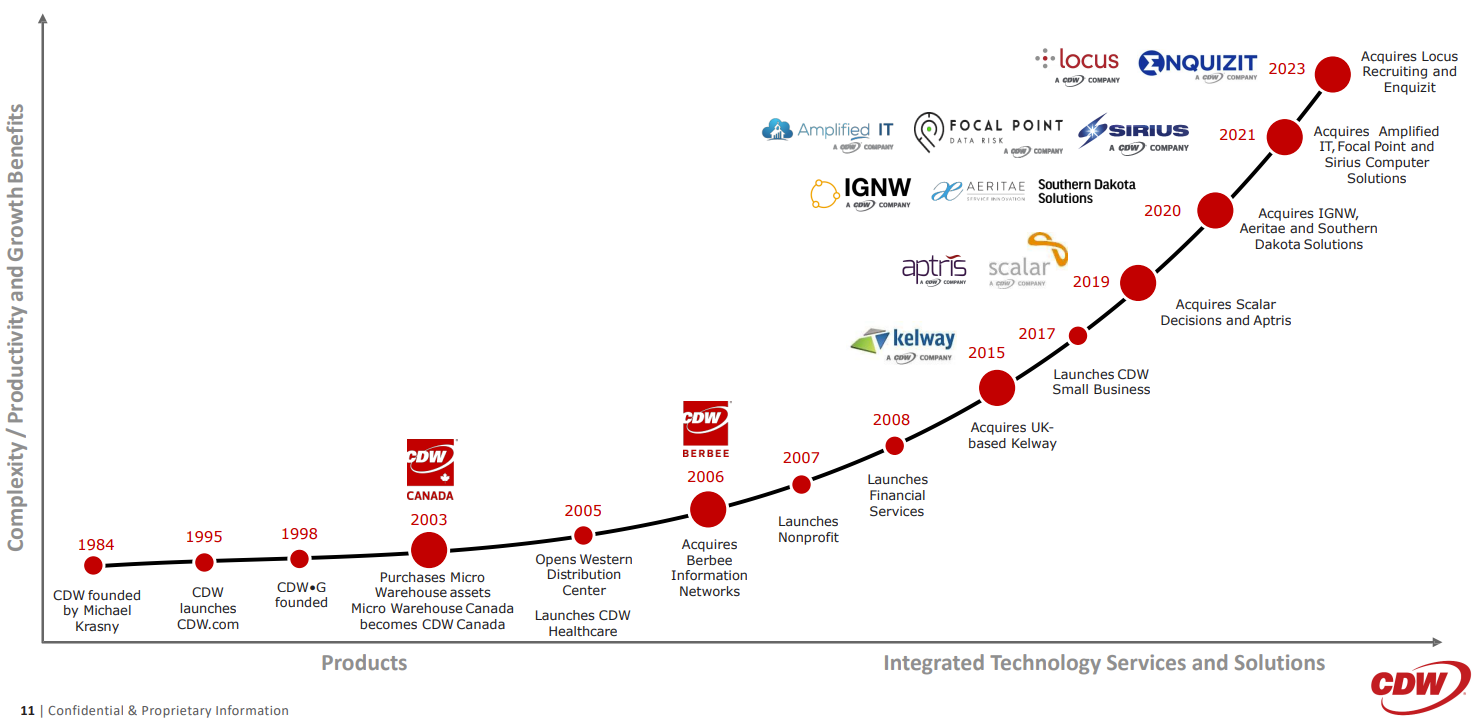

CDW holds 5% of a market estimated at $440 billion. This may not seem like much in absolute terms, but in reality the market is extremely fragmented, served by thousands of players, most of them small. CDW can therefore leverage its size by acquiring numerous companies in the sector. The Mergers & Acquisitions - M&A - division is very active, with no fewer than 10 major acquisitions in the last five years.

A career helped by targeted acquisitions (source: CDW)

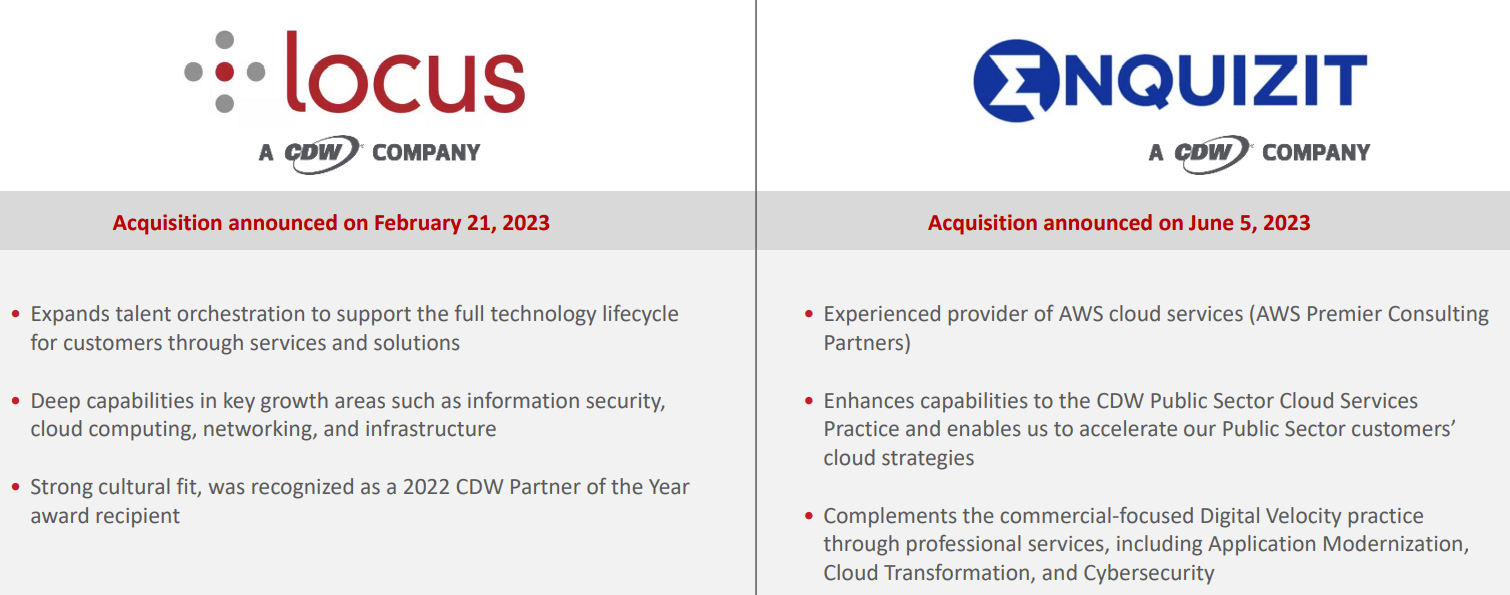

These acquisitions have enabled the Group to extend its influence and product range, and to move faster than the rest of the sector. Between 2018 and 2023, the market's compound annual growth rate (CAGR) was 4.2%, compared with 5.6% for CDW. Visibility into the future is also optimal. In the long term, demand for IT should continue to outstrip general economic growth, given new technologies, cloud computing, virtualization and mobility, and the colossal need for security, efficiency and productivity. In this respect, the $2.5 billion acquisition of Sirius Computer Solutions, a company with a wide range of expertise in many of these fields, is an example of the company's determination to expand in these forward-looking areas.

Two examples of acquisitions in 2023 (source: CDW)

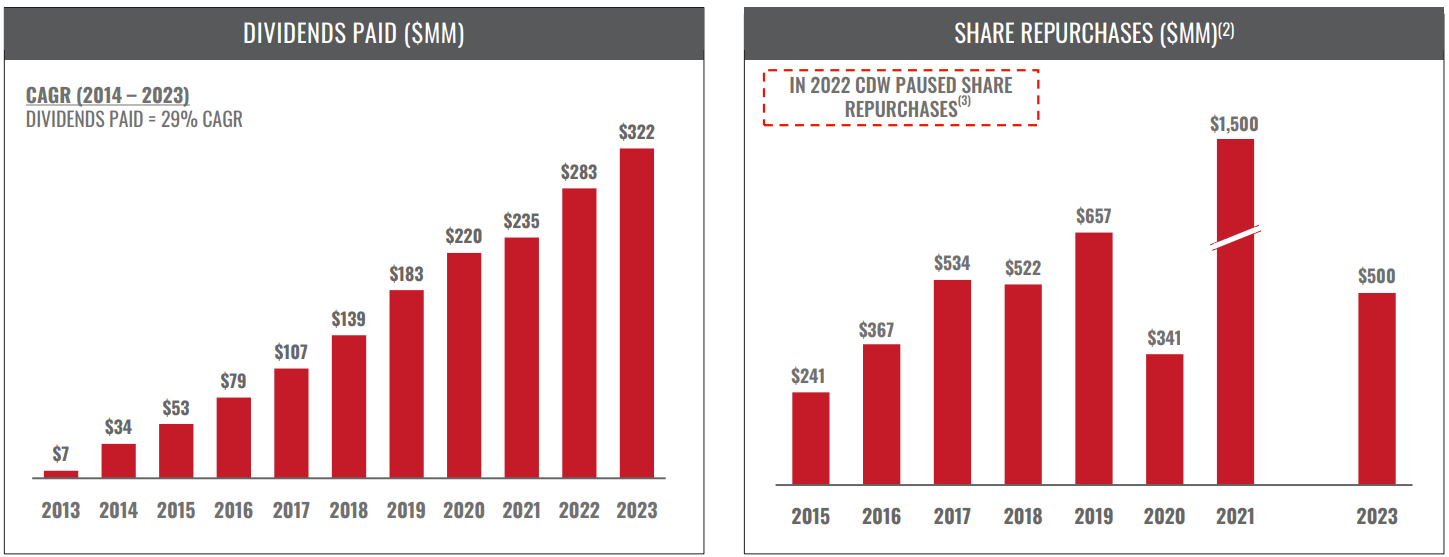

As for the management team, it excels in its ability to integrate these various acquisitions. And in presenting almost flawless accounts, for one main reason: cash flow. Cash flow from operating activities is colossal, and far exceeds net profit. Let me remind you that free cash flow is more relevant than net profit in assessing the money actually earned during a financial year, as it represents the actual cash generated excluding various accounting adjustments. As a result, over the last ten years, free cash flow has exceeded book profits on eight occasions. Most of this money is used to self-finance acquisitions, limiting recourse to debt - which is perfectly under control, by the way - to around 2.5 times EBITDA. This money is also used to pamper shareholders through juicy share buy-backs (22% of capital in 10 years) and a linearly increasing dividend.

Dividends and share buybacks paid to shareholders (source: CDW)

When it comes to margins, the picture is also very clean. Profitability has doubled in 10 years, rising steadily since 2013. Add to this a sales figure that has also more than doubled over the period, and you get an 8-fold increase in net profit.

The future looks rather bright. The latest quarterly figures were rather timid, due to weaker demand from companies who are limiting their spending in the current economic environment. But margins have continued to climb, a sign of the levers management has at its disposal to keep its books in order. As far as the latter is concerned, we can only regret that the members of the team did not invest more in the company on a personal basis. CEO Christine Leahy, who has been at the helm since 2002, holds just 0.08% of the company's capital, most of which comes from stock options.

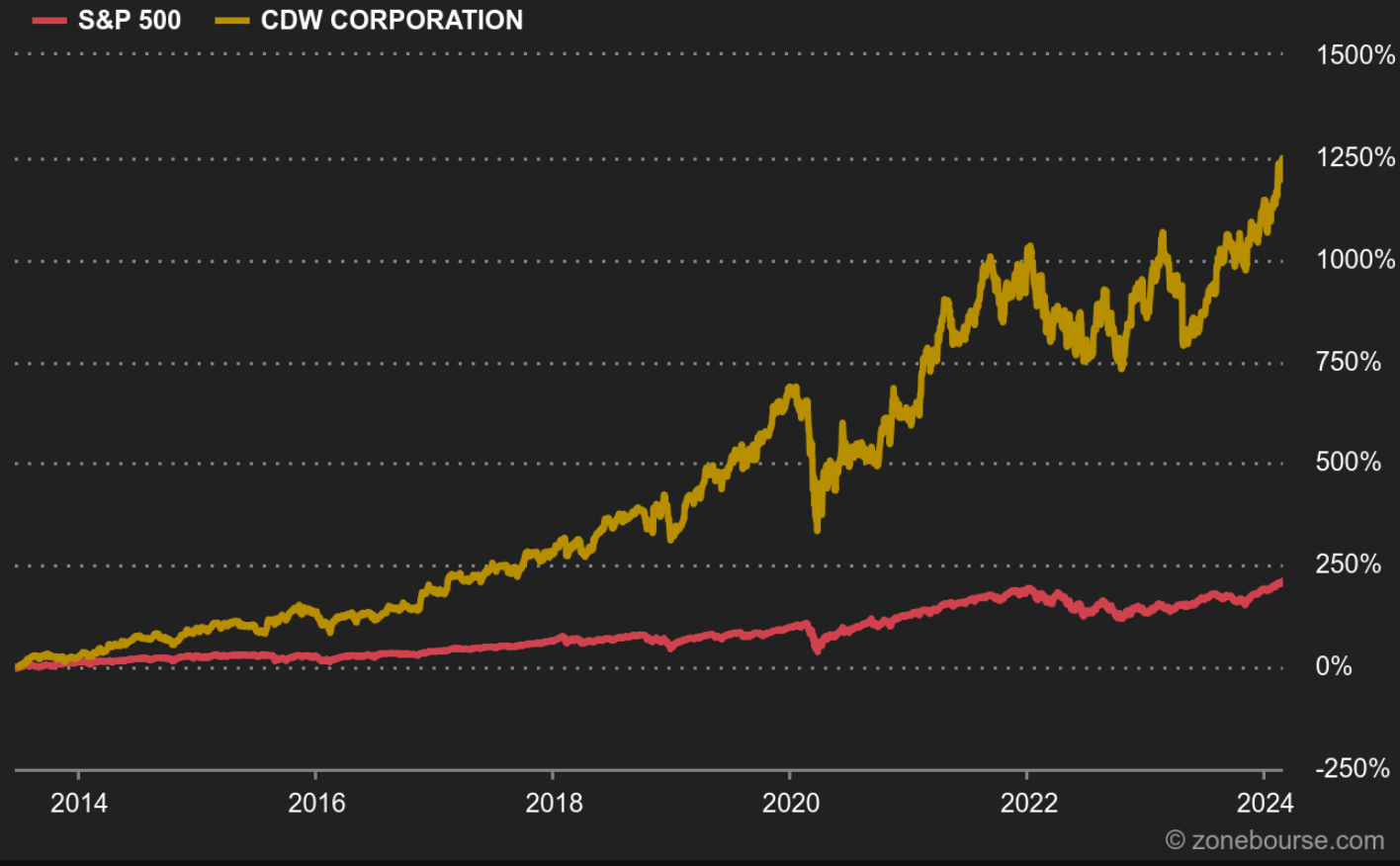

Finally, in terms of valuation, CDW has no real comparable listed company in the US. As a result, the valuation can be compared with the company's track record over the past few years, especially as the growth trajectory changes little from one year to the next. The PER and Enterprise Value / FCF multiples are very close to the levels achieved over the past ten years. CDW's quality and growth make it a long-term investment.

S&P500 vs. CDW since the US group's inception (source: MarkeScreener)

By

By