Cintas offers rental apparel programs with laundering, inspection, and delivery services. They also provide cleaning supplies, hand sanitizer, restroom products, entrance mats, disinfectants, and first aid supplies, along with fire protection equipment testing. The primary revenue source is the Uniform Rental and Facility Services segment, constituting 80% of their revenue, with key expenses being cost of goods sold and selling/administrative costs.

It has established key partnerships to enhance its offerings. Teaming up with Carhartt, they provide Carhartt-branded rental uniforms, including workpants and flame-resistant garments. Diversey Inc. supplies Signet cleaning products, like floor cleaners, which then offers these products to clients alongside cleaning services. The collaboration with Rubbermaid enables the provision of cleaning products and regular servicing. Furthermore, Cintas partners with Chef Works for culinary apparel, ensuring exclusive designs for their customers.

These alliances create a robust ecosystem, making the business resilient to market fluctuations. Their diversification efforts are notable, evident in their extensive supplier network across 21 countries, reducing dependence on any single source. In terms of revenue, they have a balanced market share, with 70% from services and 30% from manufacturing.

The company has integrated SAP Success Factors solutions into its operations, enhancing customer relationship management (CRM) through detailed data analysis. This approach enables targeted customer interactions and successful cross-selling efforts. It has also invested in technology, such as the My Cintas portal, providing customers with 24/7 access for managing accounts efficiently. SmartTruck technology optimizes delivery operations by creating denser routes and reducing the number of vehicles needed. This strategy saves time, enhances customer engagement, and reduces energy costs.

Cintas is deeply committed to sustainability and environmental consciousness, focusing on reducing, reusing, recycling, and repurposing its textiles and products. The company's environmental priorities center around reducing greenhouse gas emissions and conserving water and waste.

By 2050, Cintas aims to achieve Net-Zero greenhouse gas emissions. To accomplish this, the company is concentrating on its commercial vehicles, locations, facilities, equipment, and supply chain. For their commercial fleet, Cintas utilizes SmartTruck technology to minimize idling hours, as every idle hour contributes to approximately 8.5kg of carbon emissions. This technology optimizes vehicle routes, reducing gas consumption and saving costs. Additionally, Cintas has partnered with Motiv Power Systems to transition from carbon-sourced fuels to electric vehicles.

Regarding locations, facilities, and equipment, Cintas collaborates with Redaptive to decrease energy consumption and costs. LED lighting has been installed in large facilities, significantly reducing energy usage by approximately 18.7 million kilowatt hours annually. Moreover, a solar-powered system has been implemented in a rental location in New Jersey. In the supply chain, Cintas plans to work with suppliers to develop strategies that align with their emissions reduction goals.

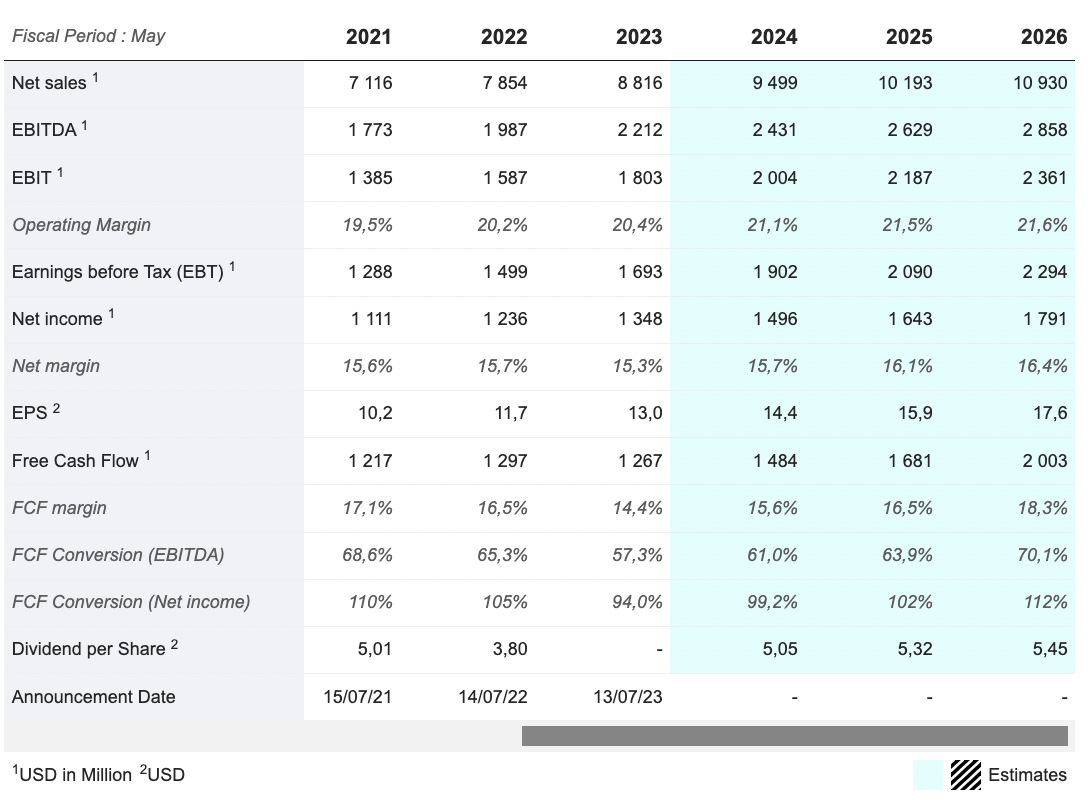

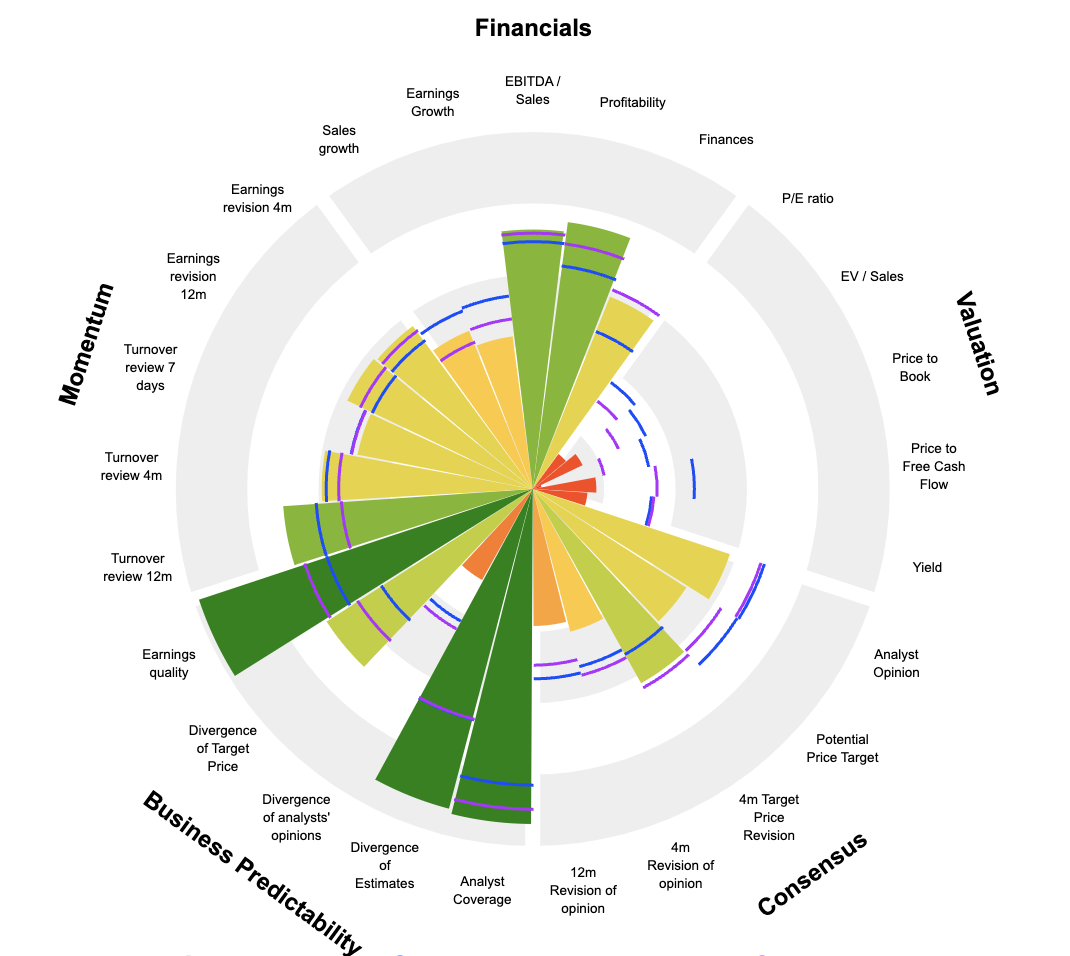

With a P/E of 36.3 times earnings, this is a high-valuation, higher than its 10 years average at 27.7x. On the face of it, nothing too exciting, even if earnings per share have grown over the past decade from $3.05 in 2014 to $13 in 2023, representing a CAGR of 15.6%. Moreover, P/E estimates for 2024 and 2025 are 35.1- and 31.8-times earnings, which seems to underline a certain homogeneity in the analyst consensus.

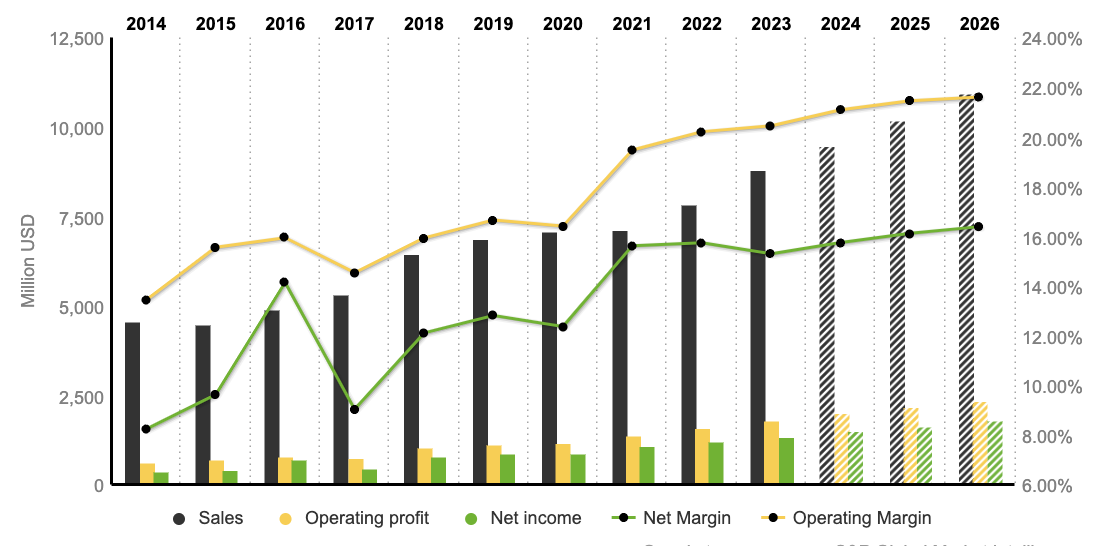

Simultaneously, the group's sales have steadily increased from 4,552 to 8,816 million dollars between 2014 and 2023, showing a consistent annual growth rate of 6.83%. This positive trend extends to EBITDA and EBIT, which have risen by 175% and 194% respectively over the same period, reaching $2.2B and $1.8B. The management's effectiveness is evident in the expanding net and operating margins, projected to rise from 15.3% to 16.4% and 20.4% to 21.6% from 2023 to 2026. Additionally, a robust Free Cash Flow (FCF) of $1,267 billion in 2023 is set to increase to $2003 billion in 2026, enhancing the company's potential for future acquisitions.

Cintas has been offering an array of solutions and investing in technology, which has and should continue to drive the company’s exceptional performance. Its strategic collaborations have made it possible for it to keep providing solutions. Despite cost-related headwinds, Cintas has still been able to generate attractive revenues and profits, especially regarding energy expenses flowing from its efforts in environmental sustainability. With the enhancement of its product portfolio, its investments in technology, and its ability to generate attractive revenues, it could be interesting to keep an eye on the company even if it looks overvalued. It might be a good idea to wait for a cheaper entry point.

By

By