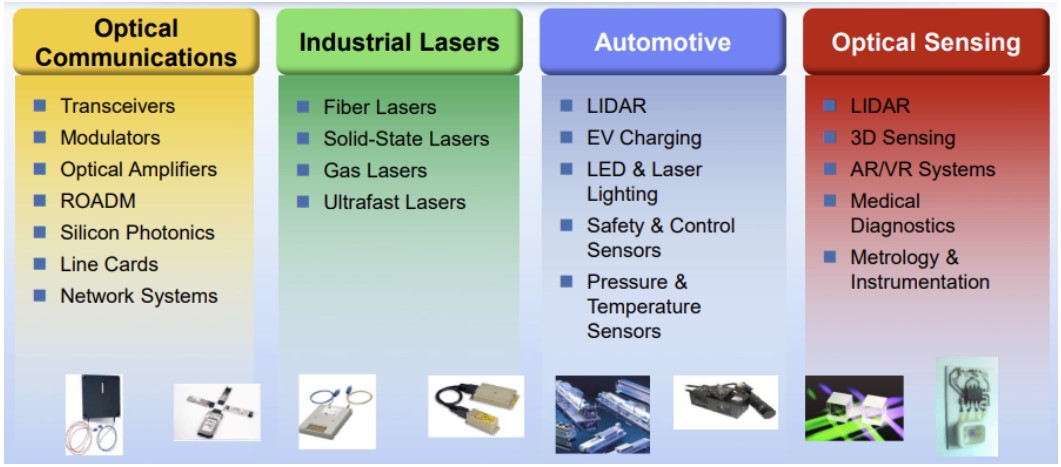

Fabrinet's product mix includes industrial lasers, optical communication modules, sensors and advanced medical devices. Fabrinet can boast of being a leader in certain segments. The main source of revenue is generated by the optical communications segment (78% of sales). Geographically, revenues are well distributed between the US (49%), Asia (33%), Europe (14%) and the rest of the world.

Fabrinet has long-term partnerships with its customers through customized programs from creation to production. Typically, with Cisco Systems for example, its largest customer, which accounts for 25% of revenues. Revenues are well distributed between the US (49%), Asia (33%), Europe (14%) and the rest of the world.

The company is benefiting from its breakthrough in the electric vehicle (EV Charging) and autonomous vehicle (LIDAR) markets and other long-term growth markets such as biotech equipment, optical communication and industrial lasers. The demand for autonomous vehicles, quantum computers, 5G and soon 6G, and advanced technology equipment are all sources of future growth for the company.

Financial analysis

Over the last decade (2012-2022), revenue quadruples from $565 million to $2.2 billion. This performance is all the more remarkable since the growth was entirely organic: there were almost no acquisitions, just a small anecdotal operation in 2016.

Source: MarketScreener

The operating margin averaged 7.5% over the cycle studied (2012-2022), which is fairly typical of an industrial company, but it is constantly increasing. Moreover, what jumps out for an industrial company is that over the cycle there were no asset depreciations, no "exceptional" expenses and that the interest expense is almost zero (there is no debt). Very good points to note.

In fact, the financial position has always been extremely conservative, with total liabilities almost entirely covered by cash, and in any case largely covered by cash and trade receivables. The inventories, for their part, are running well (5 times a year on average). There is no hitch in the cycle on this side either.

Source : MarketScreener

The number of shares remains stable (around 36800) and the book value goes from 7 to 34 dollars per share. Over the last two years, we have a profit per share of 4 (2021) and 5 dollars (2022): thus an ROE around 15%, quite typical of a well managed industrial value. Let's note that it actually has a lot of money under its belt. The ROE could be optimized because Fabrinet is largely overcapitalized.

Cash generation (conversion of book profit into free cash flow) has improved significantly over the last three years and the group has an average annual FCF of110 million, here not adjusted for stock options, which are quite high ($28 million last year, i.e. a quarter of the profit anyway).

If we relate this profit (because not restated for Stock Based Compensation (SBC) as said before) to the enterprise value (market capitalization minus excess cash), we are on a multiple of 8 times profits. This seems high at first sight and not easy to justify unless we assume that the exceptional growth of the cycle that is ending will be reproducible in the next cycle, in which case it seems justified.

From my point of view, everything suggests that the future outlook will continue to be one of strong growth. Any pullback on this stock (assuming the fundamental scenario does not change) should be seen as a buying opportunity for those looking for a growth industrial-technology stock.

That being said, insiders are selling at these price levels. This reinforces the idea that the stock may be a bit overvalued at the moment. Moreover, the shareholding is fragmented between various index and institutional funds, which is a bit unfortunate. Still on the level of shareholder dynamics, SBC (stock-based comp) are abnormally high at the moment (a quarter of the profit as seen above) and for some years the capital allocation is entirely oriented towards share buybacks (sometimes at a high price). We are therefore waiting for an improvement on this side before considering a potential purchase on this stock.

Despite these regrets about the shareholder dynamics and the premium on the stock, Fabrinet remains a very qualitative company, managed by a competent, well-capitalized, profitable management. A stock to watch closely in the coming years and which deserves its place in a watchlist.

By

By