Gentex is a technology-oriented company specializing in the design, development, and manufacturing of high-quality products for the automotive, aerospace, and commercial fire protection industries.

A significant portion of Gentex's revenue comes from manufacturing automatic-dimming rearview mirrors for cars. These mirrors utilize electrochromic technology to automatically dim in response to headlights from trailing vehicles, reducing glare for the driver and improving safety. This technology is a major selling point for the company, allowing it to command a premium.

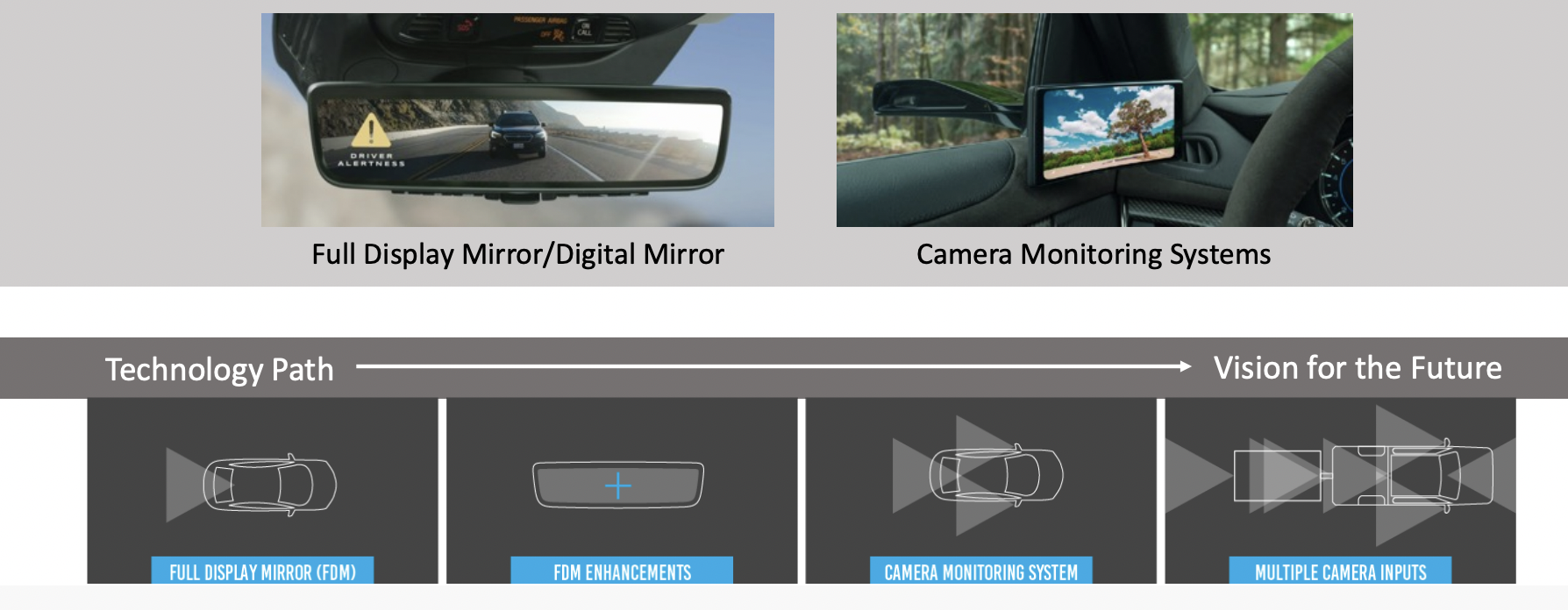

Gentex's mirrors are not just reflective surfaces but integrated with features such as compasses, temperature displays, and rearview cameras. These integrated functionalities add value to its products relative to peers while also appealing to consumers and OEMs who are looking for premium options.

In addition to these core items, Gentex also produces various electronics products, including dimmable aircraft windows for the aerospace industry and dimmable glass for architectural applications. It is also involved in manufacturing connected car features, biometric monitoring systems, and other advanced technologies.

The company has taken core automotive products, such as mirrors, and innovated them into a market-leading position, contributing to relationships with leading OEMs and the ability to command a premium price. From a downside perspective, its products will always be needed, regardless of trends and changing dynamics (such as EVs).

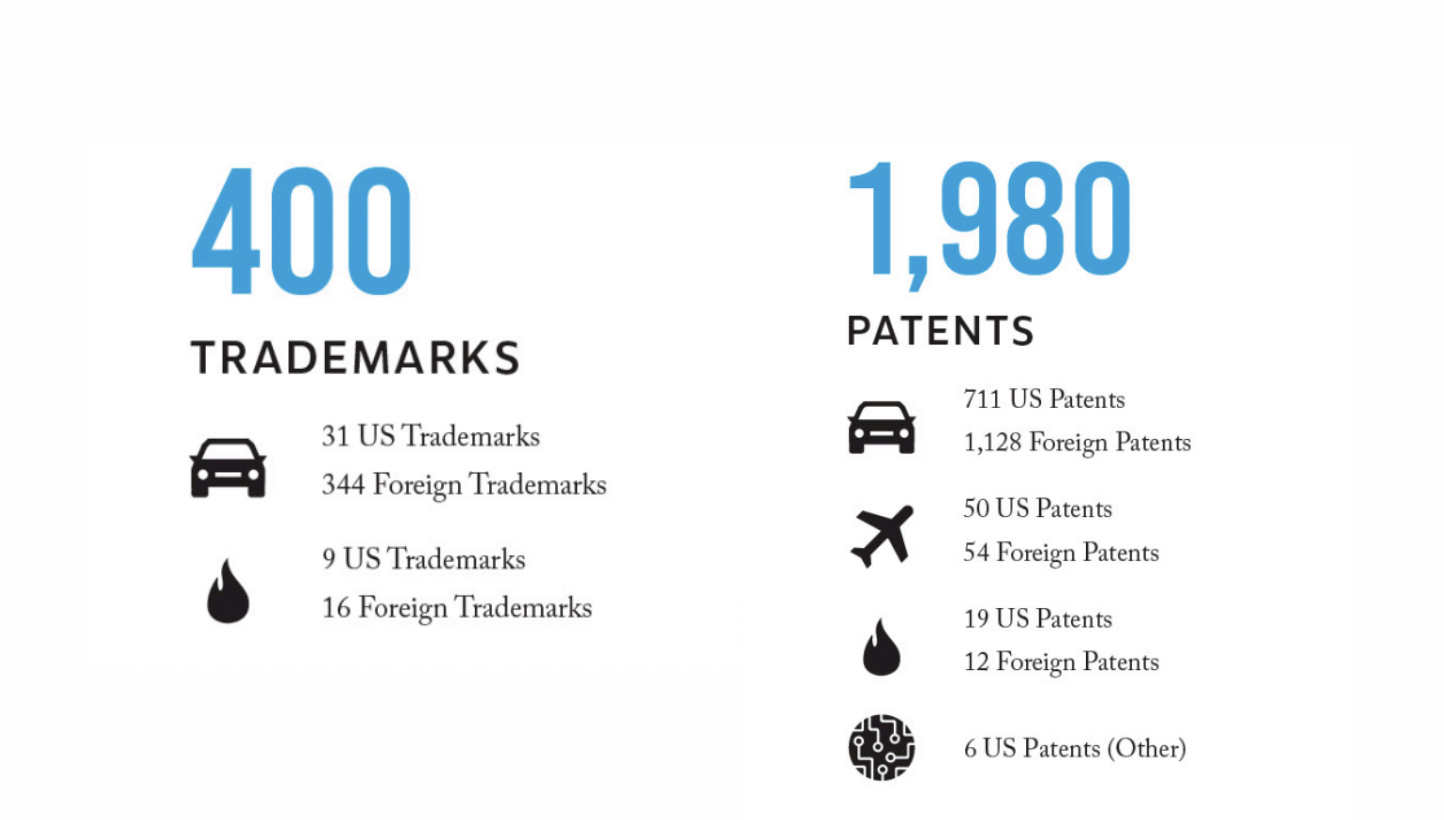

Gentex's robust intellectual property portfolio includes 786 U.S. patents and 40 U.S. trademarks, with a focus on electrochromic technology, automotive rearview mirrors, microphones, sensors, displays, cameras, and smart home products. Internationally, the company holds 1,194 foreign patents and 360 trademarks in similar fields. Additionally, Gentex has specific patents (50 U.S. and 54 foreign) for its variable dimmable windows. While the company has 176 U.S. and 296 foreign patent applications in progress, it operates R&D offices in Utah and California, indicating its commitment to innovation and product development.

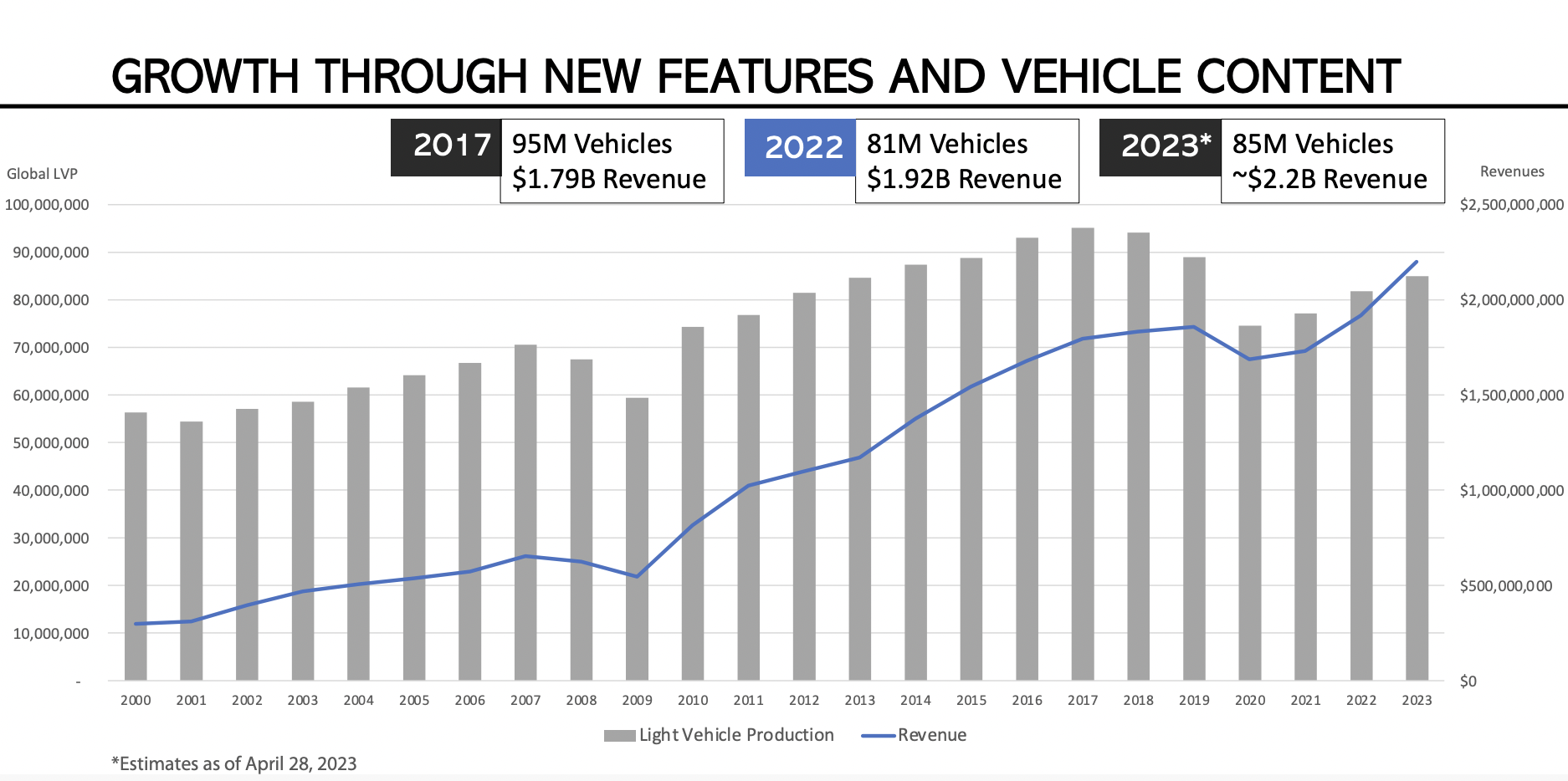

The automotive component industry is expected to grow well in the coming years, although will be impacted by various megatrends currently underway. The key driver, as discussed throughout this paper, is the demand from OEMs. For this reason, Gentex is highly reliant on consistently growing production levels.

Gentex competes with global component manufacturers such as Magna International, Continental AG, Autoliv, and Valeo SE

Key growth drivers for Gentex in the coming years include:

Electric Vehicles - The shift toward Electric Vehicles (EVs) has the potential to significantly improve the company's performance in the medium term. This is because consumers and government regulations are actively promoting the adoption of EVs over traditional Internal Combustion Engine (ICE) vehicles. As a result, there is a greater opportunity for an increase in new vehicle purchases, benefiting Gentex due to the rising demand for EVs in the market.

Market Saturation - The automotive mirror market is stable but may be considered saturated at the basic level. Numerous vehicles now offer automatic-dimming mirrors as a standard or optional feature, creating limited opportunities for substantial growth. Unless there are significant technological advancements or the emergence of new market segments, Gentex faces constraints in generating significant profits or expanding its market share significantly.

Technological Advancements - In the past two decades, technology has permeated every aspect of society, transforming various traditional industries to enhance user experiences. The automotive parts sector is no exception. This widespread technological integration presents a significant opportunity to upgrade products that were previously considered basic. Gentex recognizes this trend and is actively embracing technological advancements. We believe this strategic focus on innovation is crucial for the company's future success.

Connected Car Solutions - It involves integrating smart technologies into vehicles, enhancing safety and convenience. Gentex is actively developing services related to home connectivity, infrastructure (such as toll payments), and ride-sharing. This comprehensive approach reflects the company's commitment to embracing the growing trend of car connectivity and leveraging it for improved user experiences and functionality.

Autonomous Vehicles - The rise of autonomous vehicles, coinciding with the electric vehicle revolution, fuels the demand for advanced vision and sensor technologies. Gentex is strategically invested in this segment, starting with biometrics and driver monitoring, which are currently practical applications. The company is also expanding into thermal sensing cameras and in-cabin sensing, which hold even more significant potential for future applications.

A significant risk for the business is its heavy reliance on the automotive industry, which constitutes a substantial portion (approximately 97%) of its net sales. Historically, the automotive sector has been inherently cyclical and sensitive to economic fluctuations. The current economic environment, marked by uncertainties such as inflation, has led to challenges including volatile automotive production levels, erratic customer orders, and shortages of essential electronic components. Furthermore, the company faces concentration risk due to its dependency on a few key customers, each contributing significantly to its annual net sales (which each account for 10% or more). Additionally, geopolitical tensions, particularly between the United States and China, have introduced uncertainties regarding tariffs and trade policies. Previously imposed tariffs have escalated the company's input costs, potentially impacting its competitive position in foreign markets.

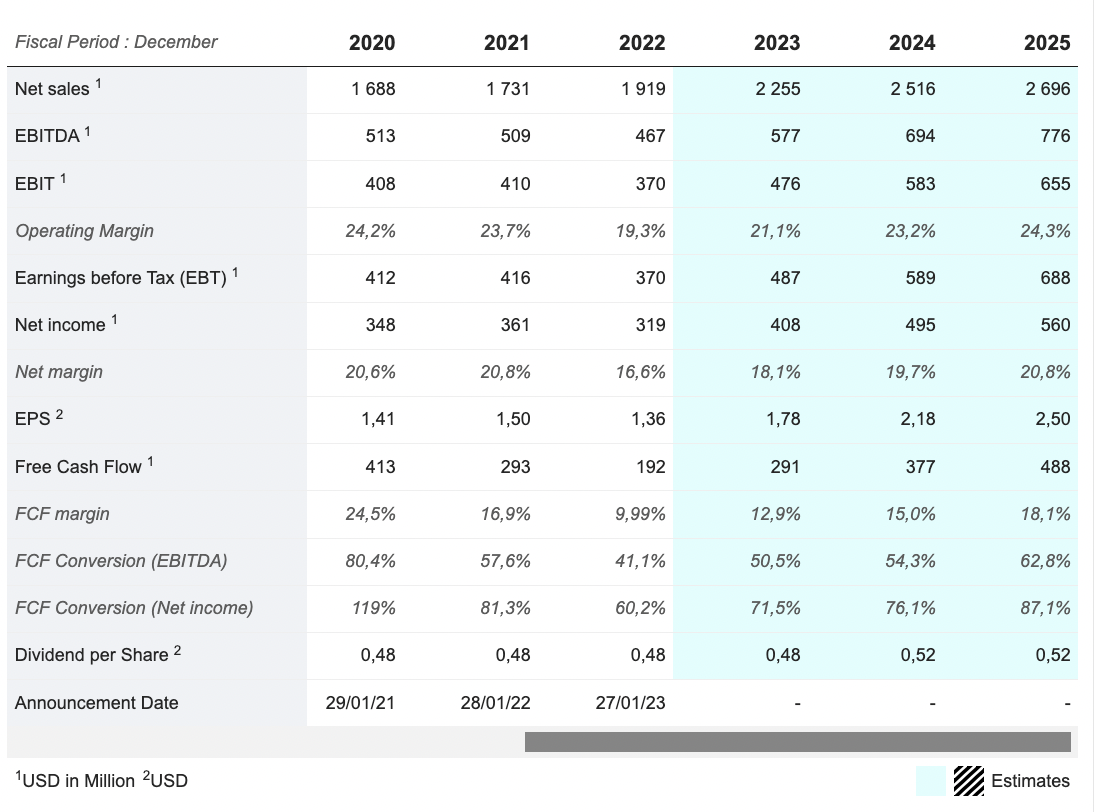

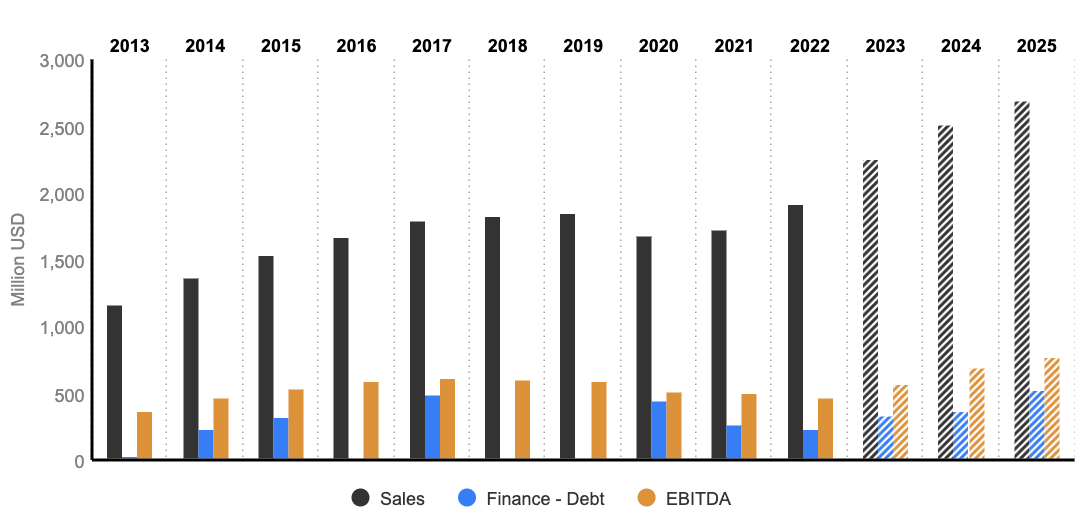

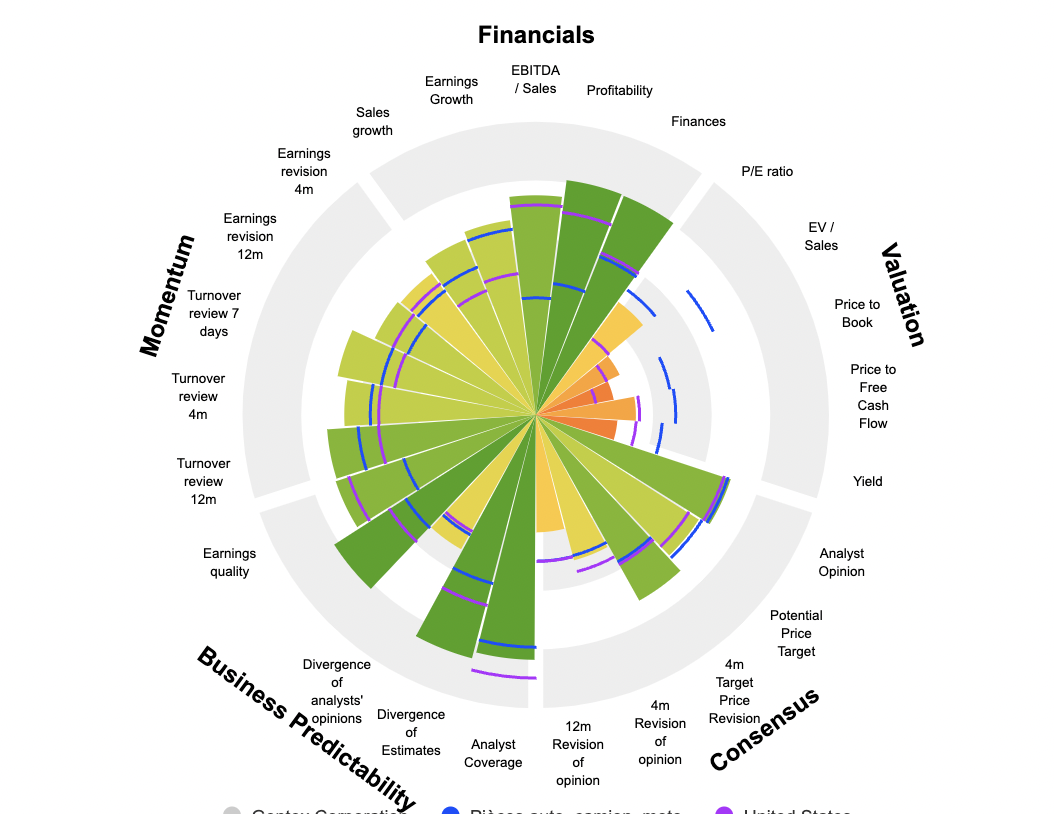

From an operational standpoint, the manufacturer hasn’t displayed amazing performance, with EBITDA and EBIT recording a CAGR of -4.6% and -5.6%, respectively, since 2017, while maintaining operating margins around 20% (32-33% Gross Margins). Analysts anticipate a 67% increase in EBITDA to $776 million by 2025, with operating margins projected to reach approximately 25%.

The return on assets (ROA) was stable around 15% since 2015 (excluding 2018-2019 where it was around 20%), but it is expected to reach 18.5% in 2024 and 19,2% for 2025. Similarly, the return on equity (ROE) has followed a similar trajectory as the ROA and is expected to reach 22% in 2023. CapEx (Capital Expenditures) is expected to increase from $146.4 millions in 2022 to $200-225 millions in 2023. Concurrently, the trajectory of free cash flow generation is projected to remain positive, with an expected FCF of $488 million in 2025. Consequently, the enterprise value is estimated to reach 12 times cash earnings by that time (lower than its 10-years-average of 18.3x).

Despite the company's qualities, such as its market-leading position, superior products, and consistent OEM success, investing in it comes with risks. With a substantial return of +250% since 2006 (CAGR of 7.2%), its performance doesn't surpass the S&P500 index, making it a risky and undiversified investment. It might be wiser to explore other investment opportunities with potentially better returns.

By

By