Since its creation in 1983, IDEXX Laboratories has established itself as a world leader in the development, production and marketing of diagnostic solutions for the veterinary sector. The company is also marginally present in animal husbandry, human health and water quality control.

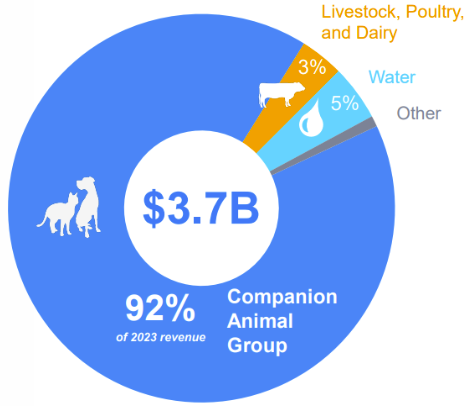

The Companion Animal Group (CAG) accounts for 92% of sales and is therefore the heart of the company. This segment offers a range of integrated diagnostic solutions for veterinary clinics, including immediate diagnostic devices, external diagnostic services (consultation and sampling), veterinary practice management systems and imaging systems using artificial intelligence.

The Water segment, which accounts for 4.5% of sales, is dedicated to the development of products for testing the presence of microbial contaminants in water. These products are crucial for government laboratories, water utilities and industries that have to comply with strict regulatory standards.

The Livestock, Poultry and Dairy Products segment, representing 3% of sales, provides diagnostic tests and services to support animal health management and dairy product quality.

Finally, the Other segment encompasses human medical diagnostics activities via OPTI Medical and IDEXX's licensing agreements for drug delivery technologies, although this segment represents less than 1% of sales.

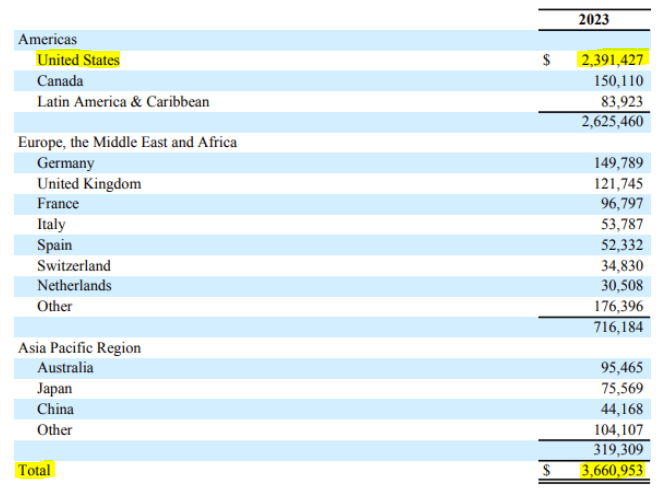

The geographical breakdown of IDEXX Laboratories' revenues bears witness to its strong presence on the American continent, accounting for 71.7% of total revenues. Among these, the United States stands out, generating 65.3% of sales. Europe also accounts for a significant proportion of IDEXX's business, with 19.5% of revenues, while Asia contributes 8.7%.

IDEXX Laboratories, with a market capitalization of $46 billion at the beginning of 2024, is positioned as a major player in the veterinary diagnostics sector. The price/earnings ratio (P/E) is 50.2 times. This is extremely high, but in line with the company's average performance over the past ten years. It's a sign of investors' unshakeable confidence in the company's growth potential and ability to generate future earnings.

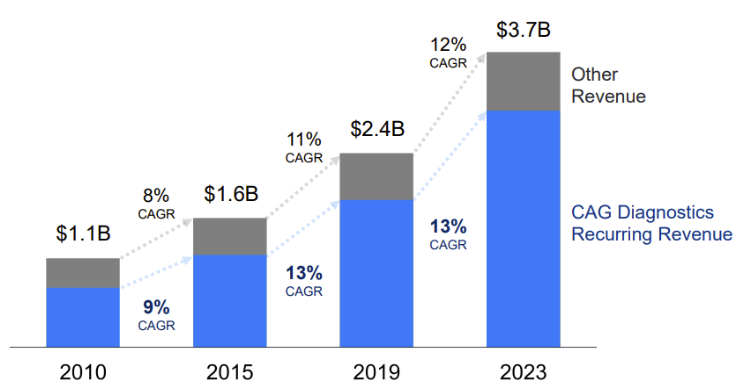

In 2023, the company achieved sales of $3.66 billion, and has posted an average annual growth rate (CAGR) of 10.5% over the last ten years. Financial performance is even more remarkable, with a net margin of 23.1%.

Although it has a no-dividend policy, it nevertheless boasts a payout ratio of 75%. Idexx favors share buy-backs, a strategy that has reduced the number of outstanding shares by almost 13% in 10 years, thanks to the investment of over $3.7 billion in capital.

Company revenue trends, broken down into recurring and non-recurring sources

Competitive edge

IDEXX Laboratories has a resilient business model that enables it to generate over 85% of its sales from recurring sources. The company capitalizes on its diagnostic instruments, designed to be uniquely compatible with its own consumables. This aspect obliges veterinary clinics, which have invested considerable sums in this equipment, to obtain supplies from IDEXX on an ongoing basis. This system erects significant barriers to switching suppliers, and makes IDEXX customers captive. The interconnection of instruments promotes the emergence of a unified ecosystem, reinforcing Apple-like customer dependency. Software, such as VetConnect PLUS, consolidates this loyalty through its deep integration into critical operational processes. The transition to competing systems is therefore becoming less and less conceivable for veterinarians, who are gradually getting used to the IDEXX ecosystem, with tools such as Cornerstone, essential for managing patients' clinical information. A change of system could lead not only to operational disruption, but also to the loss of vital clinical data.

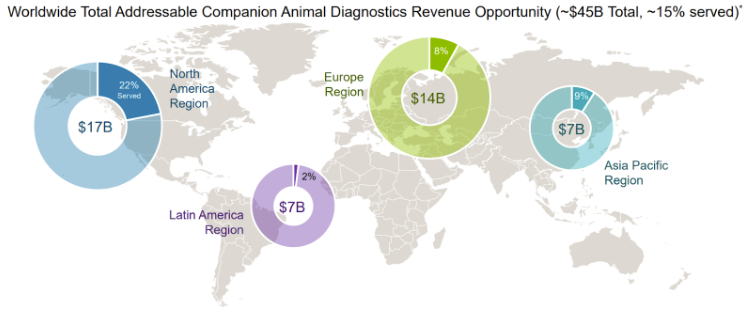

A leader with plenty left in the tank

Although IDEXX dominates the US pet diagnostics market, the company estimates that it has invested only 15% of its global addressable market, valued at $45 billion. This untapped manna presages a multitude of growth opportunities. Based on its historical expansion rates, the company projects that its market will grow by more than 10% a year over the next decade.

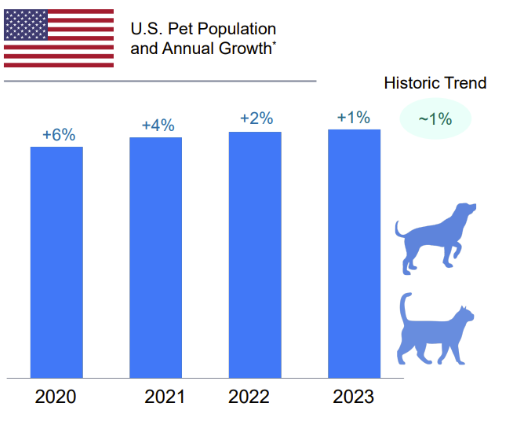

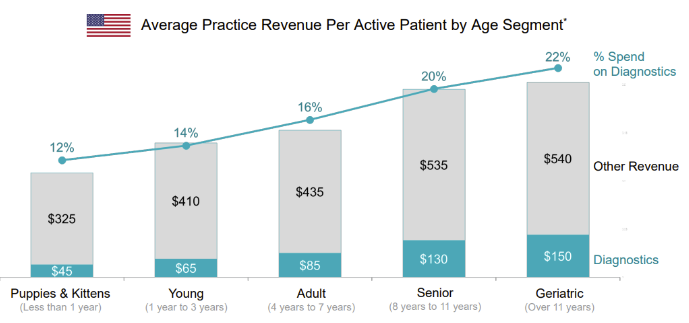

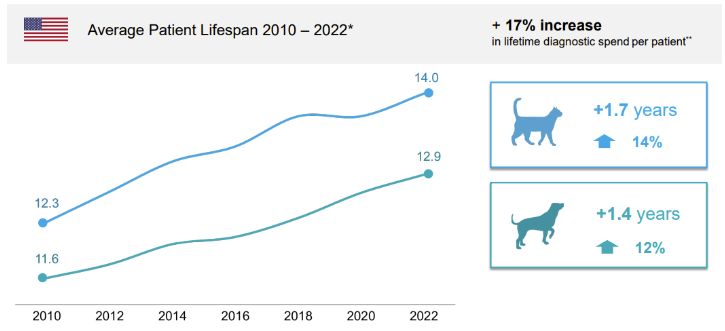

Several factors are fuelling this growth potential. The number of pets is constantly on the rise, a trend that has accelerated since the Covid-19 pandemic. At the same time, the life expectancy of pets has increased significantly over the last decade, with a 12% increase for dogs and a 14% increase for cats, driving up veterinary expenditure. On average, health care for an animal over 11 years old costs $690, almost double that for animals under a year old.

Idexx plays to the heartstrings. Pet owners are attached to their companions, and are prepared to cut back on their personal expenses to care for their furballs. New generations, particularly receptive to animal health, are more inclined to make regular visits to the vet, illustrating a potential for growth as pets age.

IDEXX Laboratories is positioned as a major player in the global veterinary market, capitalizing on a business model that generates recurring revenues and supports sustained annual sales growth. The company also boasts steadily improving margins, reflecting its operational efficiency and pricing power.

It contributes to a continuous improvement in earnings per share (EPS) thanks to its multiple share buy-backs. At his last conference, the CEO mentioned the intention to buy back between 0.5% and 1% of outstanding shares by 2024.

The company's CEO is optimistic about continued double-digit growth for 2024, and anticipates that current growth vectors will remain robust for the decade ahead.

However, its high valuation could temper the enthusiasm of some investors, although this remains in line with averages observed over the last ten years. Potential investors will therefore need to weigh IDEXX's strong growth momentum against valuation multiples, bearing in mind that premium valuations are often attributed to quality companies with superior growth prospects.

By

By