The self-storage industry, making up 63% of sales, provides storage for personal and business needs, with around 55,000 facilities in the U.S. split between institutional (often REIT-owned, climate-controlled, urban) and non-institutional (smaller, private, often rural). The sector, with REITs owning 30%, is growing, particularly through acquisitions that drive demand for brand-aligned remodeling. Growth is propelled by factors like rising consumption, population, and homeownership, despite a tight supply shown by over 90% occupancy in major REITs.

With many facilities over 20 years old, there's a pressing need for updates and expansions. High demand and occupancy hint at a future need for more capacity, possibly through new builds or conversions. Janus is a key player in providing solutions for the self-storage market, catering to a broad client base with comprehensive product offerings.

The commercial industrial door market, accounting for 37% of total sales, offers a variety of doors in metal, plastic, and wood for diverse non-residential uses. Metal doors, especially roll-up sheet and rolling steel doors, are the main products, with roll-up doors being lighter and less costly, ideal for less insulation-needy buildings, whereas rolling steel doors are heavier, more durable, and better insulated, suitable for warehouses and industrial settings. This sector has grown due to more construction, the need to upgrade old infrastructure, and desires for better security and energy efficiency. Although a smaller market participant, there's room to grow, particularly with eCommerce's rise.

Steel coil is the company's main raw material, purchased via contracts aimed at balancing cost and quality from a few suppliers. The volatile steel market, affected by various external factors, presents a challenge with unpredictable pricing trends.

Janus's business strategy includes strategic acquisitions to enhance its market presence. They did 9 successfully integrated acquisitions since 2016. In early 2021, they acquired G&M Stor-More, expanding their footprint in the Australian market. In August, they purchased ACT, a specialist in low-voltage/security systems integration for the self-storage and multi-family sectors. They also acquired DBCI, a manufacturer with over 25 years of experience in producing exterior building products for self-storage, commercial, residential, and repair markets.

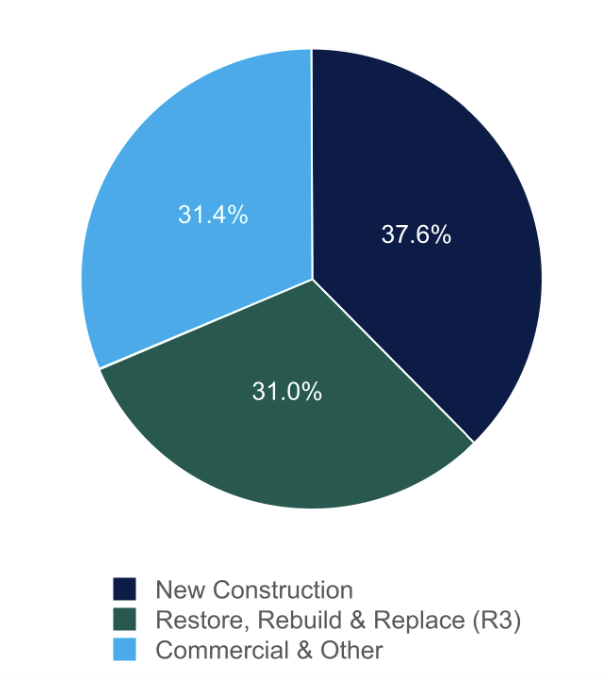

The commercial sector accounts for 31.4% of sales, featuring collaborations with brands like Amarr, Clopay, and Textdoor, while new construction makes up 37.6% and restoration, rebuilding, and replacement activities represent 31%. Janus has formed strategic partnerships with leading names such as Public Storage, Extra Space Storage, CubeSmart Self Storage, UHaul, Life Storage, Blackstone, and Simply Self Storage.

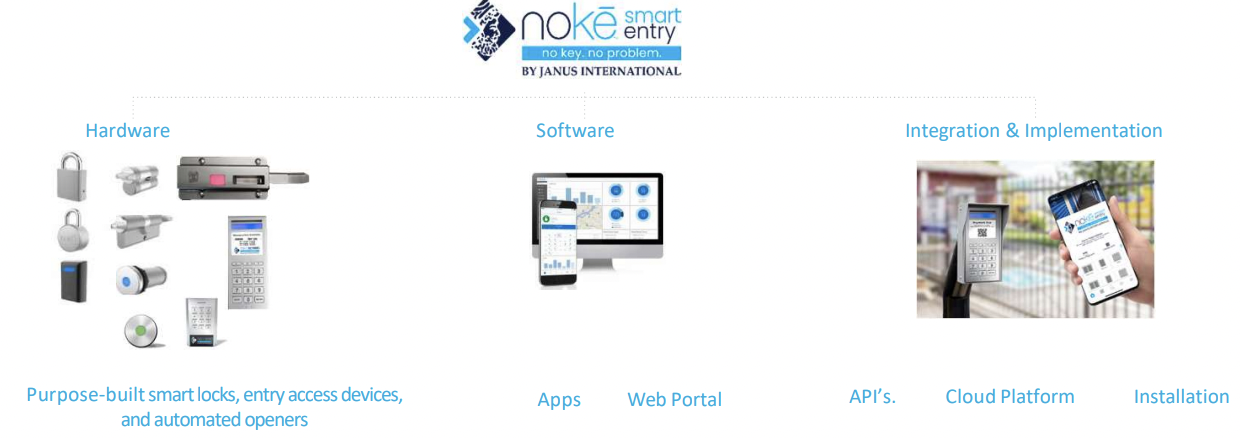

A significant development is Janus's expansion of the Noké Smart Entry System in partnership with Extra Space Storage, increasing its presence to about 1,100 Extra Space properties by adding 400 facilities. The company's latest update revealed a 10.8% sequential growth in the total installed units of the Noké Smart Entry System, reaching 255,000 units. This partnership is very valuable for Janus as Extra Space Storage stands as one of the largest self-store management companies in the US (see it here)

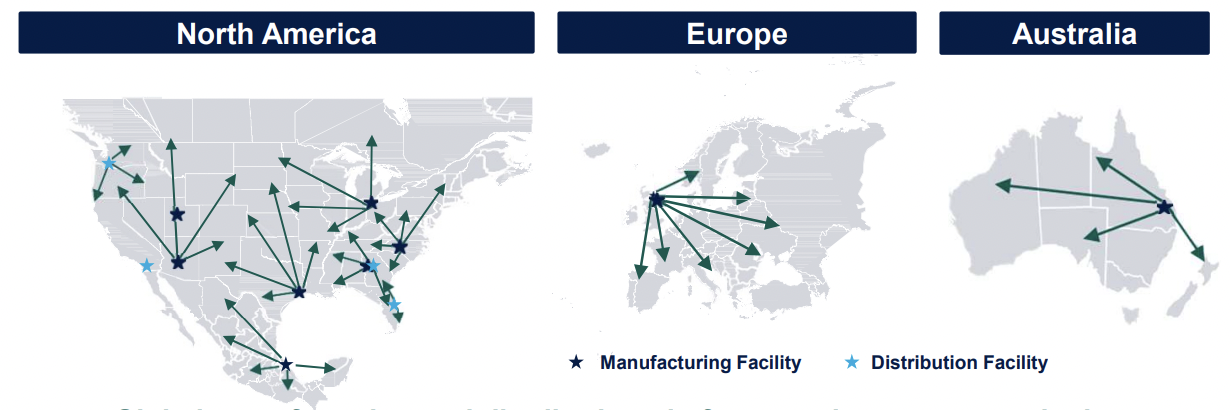

The company is also expanding its global footprint 11 manufacturing facilities with the ability to serve all key markets nationally. Janus is also present in All 50 States with over 135 Installation Companies for the Largest Network in the Industry.

The building and construction industries are highly competitive, often involving a bidding process where Janus competes on price, timeline, and services against local, national, and regional companies. This competition could lead to lower prices and reduced profit margins.

Part of Janus's strategy involves acquisitions, which come with the challenge of managing costs related to identifying and evaluating potential deals. The unpredictability in the timing, scale, and success of these acquisitions can make financial outcomes fluctuate. Additionally, Janus's operations and financial health are sensitive to steel coil prices and the availability of other components. Furthermore, a slowdown in urbanization or shifts in relocation patterns, resulting in decreased self-storage usage, could negatively affect Janus's sales and profitability.

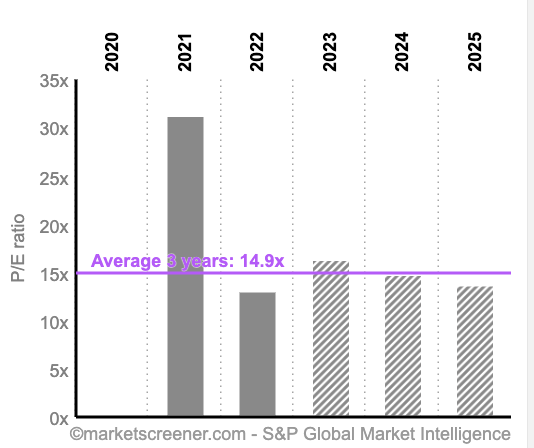

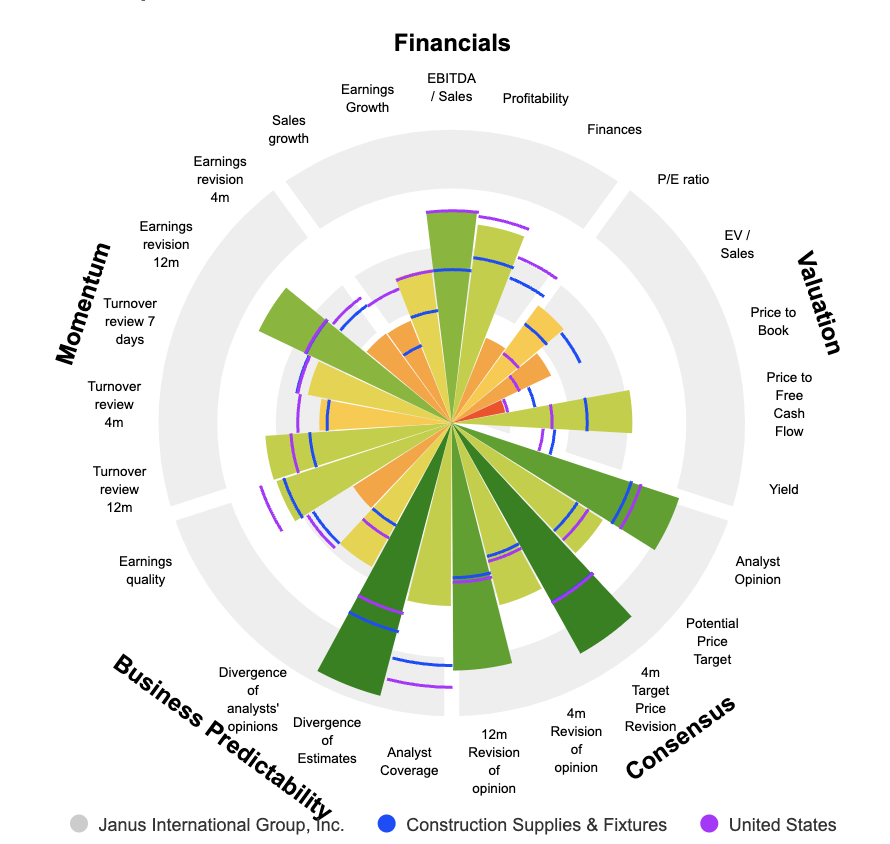

With a P/E of 13 times earnings, this is a valuation slightly under its 3 years median of 14.9x. P/E estimates for 2024 is 14.8-times earnings which seems to underline a certain homogeneity in the analyst consensus. Earnings per share have grown from $0.4 in 2021 to $0.73 in 2022 and expected to rise to $1.1 in 2025 resulting in that case a CAGR of 22.4%.

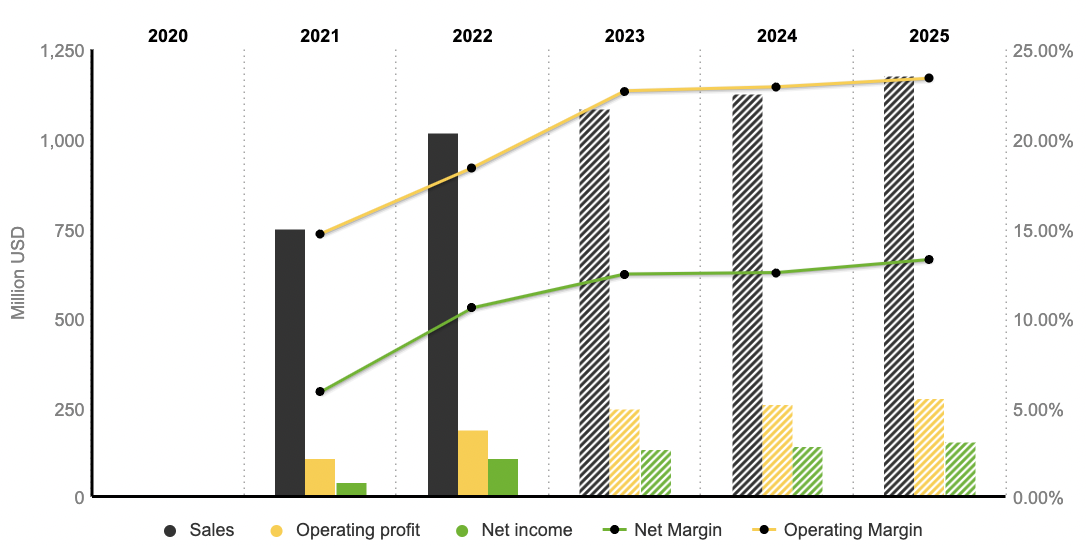

With its listing on the NYSE in June 2021, analyst don't have access to extensive data, making it challenging to identify a solid trend based on just two years of performance. Despite this, it's noteworthy that net sales saw a 36% increase, growing from $750 million in 2021 to $1.02 billion in 2022.

This growth is also reflected in EBITDA and EBIT, which increased by 40.56% and 70.6% respectively during the same period, reaching $227 million and $188 million. Analysts are forecasting net sales to reach $1.177 billion, with EBITDA at $309.7 million and EBIT at $275.3 million for the 2025 fiscal year, indicating optimistic growth projections for the company.

The management's effectiveness is evident in the expanding net and operating margins, projected to rise from 5.84% to 13.25% and 14.69% to 23.39% from 2021 to 2025. Additionally, the Free Cash Flow (FCF) of $79,66 million in 2022 is set to increase to $185 million in 2025, enhancing the company's potential for future acquisitions.

The company reported a strong third quarter in 2023, with revenues rising by 8.5% year-over-year to $802.6 million. Adjusted EBITDA reached $211.4 million, marking a 33.2% increase, and resulting in a margin of 26.3%. Operating cash flow was assessed at $146.5 million, leading to a free cash flow of $133 million.

The company maintains an active role in the competitive self-storage market, featuring a range of innovative products like the Noké Smart Entry System. Since the start of the year, its share price has increased by over 17%, indicating a growth trajectory. However, it's important to recognize that being a small-cap company, its stock tends to be more volatile. Additionally, the potential for major players in the sector to develop their own security products could impact Janus International revenue.

By

By