Kadant is a leader in Sustainable Industrial Processing and is structured into three divisions:

Flow Control: Custom-engineered products, systems and technologies that impact the flow of fluids used to reduce energy consumption, improve machine runnability, and enhance productivity.

It serves the packaging, tissue, food, and beverage, converting, and metals industries. Its main products include doctor blades and systems (holding the leading position in global market share for its markets), rotary joints and precision unions, expansion joints, fabric cleaning equipment, and filtration systems. In 2023, this segment accounted for 38% of the company's total revenue, with 69% of that revenue coming from parts and consumables.

Industrial Processing: Products and technologies used to process wood and virgin and recycled fibers to increase efficiency, reduce inputs, and drive higher margins.

Company targets industries such as packaging, tissue, recycling, engineered wood, and dimensional lumber. Key products include pulpers, screens, cleaners, recycling systems, debarkers and stranders (market leaders in their respective sectors), and chippers. This division represented 37% of total revenue in 2023, with 62% derived from parts and consumables.

Material Handling: Products and systems used to process or transport bulk and discrete materials, including renewable and biodegradable materials, to reduce operating costs.

It serves the aggregates, mining, food and packaging, metals, and waste management sectors. Its principal products are belt conveyor idlers, bucket elevators, feeders (leading in global market share), screens, vibrating conveyors, and both horizontal and vertical balers. This segment contributed 25% of the company's revenue in 2023, with 53% coming from parts and consumables.

In its most recent investor presentation in March 2024, the company outlined the areas it will prioritize moving forward:

Digitalization which facilitates the optimization of industrial processes across multiple systems and physical locations, providing real-time analysis and actionable insights. The company utilizes a digital platform called Illumen.X powered by Cogent to enhance productivity in manufacturing plants.

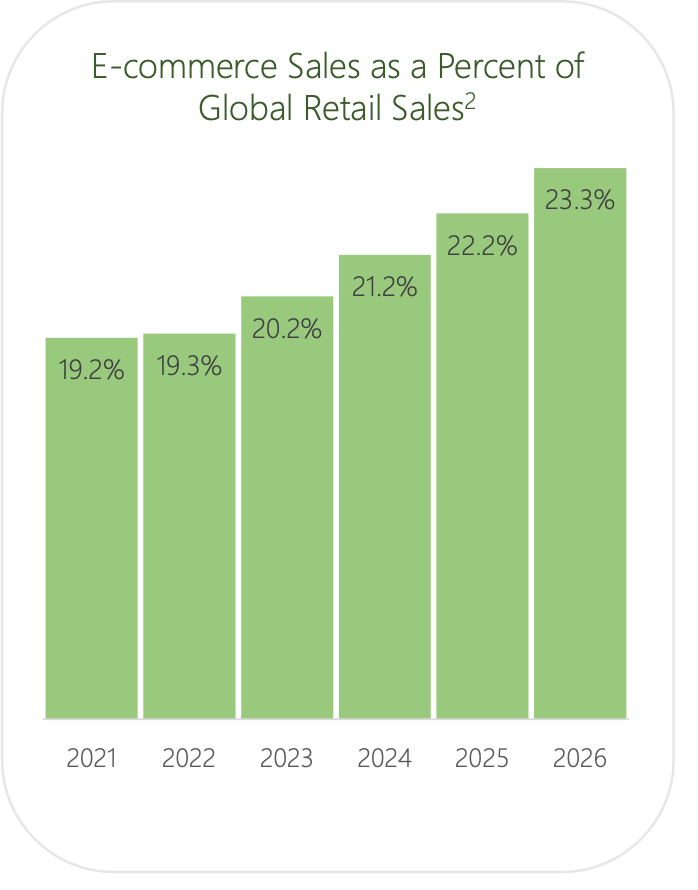

U.S. e-commerce sales are projected to grow by 16% annually through 2026, boosting the demand for containerboard, essential for producing corrugated boxes. Fiber-based packaging materials are increasingly recognized as a core element of the circular economy.

The demand for wood remains strong in the long term, driven by demographics and a backlog of housing needs. Wood-based buildings are gaining favor due to their lower carbon footprint compared to concrete or steel, and the growing use of cross-laminated timber (CLT) in taller building constructions. Additionally, housing construction in Europe is transitioning from traditional concrete and brick to wood with significant rise in the demand for materials that contribute to sustainability.

To accommodate rising global living standards, significant investments are being made in infrastructure. The US Federal Government has allocated over $1.2 trillion to the Infrastructure Investment and Jobs Act, which is expected to increase the demand for efficient mining and material processing equipment.

Kadant strategically employs M&A to enhance its portfolio of highly engineered products essential for industrial processes. These acquisitions help expand its market presence and increase its aftermarket services, contributing to consistent revenue streams. By integrating new technologies and services from acquired companies, it strengthens its customer offerings and ensures financial stability.

In 2023, the average Return on Invested Capital (ROIC) was 15%, based on an investment of $642 million.

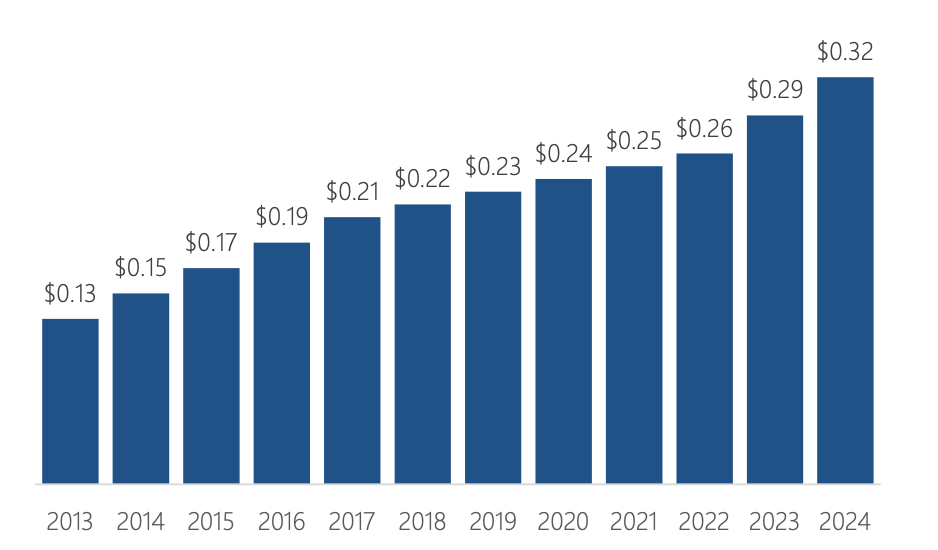

Between 2014 and 2023, cash allocation was as follows: 63% went towards acquisitions, 3% was used for share buybacks, 10% funded cash dividends, 10% was invested in Research & Development (R&D), and 14% was allocated to CapEx. Additionally, there was a consistent increase in the quarterly dividend, rising from $0.13 in 2013 to $0.32 in 2024.

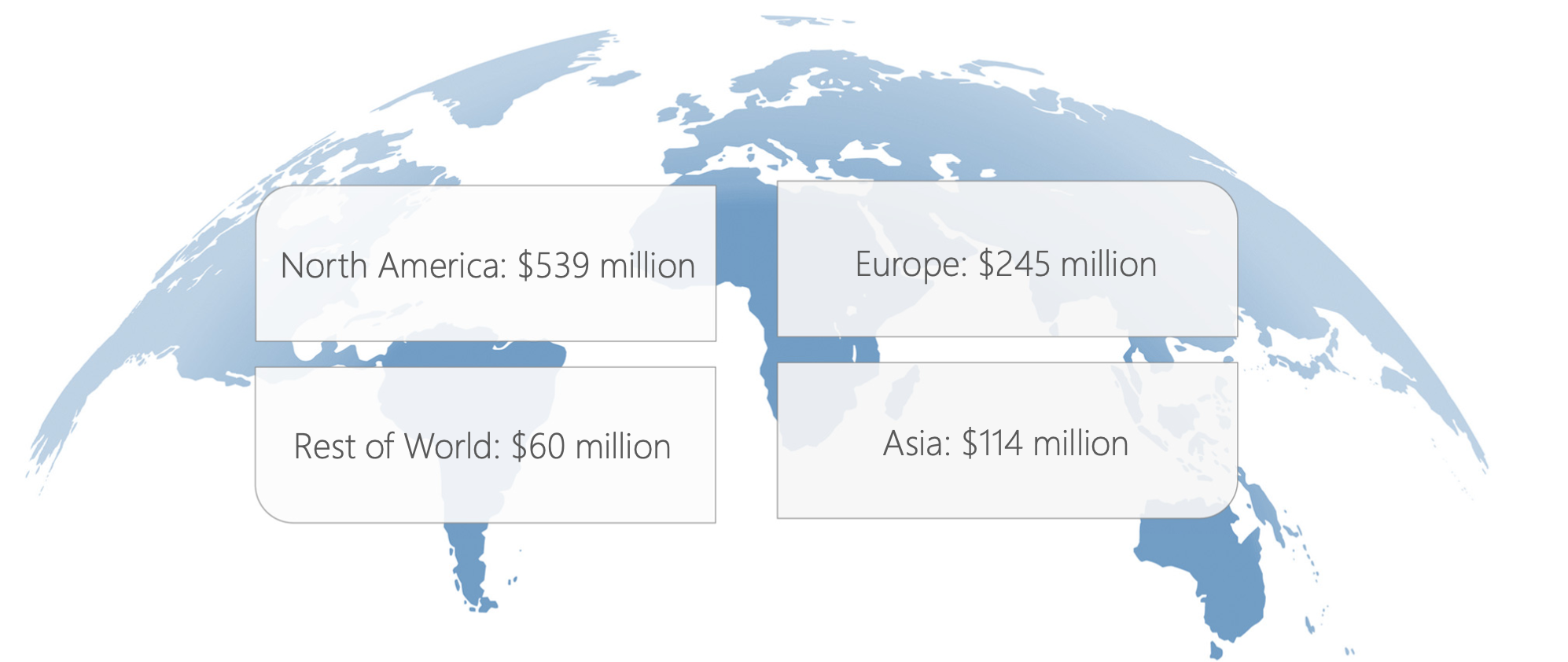

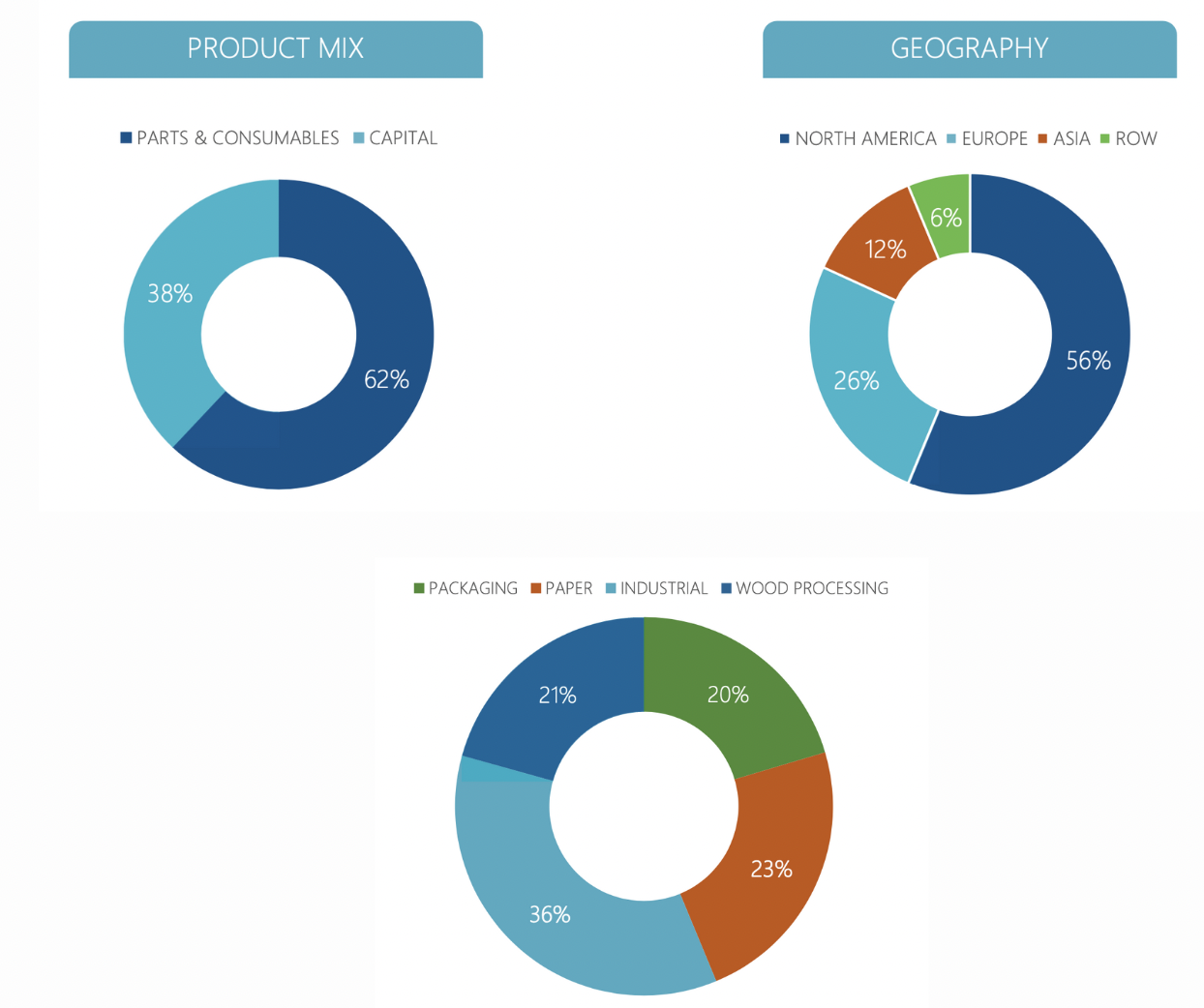

In 2023, the company reported sales of $958 million, demonstrating strong geographic and product diversification. Revenue was distributed across several regions: 56% from the US, 26% from Europe, 12% from Asia, and 6% from the rest of the world. Additionally, the company's revenues were segmented into four primary categories: Industrial at 36%, Paper at 23%, Wood Processing at 21%, and Packaging at 20%, while Parts & Consumables accounted for 62% of product mix and Capital for 62%.

Operating cash flow saw a substantial rise of 61%, amounting to $166 million, and free cash flow grew by 80% to $134 million. However, net income saw a decrease of 4%, totaling $116 million, and GAAP earnings per share (EPS) also declined by 4% to $9.90, a drop partly attributed to a $1.30 gain from the sale of a facility included in the previous year's figures. Conversely, adjusted EPS rose by 9% to a new peak of $10.04, and adjusted EBITDA increased by 6% to reach $201 million, accounting for a record 21.0% of revenue. Bookings fell by 4% to $917 million, and the ending backlog stood at $310 million.

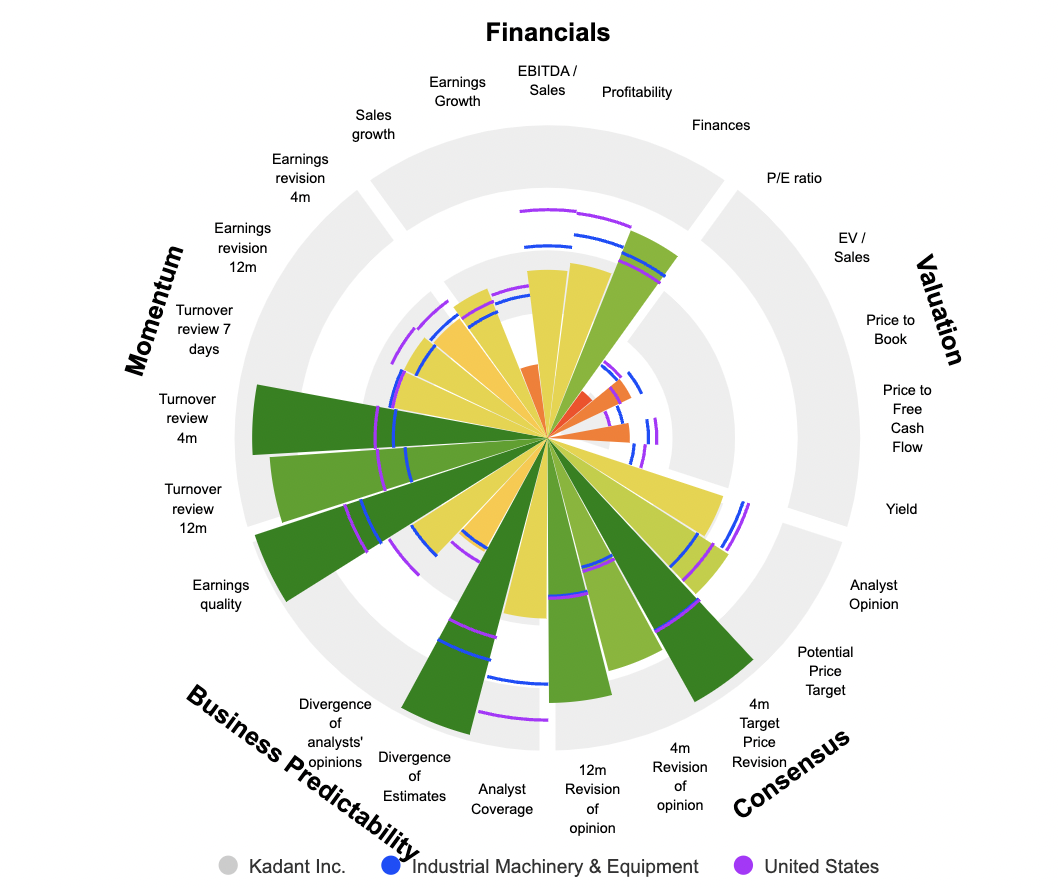

The company's operating margin showed an improvement, increasing from 17.12% in 2022 to 17.55% in 2023, while the net margin experienced a decline from 13.37% to 12.12%, and is projected to decrease further in 2024 to 10.87%. Another highlight is the growth in the company's Return on Equity (ROE), a key measure of profitability reflecting the efficiency with which the invested capital is turned into profit. ROE has increased significantly from 12.6% in 2020 to 19.9% in 2022. The first quarter results, to be released on April 29, will provide investors with more detailed insights into the company's performance and expectations for 2024.

The company is in a robust financial position, underscored by its net cash status and strong profit margins. Its outlook for sales growth is favorable, with clear visibility into its business operations. Future growth will hinge on management's continued success in executing acquisitions and mergers, similar to previous years, while sustaining high profit margins and fostering the development of innovative products.

By

By