The company is focusing on 4 distinct segments: Homebuilding, Financial Services, Multifamily and Lennar Other:

Homebuilding: Include the construction and sale of single-family attached and detached homes as well as the purchase, development and sale of residential land directly and through entities in which they have investments.

Financial Services: Provides mortgage financing, title and closing services primarily for buyers of their homes, as well as property and casualty insurance. The segment also originates and sells into securitizations commercial mortgage loans through its LMF Commercial business.

Multifamily: Focuses on developing a geographically diversified portfolio of institutional quality multifamily rental properties in select U.S. markets.

Lennar Other: Includes fund investments we retained subsequent to our sale of the Rialto investment and asset management platform as well as strategic investments in technology companies such as Blend Labs, Hippo Holdings, Opendoor Technologies, SmartRent, Sonder Holdings and Sunnova Energy International.

The company has prioritized strategies for cost minimization and expanding the proportion of land under its control. As part of this strategy, it has introduced the "Everything Included Approach," which aims to optimize its purchasing power. This approach not only allows the inclusion of luxury features as standard in their homes but also streamlines their homebuilding operations. To manage land for development and the construction of homes sold to homebuyers, the company employs a model of controlling land through options or agreements. This includes partnerships with strategic land banks and engaging in joint ventures, with Lennar currently involved in 48 active homebuilding entities tied to an exposure of $42.1 million, instead of direct ownership. At November 30, 2023, 76% of their total homesites were controlled through options with land banks, land sellers and joint ventures compared to 69% at November 30, 2022.

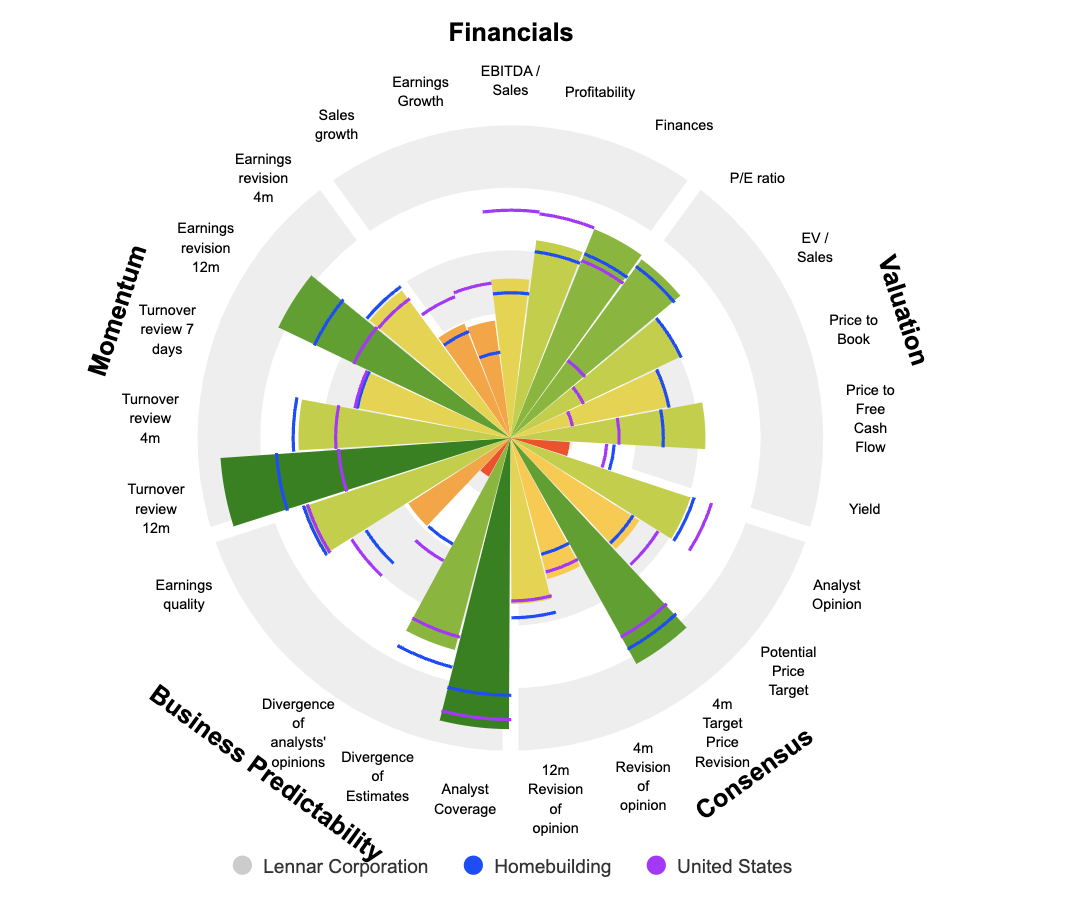

In the competitive landscape of the U.S. homebuilding industry, it stands out for its expansive portfolio that caters to a wide range of buyers, from first-time homeowners to luxury seekers. Its main competitors, D.R. Horton, PulteGroup, and NVR, each have distinct focuses. D.R. Horton with a Market Cap of $54.6B and net sales of $35.4B dominates by volume with a broad geographic spread.

PulteGroup with a Market Cap of $25B and net sales of $16B excels in land development and residential construction.

And NVR with a Market Cap of $25.8B and net sales of $9.3B integrates homebuilding with mortgage services.

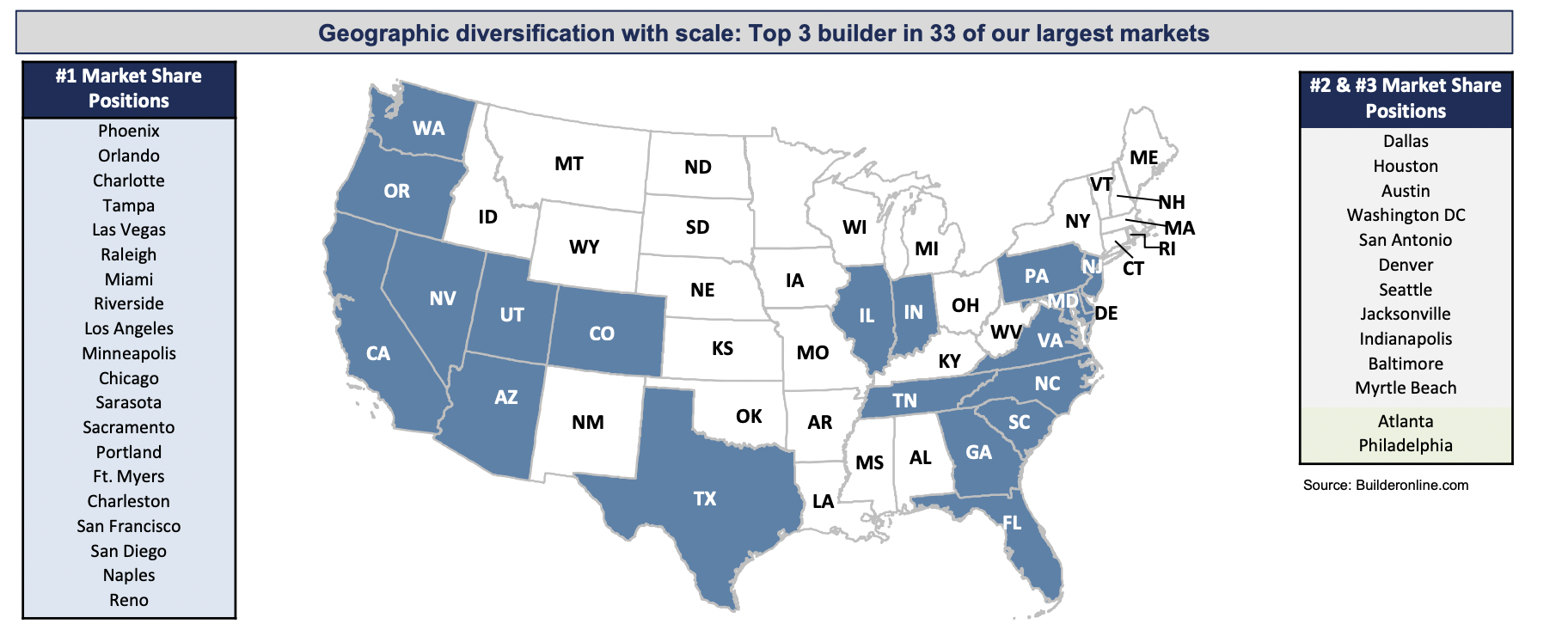

Over the years, the company has specialized itself in strategic acquisition. In 1997, it acquired Pacific Greystone Corporation to extend operations in California, Florida and Texas. Noteworthy that it is positioned within the top three homebuilders in 33 states across the U.S., with a notable competitive edge in Florida and Texas. These two states are especially attractive to new residents relocating from other areas of the country.

In 2000, Lennar acquired U.S. Home Corporation, which expanded their operations into New Jersey, Maryland, Virginia, Minnesota and Colorado and strengthened its position in other states. From 2002 through 2005, it also purchased several regional homebuilders, which brought the company into new markets and strengthened its position in several existing markets. From 2010 through 2013, it expanded homebuilding operations into Georgia, Oregon, Washington and Tennessee.

In 2017, WCI Communities, a homebuilder of luxury single and multifamily homes in Florida, was acquired. Then in 2018 came CalAtlantic Group, a major homebuilder which was building homes across the homebuilding spectrum, from entry level to luxury, in 43 metros, spanning 19 states. In 2023, deposits and pre-acquisition costs on real estate accounted for $2,002,154.

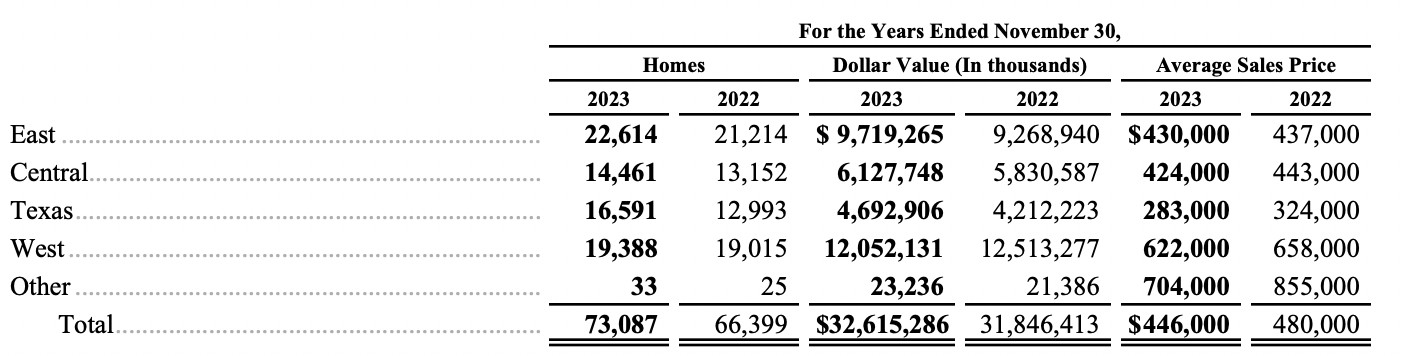

In 2023, Lennar's sales distribution showed the highest number of houses sold in the East region, with a total of 22,614 units. This was followed by the West region with 19,388 sales, Texas with 16,591 sales, and the Central region with 14,461 sales. Sales in other areas accounted for a total of 33 units.

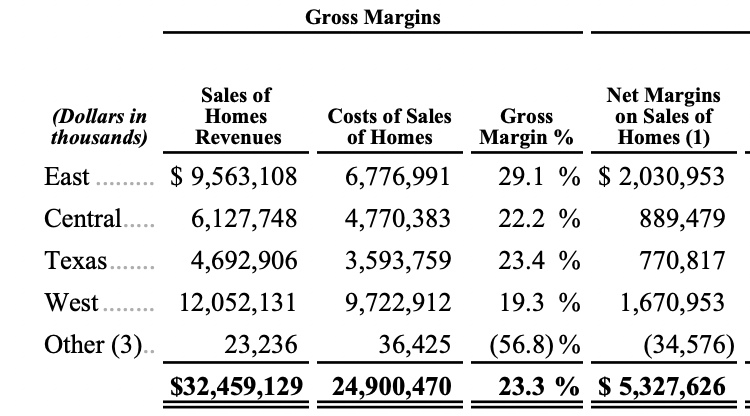

Additionally, the East region leads in gross margin at 29.1% and holds the highest net margins on home sales, totaling $2,030,952. In contrast, the West region reports a gross margin of 19.3% with net margins on home sales amounting to $1,670,953.

Over the past year, the business experienced an increase in home deliveries, reaching 73,087, compared to 66,399 in 2022 and 59,825 in 2021. Concurrently, the average sales price of homes saw a decline, settling at $446,000 in 2023 from $480,000 the previous year.

The group's revenues are distributed across four categories: Homebuilding, which constitutes 95.4% of total revenues, Financial Services at 2.9%, Multifamily at 1.6%, and Lennar Other, accounting for 0.1% of the revenue stream.

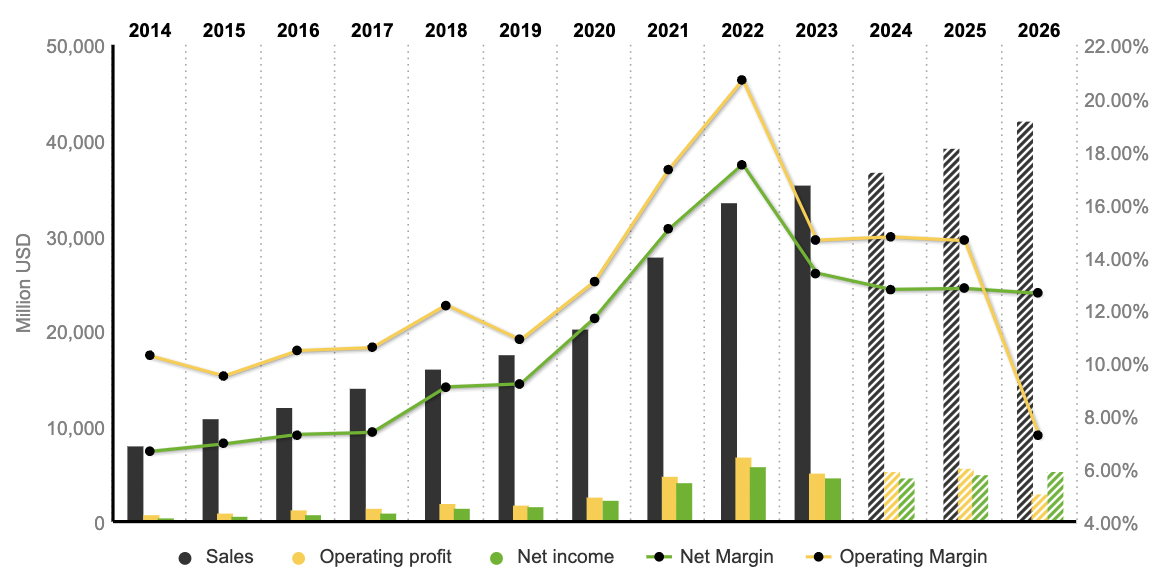

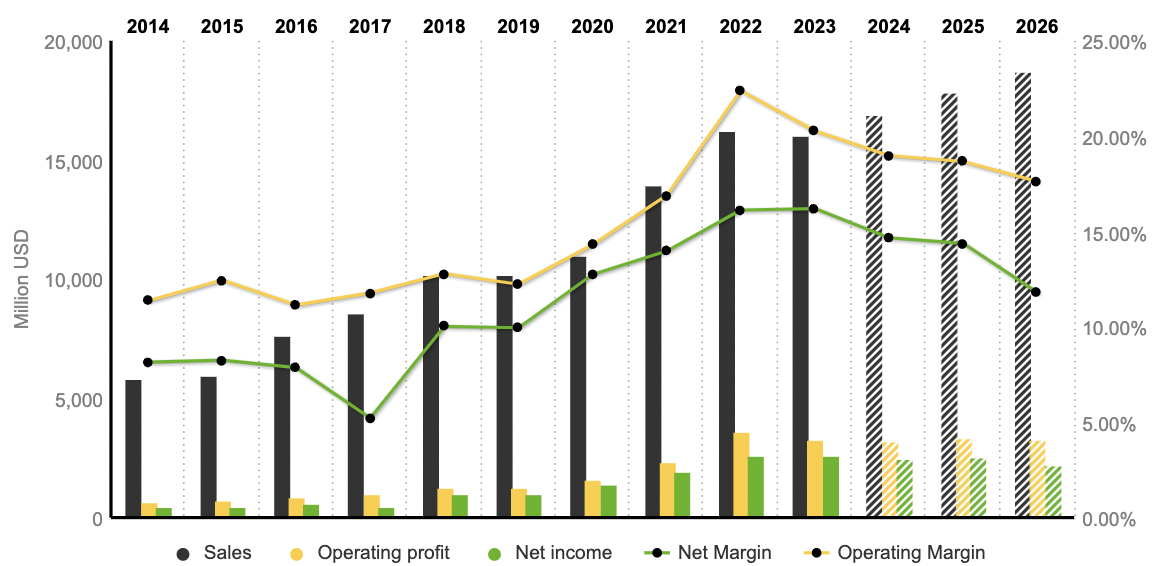

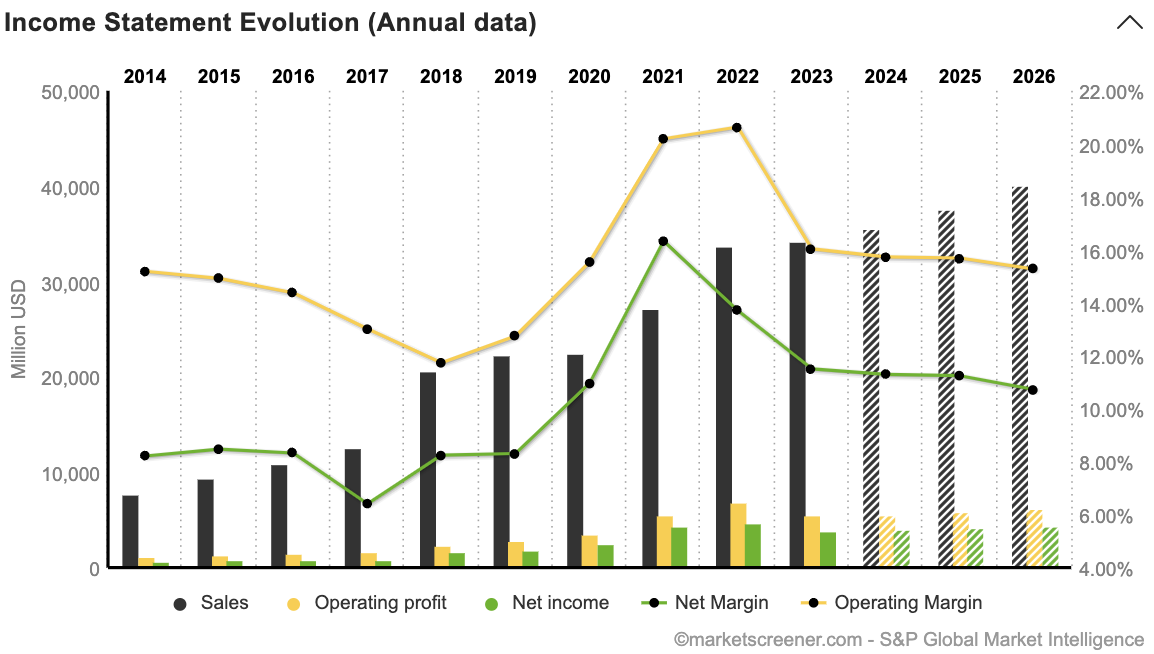

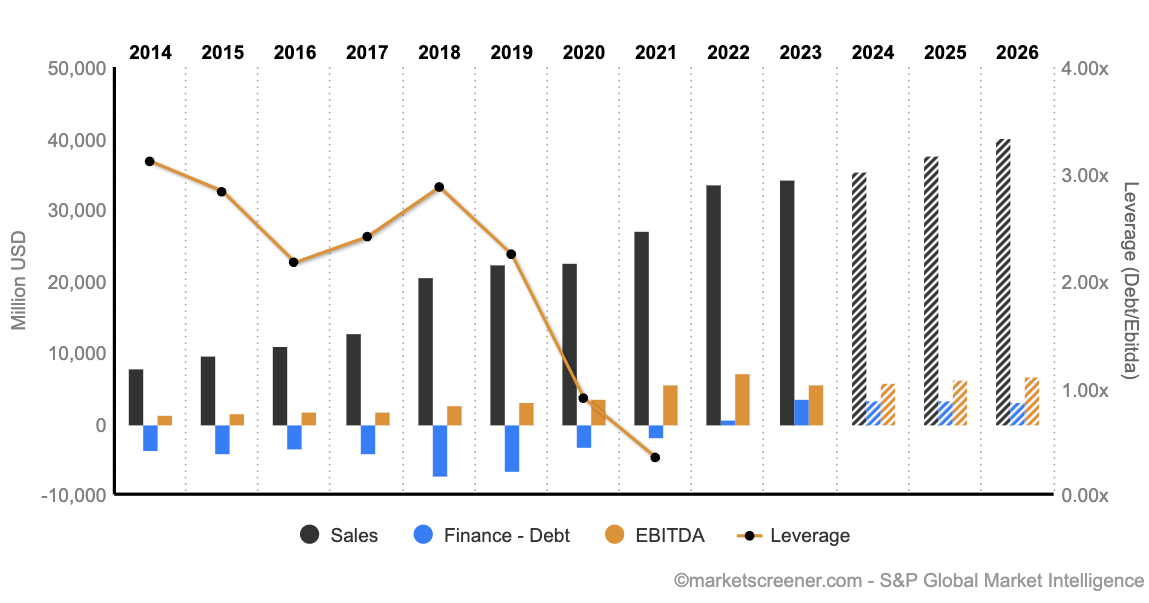

The company has seen a surge in its revenues since 2014 increasing from $7.780B to $34.233 in 2023 and expected to reach $40.1B in 2026 maintaining net margin around 11%. Since 2017, Lennar has improved its Free Cash Flow from $810.5M to $4B in 2023. Also, it increased its annual dividend to $2.00 per share from $1.50 per share.

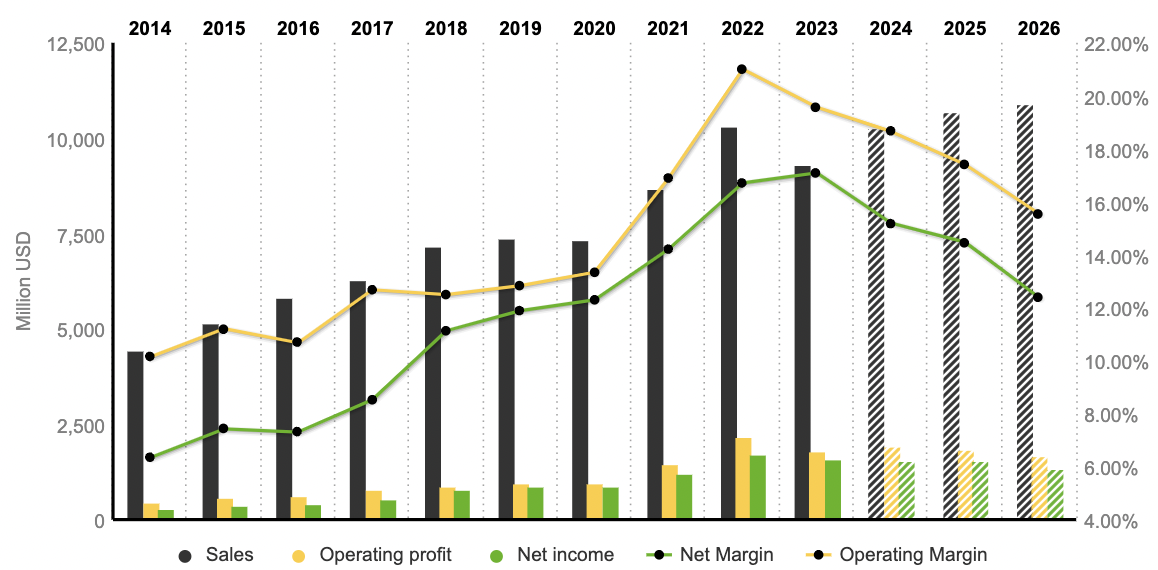

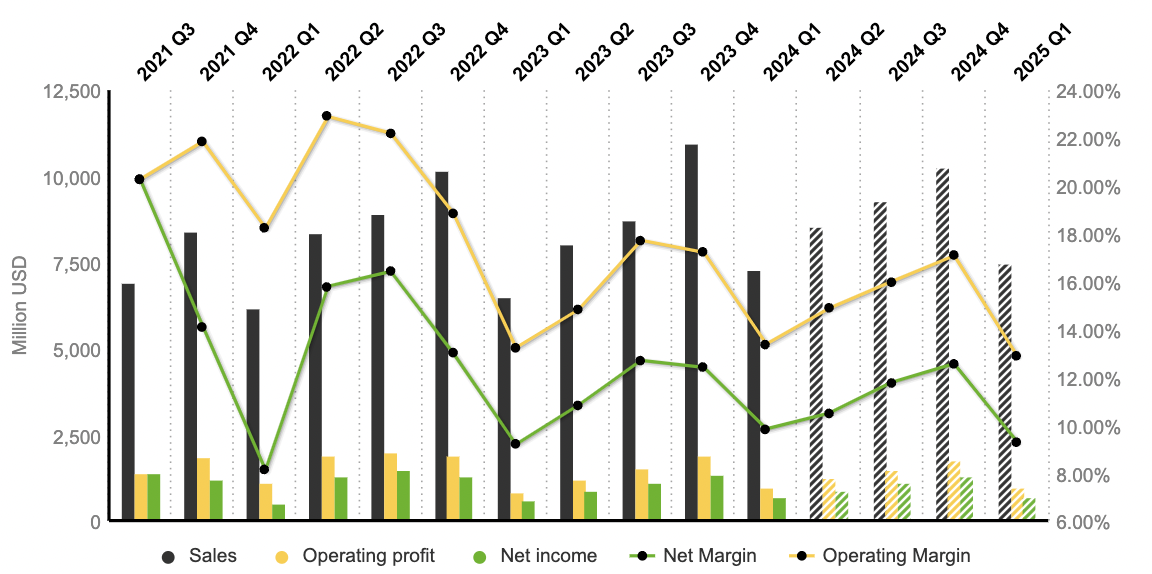

From an operational standpoint, the homebuilder has displayed good performance, with EBITDA and EBIT recording a CAGR of 16.5% and 16.6%, respectively, since 2014, while maintaining operating margins around 15 (jump to 20% during 2020-2021). Analysts anticipate a 18% increase in EBITDA to $6.6 billion by 2026, with operating margins projected to be maintained around 15%. The return on assets (ROA) has fluctuated between 5% and 14% since 2014 but it is expected to be at 10% in 2026. Similarly, the return on equity (ROE) has followed a similar trajectory as the ROA and is expected to be at 14.6% in 2025.

In the first quarter of 2024, Lennar Corporation reported a notable increase in its homebuilding segment, with revenues from home sales climbing 13% to $6.9 billion, up from $6.1 billion in the corresponding quarter of 2023. This rise was attributed to a significant 23% increase in new home deliveries, totaling 16,798 homes, despite an 8% reduction in the average sales price to $413,000 due to strategic pricing adjustments and product mix. Gross margins on home sales improved to 21.8%, reflecting the company's ongoing efforts in construction cost savings, even as land costs rose. However, selling, general, and administrative expenses grew to $568 million, marking an increase in brokerage use and digital marketing investments to enhance direct sales.

The Financial Services segment saw its operating earnings jump to $131 million, driven by higher margins and volume in the mortgage and title businesses, benefiting from technological advancements. Meanwhile, losses in the Multifamily and Other Ancillary Businesses segments showed slight improvements. Additionally, Lennar demonstrated its confidence through the repurchase of 3.4 million shares of its common stock for $506 million, underscoring a robust start to 2024.

Predictions for a steady rise in new household formations up to at least 2030, coupled with valuations sitting at around eight to nine times earnings—well below the historical average of twelve to thirteen times—highlight a potential opportunity. This current valuation has motivated the company to strategically repurchasing its shares and attract confidence of major investors such as Berkshire Hathaway.

By

By