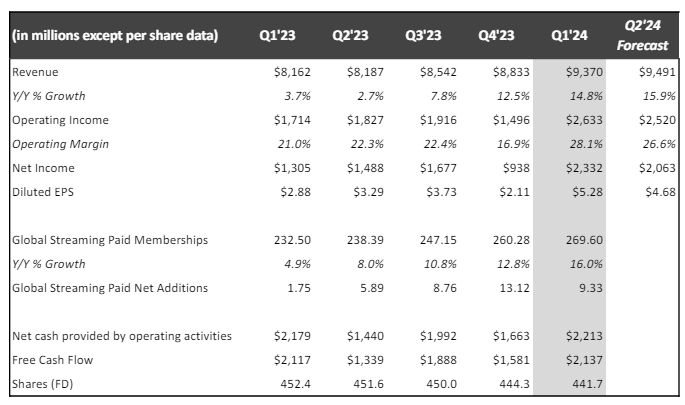

Overall, results are quite good, with double-digit growth in both the top and bottom lines, and rising margins. Sales rose by 15% to $9.3 billion in Q1 2024, versus $8.1 billion in Q1 2023 and $9.2 billion expected by analysts according to the S&P consensus. Operating income rose by 54% to $2.6 billion versus $1.7 billion for Q1 2023 and $2.4 billion expected by analysts according to the S&P consensus. Operating margin increased by seven percentage points to 28%. EPS came out at $5.28 versus $4.53 expected (+16.66% surprise rate) and $2.88 for the same period a year ago.

Here is a breakdown of key past and estimated metrics for Q2 2024:

Cash generation from operating activities was $2.2 billion for the quarter, representing over 94% of net income. Netflix repurchased 3.6 million shares for $2 billion.

To maintain healthy growth over the long term, Netflix must focus on continuously improving its catalog, both in terms of variety and quality. The American firm intends to accelerate the availability of TV shows, games and live programs.

Netflix aims to develop its additional revenues and profit pools - in particular the scaling of advertising - in order to become a more significant contributor to its business in 2025 and beyond. Ad monetization saw modest growth of 1% on a reported basis and 4% on a currency-neutral basis in the first quarter. This is mainly due to the fact that the company has not changed its prices in most countries over the past two years, and to the growth of its ad-supported offering.

Netflix enjoys a competitive advantage thanks to its hard-to-replicate superior recommendation algorithm, a broad international reach thanks to its presence in over 190 countries, and a loyal community, which fosters healthy engagement with Netflix. Of particular note is the success of original films and series, which dominate the rankings. Improvement in these key areas is the best way to delight members and continue to grow the business.

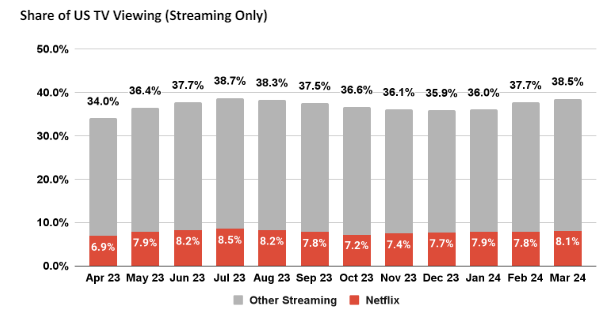

With more than two people per household on average, Netflix has an audience of over half a billion people. The American company has a market share of 8.1% of television time in the United States.

However, the group is forecasting weaker subscriber gains for the current quarter (Q2 2024), which is where the rubber meets the road when valued at 36 times its estimated profits for 2024. Netflix needs to grow at a sustained pace if it is to continue to be cherished by the market.

In fact, they have announced that from next year onwards, they will no longer be disclosing the number of new subscribers every three months as they do at present. This is in order to focus on audience engagement metrics (time spent watching content) that better reflect the platform's ability to build loyalty and appeal.

Revenue growth is forecast at between 13% and 15% for the full year, compared with 15% to 16% growth for the first and second quarters of this year. This deceleration is attributed to difficult comparisons with the second half of the previous year and the potential impact of exchange rate fluctuations. Operating margin is targeted at 25% for the year, up on the initial target of 24%.

The Group's strategic priorities therefore include continuous improvement of the service to increase engagement and value for members, expansion of the paid-sharing functionality, launch of the advertising offer and sustainable revenue growth.

Potential threats include increased competition (Disney+, Amazon Prime et al.), the impact of currency fluctuations, and the need to adjust prices and plans to reflect added value.

Following this earnings reports, and due to disappointing forecasts, the stock is expected to fall before the day's opening.

By

By