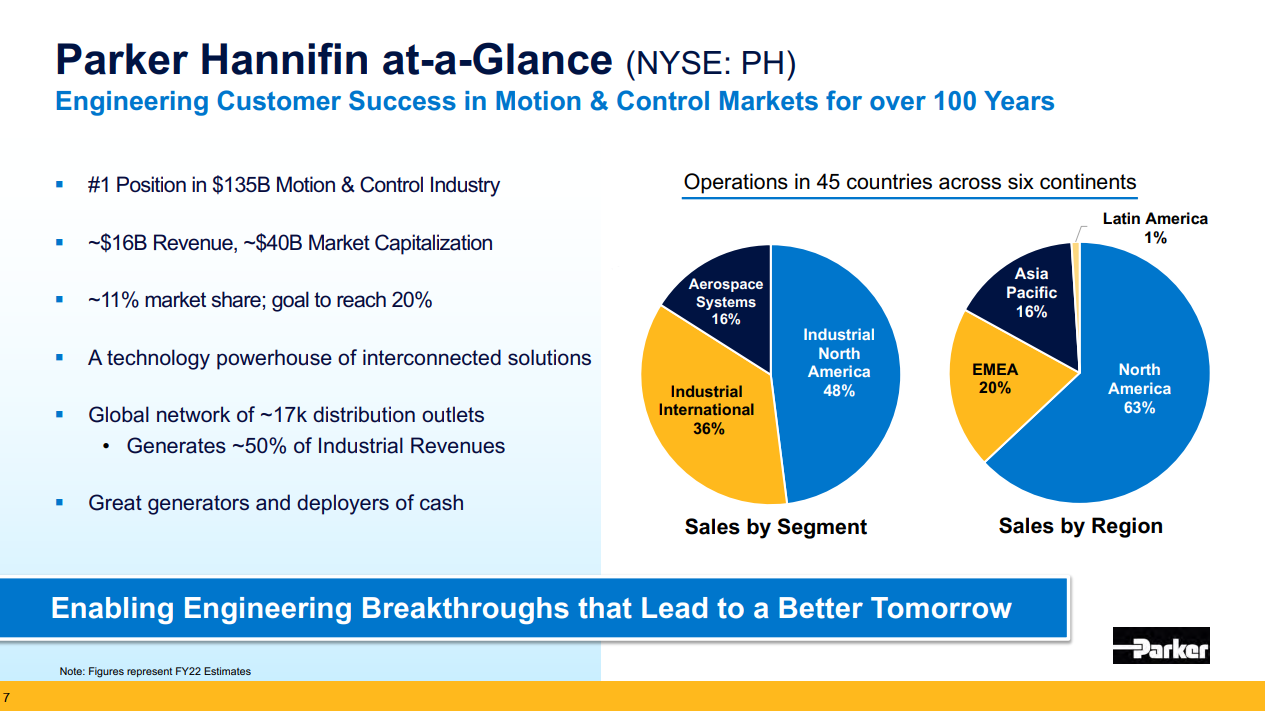

Parker-Hannifin Corporation is the world leader in the motion and control segment with an 11% market share and has been successfully deploying a dual strategy of organic and external growth for over 50 years. The company's success is built on its unparalleled distribution network, exemplary capital allocation and strong free cash flow generation for its shareholders.

Source: Parker-Hannifin

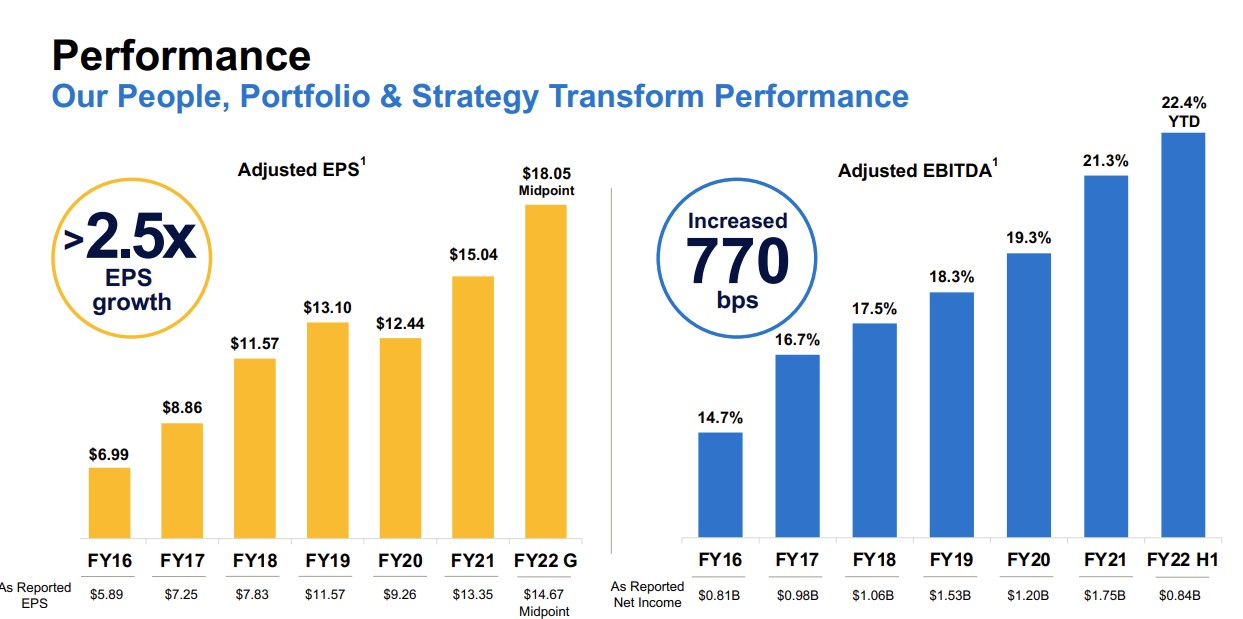

All income statement metrics have been steadily improving for many years. Over the last decade, operating income has doubled. Its growth prospects are not waning: there is still a long way to go for this "good father" stock. The current macroeconomic outlook is complicated, with justified fears of recession and many industrial companies having revised their projections downwards. In contrast, Parker-Hannifin has raised its earnings outlook for fiscal 2023. The company's management of rising inputs and its strong market position make it a stock to watch in 2023.

Source: Parker-Hannifin

The September 2022 acquisition of Meggitt for $9.9 billion will boost its sales as well as the aerospace and defense portion of its business model. Meggitt manufactures advanced composite materials for defense and weapons systems for military aircraft, among others. This acquisition will also allow the company to strengthen its presence in the aerospace industry as commercial flights are in full swing in the post-Covid era.

The management team is stable with an average of 20 years of experience in the business for its members. The company has increased (or stabilized) its dividend for 65 consecutive years. It is therefore one of the Dividend Kings. Given the strong fundamentals and the strategy of the management team, there is every reason to believe that the dividend will continue to increase this year.

Less cyclical and vulnerable to recessions than one might think at first glance, the company is generating steady cash profits with an FCF margin close to 14% in 2022 and a FCF conversion of 62%. So, yes, during the health crisis, it experienced a 9% decline in earnings per share (EPS), but it has emerged stronger thanks to cost-cutting initiatives and increased demand. The business has recovered quickly and if the last quarter is any indication, it posted a 16% increase in organic sales and 40% adjusted earnings per share, exceeding analysts' expectations for the 25th consecutive quarter.

In terms of valuation, the stock is paying 23 times its NAV, 2.2 times its sales, 13 times its EV/EBITDA, and 23 times its Free Cash Flow to Equity, overall in line with its history, but things have changed and the new cycle in aerospace and defense could boost the company's growth in the coming years. Thus, in 2025, the P/E falls to only 15 with the current capitalization. These few valuation ratios therefore do not seem to reflect its unique position in the value chain, its obvious qualities and the current tailwinds.

Parker-Hannifin derives its competitive advantage from its strengths, including the strength and interconnectedness of its product portfolio, its time-tested business model, its sprawling distribution network, and its clear and focused roadmap. We are dealing with a very profitable company, with controlled debt, recurring and growing revenues, a broad and diversified portfolio with loyal customers, and all at a reasonable valuation. In short, we're having our cake and eating it too.

By

By