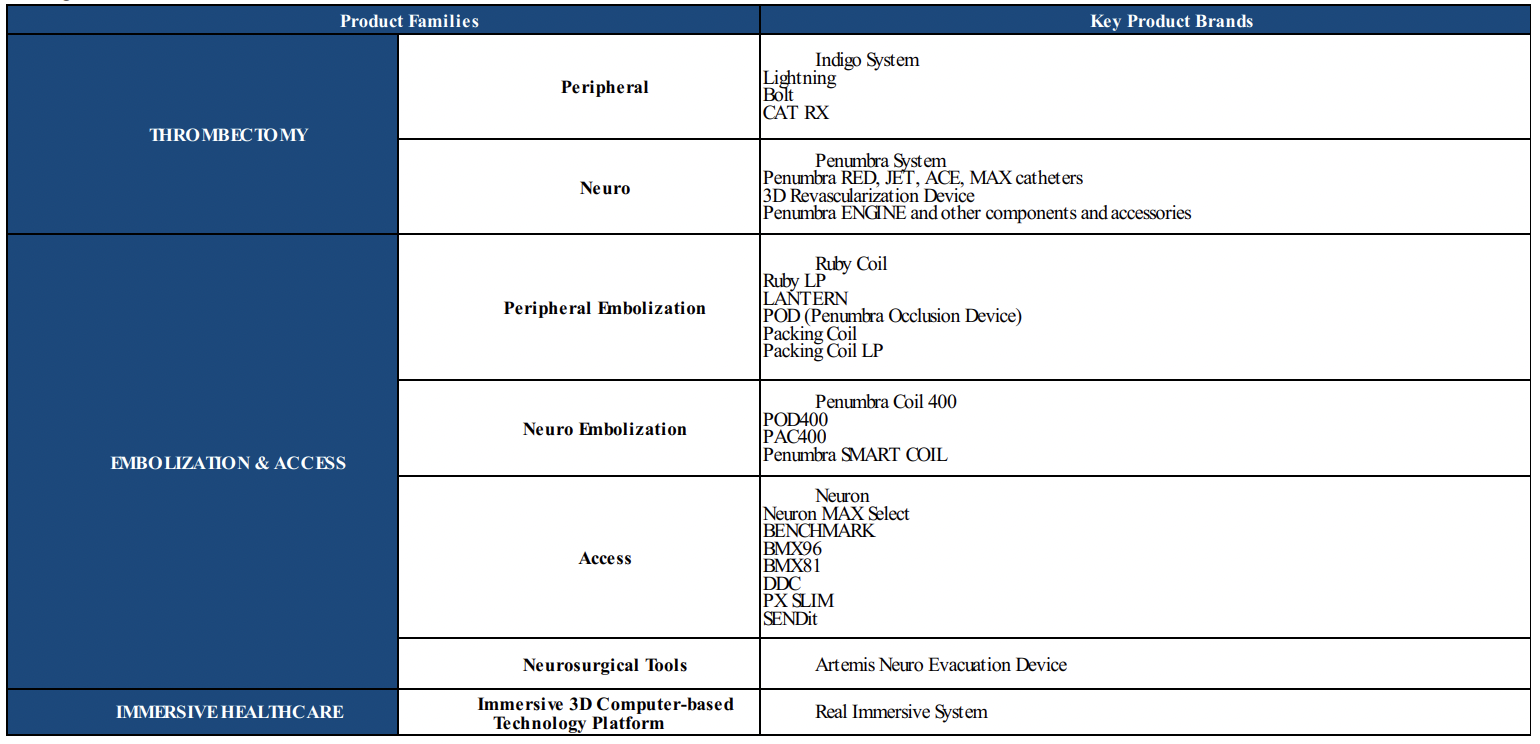

The company introduced products into the thrombectomy market since 2007, access market since 2008, embolization market since 2011, neurosurgical market since 2014, and immersive healthcare market since 2020.

It concentrates on improving treatment outcomes for patients with certain forms of vascular disease and strive to improve the long-term quality of life for patients who could benefit from immersive healthcare applications.

The thrombectomy segment offers products aimed at treating conditions such as pulmonary embolism, deep vein thrombosis, acute limb ischemia, ischemic stroke, and coronary disease.

The more common conditions the company is focusing on are:

- Pulmonary embolism (PE) which is a condition where blood clots from leg veins block lung arteries, results in about 350,000 U.S. cases and 50,000 deaths annually, with around 800,000 cases worldwide.

- Deep Vein Thrombosis (DVT) involves clot formation in deep veins, primarily in legs, with 550,000 U.S. cases and 4 million globally annually, leading to 30,000 deaths in the US.

- Peripheral Arterial Occlusion (PAO), including Acute Limb Ischemia (ALI), results from clots in peripheral arteries, affecting 250,000 US and 2.5 million people globally per year, with 50,000 US deaths.

The embolization and access category includes products for treating aneurysms and for vessel occlusion, as well as those that facilitate vascular access:

- Aneurysms affect about 2% of the population, with around 9 million people in the US potentially having one, and embolization serves as the primary treatment for unruptured aneurysms.

- Hemorrhagic Stroke, caused by artery ruptures in the brain, accounts for about 13% of U.S. strokes, with a risk of bleeding from aneurysms or arteriovenous malformations (AVM) ranging from 0.5% to 3%, and carries a significant mortality risk post-bleeding.

The immersive healthcare segment develops applications for patients undergoing rehabilitation from diseases, injuries, or illnesses, in addition to applications targeting mental well-being and cognition:

- Immersive healthcare employs 3D computer technologies for patient care, spanning physical rehabilitation for conditions like strokes and orthopedic issues, to mental well-being for managing pain, mood disorders, and age-related challenges across various settings. It's estimated that over 50 million US patients annually could benefit from these applications.

Penumbra has developed a product portfolio that includes 7 product families within their major markets:

Peripheral Thrombectomy Products: The Indigo System utilizes continuous power aspiration for thrombus removal across various vascular regions, enhancing safety, efficiency, and ease of use for diverse clot morphologies. In 2023, the Lightning Flash and Lightning Bolt 7 systems were introduced, utilizing CAVT technology for mechanical thrombectomy in venous, pulmonary, and arterial thrombus removal, targeting conditions like ALI and visceral occlusions with modulated aspiration features.

Neuro Thrombectomy Products: The Penumbra System brand encompasses mechanical thrombectomy products for revascularizing blood vessels in the intracranial vasculature obstructed by clots, featuring aspiration-based technology, including reperfusion catheters, separators, the 3D Revascularization Device, aspiration tubing, and pumps.

Peripheral Embolization Products: The Ruby Coil System includes detachable coils for peripheral applications, featuring a controlled mechanical detachment mechanism that allows for coil delivery and repositioning until a satisfactory placement is achieved before detachment.

The principal specialist physicians and other healthcare providers in the target end markets include:

- Thrombectomy: Interventional radiologists, interventional neuroradiologists, vascular surgeons, neurosurgeons, interventional cardiologists, and interventional neurologists.

- Embolization and Access: Neurosurgeons, interventional neuroradiologists, interventional neurologists, interventional radiologists, vascular surgeons, and pediatric interventional cardiologists.

- Immersive Healthcare: Occupational therapists, physical therapists, nurses, mental health professionals, and other healthcare providers.

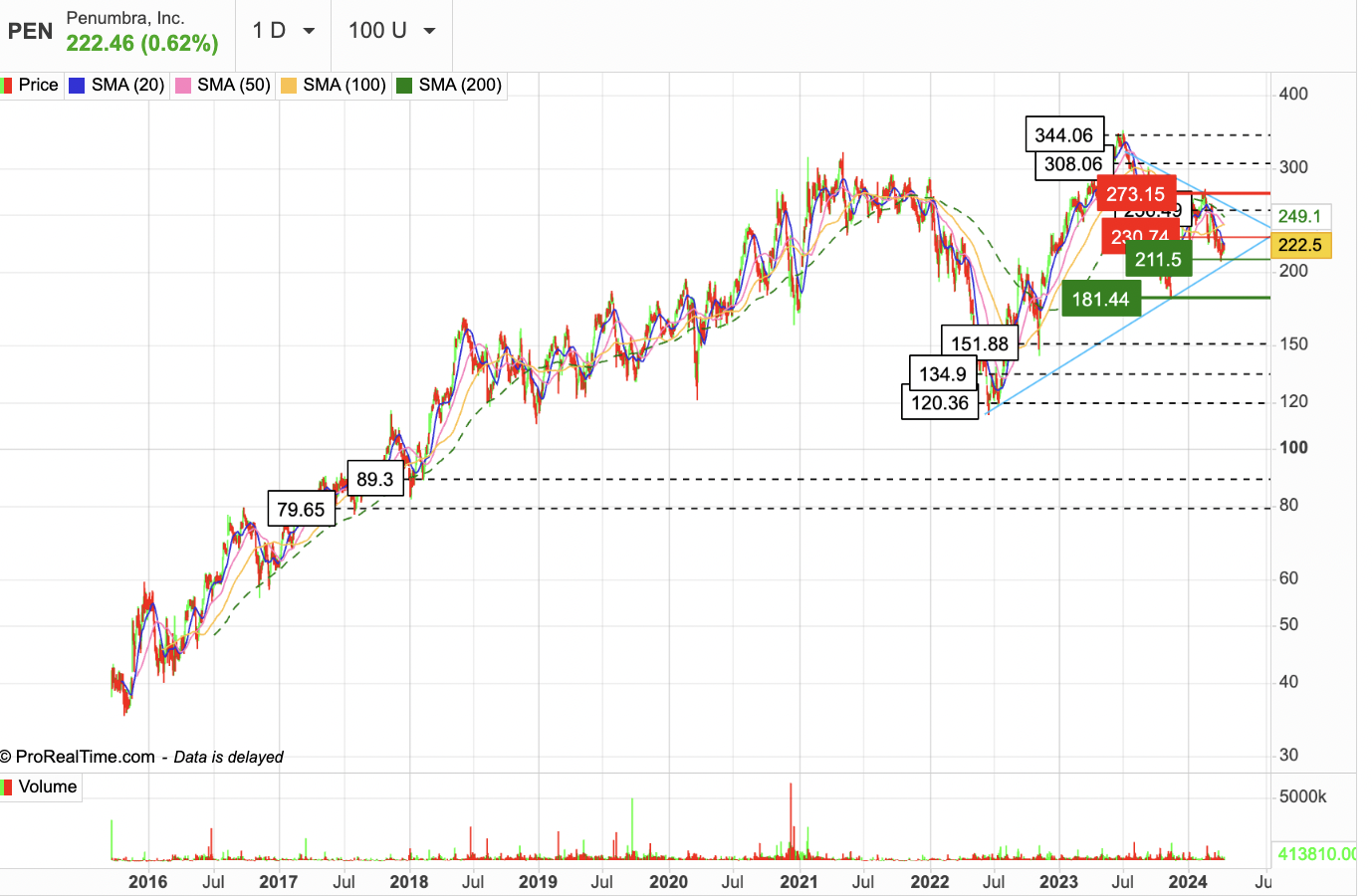

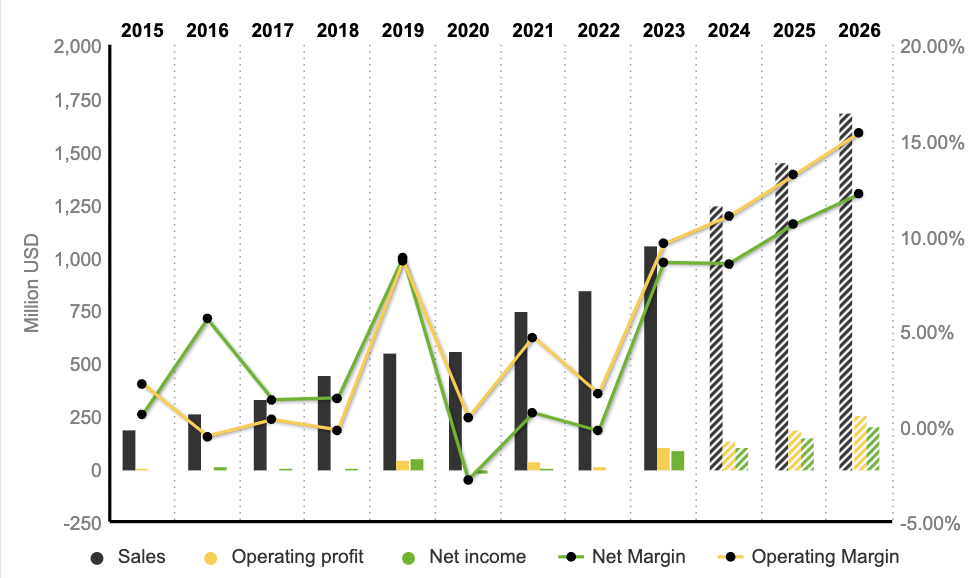

Sales have been made in the United States, Europe, Canada, and Australia, complemented by partnerships with distributors in select international markets. Financially, the company reported growing revenues, reaching $1.058B in 2023, from $847.1M in 2022, and $747.6M in 2021, showing robust annual growth.

The thrombectomy and embolization and access segments were particularly significant, making up 64% and 37% of net sales, with notable increases in their respective sales. Most of the revenue is originated from the US market, which constituted 71.5% and 28.5% for international. Operating income recovered remarkably from a $7.5 million loss in 2021 to $73.6 million in 2023, fueled by direct sales and international partnerships. R&D investments grew to $84.4 million in 2023, accounting 8% of revenue.

Future outlooks are positive, with revenue projected to rise to $1.45B in 2025 and $1.68B in 2026, accompanied by EBITDA expectations of $234M and $297M, respectively. This growth trajectory is supported by anticipated improvements in both operating expected to rise from 9.57% in 2023 to 15.4% by 2026 and net margins, forecasted to improve from 8.59% in 2023 to 12.18% in 2026. It also projects a significant enhancement of the net treasury, targeting an increase from $142M in 2023 to $559M in 2026, along with a projected cash flow of $160M in 2026.

The medical device sector is highly competitive, experiencing swift changes and influenced by new product launches and market actions of participants. The field includes competitors like Boston Scientific, Inari, Medtronic, Stryker, Terumo, and various private entities, many of which have more extensive histories, larger capital, and greater resources for product development and marketing. There's also competition from smaller companies with single or limited product offerings.

The company's positive outlook underscores its strong market positioning and product offerings, with financial forecasts indicating rising sales, increasing net and operating margins, and growing free cash flow. Concurrently, the company continues to invest in R&D to maintain its innovative edge and deliver high-quality products. However, its high valuation (P/E ratio of 108x for 2023 and 80x for 2024) leaves little room for error, and even slight disappointments could impact results. Additionally, intense competition could also affect the company’s future performance.

By

By