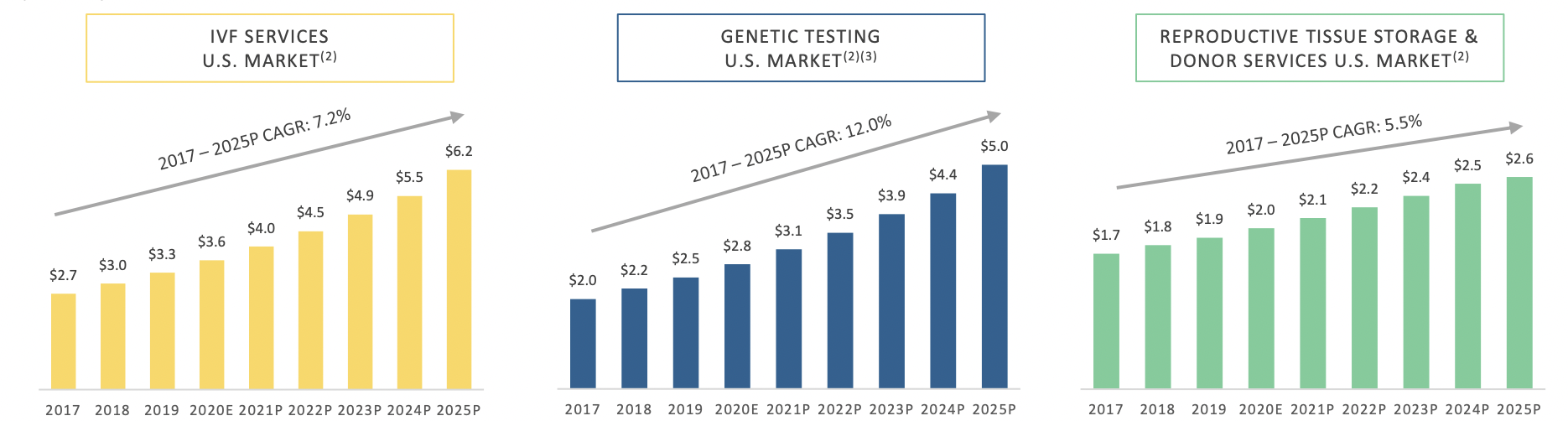

The global fertility services industry is rich in innovation and growth. With a strong demand for services like in-vitro fertilization (IVF), genetic testing, reproductive tissue storage, and donor services, the fertility market is primed for continued expansion. Progyny's approach focuses on personalized benefits plan design, patient education, and active network management, enabling members to access effective treatments from top physicians, leading to optimal outcomes. The company's commitment to member empowerment is evident through their Smart Cycle approach, which streamlines the process and provides dedicated support from Patient Care Advocates. Additionally, Progyny offers an integrated pharmacy benefits solution, Progyny Rx, providing necessary medications and care management services. Progyny's ability to deliver superior clinical outcomes and cost-efficiency has contributed to its growth, with retained clients and high member satisfaction scores.

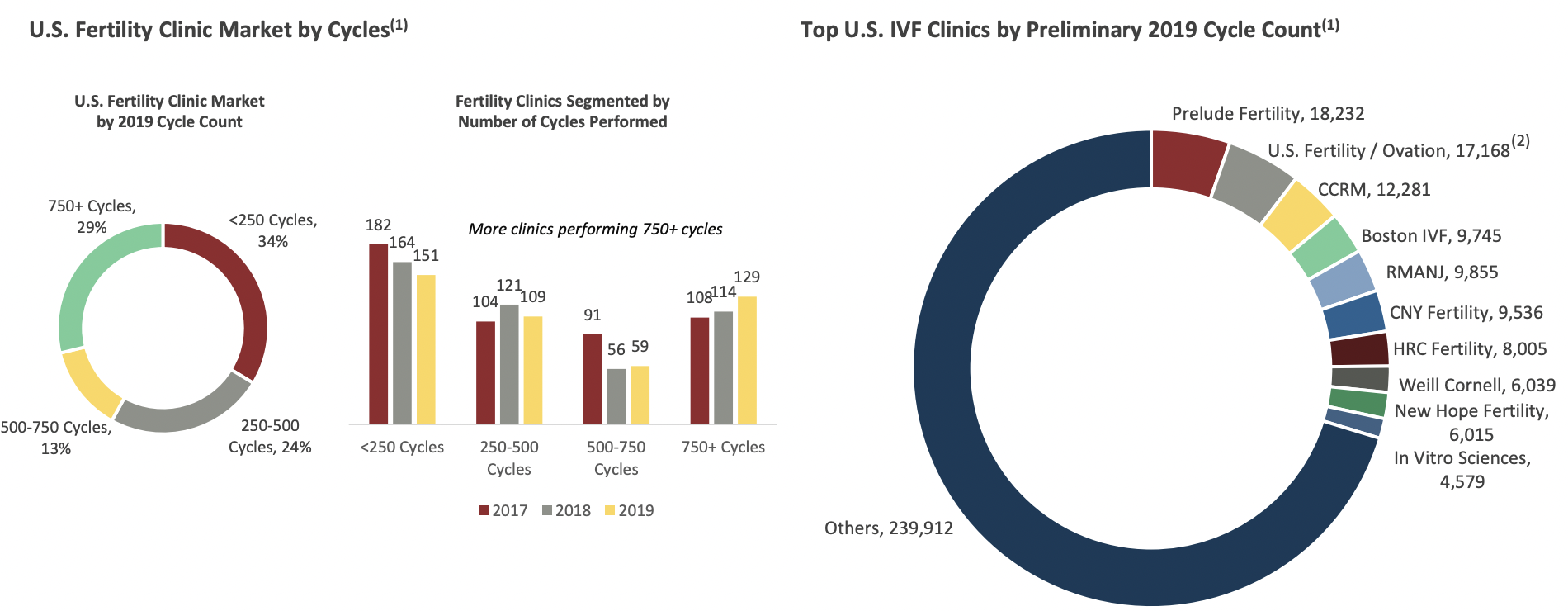

The fertility industry in the United States has experienced notable changes driven by societal shifts and increased awareness of infertility struggles. According to the Centers for Disease Control and Prevention (CDC), approximately one in eight couples in the country face infertility issues. Despite its prevalence, infertility remains inadequately covered by medical insurance, unlike other common medical conditions such as diabetes and asthma. This limited coverage has created a significant gap in fertility services, leaving the majority of patients to cover the high costs of treatments out-of-pocket. The lack of comprehensive coverage is attributed to broader public policy issues and specific policies of health insurance carriers. Cultural changes, including the trend of delayed family planning and the acceptance of non-traditional paths to parenthood, have contributed to the increasing demand for fertility treatments. Employers, in response to employee demands and to maintain competitiveness, have started offering more inclusive fertility benefits plans. This trend has been further fueled by a network effect, where industries adopting these benefits encourage others to follow suit. As a result, the fertility market grew at a compound annual rate of 9.4% from 2010 to 2019, reflecting the rising demand for accessible fertility services in the United States.

In the fertility benefits industry, Progyny faces several challenges reflective of broader industry limitations. Employers, seeking to support their employees' fertility needs, encounter obstacles due to the lack of comprehensive solutions. Existing offerings from conventional health insurance carriers often fall short, featuring restrictive plan designs with lifetime dollar maximums, mandated step therapy protocols, and limited coverage for crucial diagnostics and procedures. These limitations lead to suboptimal clinical decisions by patients, potentially resulting in increased risks and healthcare costs associated with multiple births. Moreover, the emotional and physical complexities of fertility treatments are often overlooked, lacking meaningful care coordination, education, and patient support. The existing pharmacy delivery infrastructure also struggles to meet the unique demands of fertility treatments, causing delays and complications in medication provision. Progyny's approach attempts to address these challenges by providing a more tailored solution, acknowledging the increasing demand for fertility benefits while recognizing the deficiencies in the current market offerings.

Progyny is a leader in comprehensive coverage, including a large and growing network of providers, coordinated member services, data-driven solutions, and pharmacy benefits. They also have to face against major competitors such as UnitedHealth ($500B) or Cigna ($90B)

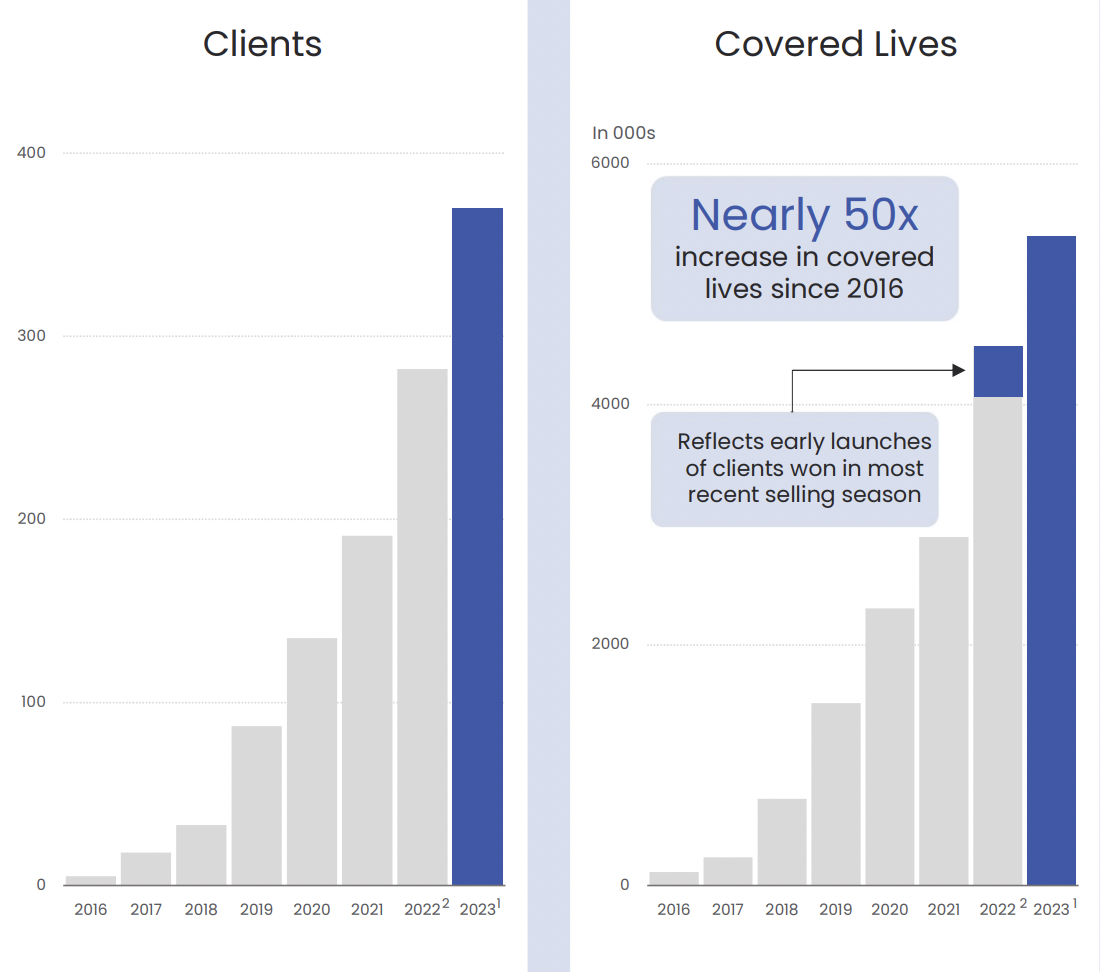

Progyny reported its first healthcare system client four years ago. They have more than 30 healthcare system clients today. The critical measure of Progyny's progress at this stage is its ability to attract clients. The company counts some recognizable brands among its clients.

In 2022, 65% of revenue came from fertility services and 35% from pharmacy benefits. Progyny's potential customer base is vast, with large corporate clients and self-insured health and welfare plans that serve union members. It estimates there are 8,000 US employers with more than 1,000 employees and millions more in the labor population, representing an addressable market of 100 million participants.

The company has developed a multifaceted approach to address challenges within the fertility benefits industry. Their innovative Smart Cycle plan design offers personalized fertility treatment options, moving away from conventional standardized protocols. With 19 different Smart Cycle treatment bundles, members can select treatments aligning with their specific needs, allowing for a more tailored approach. Progyny's focus on high-touch member support includes dedicated Patient Care Advocates (PCAs) and a user-friendly member portal, offering educational resources and emotional support. Additionally, its selective network of 900 fertility specialists ensures access to quality care. Their data-driven strategy allows them to actively manage their network and continuously enhance services. While Progyny offers a surrogacy and adoption reimbursement program, their value proposition lies in providing measurable financial benefits to employers, including savings in upfront fertility treatment costs and improved employee productivity and retention. These initiatives position the company as a comprehensive solution provider within the industry.

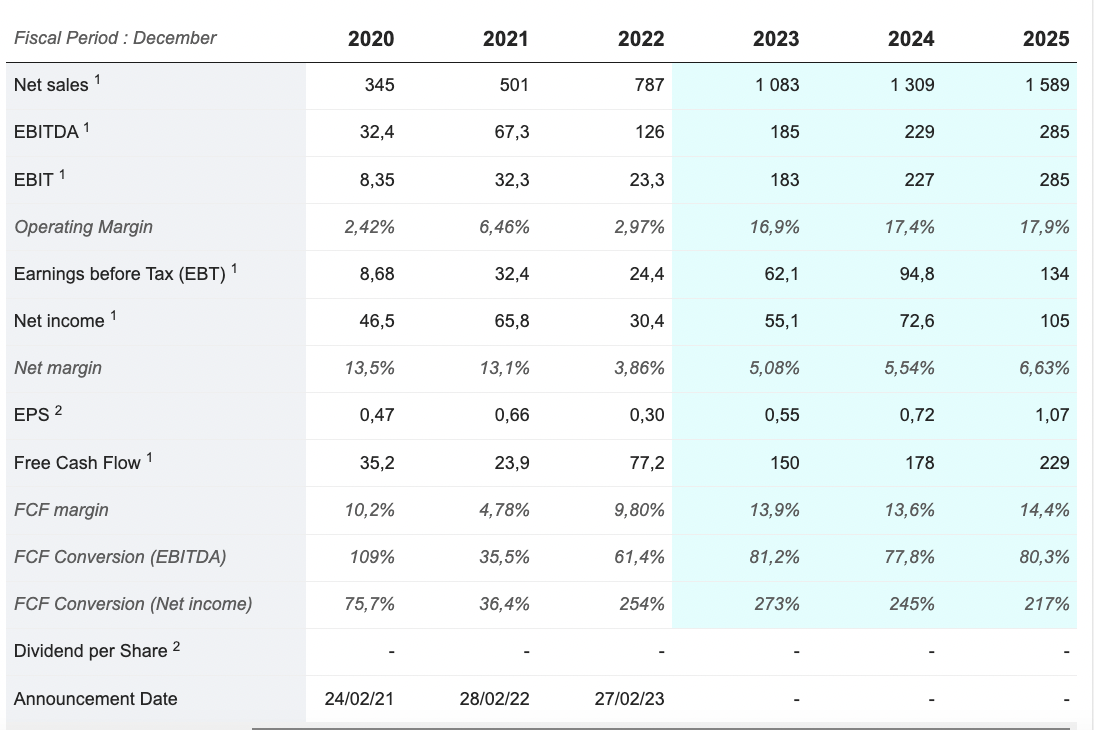

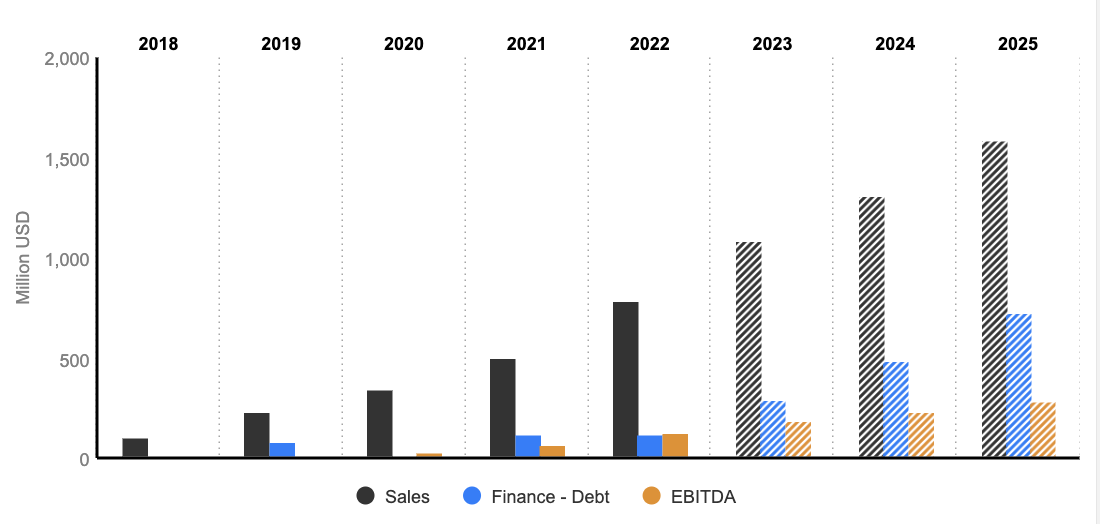

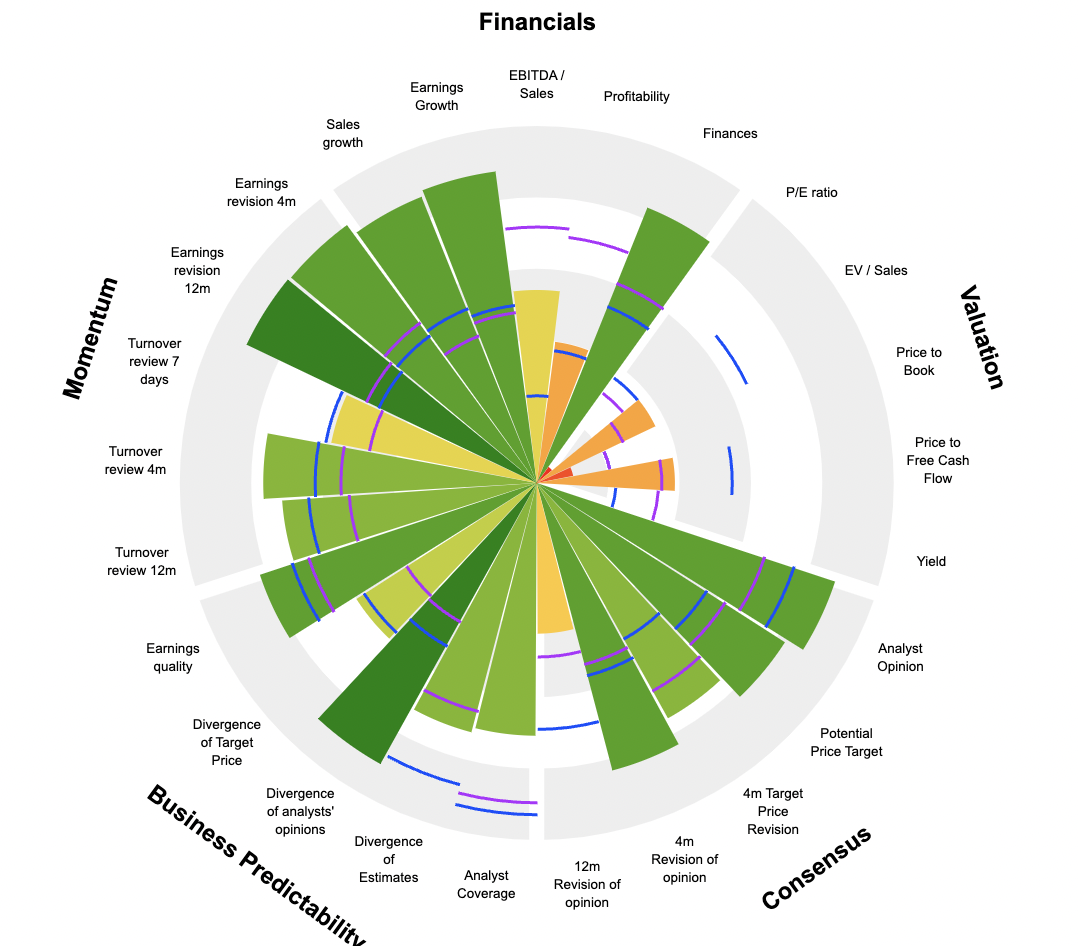

Progyny has experienced remarkable revenue growth in recent years, surging from $230 million in 2019 to an impressive $787 million in 2022, reflecting a 36% compound annual growth rate (CAGR). It reported a substantial 43% year-over-year net sales growth in Q2 2023. Progyny is currently GAAP profitable, and its operating income is showing positive trends after increased expenses affected margins in 2022. The company projects sales to exceed $1 billion in 2023, with expected diluted earnings per share (EPS) around $0.55. What sets it apart is its capital-light business model, freeing up cash flows that aren't tied up in substantial investments in property and equipment, a characteristic uncommon in many other industries.

In 2022, Progyny spent only $3.2 million on CapEx. It anticipates achieving $185 million in adjusted EBITDA in 2023, equivalent to 17% of sales. The majority of this is expected to translate into free cash flow, further strengthening the company's financial position. Progyny boasts a robust balance sheet with $320 million in working capital and no long-term debt, impressive achievements for a company in a growth phase.

It's a problematic stock to value due to its growth and specialization. With a market cap of just $3.2 billion, it has massive potential for gains if it continues to land customers. However, the price-to-earnings (P/E) ratio (104x in 2022) and 60x expected for 2023 is very expensive. The company cannot make mistake at this point.

Profits have the potential to multiply over the next several years. It will be interesting to look, in the coming years, for cash flow, margin expansion, and increasing clients as key performance indicators.

Progyny is an interesting stock in an industry that could see exponential growth due to demographic and social trends. The financial results are compelling, and the company appears well-managed. However, the stock price will be volatile, so interested investors should accumulate shares over time to lessen risk and take advantage of dips.

By

By