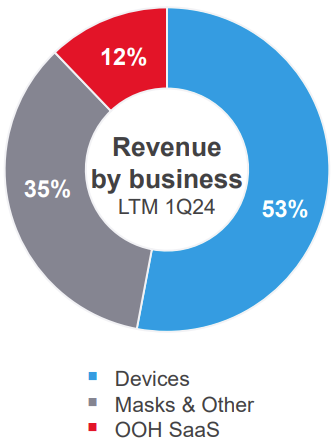

The American company is active in sleep technologies. The company designs and sells devices for people suffering from sleep apnea, bronchopneumopathy - a common lung disease that reduces airflow and creates breathing problems - and other chronic illnesses. The range also includes masks, diagnostic products such as sleep loggers and accessories. Finally, SaaS software products are marketed. These are mainly out-of-hospital products for professionals and caregivers. Examples include Healthcare First, a software solution for electronic retrieval of patient medical records, and MatrixCare Solutions, designed to improve the efficiency of activities in retirement homes.

At the heart of a colossal market

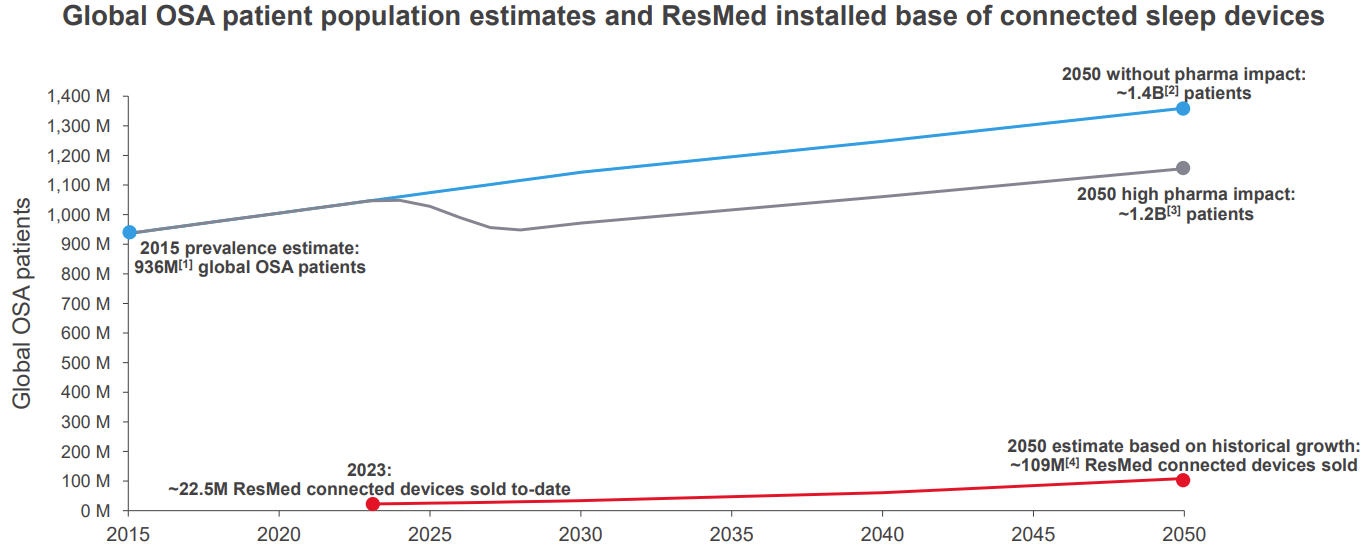

Resmed operates in a huge market. A 2019 Lancet Respiratory Medicine study revealed that worldwide, 936 million people suffer from obstructive sleep apnea, 45% of whom have a moderate to severe form. The problem is made all the more serious by the fact that several studies have revealed a strong correlation between sleep apnea and a number of cardiovascular diseases. The trend towards a better understanding of the role of sleep apnea treatment and respiratory care is growing. Digital technologies, such as Resmed's machines, are invaluable tools for improving patients' quality of life at home, in complete autonomy.

Long-term evolution of the number of patients who may require respiratory equipment (source: ResMed)

A diversified group

Resmed has diversified its activities to broaden its revenue opportunities. As a result, it also targets respiratory pathologies such as asthma, various respiratory syndromes and neuromuscular diseases. The breakthrough in software also enables Resmed to position itself in a market that is still fairly dispersed - no single player really dominates it - but whose needs are growing. The out-of-hospital and homecare environment is still rather neglected in terms of technology.

Respiratory equipment will have to rebuild its image

Resmed is one of the main listed players in this sector. Others include Philips and New Zealand's Fisher & Paykel Healthcare Corporation. Philips of the Netherlands does not look good. The company is facing major controversy after launching a massive recall of its apnea breathing apparatus because of a sound-absorbing foam contained in the devices. The foam is suspected of releasing potentially carcinogenic particles. More than 200 people have lodged complaints. Admittedly, this is good news for competitors, in the sense that if a player's reputation becomes shaky, customers are more likely to switch to other brands. But it can also lead to a general lack of confidence in these solutions on the part of consumers and prescribers. All the more so as Resmed is not without blame. Just recently, Resmed and Dräger - a German manufacturer of medical devices - informed the French Drug Safety Agency of the risk of interference between masks containing magnets and implanted medical devices. Such interference could cause the devices to malfunction. The problem is obviously less dramatic than that of Philips, but the reputational risk is not to be neglected. For the time being, Resmed should be able to gain market share at the expense of its European competitor.

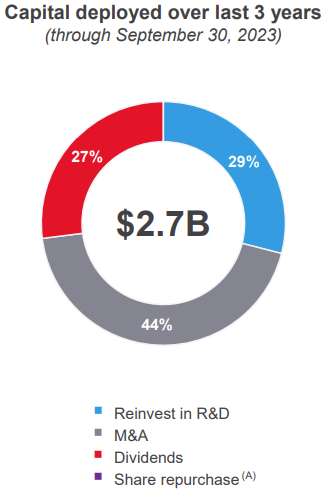

Impressive figures

Resmed is easily one of the world's fastest-growing, high-quality companies. Revenues have increased 3-fold in 10 years. Profitability is high, rapidly approaching 30%. Value creation is on target. Earnings per share are rising steadily, and free cash flow generation is satisfactory. Debt is not a problem, and Resmed has excellent control over its cost structure, despite relatively high R&D costs (7% of sales). Capital is well distributed between reinvestments, acquisitions and returns to shareholders. Last but not least, we appreciate the fact that management holds part of the capital, a sign that the interests of investors and management are aligned.

Nevertheless, the share price has fallen by 45% since its 2021 highs. Valuation ratios are lower than the Group's track record. The PER is less than 25 times this year, compared with an average of 39 times over the last 10 years. Resmed is one of those stocks that saw its share price soar during the Covid. A phase of normalization followed, before the Philips affair cast a pall over the sector. More recently, in August, annual results were slightly below expectations. Nevertheless, the future looks bright. The company should be able to maintain its growth rate of the last decade and improve its margins.

By

By