At a time when manufacturers of exclusively electric vehicles are waging a price war to maintain their market share, Stellantis shares are breaking records, up 10% since the start of the year and 55% over 1 year. How do you explain this performance? Is the Group's strategy bold enough in a fast-changing automotive market?

Strength in numbers

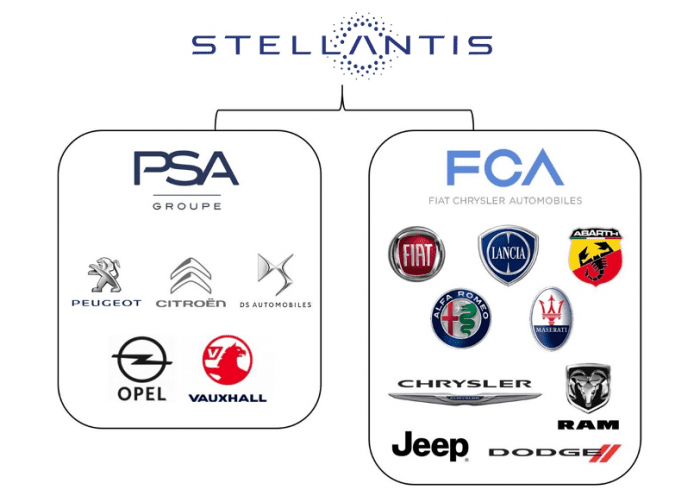

Investing in the automotive sector has never been easy, given the industry's troubled history, with periods of dearth, bankruptcies and takeovers. Stellantis is the culmination of one of the industry's greatest mergers, creating a giant capable of rivaling the likes of Toyota, Volkswagen, Ford, General Motors, Mercedes-Benz and BMW.

In 2020, the objectives of this merger are multiple. On the one hand, economies of scale and costs in a context of health crisis; on the other, the pooling of innovation efforts to make up for the glaring lag of the PSA and FCA Groups in the electric segment, in the face of the devouring appetite of Tesla and Chinese manufacturers.

The PSA - FCA merger gave birth to a giant

Despite sales volumes still marked by the consequences of the health crisis, the merger of the two groups will have enabled FCA to accelerate the implementation of its strategy of transition to electric vehicles, while at the same time turning around its finances.

This transition is reflected in massive investment in electric technologies through the development of motors and batteries, and the adaptation of production resources, as well as a sustained effort on the software dimension of vehicles. By 2023, Stellantis' capital expenditure will have reached 6% of sales, at the top end of the range among historic automakers, approaching Tesla's 9%.

Record performance

The galloping proportion of hybrid and electric cars in global sales may not be unanimously supported by public opinion, but it's good business for the Group. With revenues of MEUR 189,544 in 2023, up 7% year-on-year, and record net income of MEUR 18,625, up 11% for the year. By way of comparison, the combined pre-merger net income of PSA and FCA amounted to MEUR 5.9 billion in 2019.

Over the past 5 years, the growth in sales of hybrid and electric cars, boosted by public subsidies, has greatly contributed to the rise in vehicle prices. Between 2019 and 2023, the average price of a new vehicle rose by 20% in Europe and 36% in the United States. Like Tesla, Stellantis has taken advantage of these price rises to generate record margins. The stock's outperformance on the markets is thus explained, unsurprisingly, by impressive financial publications and renewed investor confidence.

Stellantis' economic performance led to record market results

A cautious, resilient strategy

Stellantis is now facing a number of challenges affecting the entire sector, with declining enthusiasm in the electric vehicle market and the massive arrival of Chinese manufacturers in the market putting pressure on margins.Against this backdrop, the Group can look back on a successful transition to plug-in hybrids that has boosted margins. Like Toyota, Stellantis anticipates a sharp decline in the hybrid market and is embarking on the final phase of its vehicle electrification strategy. As a result, from 2023 onwards, the group will offer 100% electric models, while maintaining a broad range of combustion and hybrid vehicles.

What has long been the mainstay of combustion engine manufacturers is now their greatest strength: diversification. Thanks to the technological catch-up achieved in recent years, they are able to take advantage of electric vehicle sales without depending on the fluctuations of an overheated market heavily dependent on public subsidies.

Tesla' s latest communications confirm Stellantis' position. In the midst of a growth crisis in the electric vehicle market, the share price of Elon Musk's company has plummeted by 35% since the start of the year. The only bright spot in the share price, despite a disappointing publication, was the announcement of a diversification of its range, with more affordable models to effectively resist the pressure of fast-growing Chinese competitors.

Many challenges ahead

The massive arrival of competition is already starting to put pressure on the electric sedan segment. For the time being, the Group's margins and market share remain unaffected, thanks to a range geared towards hybrids and electric city cars. However, we can expect the giant BYD to gain a foothold in Europe in the hybrid SUV market, and Dongfeng or Zhejiang Leapmotor Technology in the city car market.

Chinese competition steps up a gear in the US and European markets

Like Tesla in the high-end electric segment, Stellantis is likely to suffer the repercussions of its heavy reliance on hybrids, with margins expected to fall in this segment over the next few years. In addition, although the widespread use of hybrid technologies on the Group's vehicles is benefiting fully from the slowdown in electric vehicle sales, the Group must not rest on its laurels. It will be necessary to pursue an ambitious strategy towards electric vehicles if we are not to find ourselves once again lagging behind technologically.

Signalling a sector under pressure, the share price has fallen by 15% in 1 month, despite positive indicators for Q1 2024. The markets seem to be awaiting the detailed Q1 publication on April 30, 2024, particularly with regard to margin trends. Investors will also need to be alert to the impact of likely protectionist measures in Europe and North America in the face of the arrival of Chinese competitors.

In addition to the stock's strong performance over the past 3 years, its yield of over 6% makes it difficult to circumvent in a diversified portfolio. Its Europe/America exposure and its industry/technology profile will enable effective diversification and make it a less risky alternative to Tesla, whose P/E is expected to reach 72 in 2024, i.e. 17x that of Stellantis.

By

By