SES-imagotag, with a market capitalization of €2.6 billion, is part of the French SBF120 index. This French success story has established itself as a global leader in the electronic labels and retail management systems market. Its share price has more than quintupled in five years. Highly valued by investors and managers alike, the company's valuation is high, at 54 times this year's expected profits. Qualcomm and Walmart are among the shareholders in the company. The U.S. retail giant recently signed a significant agreement with the French company, which included a stake in the round table.

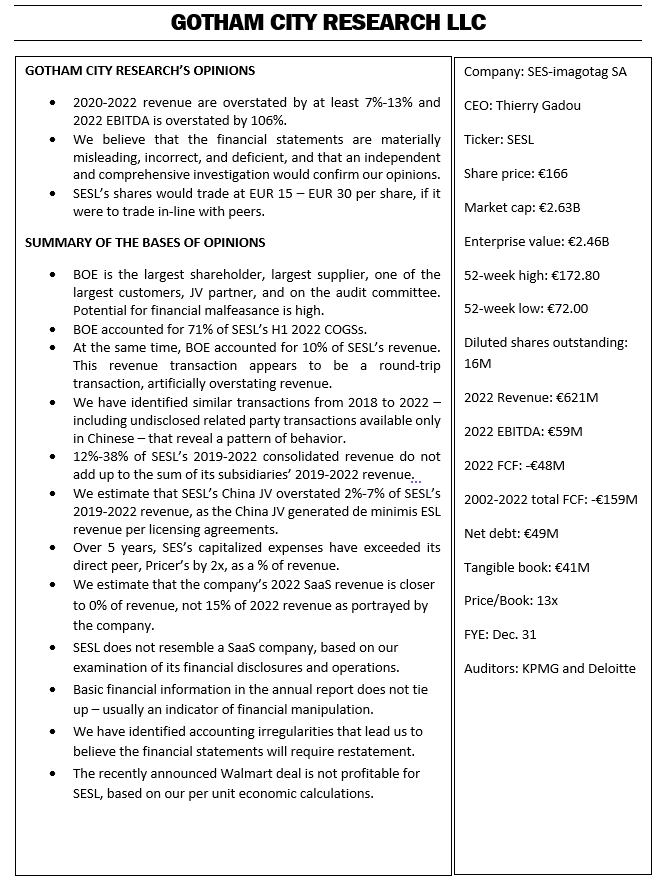

A fifty-page document, of which we have a copy, was circulated by Gotham City Research on its website. It was later relayed on Twitter.

The principle of short selling is to take a short position in a company by borrowing shares to sell on the market before deThe short seller wants to see the company's reputation circulate in the media. The short-seller wants his report, and therefore his opinion, to circulate as widely as possible, so as to impact the market downwards and buy back his position at a much lower price. We all remember the Solutions 30 affair and the famous anonymous report, followed by a full-scale attack by Carson Block's Muddy Waters fund. If the allegations are false, then it's an offence of price manipulation. Recognized short sellers are therefore generally more than convinced; they have information and investigative teams at their disposal.

The relationship with BOE Technology in the spotlight

This document focuses in particular on accounting irregularities and links with the Chinese company that holds 32% of SES-imagotag's capital, BOE Technology. The report does not call into question the very existence of the company or its activity. It attacks accounting irregularities deemed extremely serious and suggests incestuous relations over several years with its main shareholder and customer, BOE Technology.

The auditor is KPMG. Gotham City Research values SES-imagotag at between EUR 15 and EUR 30, while the share price is currently EUR 166.80.

As is often the case in such situations, the stock will come under severe attack and the company will have to enter into crisis communications.

By

By