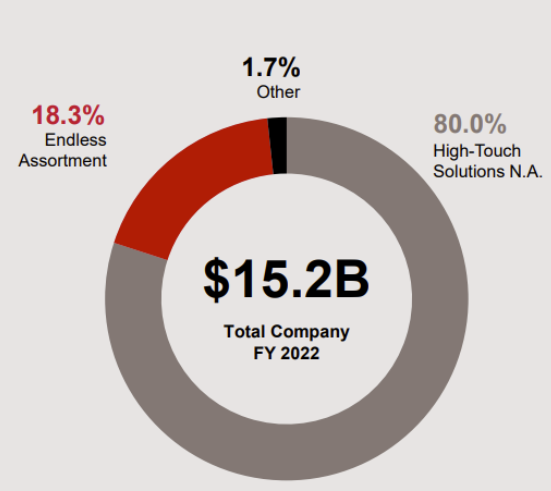

Grainger sells every conceivable product needed for MRO (maintenance, repair and operations) through two main segments. The first, High-Touch Solutions, is the Group's driving force, accounting for 80% of sales and 89% of EBIT. The second, Endless Assortment, is smaller (18.3% of sales) and less profitable (10.5% of EBIT).

The geographical breakdown is quite clear: the United States accounts for 80.9% of sales, ahead of Japan with 11.3%. The Group is also present in other countries, mainly Canada and the UK.

The Amazon of MRO

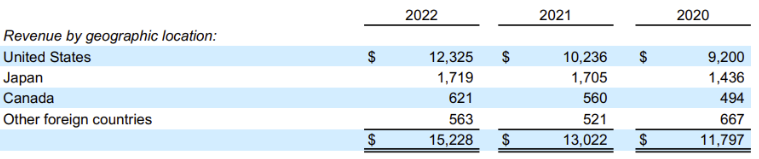

The High-Touch Solutions segment corresponds to the parent brand, Grainger. Behind this highly marketing name lies a range of products and services for businesses and organizations of a certain size. The group is the leader in North America, with 7% of a market worth $165 billion.

Grainger has capitalized on its ability to offer an inventory management solution with a range of over 30 million products distributed via its network of 35 distribution centers. In a way, it is the Amazon of MRO, with 75% of its sales generated through its digital channels: website (36%), BtoB software (21%), and KeepStock (18%), Grainger's own software.

This has enabled the distributor to drastically reduce the number of its branches (-40% from peak). In fact, they now account for just 8% of orders.

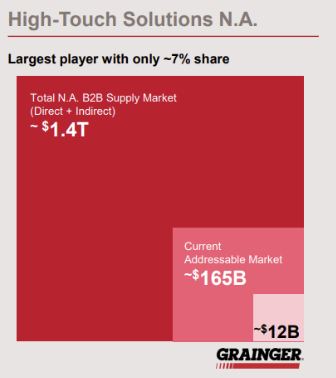

The other division, Endless Assortment, combines its subsidiary Zoro and the Japanese company MonotaRO, acquired in 2009 for 50.5%. The offering is similar to that of the parent company, except that it is 100% digital and geared towards smaller customers who do not require as complex a transaction follow-up as others.

Other activities mainly include revenues from Cromwell in the UK, acquired in 2015 for $482 million, and an insurance captive.

On the other hand, the group has also experienced setbacks. In 2020, Grainger divested itself of Fabory Group, acquired nine years earlier with a view to European expansion. In the end, it never quite caught on.

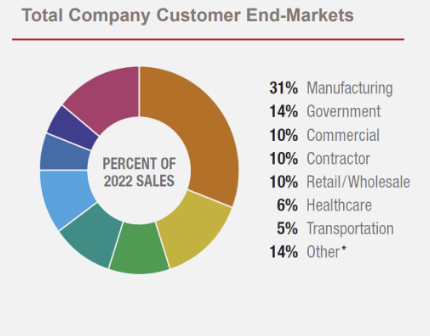

As the breakdown of the company's customer base illustrates, Grainger's main focus is on industry, local authorities, the service sector, construction and distribution.

W.W. Grainger customers are diverse

A necessary transformation

W.W. Grainger generated sales of $15.3 billion in 2022. Average annual growth has reached 9.9% over the last three years. Operating margin remained under pressure between 2014 and 2021. This is due to exacerbated competition, which has had a deflationary effect on prices. Competition fanned by the growth of online sales, which rose from 35% in 2010 to 65% in 2017. We've had to adapt: digitization, margin adjustments, automation of distribution centers, and so on.

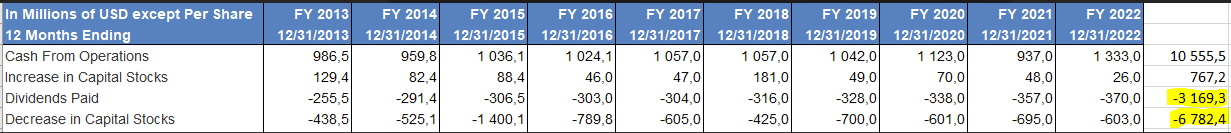

These measures have paid off: the CAPEX/sales ratio has fallen from 3.9% in 2014 to 1.7% in 2022. In the same year, Grainger achieved an operating margin of 14.4%, its highest level for 10 years.

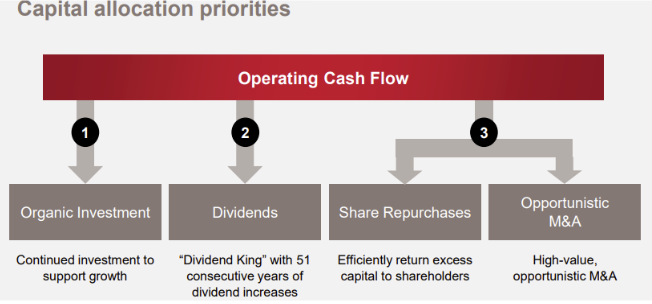

Despite the challenges of the digital transition and lean times, Grainger has managed to maintain consistent dividend growth for 51 consecutive years. In 2022, the distributor paid out a total of $949 million to its shareholders through dividends and share buybacks. What's more, its earnings per share (EPS) have grown at an average annual rate of 19.7% over the past three years, twice as fast as its sales. This is further proof of the company's successful transformation.

As "Dividend King", Grainger is aware that the absence of an annual dividend increase could lead to a deterioration in its share price.

Its long-term debt in 2023 amounts to $2.3 billion, spread out to 2046, which is equivalent to its shareholders' equity. Although the ratio remains higher than the average for its sector, this does not seem to presage any major difficulties for the company.

In order to attract the interest of investors, Grainger uses 87.1% of its operating cash flow to finance dividends and share buy-backs. This strategy is the norm for a mature company (see company life cycle) whose average annual real sales growth is between 4% and 5%.

Overall, W.W. Grainger remains the leader in North American retailing. Faced with the rise of Amazon Business and e-commerce, the group has successfully readjusted its strategy. The brand takes advantage of its strong reputation in the industrial landscape to maintain solid links with its customers and continue to offer growing returns to its shareholders.

By

By