For over 40 years, Agilysys has stood as a prominent force in the realm of hospitality software, delivering both cloud-native SaaS and on-premise solutions across a diverse array of sectors. Catering to hotels, resorts, cruise lines, casinos, foodservice management, restaurants, universities, stadiums, and healthcare, Agilysys has cultivated a comprehensive software suite encompassing point-of-sale, property management, inventory, procurement, payments, and related applications. Known for their customer-centric approach, Agilysys focus on enriching guest experiences, drive revenue growth, and enhance operational efficiency.

Within their specialized focus on the hospitality industry, Agilysys provides tailored solutions, such as Agilysys InfoGenesis point-of-sale (POS) system (known for its system's ability to manage high-volume transactions) and rGuest property management solution. The seamless integration of these solutions creates a powerful and cohesive ecosystem, making Agilysys a strategic partner for businesses aiming to optimize their operations and provide a superior hospitality experience. User feedback highlights an intuitive interface for quick onboarding. However, concerns include higher pricing, less responsive customer support, and limited customization compared to alternatives like Micros.

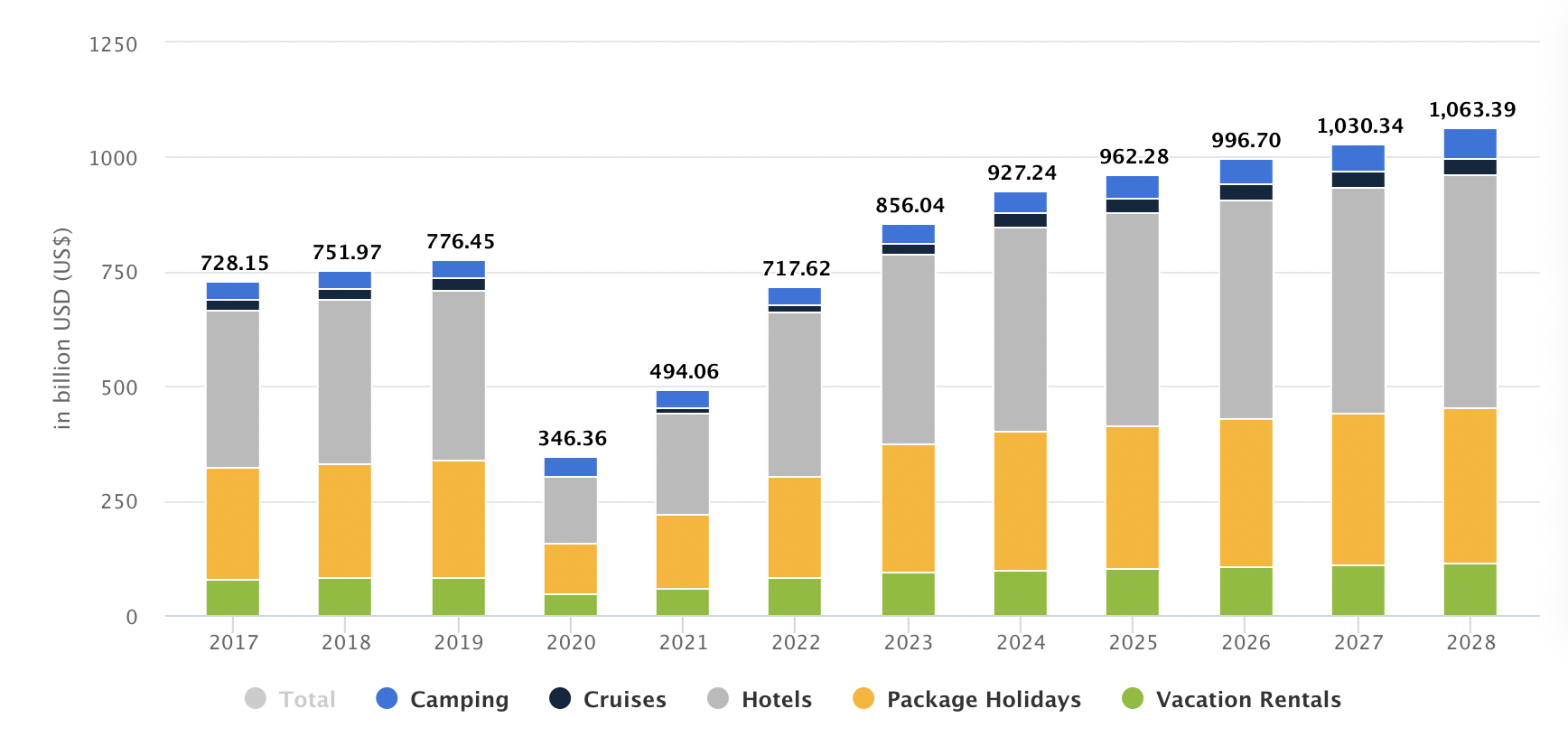

Projected at a CAGR of 4.42%, Travel and Tourism Revenue is expected to reach ~$1.063 trillion by 2028, with the hotel segment estimated at $410 billion. Online sales are anticipated to constitute 74% of hotel revenue by 2027, emphasizing the need for software solutions, like those offered by the group, to enhance sales management and customer experiences while reducing operating costs through automation.

Smart hospitality, encompassing operation management, automation, guest service, and security systems, anticipates a 22% CAGR from 2021 to 2031, aligning with the digitalization trend. Agilysys's provision of hospitality solutions positions it well for future growth amid this industry shift.

Post-pandemic, the phenomenon of "revenge travel" fueled tourism growth, but the current challenges lie in inflation and rising travel costs, posing obstacles to sustained market expansion.

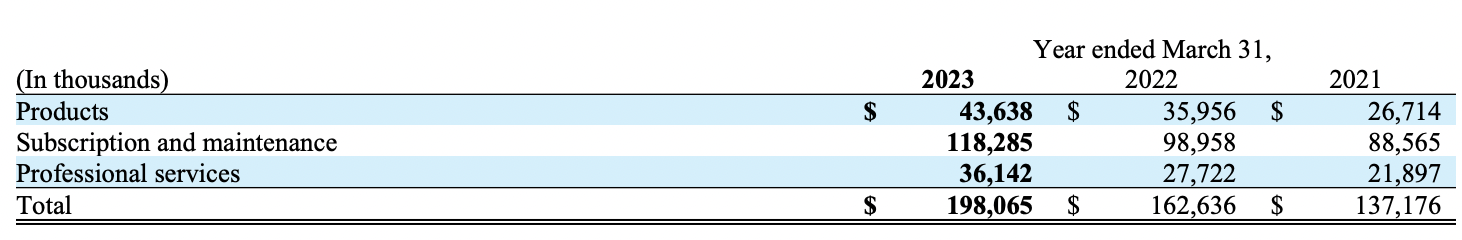

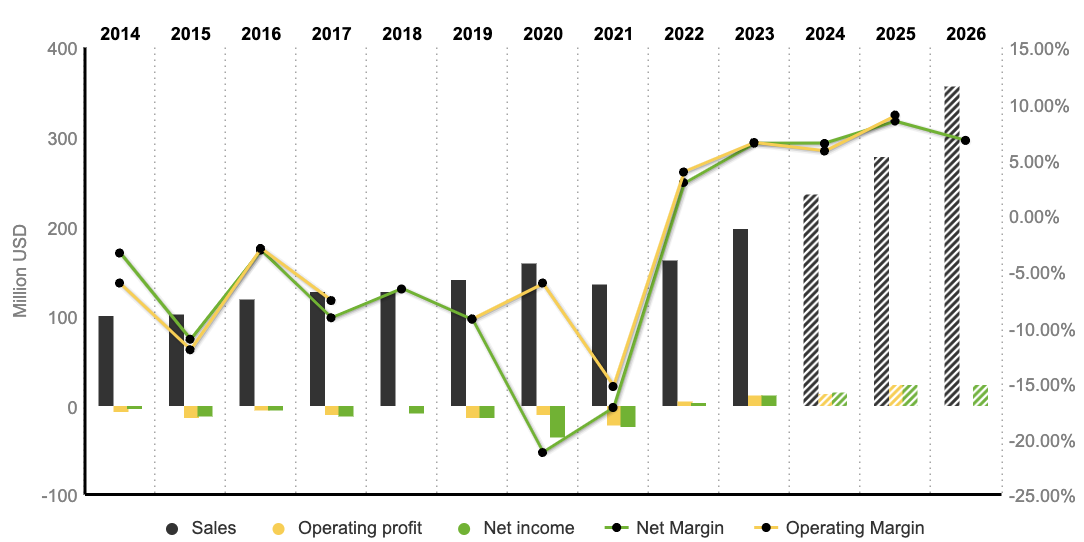

Agilysys has shown strong financial results, overcoming a brief setback in 2021 due to the pandemic. The company's revenue climbed from $137 million in 2021 to $198 million in 2023, and is anticipated to reach $237 million in 2024 and $359 million in 2026. Recurring revenue constitutes 59% of total revenue, with subscription and service revenues making up 52% and 19%, respectively. Notably, subscription revenue has experienced a 27% YoY growth.

The Group's revenues are divided into 3 categories: Products; Subscription and maintenance; Professional services:

- Products: Agilysys earns from software sales and third-party hardware, driven by adaptability and third-party integrations.

- Subscription and Maintenance: This revenue segment, a significant part for the business, comes from end-to-end solutions and market demand for innovative products.

- Professional Services: The group is specialize in designing and implementing customized solutions for traditional and emerging platforms, supporting start-ups and large-scale rollouts.

Notably, the net margin improved from a negative 17.21% in 2021 to a positive 6.44% in 2023, while operating margins displayed positive development, rising from negative 6.14% in 2020 to a positive 6.5% in 2023, driven by strategic expense management.

EBITDA and EBIT are expected to follow a similar upward trend as sales, projected to increase by 11% and 116%, respectively, over the 2022-2023 period. Its commitment to maintaining consistent SG&A and R&D expenditures relative to total revenue facilitated innovation without compromising margins. The recent 2Q24 financial results highlighted the company's strength, with a commendable 22% YoY growth in total revenue and an 18% YoY increase in recurring revenue.

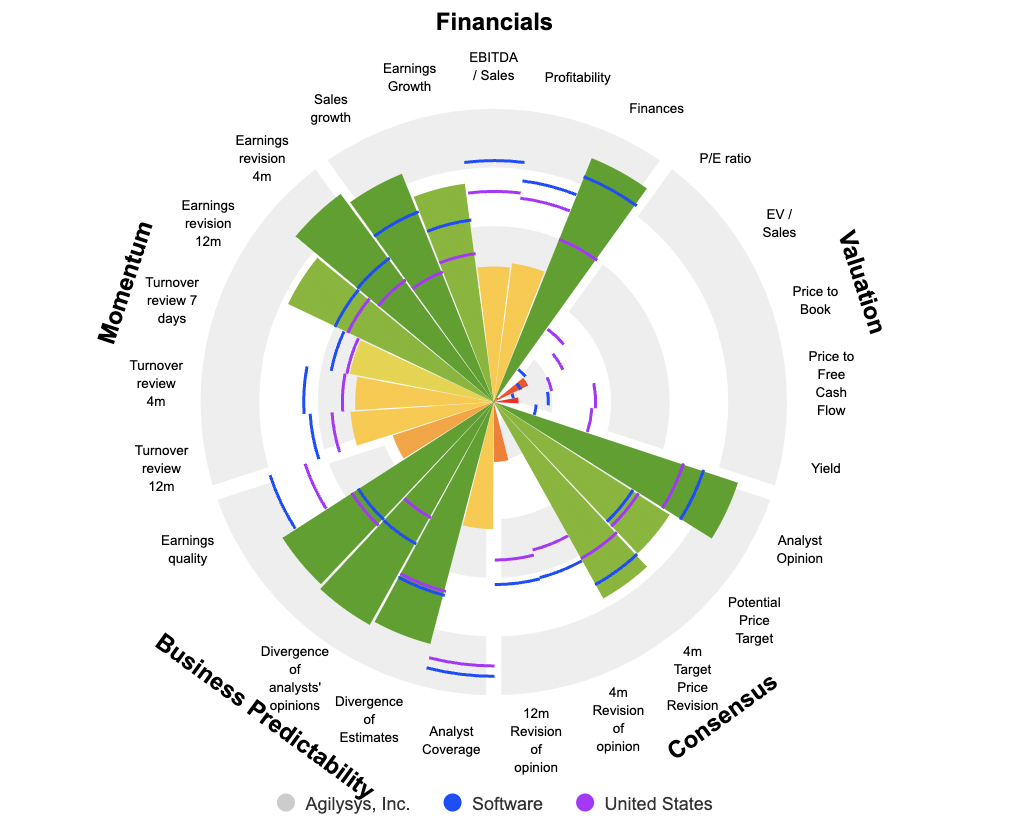

While Agilysys has maintained a super high valuation since 2022, with a PER of 222x in 2022 and 168x in 2023, reflecting substantial investor expectations, a potential underperformance in results may lead to a significant share price decline. The Group's stable FCF at $27 million for three years is expected to reach $41 million in 2025, with net cash increasing by 16.5% YoY to $113 million.

The group boasts a diverse clientele across various industries, including Gaming, Managed Foodservice, Hotels, Resorts, and Cruise. Notable clients include Ceasars Entertainment, Mariott, Royal Caribbean Group, and Hilton. Furthermore, the group expanded its portfolio by securing a contract with Black Rock Oceanfront Resort in the summer of 2023, enhancing revenue streams and enabling a more personalized guest experience.

Agilysys is marked by solid fundamentals and a positive financial outlook; however, it operates in a highly competitive industry, making it imperative to tread cautiously. The current valuation leaves little room for unfavorable results. In this challenging landscape, Agilysys could capitalize on its position as a Software as a Service (SaaS) provider to organically grow its client base and, consequently, enhance its revenue streams.

By

By