Founded in 1915 as Domestic Electric, Ametek has evolved from its roots in electrical motor components to become a global leader in electronic instruments and electromechanical devices. Listed on the NYSE in 1930 as American Machine and Metals, it underwent several transformations, including a name change to Ametek in 1961. Through strategic acquisitions and technological innovations, the company expanded its portfolio and global footprint, now encompassing 40 businesses across 30 countries thanks to the development of pioneering products, positioning it today as a powerhouse in its niche markets.

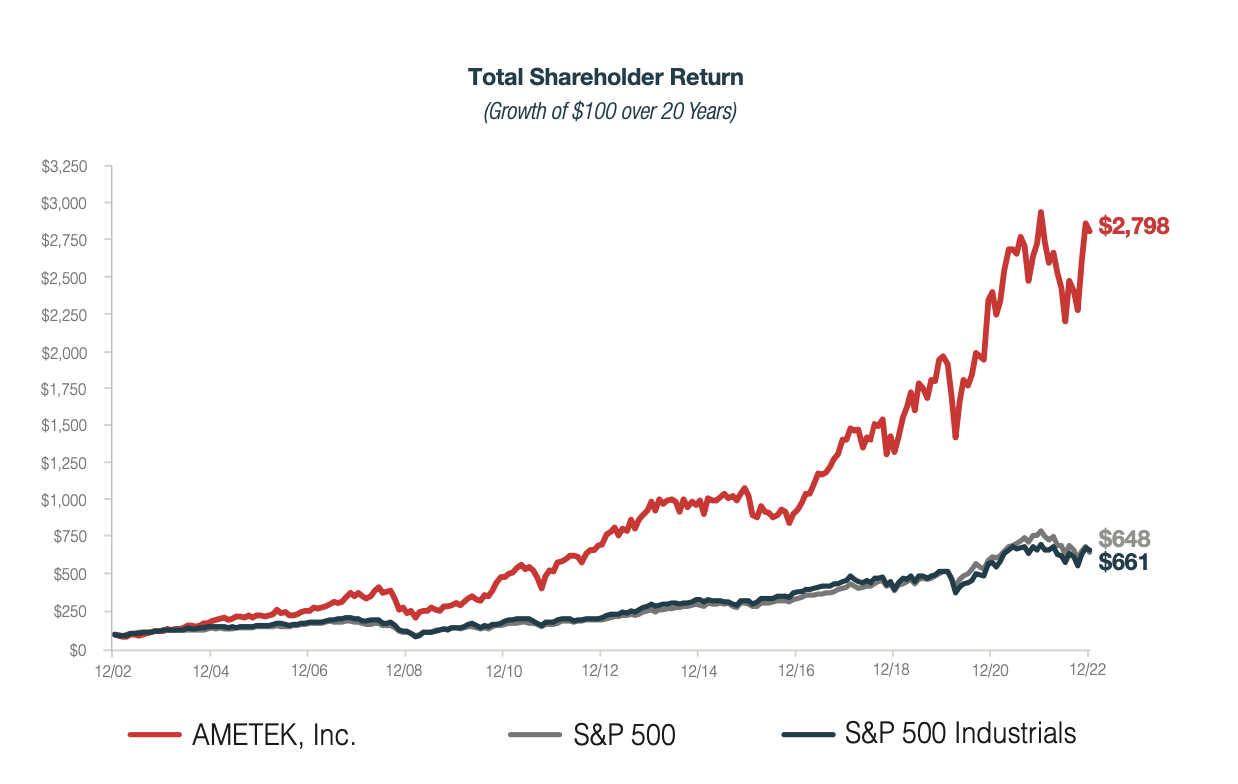

The stock's performance is noteworthy, boasting a Compound Annual Growth Rate (CAGR) of 18.12%, which highlights its exceptional performance in outpacing the S&P 500.

Ametek organizes its operations into two primary divisions: Electronic Instruments Group (EIG), which contributes 69% of revenue ($4,229 billion), and Electromechanical Group (EMG), accounting for 31% ($1,921 billion) while achieving a remarkable operating margin of 26%. This distribution has shifted from a more even split a decade ago. Within these divisions, there are four key segments:

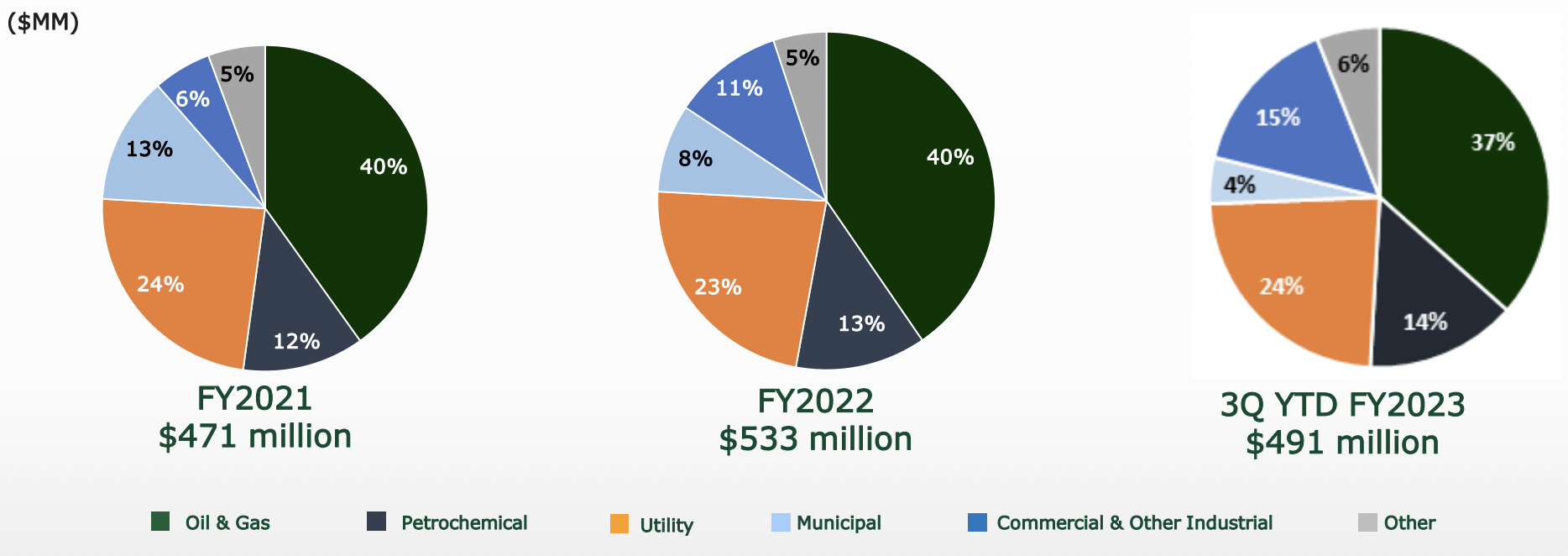

- Process Segment: This is the largest part of EIG, representing 72% of EIG's revenue and half of the company's total revenue. It includes devices for testing and measurement used in sectors like life sciences, power generation, technology manufacturing, and the oil & gas industry.

- Power and Aerospace Segment: Making up 28% of EIG and 19% of total revenue, this segment provides systems, sensors, and instruments for aerospace, power, and industrial markets.

- Automation & Engineered Solutions Segment: This is the major component of EMG, constituting 71% of EMG's revenue and 22% of total revenue. It encompasses motion control systems, motors, heat exchangers, and pumps for technology, industrial, and life sciences sectors.

- Aerospace Segment within EMG: Accounts for 29% of EMG and 9% of total revenues, offering thermal management and MRO (Maintenance, Repair, and Overhaul) services to the commercial aerospace and defense industries.

In addition to these segments, the company periodically discloses end market verticals, such as Healthcare (approximately 15% of revenue), Aerospace (also around 15%, with sub-categories including defense, commercial OEM, business jet, and MRO), Energy (5%, reduced from 10% a decade ago), and Automation (which has grown from 7% to 12%).

Ametek's evolution over the years has seen a shift towards businesses with significant product and technology differentiation, leading to more opportunities for growth, especially in Automation, Aerospace, and Healthcare sectors.

Its revenue showcases notable geographic diversity, with around half of its sales coming from outside the United States. Specifically, North America accounted for $3.2 billion in sales, Europe added $1.4 billion, and Asia along with the rest of the world combined contributed $1.6 billion. Further emphasizing its commitment to global expansion and enhancing service capabilities, it recently inaugurated a new Technology Solution Center in Asia.

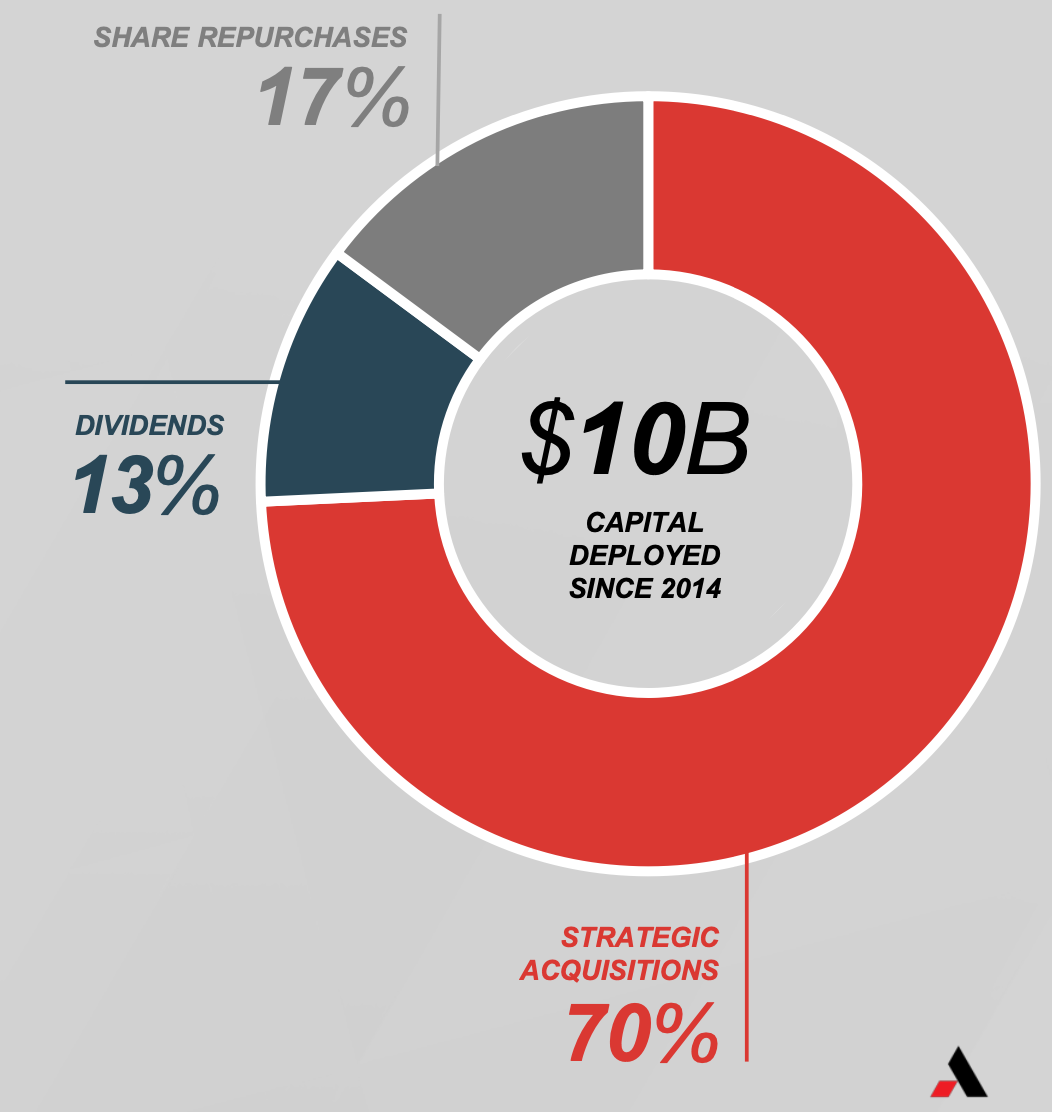

It becomes evident that from 2014 onwards, it has allocated $10 billion in capital expenditures. A significant portion, 70%, was channeled into strategic acquisitions to bolster its market position, while 13% and 17% of this capital were respectively dedicated to rewarding shareholders through dividends and share repurchases. These dividends saw a notable rise from $0.24 in 2013 to $0.88 (CAGR of 13.87%) in 2022, with forecasts suggesting an increase to $1 in 2023 and further to $1.07 in 2024, underlining the company's robust financial health and commitment to shareholder value.

The acquisitions strategically target oligopolistic markets where they swiftly gain up to a 30% market share. Ametek's approach focuses on optimizing cost structures to boost margins within a three-year timeframe, subsequently reinvesting capital to fuel growth through innovation and new product launches. These acquisitions often complement and strengthen existing business units.

Since 2014, the company has completed 36 acquisitions, deploying $6.9 billion in capital. Recent notable acquisitions include Navitar, a specialist in optical solutions for critical applications; RTDS Technologies, a leader in real-time digital simulation systems; Bison, which offers customized linear motion control solutions; United Electric Industries, known for its data acquisition application products; and AR, recognized for control software and EMC testing services.

Most recently, Ametek announced its acquisition of Paragon Medical, a leading provider of highly engineered medical devices, components, and instruments, marking a significant expansion into the MedTech space. Paragon Medical boasts annual sales of approximately $500 million, with the acquisition valued at $1.9 billion.

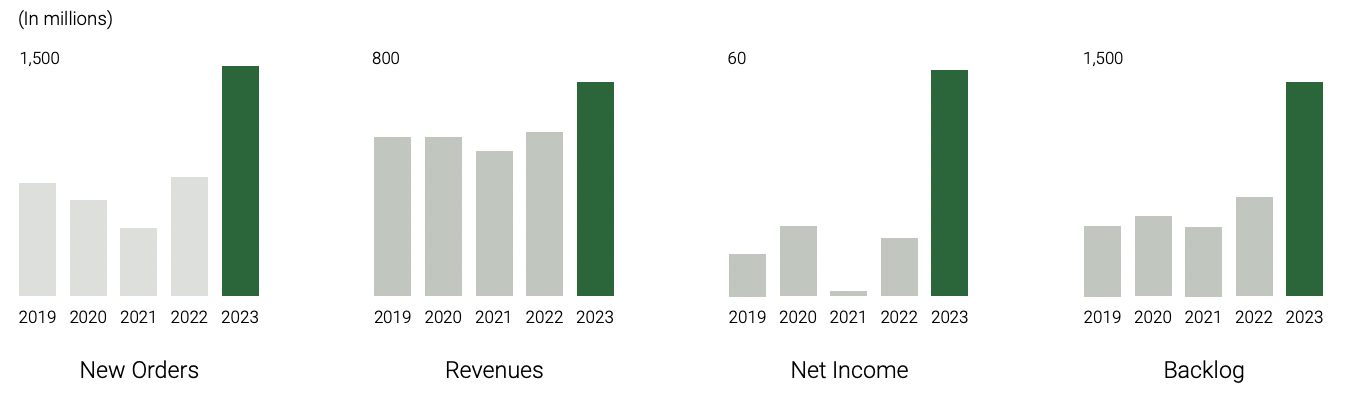

The group stands poised for future growth, bolstered by its robust balance sheet and strong cash-flow generation. Its annual acquisition strategy has proven effective, though only time will tell if it can continue to execute successful operations over the next decade. Additionally, its well-diversified portfolio offers a measure of stability to its stock, underlining its solid market positioning.

By

By