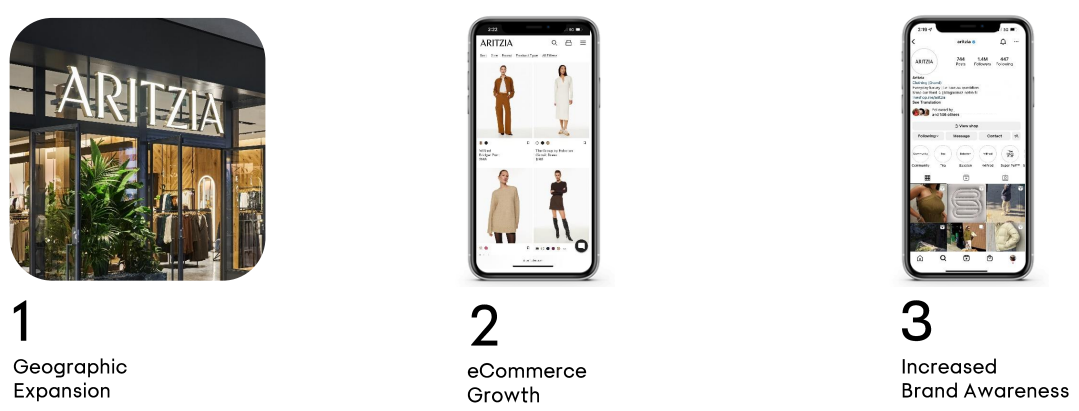

How did a fashion company with no particular visual identity - such as Nike's comma or Gucci's highly recognizable style - manage to establish itself so quickly in a highly competitive market? The answer is undoubtedly to be found in a strategy based on three pillars.

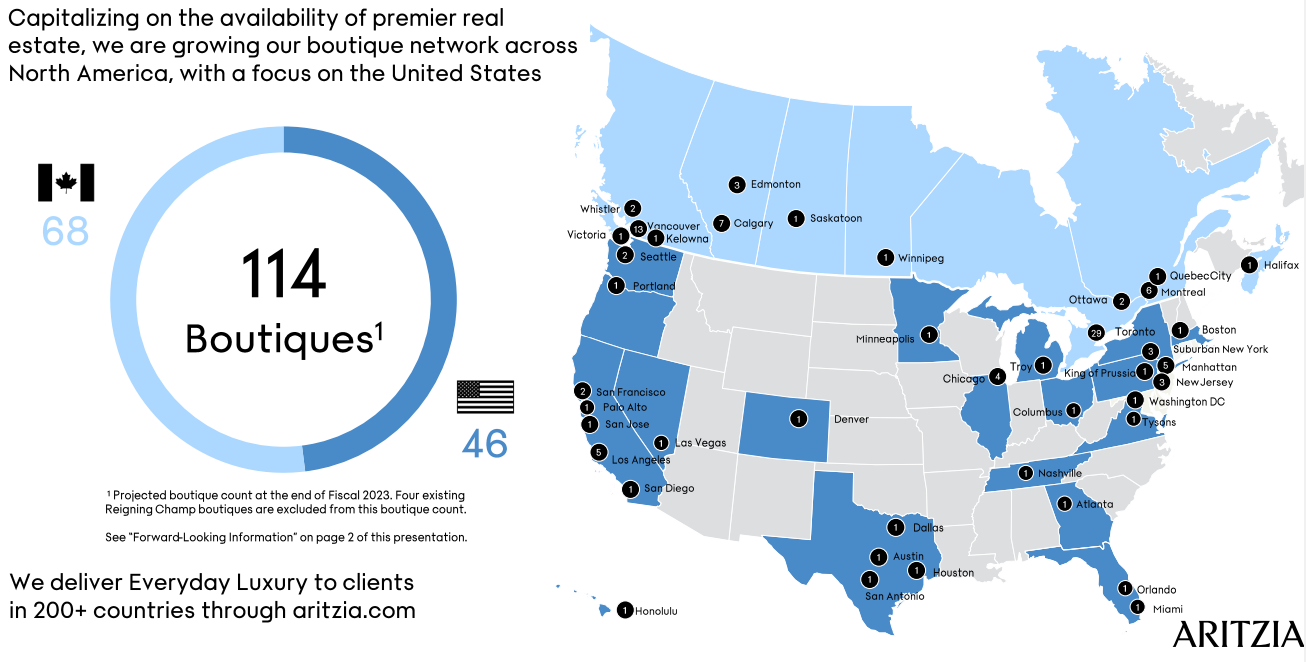

First, Aritzia has a network of 114 stores, including 68 in Canada - 13 in Vancouver, where the first store was opened - and 46 in the United States. There, the company sells mostly house brands like Wilfred, Le Fou or Babaton. In 2014, the company launched its own handbag lines with Six Eleven and Auxiliary. Aritzia also sells clothing from brands such as Levi's, New Balance or Adidas. The boutiques are at the heart of the company's strategy: a breathtaking luxury offering the customer the feeling of being in the heart of a big show or in a boutique of a prestigious brand.

Luxurious boutiques: this one in Markville, near Toronto

Source: Aritzia

The company has plans to accelerate its growth with eight new stores - seven of them in the U.S. - scheduled to open in 2023 and five expansions of existing stores.

The extensive network of stores across North America

Source: Aritzia

The second success factor is online commerce. Beyond the obvious aspect that any retail company today must be exposed to online commerce to evolve, Aritzia shows impressive growth rates on this specificity. Online sales represented 36% annualized growth between 2016 and 2020, then 88% between 2020 and 2021 - pandemic effect - before normalizing last year with a 33% growth. Today, they represent 38% of total sales.

The company's brand image is the third pillar of this strategy. The group has relied in particular on social networks to make itself known and attract the public. The luxury brand has over 1.4 million followers on the social network Instagram. The quality of the stores and the website has also greatly helped the company to become a reference player of "everyday luxury" on the North American continent.

The success of the strategy

Source : Aritzia

So far the strategy has worked as the company has a very strong income statement and balance sheet. Listed since the end of 2016, Aritzia has seen its revenue grow from 667M Canadian dollars (CAD) to CAD 1.5B over the period from 2017 to 2022. For the fiscal year ending 2023, - a lagged year - sales are even expected to exceed CAD 2.1 billion, as the group has posted better-than-expected results for the first three quarters.

Another element to Aritzia's advantage: its free cash flow generation. They have been very clearly positive since 2017 and amounted to CAD 271m in 2022, representing a free cash flow margin of 18.2%. This record year is an exceptional one and 2023 should mark a phase of normalization.

However, if we exclude the year 2021 - a Covid year that in reality corresponds to 2020 because the year is offset in accounting terms - the margins are up quite impressively. The net margin rose from 7.7% in 2018 to 10.5% in 2022. This is high for the sector. As for Covid, a difficult year for the entire market, it nevertheless ended with a profit of CAD 19.2 million, a net margin of 2.2% and CAD 83.7 million in free cash flow.

With no debt and a positive cash flow of CAD 265 million, the company has the resources to pursue external growth operations, as it did in 2021 with the acquisition of the Canadian brand Reigning. The company has the resources for external growth, as it did in 2021 with the acquisition of the Canadian brand Reigning Champ for $63 million, enabling it to gain a foothold in men's clothing (prior to this acquisition, the company was only active in the women's fashion market).

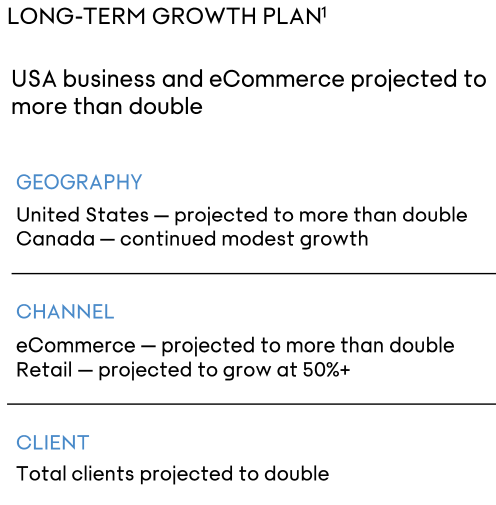

The continuation of the strategy described above can therefore be carried out under good conditions. By 2027, Aritzia expects to achieve between $3.5 and $3.8 billion in sales, representing an annual growth rate - CAGR - of 15% to 17%. To achieve this, store openings should continue to increase with the number of stores in the United States expected to be the same as those in Canada (the company has already identified more than 100 locations in the United States that match the brand's location criteria). This investment item should represent the vast majority of the cash generated by the business, with the rest dedicated to returning to shareholders. The company is also betting big on online sales: they should represent more than double the "retail" sales in physical stores. Finally, the number of customers should double.

An ambitious strategic plan to 2027

Source: Aritzia

At the current price, the stock is paying 26.3 times its 2023 net profits and 20.4 times its 2024 net profits, compared to an average since its listing of 28.5 times (excluding 2021). Since its introduction, the company has had a good stock market performance as the stock has more than doubled, following the growth trajectory of its results.

Aritzia is a high quality company that has grown under Brian Hill's leadership from a small Vancouver store to a group that has a presence throughout North America and sells its products worldwide through its internet channels. As a sign of true scale, Brian Hill has passed the torch to Jennifer Wong who has been CEO since May 2022.

The company is profitable and its cash generation seems to be the keystone of its growth ambitions. The stores are located in quality locations and their design requires significant capex. As for the growth of e-commerce, the upward trend will have to be confirmed over the coming years. These elements should enable the company to outperform the tough competition in the North American fashion market.

By

By