Autoliv's prominence in the automotive safety systems domain is evident through its extensive global footprint, reflecting a steadfast commitment to reshaping safety standards. The company specializes in the development and manufacture of passive and active safety technologies, encompassing seatbelts, airbags, steering wheels, radars, and camera systems. Anchored by its guiding principle of "Saving More Lives," Autoliv navigates the delicate balance between tradition and innovation within the automotive industry.

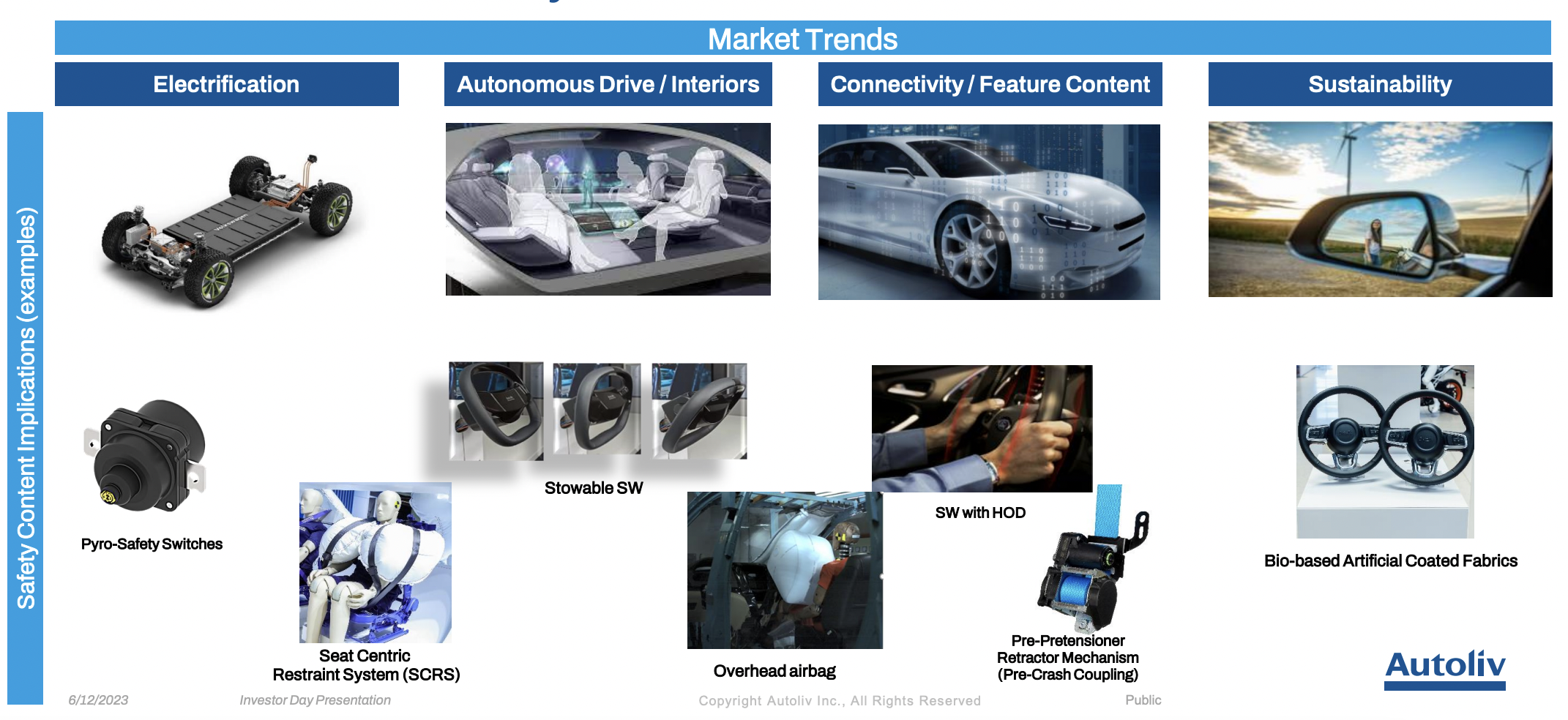

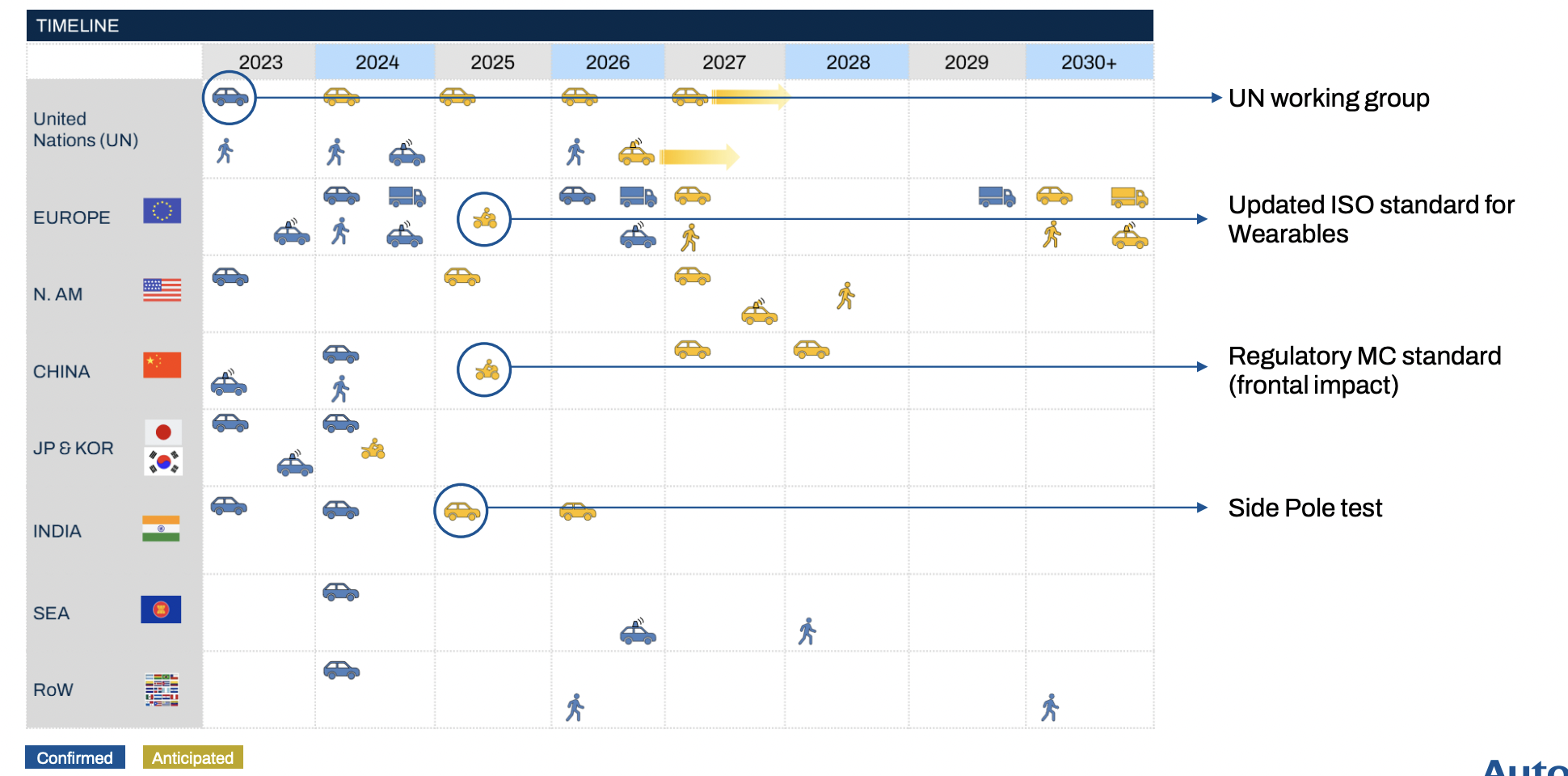

As a key player in both passive safety systems (seatbelts and airbags) and active safety systems (advanced driver-assistance systems or ADAS), Autoliv adapts to the evolving landscape of automotive safety. While traditional safety components form a vital part of its portfolio, the company allocates resources to the dynamic realm of active safety systems, aligning with the industry's technological evolution.

In the face of advancements that have enhanced overall safety, Autoliv acknowledges the persistent reality of accidents and inherent risks in vehicle usage. Autoliv's solutions focus on developing products to minimize the impact of accidents, emphasizing post-accident protection while actively investing in preventative measures like Crash Detection and High Complex Steering Wheels.

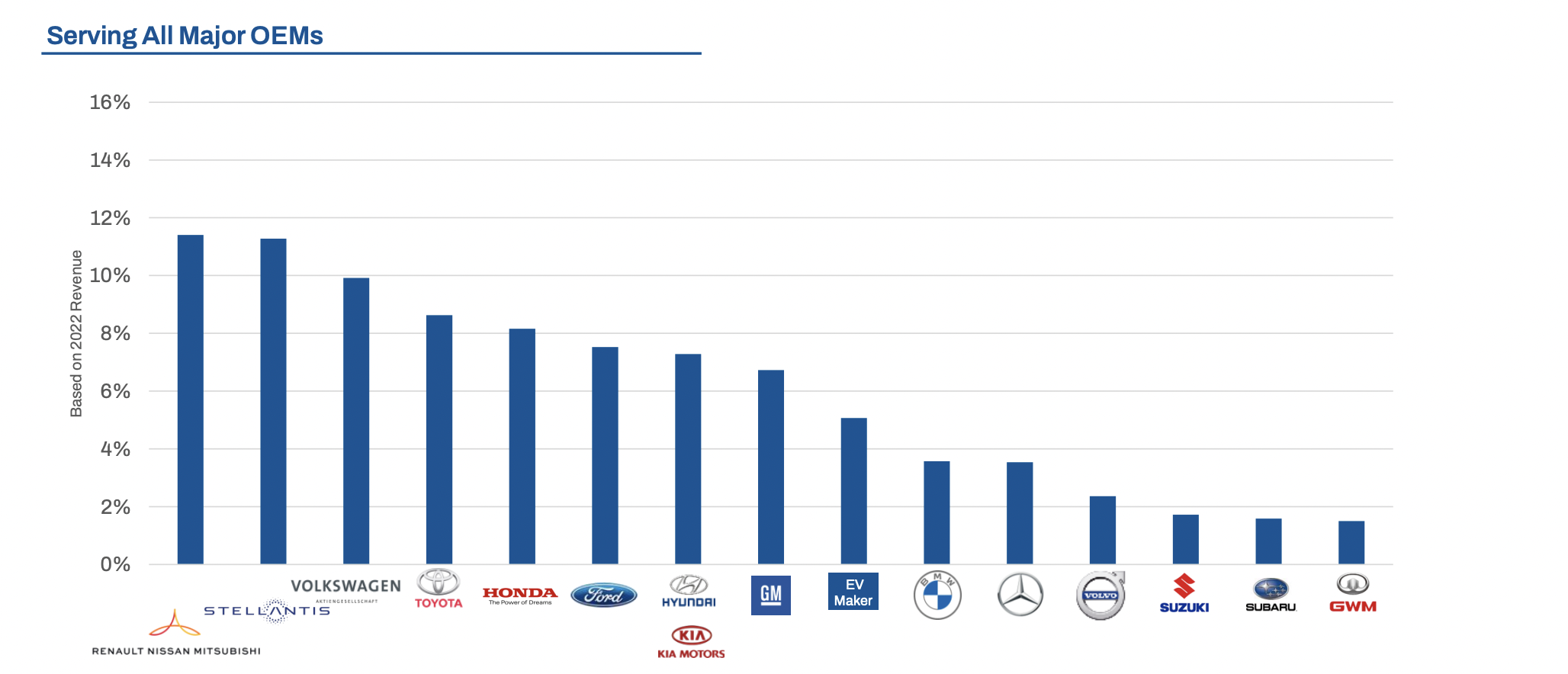

Playing a pivotal role in the automotive industry, Autoliv supplies safety solutions to original equipment manufacturers (OEMs), integrating them into new vehicles. Additionally, the company offers aftermarket products and services, maintaining enduring relationships with leading OEMs, positioning itself as a trusted partner for major global automakers.

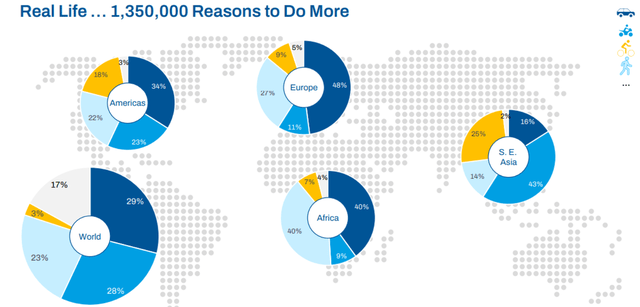

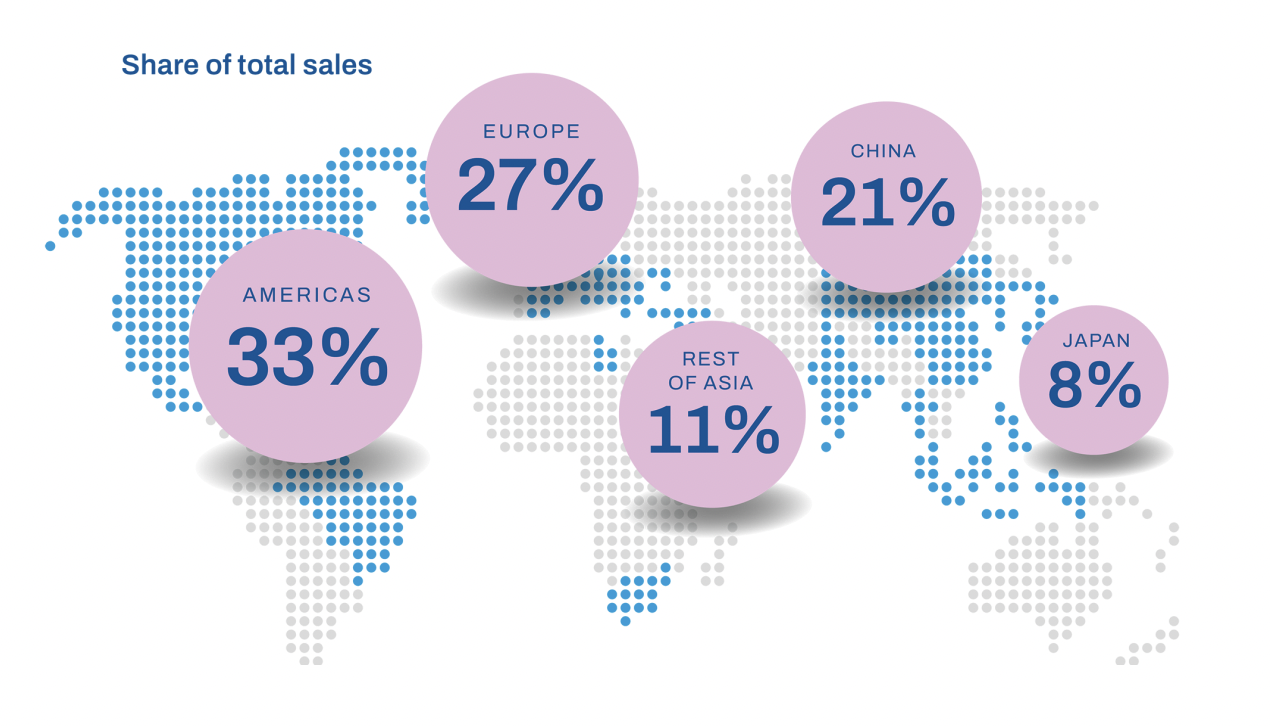

Autoliv's global presence allows it to cater to automotive manufacturers across different regions, effectively addressing diverse customer needs and adhering to regional regulations. The company's balanced revenue distribution among key automotive industries in Europe, the Americas, and Asia mitigates dependency on any single market, providing a strategic advantage aligned with global production trends.

Significant corporate changes, including the spin-off of its electronics business into Veoneer, have marked Autoliv's journey. While M&A activity has been limited, Autoliv remains focused on research and development (R&D) to innovate in automotive safety technology. Current R&D efforts are directed towards developing products for autonomous vehicles and electric vehicles (EVs).

Acknowledging the mature nature of the automotive safety industry, Autoliv faces competition from established players. Despite industry maturity and strong competition, its strategic advantage lies in its diversified geographic exposure, ensuring resilience and adaptability to global production trends.

Changes in consumer preferences, the shift toward SUVs, and the EV revolution contribute to increased demand. However, the adoption of advanced safety technologies may be slow due to factors like high costs, consumer skepticism, and regulatory challenges.

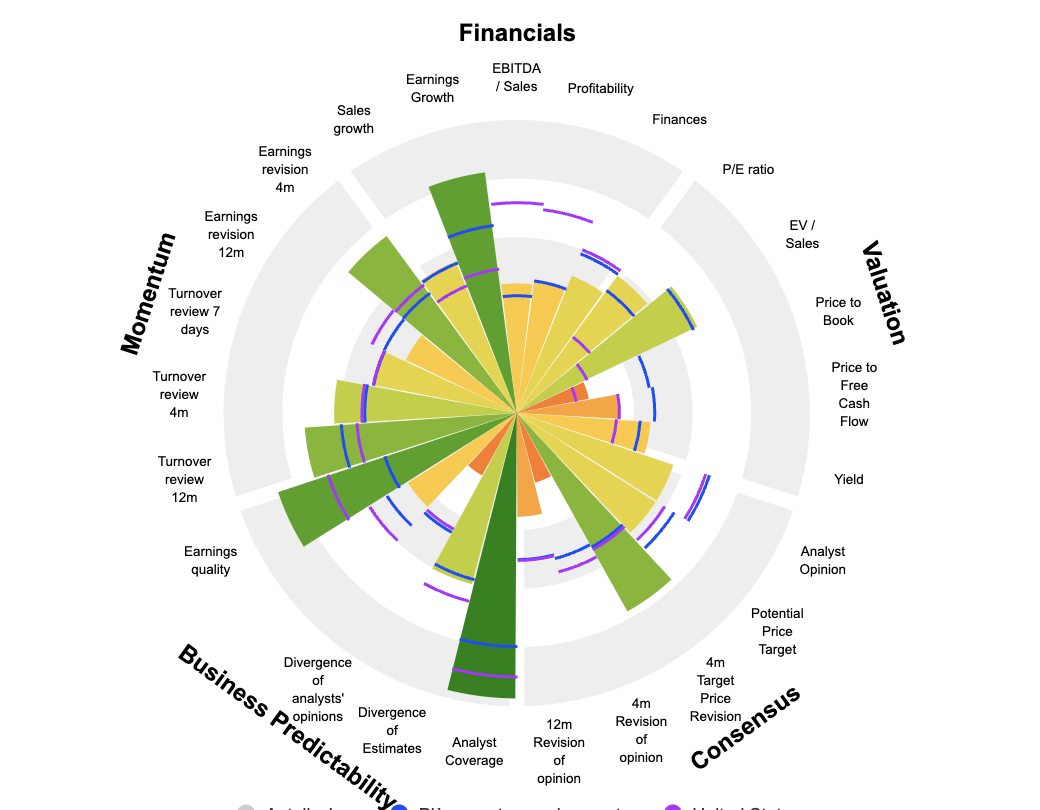

While Autoliv's segment of the automotive industry demonstrates resilience and consistent demand, achieving outsized growth poses challenges due to the nature of safety products. The company's finances, though not stellar, indicate a focus on cost efficiency amid changing market dynamics.

Autoliv has an extensive global reach, with 62 production facilities in 27 countries. It signed major partnerships with industry giants like the Renault Nissan Mitsubishi group, Stellantis, and Volkswagen (43% Market Share), as well as Rolls Royce, as evidenced by their joint work on the Spectre model.

Despite Autoliv's industry-leading position, financial metrics reveal a modest growth trajectory, with revenue showing a Compound Annual Growth Rate (CAGR) of 0.04% over the last decade. Negative performances in EBITDA and EBIT, hovering at -1.28% and -2.96%, respectively, suggest the impact of changes in the product mix and inflationary pressures post-pandemic. While net and operating margins currently stand around 5% and 7%, analysts anticipate a potential increase to 8% and 12% by 2025, underlining management's focus on transitioning to a cost-focused strategy in the near term. Despite these financial nuances, Autoliv's robust product portfolio, innovation, and safety-centric culture continue to position it as a key player in the automotive safety systems sector.

Autoliv's strong product portfolio, commitment to safety, and global presence underscore its position as a significant player in the automotive safety systems sector. However, the outlook for substantial growth presents challenges, and the company remains attentive to evolving market dynamics and cost-focused strategies.

By

By