Founded in 1978 in Beverly, Massachusetts, Axcelis is a company that designs, manufactures and sells surface treatment equipment for cleaning, modifying and processing the surfaces of semiconductor substrates.

Today, semiconductors are used all around us, whether in PCs, smartphones, cars, data center servers (Cloud Computing), game consoles or medical machines. The supply continues to grow and this prosperous sector is not immune to cyclicality and overcapacity. However, the manufacturing process of electronic chips, which include semiconductors, involves many steps. It takes years of experience and research in the industry to develop, design, produce, market and service a single line of microchips. The process of building a semiconductor plant is also extremely expensive in terms of capital, time and complexity.

As you can see, one of the main problems of this market is the big complexity of the production chain. Not all groups have foundries (semiconductor manufacturing plants) because of the huge capital costs involved. Axcelis has this advantage. The company benefits from its ATC (Advanced Technology Center) and AOC (Asia Operations Center). The ATC is a state-of-the-art facility dedicated to advanced chip manufacturing and equipment demonstration while the AOC is a state-of-the-art manufacturing and engineering facility to meet the growing market demand by serving their growing footprint throughout Asia and their Korean customer base.

The constant demand for ever more advanced and high-performance electronic products forces companies to be constantly innovative to stay ahead of the competition. In addition, high R&D costs are a significant barrier for new companies wishing to enter the market, increasing competition between established players. The short life cycle of electronic products means that companies must be able to release new products quickly to satisfy consumer demand and remain competitive. Finally, sensitivity to economic cycles can cause significant fluctuations in demand for electronics products, requiring the ability to adapt quickly to stay ahead of the competition.

With an order book (Samsung, Intel, TSMC, Micron, SK Hynix, GlobalFoundries) that is overflowing and a competitive advantage in equipment design, what could stand in the way of Axcelis? The first risk that comes to mind is pressure from the United States to prevent Beijing from gaining access to advanced technologies. China is already embargoed on certain equipment, but Washington is pushing to extend the restrictions to other machines. At this stage, Axcelis has not been penalized too much, but it is a point of vigilance. Other threats include the risk associated with the highly technical nature of the equipment produced, which forces the company to maintain a constant level of excellence with very demanding customers.

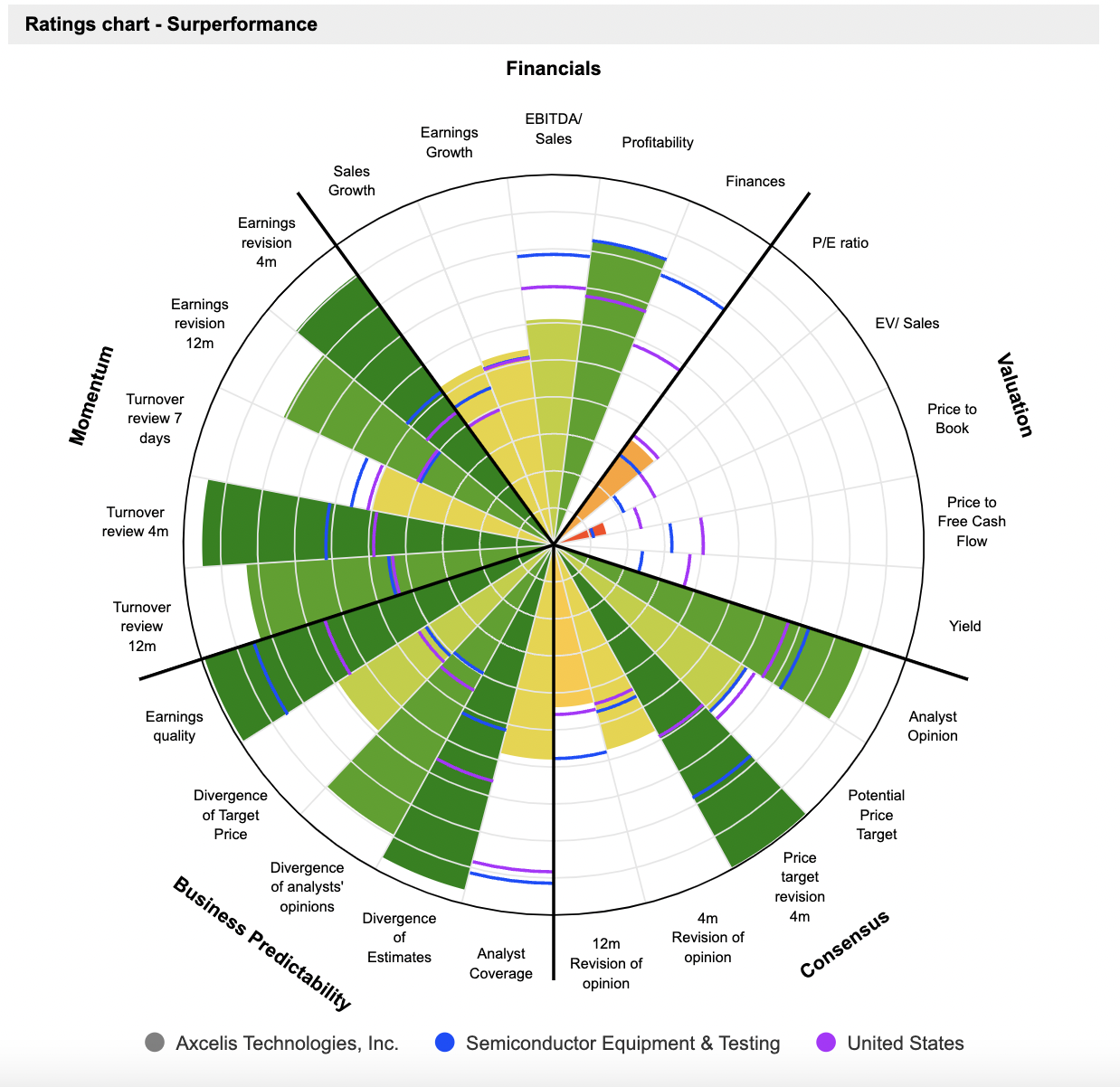

Valuation:

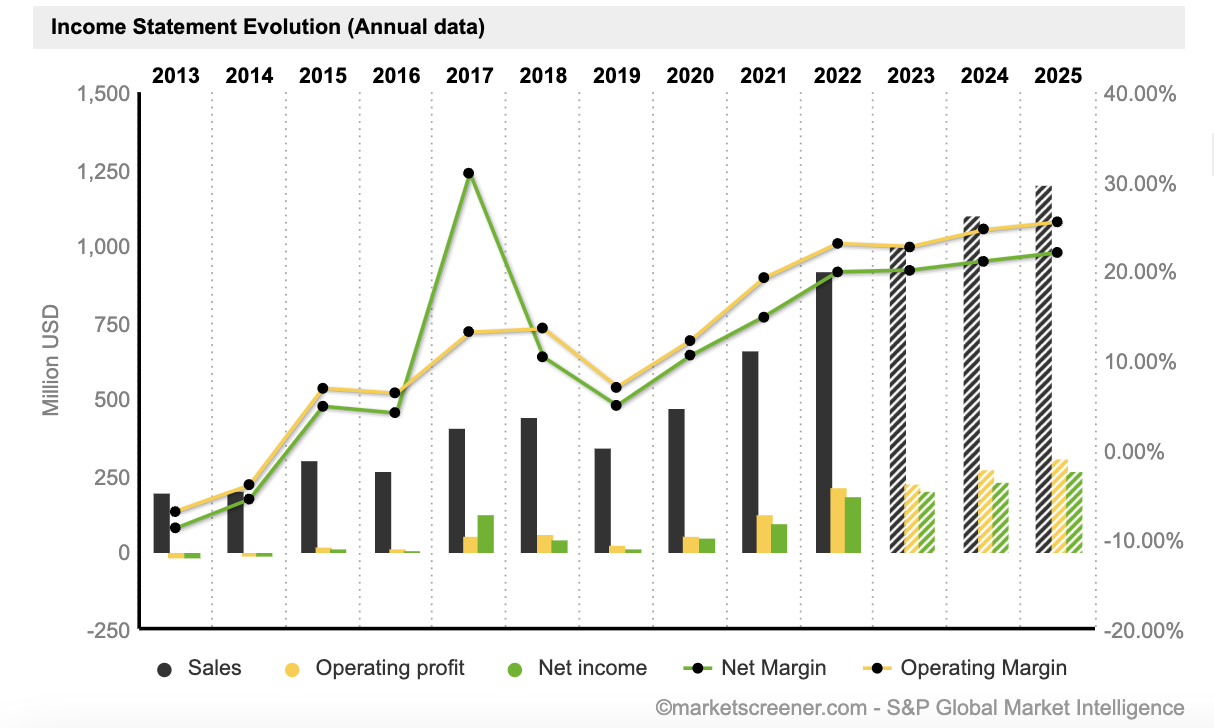

This explains the attraction of Axcelis to investors. In ten years, the stock has gained more than 2700%. Revenues have risen from $193 billion in 2013 to $920 billion in 2022, an average annual increase of almost 17%. At the same time, the operating margin increased from -6.88% to 23%. The company's net income is quite considerable with an increase of more than 975% between 2019 and 2022 from $17 million to $183 million. Meanwhile, Axcelis is paying between 15 and 20 times earnings which makes it a rather attractive price, unlike its competitor ASML which is paying 30 times earnings.

In the fourth quarter of 2022, the group's revenue rose 16% quarter-over-quarter to $266 billion, beating analysts' estimates. The company's earnings per share came in at $5.46 in 2022 compared to $0.48 in 2015.

By

By