BYD has now become the world’s biggest electric vehicle manufacturer, in addition to having built one of the world's largest electronics businesses. This phenomenal entrepreneurial story at the crossroads of genius and opportunity couldn't be described better than by Li Lu himself:

"The story of BYD is relatively simple. Wang Chuanfu, BYD’s founder and CEO, who is a really terrific engineer, started the business from just a $300,000 loan with no additional money until the IPO. He created a company with $8 billion in revenue and 170,000 employees and tens of thousands of engineers. He solved a whole bunch of different problems. So the record is impressive. They happen to be in the right industry and the right environment, and they get the right support from the government."

The company now has a large electric car business, a small gasoline car business, a huge battery business, and a lithium mine near Tibet. It is also is in talks to buy six lithium mines in Africa.

"We have an interesting venture capital type business, and BYD has gone into a business they were never in before, which is monorails. And they are selling monorails like you can’t believe (…) And they’re also selling those big electric buses, and so on. Wang Chuanfu is a combination of Thomas Edison and Jack Welch – something like Edison in solving technical problems, and something like Welch in getting done what needs do. I have never seen anything like it," said Charlie Munger in 2018.

It all started in 2001 when a Shenzhen-based manufacturer of lithium-ion («li-ion») and nickel rechargeable batteries, BYD («Build Your Dreams») enjoys a huge tailwind due to the booming usage of mobiles, electric and electronic devices. The company already ranks as the third li-ion batteries manufacturer worldwide.

Dramatic surge of demand for li-ion batteries, driven by mass adoption of mobiles, notebooks and other devices, boosts the company's revenues and profits. The company makes several acquisitions, including a 15% equity interest in BYD Auto in 2004 – aiming to use the latter as a platform to develop battery-powered vehicles.

In 2010, BYD was already selling 500,000 vehicles a year and entered into a memorandum of understanding with Daimler, pursuant to which both parties will cooperate in China to develop passenger vehicles powered by electric motors. In the handset components business, management claims that banking on a vertically-integrated model has created a sustainable price advantage – an assertion backed by impressive results indeed.

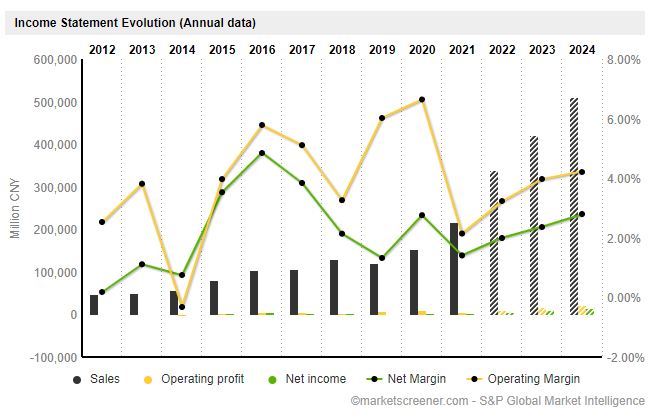

Revenues surged in the past few years

Right before the pandemic started, a third of vehicles sold was new energy vehicles. In a like manner, sales of electric buses grow thanks to numerous orders from overseas.

How did they fare since 2018? Revenue doubled again over the last five years, from $18bn to $36bn. Which means that over the last fifteen years revenue grew thirty-six-fold. But that epic run has also come with perpetual margin compression, with BYD's operating profits tracking sideways for several years.

The electronics business' growth has slown down and Chinese electric vehicles producers used to rely too heavily on state subsidies, which are being reduced or redirected elsewhere. Nobody knows how BYD's sales will pan out in a subsidy-free environment. There is no visibility on BYD's actual ability to generate cash earnings, for growth consumes all resources.

From a free cash-flow perspective, the two past earnings reports have been impressive, but they benefited from unusual releases of inventory due to the pandemic, which freed up massive amounts of working capital. Other than that, capex is running as high as ever and should consume all cash from the foreseeable future.

Not for any investor

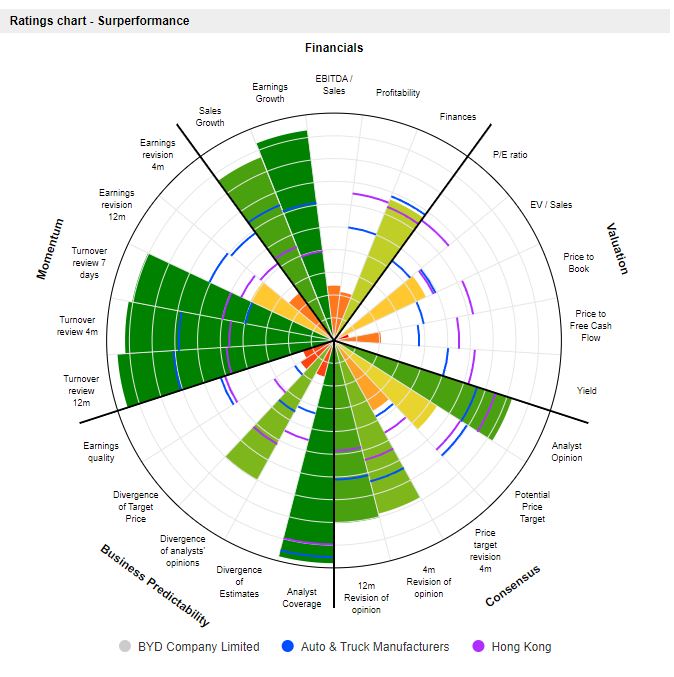

Market cap and enterprise value are roughly equal at $130bn. Barring all the usual precautions about investing in China, what could be said is that in the end it remains a story for believers. A big part of the appeal is that Berkshire Hathaway is still holding a fifth of equity capital. But this investment is not easy to understand because it is changing so fast, at such a large scale.

A neat competitive advantage that must be underscored is BYD's wholly owned and integrated supply chain, from the lithium mines in Tibet to its extensive manufacturing base for batteries. Other automakers depend on external suppliers for both batteries and raw materials. BYD's vertically-integrated model should provide the same kind of cost advantage it did within its electronics business.

In any case, conservative investors will likely pass on that one. After all, Warren Buffett, Charlie Munger and Li Lu invested when BYD's stock was trading at rock-bottom valuations. To quote Munger: "It got pounded so hard, it was a Graham-type stock. A Graham stock in a start-up company."

By

By