Its primary business has been brokering "app slots" on new Android phones. What this means is that based on subscriber data provided by the carrier, Digital Turbine automatically chooses which apps to pre-install on the phone.

In return for this service (called "Out-Of-The-Box"), developers pay Digital Turbine for placing their product on the phone. The company shares the proceeds with the carrier, enabling the latter to monetize a portion of the screen space, earn high-margin revenue and improve the overall ownership experience.

On the surface this looks like a simple business. Revenue is a function of the number of devices for which Digital Turbine serves as a pre-uploaded app broker, and then of the revenue generated from each device.

In effect, monetization comes from both a pay-per-install and revenue-sharing model, in which Digital Turbines captures a chunk of a user's lifetime value on a specific app. Think of the implications for high-usage apps such as Uber or Disney+…

An impressive track record

The company has also developed a new feature called "SingeTap", which dramatically improves the likelihood that an app is installed when a user clicks on the service-enabled ad. Impressively, SingleTap has grown from zero to a $100M+ business with just 15 customers.

At their analyst day, Digital Turbine’s chief revenue officer charted the course to accelerate this into a $1B+ business over the next few years. The SingleTap technology could also be licensed to other platforms, such as Snap and Meta, which are currently testing it.

Digital Turbine’s softwares are installed on over 1.5 billion devices. Management has done an excellent job of lining up carriers (including Verizon and AT&T Wireless), manufacturers (such as Samsung, OPPO and Vivo, which taken together sell approximately 40% of Android phones worldwide) and large advertisers (Amazon, Netflix, Disney+). Execution has been nothing short of stellar.

Last year Digital Turbine completed three acquisitions to control the mobile advertising process from end-to-end. This should strengthen the company's already serious competitive advantage—its softwares are pre-installed on devices and they collect first-party data from their carrier partnerships.

Management laid out a path to quadrupling revenues and growing EBITDA by 10X in the next three to five years. Reasons for optimism include the fact that their software is currently installed on less than 20% of mobile phones; that the company has opportunities to increase the number of carriers and phone manufacturers it works with; and that a number of new services could be sold to carriers.

Some risks

Nevertheless, Digital Turbine's shares got hammered with the burst of the technology bubble; recession fears driving down digital advertising-related businesses; as well as concerns that Google could change its policies on Android devices regarding advertising targeting and attribution.

In addition, the rollout of Digital Turbine's new products, including SingleTap, has been delayed, perhaps as a result of lackluster enthusiasm from AT&T and Verizon. Given their size and market power, the company does not have a lot of leverage with these customers.

This setback, coupled with the sheer impossibility to accurately model forward revenues due to hundreds of inputs and ever evolving relationships with multiple stakeholders (carriers, manufacturers, developers, etc.), has disheartened investors and sent shares top-to-bottom from $85 to less than $20—prompting CEO William Stone to sell a significant amount of his stock.

There are other risks. Competition with sophisticated digital marketing platforms could spring up, shipments of new phones are plunging, while Apple overtook Android and now has more than a 50% share of smartphones used in the US. And of course, carriers and Google likewise could decide to create a competitive offering. For now, it remains is a very small market, so they've been okay with leaving the crumbs to Digital Turbine, but clearly a lot could go wrong here.

Still, the company grew revenue at an impressive CAGR of 80% over the last six years. It became cash-flow positive and is working at rolling-out its nascent, improved monetization strategies. These positives notwithstanding, valuation lingers at x10 EBITDA and x2 revenue—the latter may not necessarily be a relevant yardstick though, because Digital Turbine has much lower gross margins than the vast majority of platform/marketplace type companies.

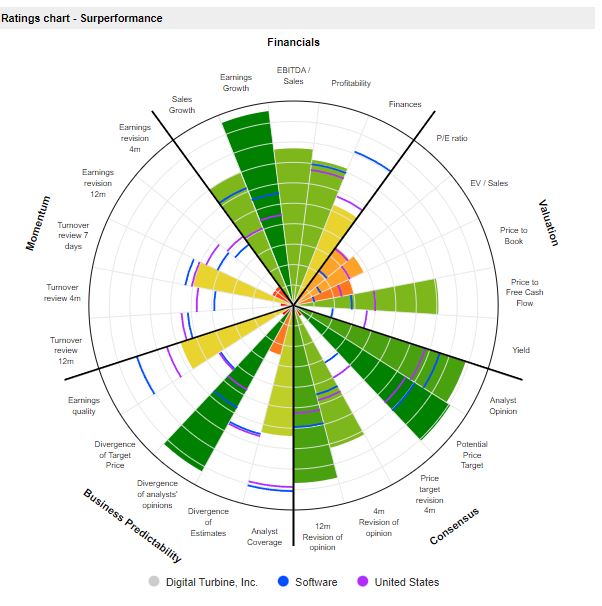

Source: MarketScreener

Source: MarketScreener

On a side note, its most direct competitor, IronSource, is being bought out by Unity Software in a deal that implies a valuation of about x4 forward revenue and x14 EBITDA, i.e metrics twice higher than those currently applied to Digital Turbine's shares.

This is a business that has a history of rapid growth and operating leverage, solid unit economics, and a very capable management team. If growth is permanently impaired, things can go to zero. But there are multiple ways to win of the company manages to carve out a durable and profitable niche for itself.

High-octane and technology-focused investors should keep track.

By

By