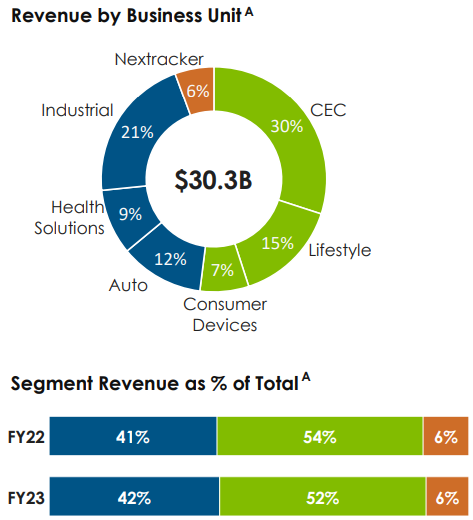

Flex generates 94% of its sales from subcontracting services. Sales are dominated by the Agility Solutions segment (52% of sales), which focuses on products that need to be brought to market quickly. These include data and communications infrastructures, lifestyle devices (household appliances, consumer packaging, audio, floor care), and mobile and consumer devices.

The Reliability Solutions segment (42% of sales) is optimized for longer life cycles. Production models are more complex. Specifically, these include technologies for the automotive industry (connectivity systems, smart technologies, electrification solutions), healthcare (medical devices, drug delivery solutions) and industry such as capital goods and devices for renewable energies and grid peripherals.

Flex holds a stake in Nextracker, a supplier of solar trackers for solar panels. Nextracker contributes 6.5% to Group revenues. This subsidiary was floated on the stock exchange at the beginning of the year, as part of a demerger aimed at bringing a more appropriate valuation to this activity, which was camouflaged by the American company's core business. Flex still owns 61.4% of its subsidiary.

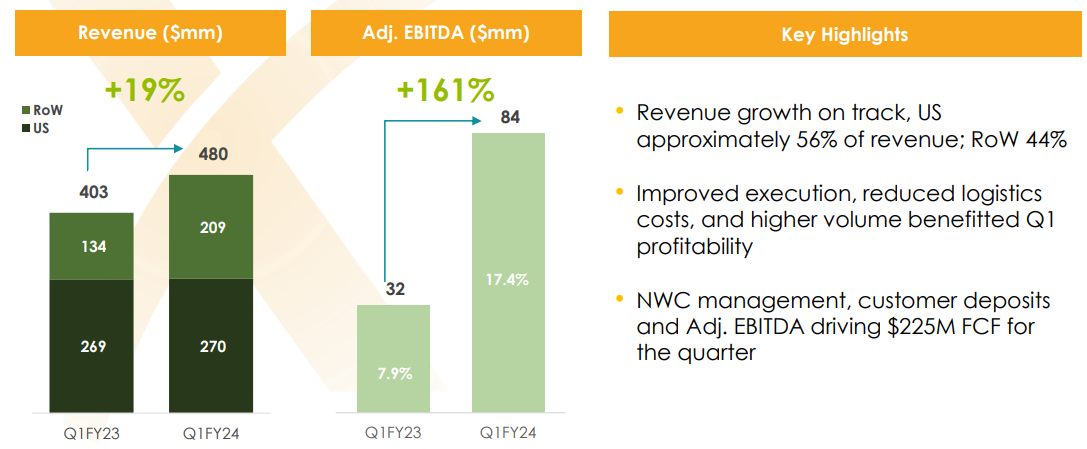

Nextracker goes from strength to strength (source: Flex)

Flex operates in a highly competitive market. But unlike many players who specialize in very specific fields, it is diversified. The group tackles technology as well as automotive, healthcare and telecommunications. This is an advantage, as the company is not exposed to the cyclicality of a specific market. What's more, Flex benefits from cross-sector synergies. Some technologies and means of production are applicable to several sectors, such as data centers, electric vehicle connectivity and sophisticated medical equipment. However, strong competition is putting pressure on prices and margins.

Geographically, North America is the Group's main business region, accounting for 38% of sales (17% in the United States). It also has a strong presence in China (22%), EMEA (Europe, Africa and the Middle East) and South America, notably Mexico and Brazil. Last but not least, the Group's customer base is equally diverse, with no single customer accounting for more than 10% of sales. The top ten customers account for 34% of sales.

Over the decade from 2014 to 2023, revenues rose only slightly, from $26.1 billion to $30.3 billion. Despite a doubling of operating margin since 2014, profitability remains relatively low. Net margin is more volatile, mainly due to significant restructuring costs over several years and asset impairments. Nor have free cash flows reached particularly remarkable levels. That said, how can we explain the more than 4-fold increase in the share price since 2013?

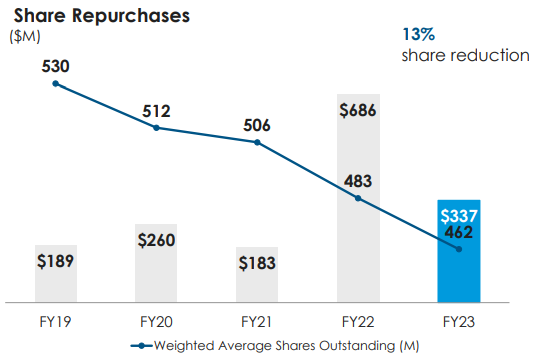

Firstly, Flex is one of North America's leading subcontractors. Secondly, the group is positioned in modern technologies. It also has good control over its production network, since it has a strong presence in countries where labor is cheap: China, Brazil, Hungary, Malaysia, Mexico, and so on. Return on equity is high (over 20%), and returns to shareholders are substantial, with substantial share buy-backs. The mechanical effect is that the value of the remaining shares increases. The number of shares fell from 602.4 million in 2014 to 446.6 million last year.

Flex share buybacks (source: Flex)

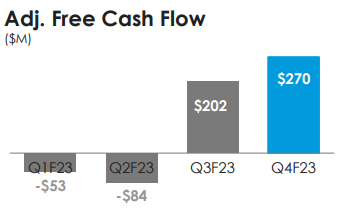

Flex makes many growth investments. In recent years, these have been instrumental in boosting operating profitability. Capex amounts to $2.3 billion since 2019, well above free cash flow, one of the Group's major weaknesses. Cash and cash equivalents amount to $3.3 bn, and the balance sheet is healthy, since debt is well managed and maturities well spread over time.

Cash Flow is ... NOT king for Flex (source: Flex)

Looking ahead, the outlook is rather encouraging and was revised upwards at the end of the first quarter. Flex now expects to achieve a record operating margin of between 5% and 5.2%. In addition, earnings per share, which have been somewhat volatile in recent years, should also exceed the usual standards this year, at between $2.35 and $2.55. As far as valuation is concerned, it is rather attractive. The earnings multiple is 12x for this year and barely 10x next year. The Nextracker deal is a good thing, as this subsidiary has a lot of potential. Earnings and profitability forecasts have also been significantly revised upwards.

Financial outlook for this year (source: Flex)

By

By