The company has a portfolio of 8 approved drugs. These include Jakafi. This is the company's main therapeutic treatment. Last year, it generated sales of $2.4 billion out of a total of $3.4 billion. That's a colossal sum, but the group aims to avoid dependence on this solution. The drug was initially approved in 2011, and the company has constantly found new applications for it. The latest is in 2019 to treat steroid-refractory polycythemia, a condition characterized by excessive production of red blood cells.

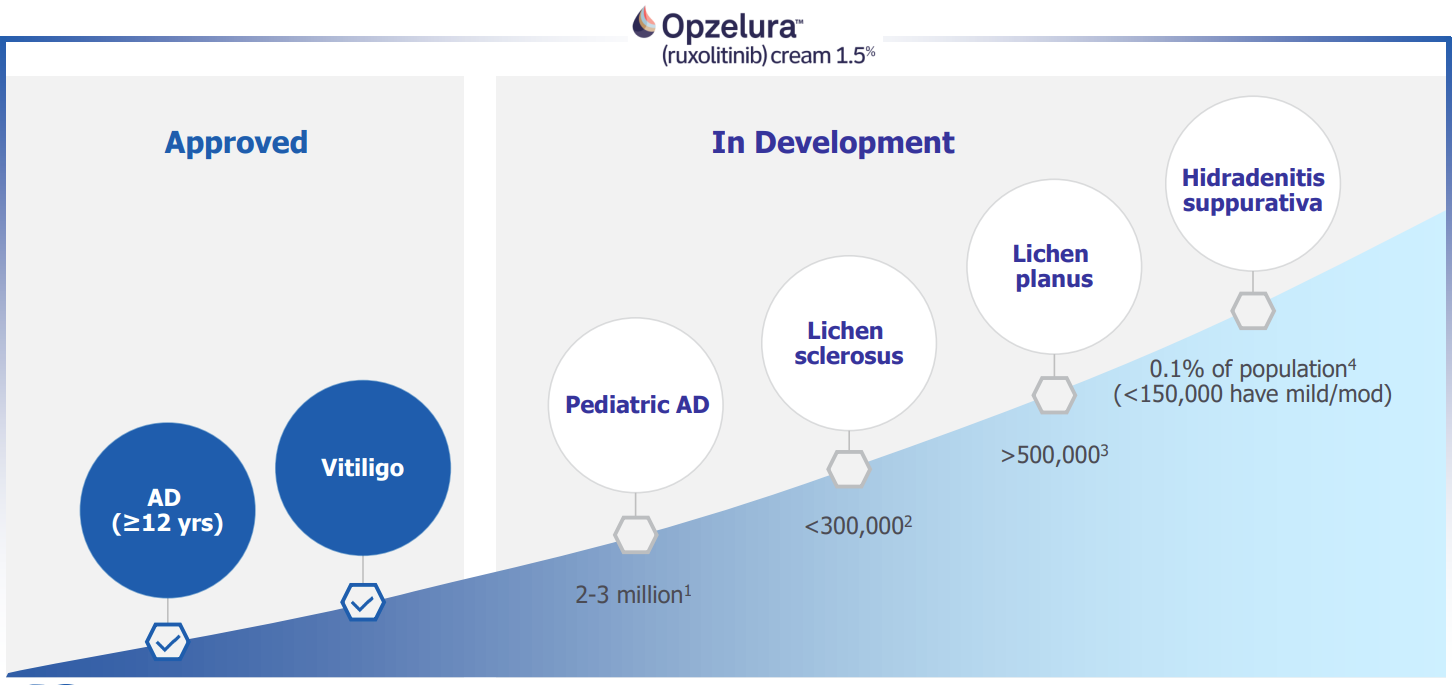

Other drugs marketed by Incyte include Opzelura, which gained approval in the US last year and in Europe in the first quarter of this year. This treatment targets various autoimmune skin diseases, such as vitiligo, characterized by skin blemishes. The potential is considerable, as these diseases still have few reliable treatments, and the number of patients to be treated is substantial.

Opzelura could become a major player in the years to come (source: Incyte) NB: AD = Atopic Dermatitis

In addition to Jakafi and Opzulera, the range includes three other treatments with sales of $209 million. Incyte also owns several patents exploited by other laboratories such as Novartis and Eli Lilly. These royalties provide recurring revenues, accounting for 14.2% of sales. Finally, milestone and contract revenues account for 4.9% of annual revenues.

A substantial development portfolio

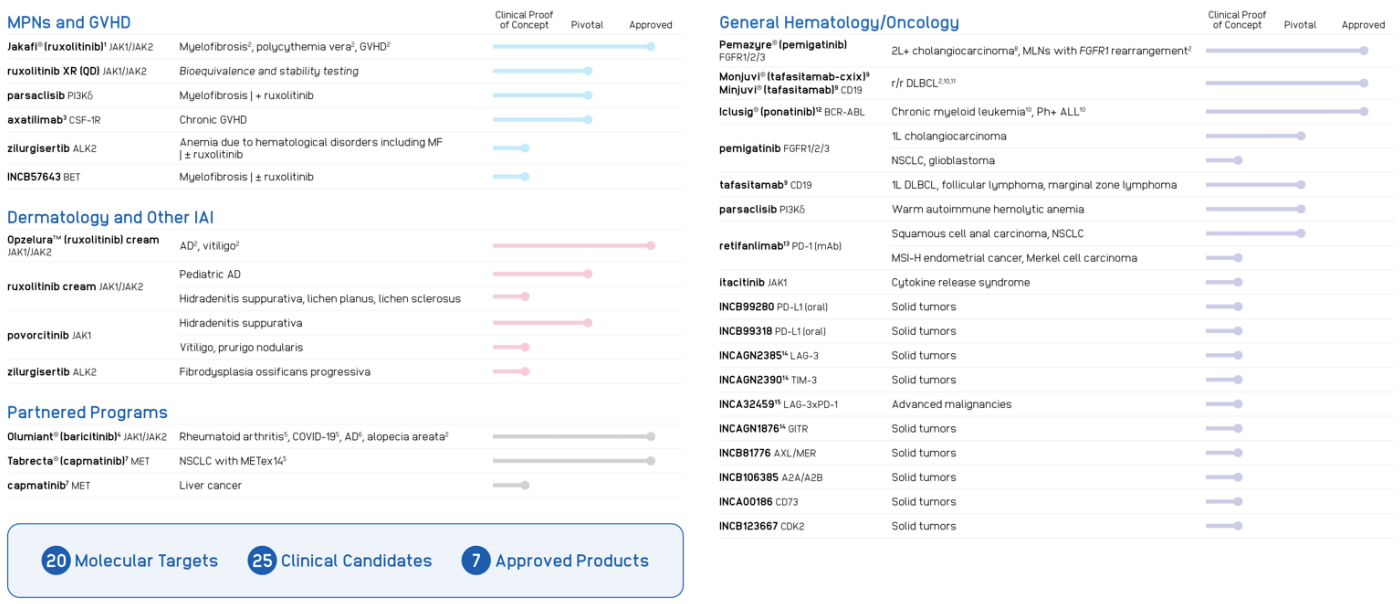

Incyte 's development is not limited to extending its existing treatments: 25 clinical trials are underway, nearly half of which are at advanced stages, in phases 2 and 3.

A brief overview of the range of treatments in development (source: Incyte)

This future potential does, however, present two major challenges. Firstly, research and development costs are considerable (47% of sales). Secondly, the return on investment is not guaranteed. Even if extending the spectrum to include a large number of studies increases the chances of bringing a drug to marketthere is no certainty of success, and so a significant part of future growth depends on the results of clinical studies, which can be quite uncertain.

Yo-yo profitability

From a financial point of view, revenue growth has been spectacular, driven by Jakafi's rise to prominence. In the space of just ten years, revenues have increased by a factor of ten, from $355 million in 2013 to $3.4 billion last year. In terms of profitability, the picture is a little more nuanced. The net margin varies from exceptionally profitable years, such as 2019 (20.7%) and 2021 (31.8%), to years when costs weigh too heavily on the balance. This was notably the case in 2020. However, the trend is improving, with years of positive profitability starting to occur more regularly than in the last decade. The company is beginning to generate cash on a more regular basis, and to keep a tighter rein on expenses - a good point.

However, Incyte has had to call on the market several times to bolster its cash reserves and meet its stock compensation requirements ($188.4 million last year). The number of shares outstanding has increased by 38% over the past decade. This will be a key factor to monitor over the next few years, especially as the company does not pay dividends. Nevertheless, as a biopharmaceutical company, Incyte can look to the future with confidence: cash flow is solid at $3.2 billion, and debt poses no problem in terms of its operational situation.

Incyte has entered a crucial phase in its journey: the one that could enable it to change its status from a biopharmaceutical company in clinical development to a pharmaceutical company in the marketing phase. The company's balance sheet is solid, its revenues are growing strongly, and it is worth noting the proportion of recurring revenues and the strength of its portfolio of treatments. The company is not expensive at current levels in terms of key valuation ratios. On the other hand, it's important to bear in mind that clinical results can create a high degree of volatility in the stock, which is the norm in this sector. Even so, the potential of current studies is only marginally reflected in the share price.

By

By