A little history

ITT stands for International Telephone & Telegraph, one of the glorious telecommunications companies of the early 20th century in the United States. In the 1960s, the group succumbed to conglomerate fashion, with a flurry of acquisitions in the military, industrial, hotel and even car rental sectors.

Investors' love affair with large, diversified groups came to an end in the 1990s, prompting ITT's first demerger, followed by a second in 2011, which saw the birth of Xylem, one of the world's leading water treatment companies, Exelis, a military contractor, and ITT Inc, the company we're interested in today.

Business

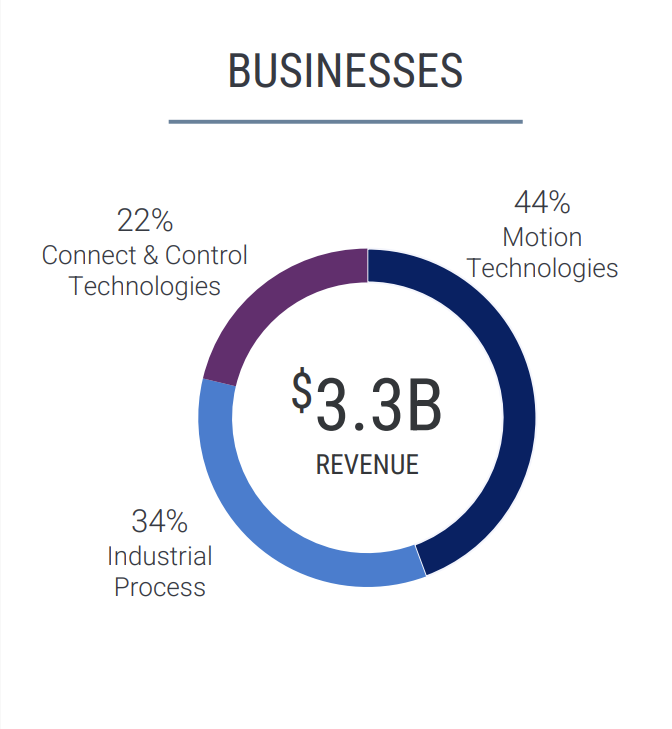

The Group is divided into three main divisions: Motion Technologies, Industrial Processes, and Connectivity and Control Technologies.

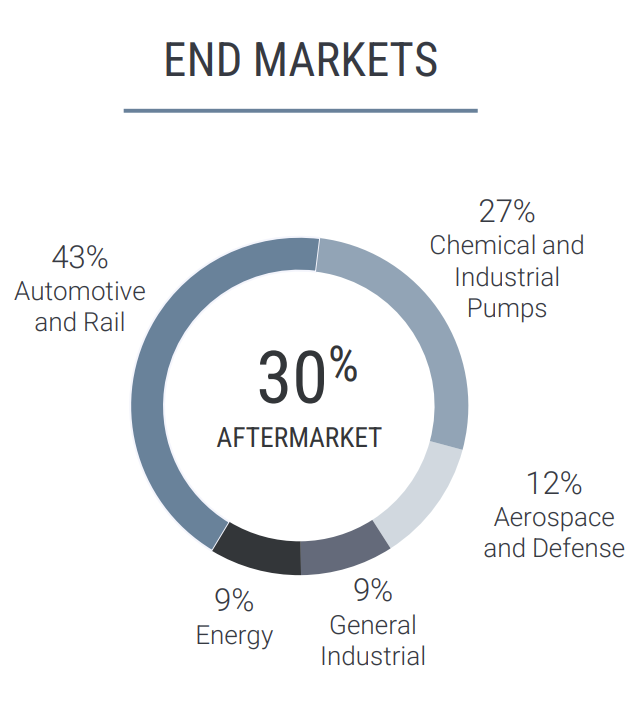

The Motion Technologies (MT) segment, which generates 44% of sales, specializes in the manufacture of braking components, shock absorbers and energy absorption technologies. This branch serves a wide range of markets, including light and heavy vehicles, both civil and military, as well as the rail sector.

Industrial Process (IP), accounting for around 34% of sales, supplies industrial pumps, valves and after-sales service. This segment is vital to a variety of industries, including chemicals and petrochemicals, pharmaceuticals, and power generation, providing essential products and services for the operation and maintenance of their operations.

Finally, Connectivity and Control Technologies (CCT), contributing 22% of sales, offers a wide range of connectors and components designed to withstand the most extreme conditions. This segment caters for demanding industries such as aerospace, defense, industry and energy.

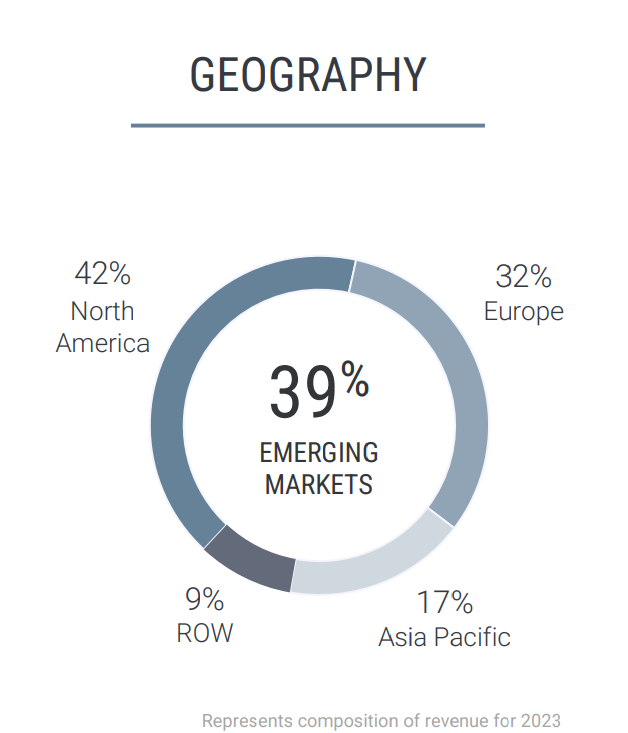

The geographical breakdown is as follows: 42% for North America, with the United States accounting for 33% of the total, the company's home market. 32% for Europe, with Germany alone contributing 11.8%, making it ITT's biggest European customer. 17% for Asia, including 10.7% specifically for China. The remaining 9% is divided between the Middle East and Africa with 5.2%, and South America with 3.8%.

Financial

ITT has a market capitalization of $10.8 billion, making it an average player on the US coast, but a fairly important industrialist in its sector. Its price/earnings ratio (P/E) of 22.9 is in line with the average of the last ten years. Remarkably, the company's net margin has almost doubled in a decade, rising from 6.9% in 2014 to 12.5% in 2023, despite a dip in 2017 due to an exceptional tax related to a US tax reform (the "Tax Cuts and Jobs Act").

The average annual growth rate of 9.8% over the last three years marks a break with the stagnation of the last decade. Sales have just passed the $3 billion mark, and forecasts predict $4 billion by 2026. This new momentum, coupled with steadily rising operating margins, has sparked renewed interest from investors.

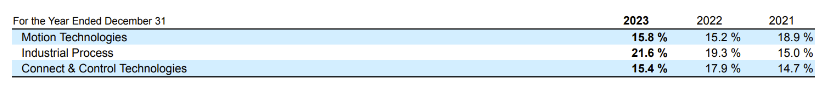

For 2024, ITT anticipates revenue growth of around 10%, driven by better-than-expected demand since the beginning of the year. Margins should expand by 110 basis points, mainly thanks to the Industrial Process segment, whose margin had already risen from 15% in 2021 to 21.6% in 2023. This increase in margins is -in part- attributed to recurring after-sales service revenues, which now account for 30% of total sales, becoming a key source of revenue for ITT.

Margin trends by segment over the last three years

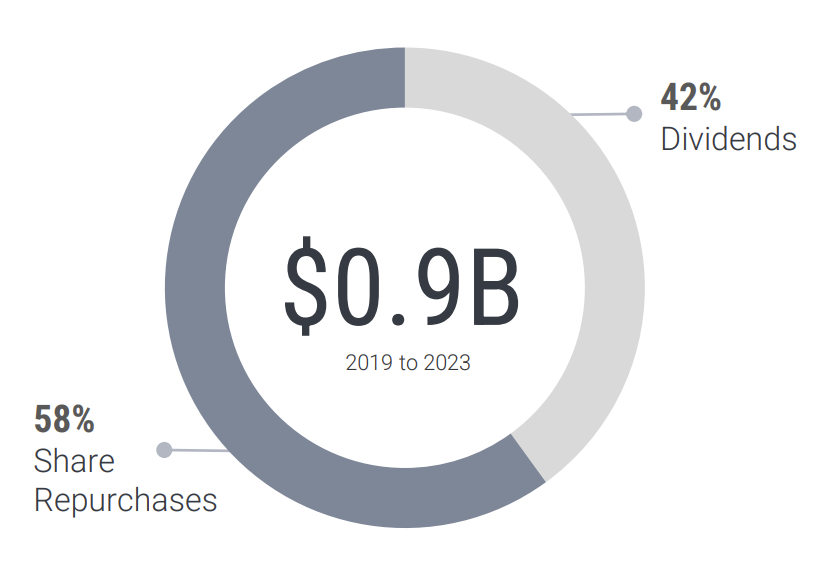

In terms of redistribution to shareholders, the payout ratio stands at 46.5%. Over the last ten years, ITT has paid out $590 million in dividends - with a CAGR in excess of 10% - and bought back $773 million in shares, reducing the number of outstanding shares by 10.4%.

Breakdown of redistribution to shareholders over the last 4 years

On the debt side, ITT has taken out $448 million in short-term loans to finance its acquisitions, share buy-backs and maintain liquidity. With 266 million already repaid this year, this debt remains perfectly manageable.

ITT's financial strength is underpinned by nearly $500 million in free cash flow, and free operating cash flow of $538 million in 2023.

Over the past three years, the company has made $1 billion worth of acquisitions, the latest of which was Svanehøj, a supplier of pumps for the maritime transport of liquefied gas, at an acquisition cost of $410 million.

The most important acquisitions of the last three years

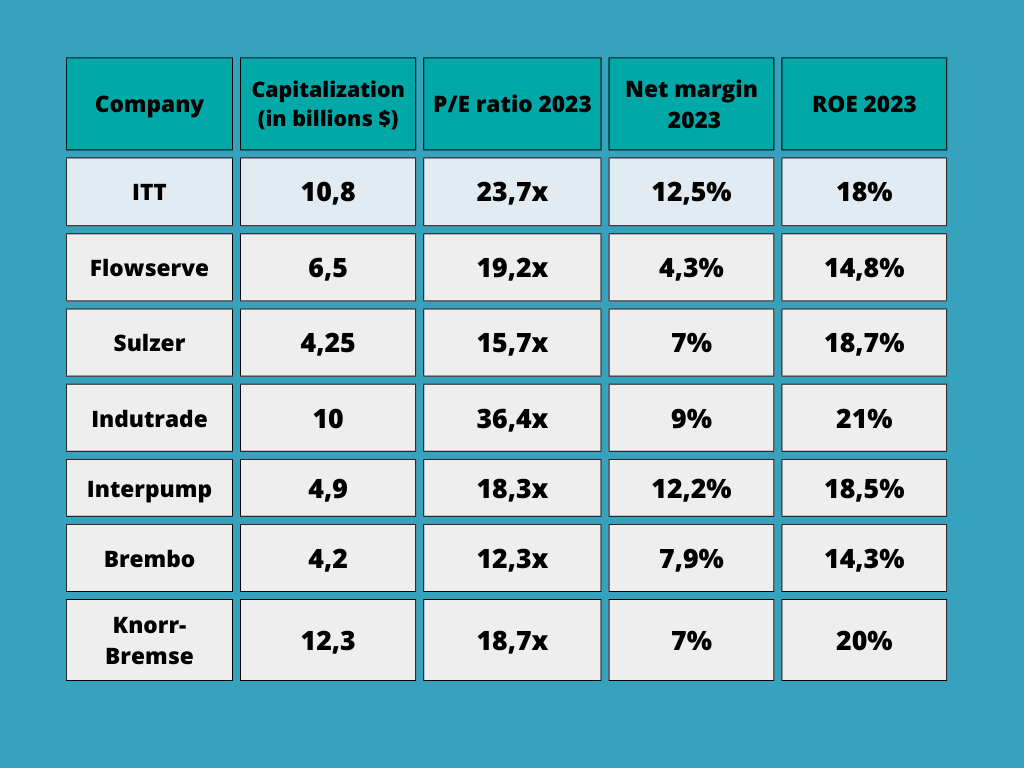

By way of comparison, here is a table showing ITT 's main competitors listed on the stock exchange:

After two spin-offs, ITT is back on its highs! A new demerger in sight?

By

By