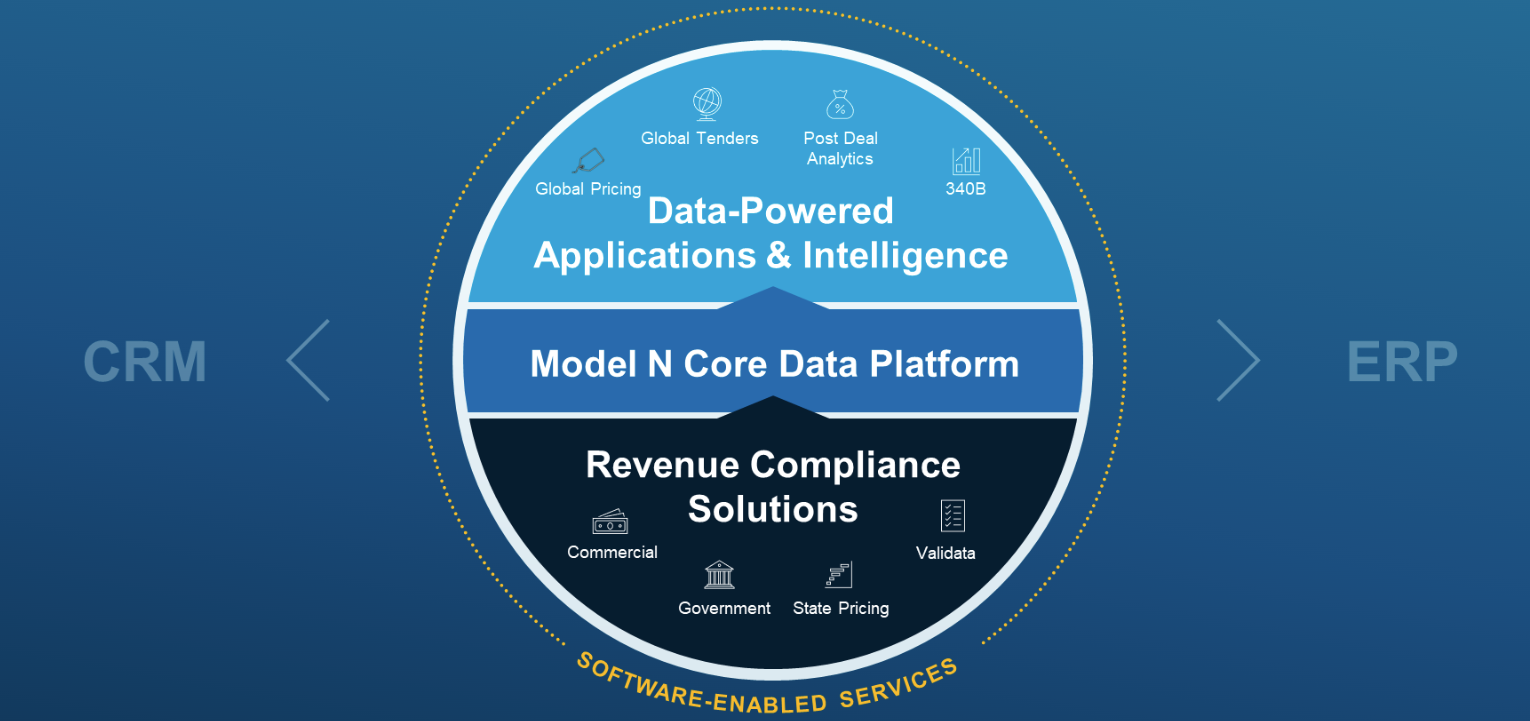

Model N offers revenue management solutions that help companies maximize revenues while complying with regulations and optimizing pricing. Their platform uses artificial intelligence to provide predictive analytics and pricing recommendations. Model N's solutions are designed to be integrated with existing ERP (Enterprise Resource Planning) and CRM (Customer Relationship Management) systems, making them attractive to large companies looking to improve efficiency without disrupting their current operations. Its integrated cloud solution automates decisions on pricing, incentives and contracts.

Source : Model N

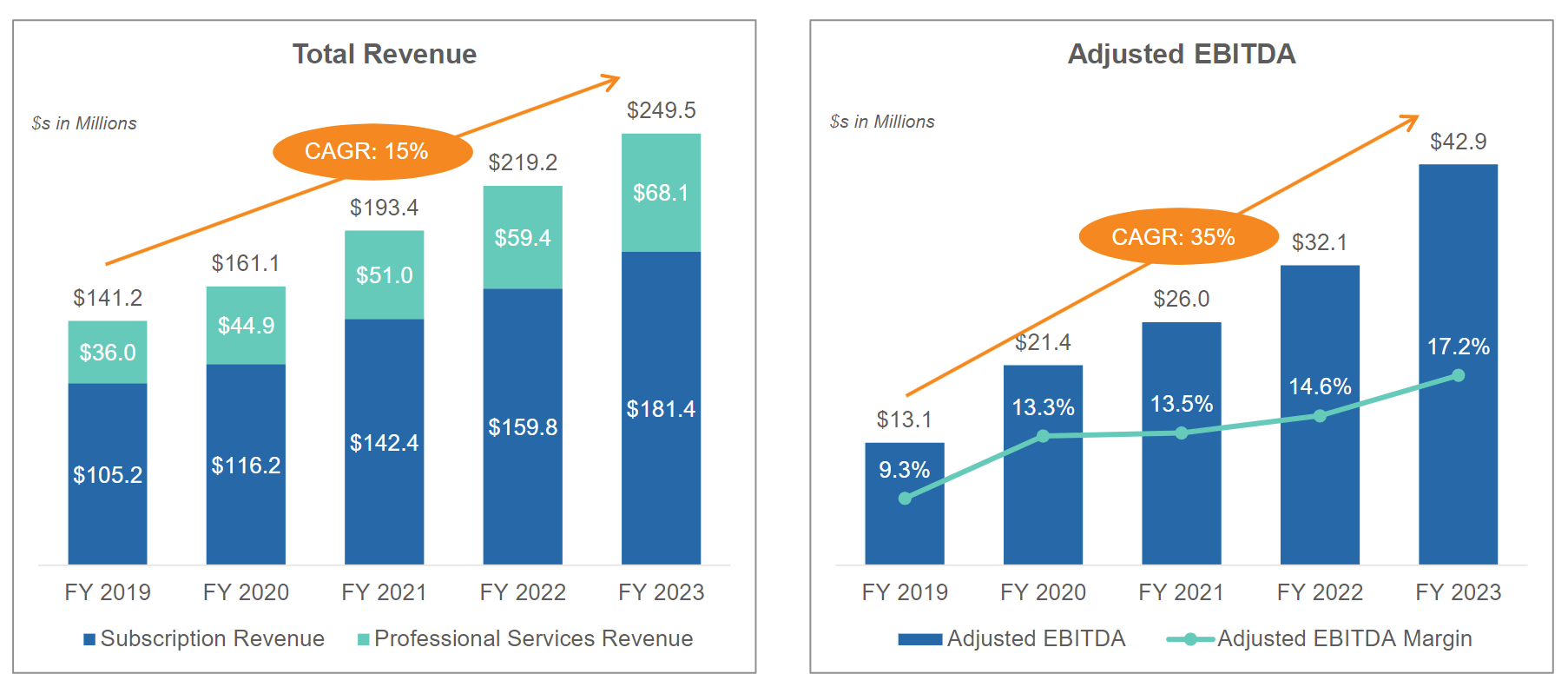

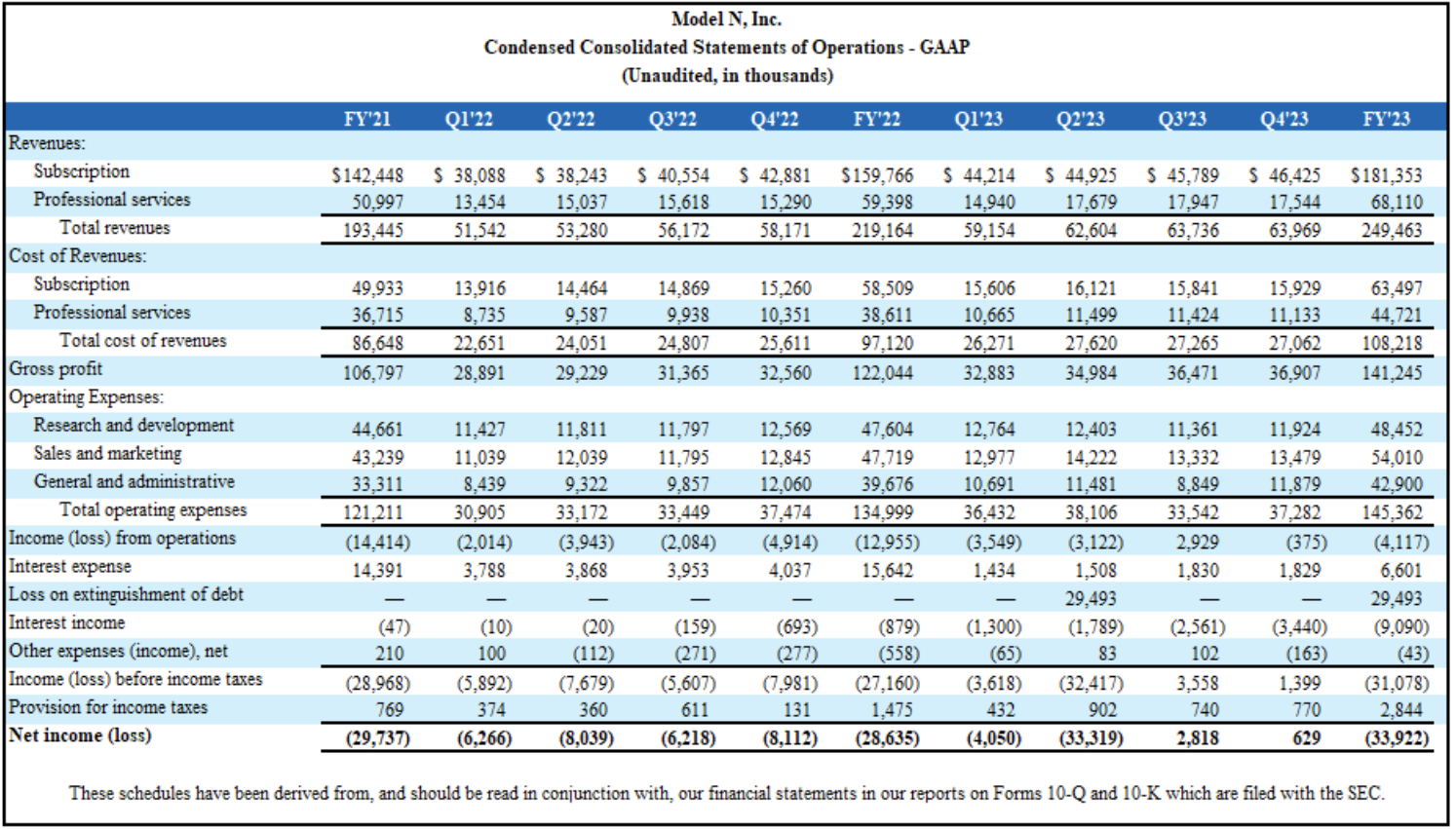

Model N's revenues come mainly from subscriptions to its software and services. The company has shown steady revenue growth, which is a positive sign for investors. However, it is important to note that profits can be affected by research and development costs, as well as administrative and sales expenses. Model N 's bottom line is close to the red (net margin of less than 1%), even though it began turning a profit this year for the first time in Q3 2023.

Source : Model N

Model N is positioned in a niche market. The company benefits from its loyal customer base in the life sciences and high-tech sectors, and its ability to offer integrated solutions that meet specific needs. Its focus on innovation and the adoption of artificial intelligence in its products could position the company favorably for the future.

However, its weak points should not be overlooked. Model N faces intense competition from other revenue management software providers such as behemoths Oracle and SAP. The network effect and scale are major assets in this sector. In addition, dependence on a few major customers (notably Johnson & Johnson, AstraZeneca, Stryker, Seagate Technology, Broadcom and Microchip Technology) could represent a risk if these customers decide to change supplier or reduce their spending. In addition, ongoing investment in R&D is necessary to remain competitive, and this may weigh on profit margins, which are already virtually non-existent.

Source: Model N

The management team is led by CEO Jason Blessing, who joined the company in 2019. He brings significant experience in technology and business leadership, which is crucial to driving Model N's growth strategy.

Model N is a small company offering sophisticated revenue management solutions with significant growth potential. Managing costs and improving profitability will remain key challenges for the company. It is important to weigh its strengths, such as its niche position in life sciences and semiconductors, against its weaknesses, such as intense competition and customer dependence, before making an investment decision.

By

By