Panorama of the Road Transport Sector

The trucking industry is segmented into three parts in the USA:

- Private fleets: This segment includes fleets owned and operated by shippers who transport their own goods. These fleets are generally not accessible to other customers and are optimized to meet the specific needs of the owner company (Amazon, Walmart, etc...).

- Full-load "package" carriers (truckload or TL). TL carriers handle large shipments, generally over 4.5 tons, transporting goods directly from origin to destination without intermediate handling. Due to their point-to-point business model, TL carriers generally have lower variable costs and do not require an extensive network.

- Less-than-truckload (LTL) "package" carriers: Unlike TL, LTL means that a company's goods do not occupy the entire truck. This segment involves the collection of several shipments from different customers, which are then routed through a network of distribution centers for delivery to their destination. This system requires significant investment to maintain a network of terminals, handling equipment and transport vehicles.

Old Dominion 's core business is LTL transport, which accounts for over 99% of its sales. This operation involves collecting shipments from various customers and routing them through its network of 255 service centers. These centers, located throughout the United States, are at the heart of Old Dominion's operational efficiency.

2023: a difficult year for the sector

In 2023, the less-than-truckload (LTL) freight sector experienced a significant contraction after the post-pandemic boom.

During the period of economic recovery following the health crisis, demand for LTL services had risen sharply, due to the need for companies to adapt to disrupted supply chains and more volatile consumption.

However, a decline in demand, coupled with rising operational costs, such as wages and fuel prices, has taken its toll on LTL carriers. According to Freight 360, while trucker revenues rose by 7% last year, costs climbed by 22%.

All these factors have created an imbalance between supply and demand, leading to a squeeze on margins.

The bankruptcy of Yellow Corporation, the country's third-largest player, enabled Old Dominion, in a year of oversupply, to recover sales and extend its influence in the territory.

Finance

With a market capitalization of $43 billion, Old Dominion Freight Line ranks as the second major player in the LTL transport market, just behind FedEx. The company boasts a price/earnings (P/E) ratio of 30.2x, reflecting a valuation in the upper range of the sector.

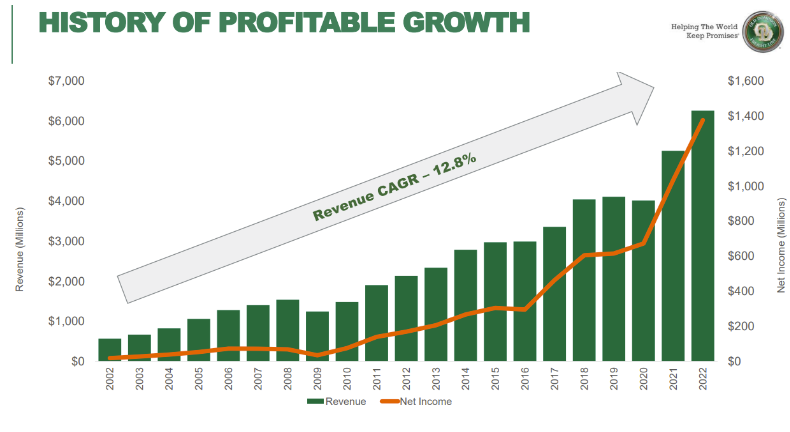

Old Dominion's average annual growth rate since 2002 stands at 12.8%, illustrating a trajectory of sustained growth over two decades.

In 2023, the company experienced a slight downturn, with sales of over $5.8 billion, marking a 6.3% decline on the previous year.

Despite this context, Old Dominion maintained exceptional net margins of 21.6%, well above those of its competitors. Over the past ten years, they have grown by more than 150%.

The company's return on equity (ROE) for 2023 was 31.3%, the highest in the sector, signalling remarkable efficiency in the use of invested capital.

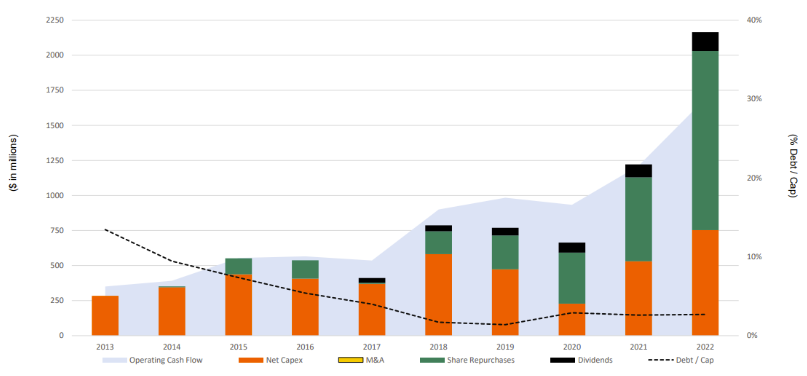

In terms of earnings per share, Old Dominion continues to reward its shareholders through a generous dividend and share buyback policy. In 2022, the company distributed $134 million in dividends and repurchased over $1.5 billion in shares.

In 2023, the company launched a new share buyback program of over $3 billion, spread over the next few years.

Use of company cash

Since 2013, $2.2 billion has been used to expand and improve its infrastructure, resulting in the addition of 40 new service centers (18% growth), and a 52% increase in the number of doors.

Management

Since its creation in 1934, Old Dominion Freight Line has been run by the Congdon family, who maintain an active presence on the Board of Directors and hold a significant 11.8% stake in the company. This family involvement is often seen as a guarantee of stability and long-term performance, a feature appreciated by investors.

ODFL's second managerial strength lies in the corporate culture established across all hierarchical levels.

This is characterized by an incentive-based compensation system, where bonuses for service center managers are closely linked to financial results and service quality.

Employees' commitment to Old Dominion is also evident: over 20% of their pension plan assets are allocated to the company's shares.

As a result, the Group boasts one of the lowest employee turnover rates in the industry, at just 10%. This figure is all the more impressive in that the workforce is non-unionized, allowing the company flexibility and low costs thanks to the absence of collective bargaining agreements.

Old Dominion, a MOAT

Barriers to entry in the LTL sector are significant, making it difficult for new entrants to establish themselves and compete effectively with established players like Old Dominion Freight Line. Unlike truckload (TL) freight, where initial investment can be relatively low, the LTL segment requires substantial capital investment to build and maintain an extensive network of distribution terminals, as well as to acquire specialized handling and transport equipment.

LTL freight terminals are key infrastructures that require sophisticated freight handling systems and a skilled workforce to operate efficiently. Thanks to decades of investment, Old Dominion's route-network density gives it a competitive edge today. Its star network system offers higher freight volumes and therefore lower fixed costs. And to be able to apply its price in a highly competitive market.

The year 2023 has not been an easy one for Old Dominion Freight Line, but the company has demonstrated its resilience by preserving margins and limiting the decline in sales. Quarterly results showed that the fourth quarter of 2023 performed better than the previous year, signalling the start of a recovery. Forecasts for 2024 point to slightly higher revenues than in 2022. Old Dominion continues to stand out as the most profitable company in its sector, generating cash flow that enables it to maintain its policy of redistribution to shareholders.

By

By