It holds a significant position in the truck sales industry, which contributes to 72% of its total sales (a growth of 27.9% compared to 2021). The company's truck brands, including DAF, Kenworth, and Peterbilt, enjoy a strong market presence. It also provides various services under its own brand, such as Powertrain, Financial Services, and Information Technology. One of its notable advantages is its ability to internalize a significant portion of its production, ensuring a high level of independence from suppliers, particularly in the truck segment.

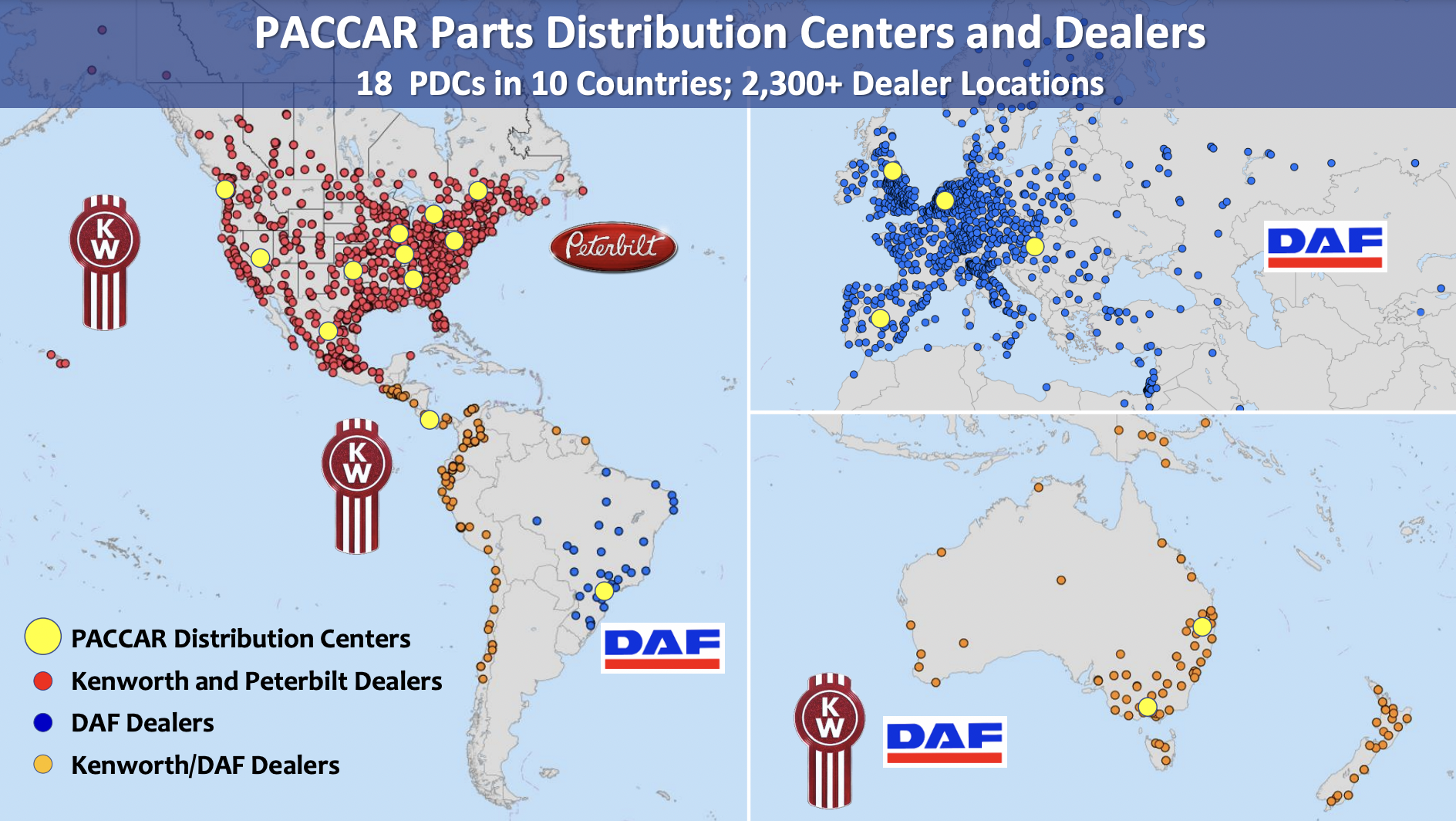

In addition to truck sales, Paccar's business encompasses accessory sales, accounting for 21% of total sales (a growth of 16.58% compared to 2021). This segment is supported by an extensive network of 18 distribution centers across 10 countries and over 2,300 dealer locations. The company's part sales have demonstrated a consistent compound annual growth rate (CAGR) of 8% since 2002. However, the financial services segment, constituting 7% of sales, experienced a decline of -10.81% compared to 2021.

Geographically, the group operates worldwide, with its major revenue sources being the United States (52.7% of sales), Europe (26.9%), and other regions (20.4%). Notably, the years 2021 and 2022 proved highly profitable for the company, with sales growth of +24.14% in the USA, +18.36% in Europe, and +23.83% in other regions.

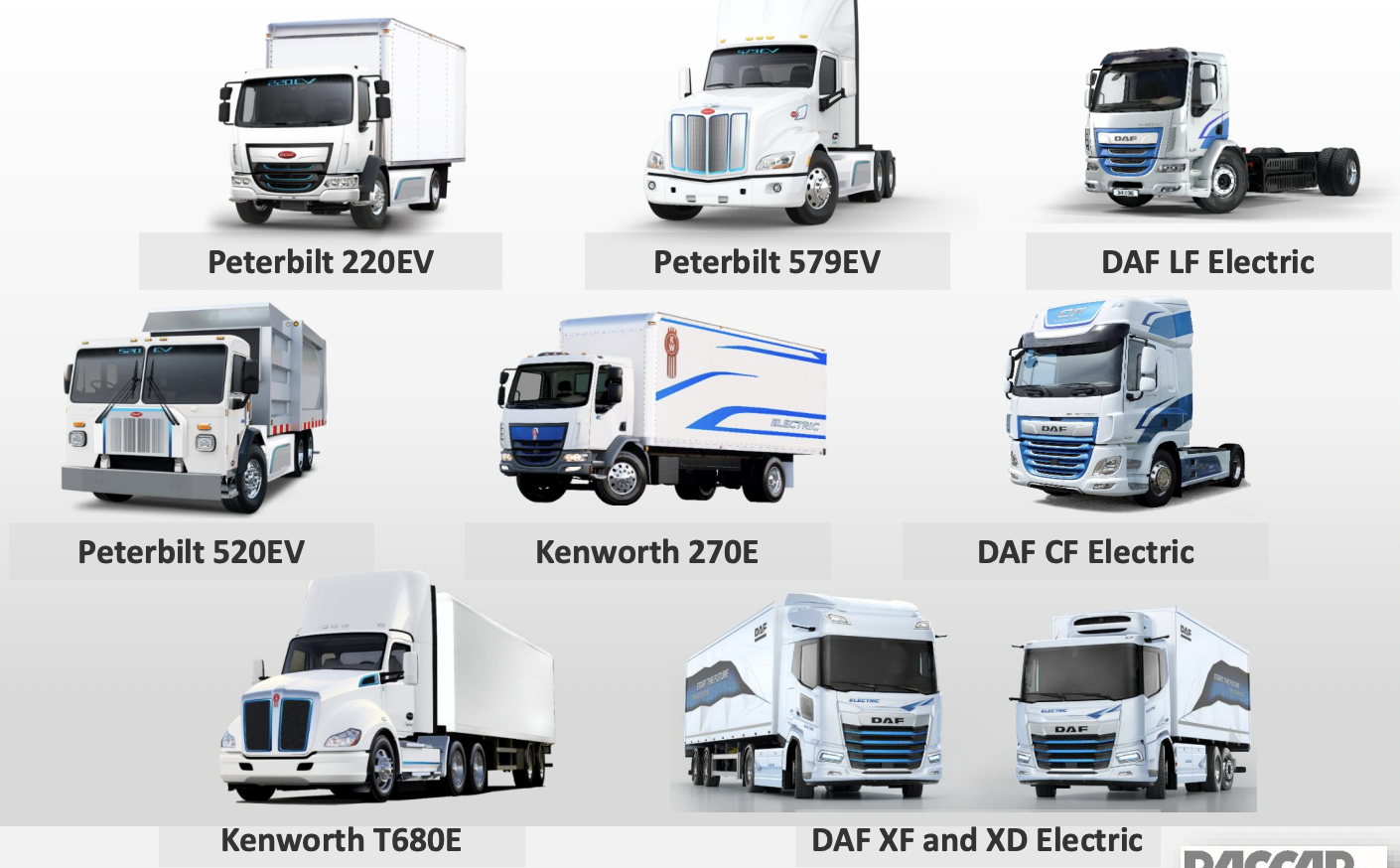

The automotive industry as a whole faces uncertainty that limit visibility, particularly concerning the transition to electric vehicles, which represents a significant disruption for the sector. Paccar has proactively anticipated this transition by offering nine battery electric vehicle models to its customers. Additionally, the company has partnered with Faith Technologies and Schneider Electric to provide charging infrastructure solutions for customers in the United States and Canada.

Moreover, the company has entered into a partnership with Aurora to conduct testing, development, and sale of autonomous vehicles, aiming to enhance safety and operational efficiency. This partnership involves renowned companies such as FedEx, Uber Freight, and Werner Enterprises, which contribute to the robustness of the testing process.

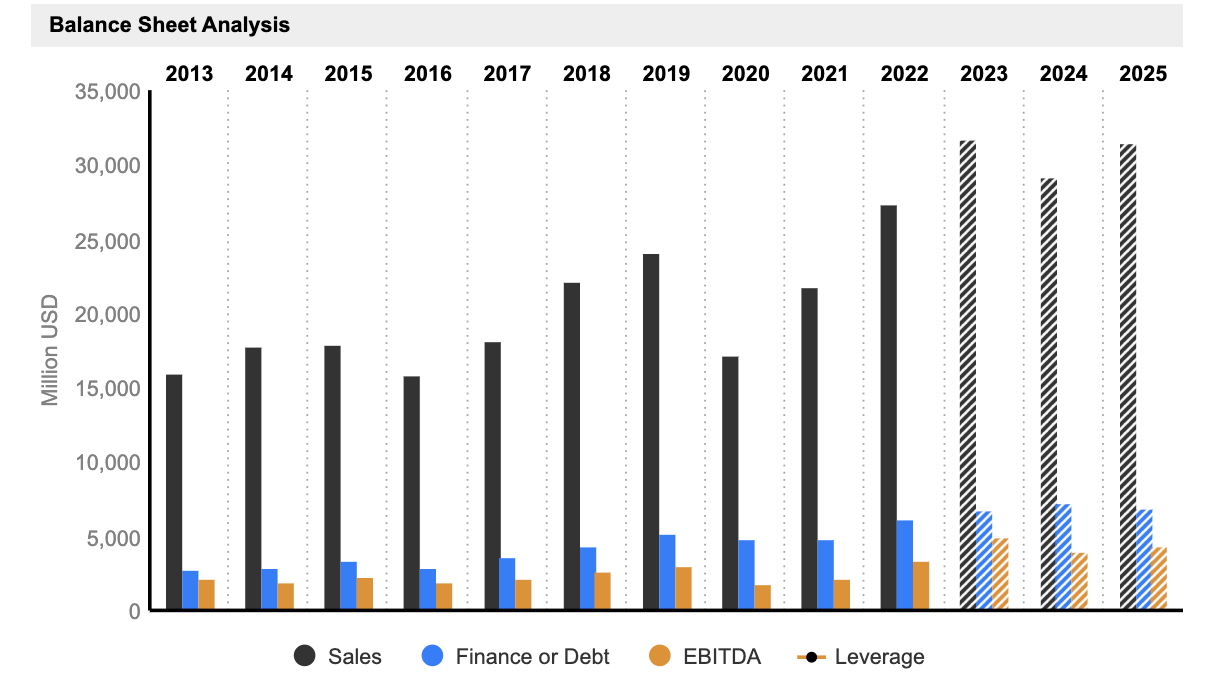

Its financial statements reflect a solid foundation resulting from its rigorous strategic approach. However, it experienced in 2020 a phase of normalization due to the adverse impact of the Covid-19 pandemic on international trade. Consequently, the company witnessed a decline in margins, EBITDA, net income, and sales, which was expected as declining sales typically lead to decreased margins in the manufacturing sector. Nevertheless, it has successfully rebounded, demonstrating its capacity to raise prices, as evidenced by the substantial 59.23% increase in sales between 2020 and 2022.

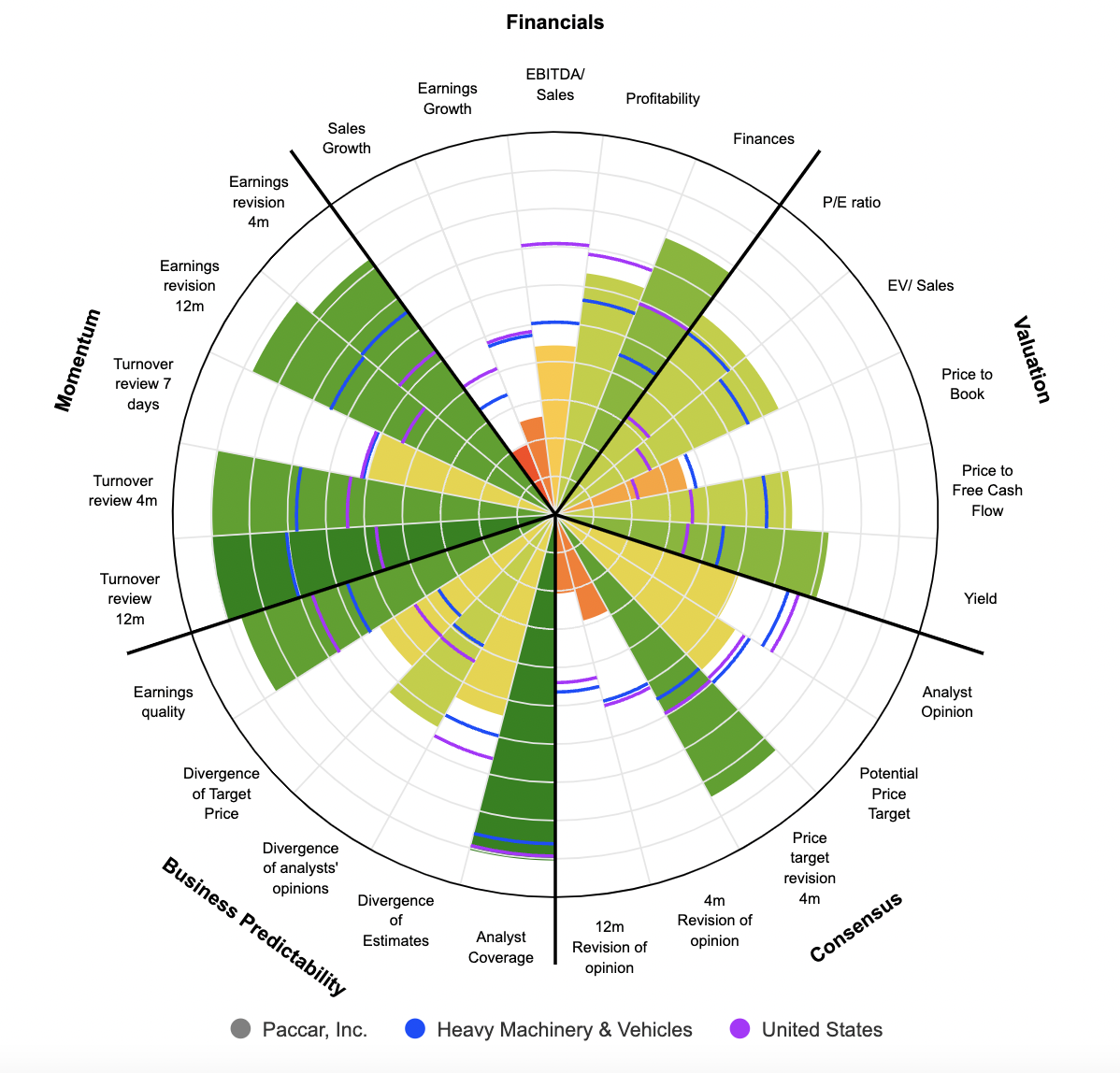

Looking ahead to the medium term, expectations align with the cyclical nature of the business. The fiscal year 2024 is likely to witness a downturn due to the projected economic slowdown. However, a rebound is expected in 2025, although not to the same margins achieved in 2023. Concurrently, the trajectory of free cash flow generation is projected to remain positive, with an expected FCF of $3.056 billion in 2025. Consequently, the enterprise value is estimated to reach 10.8 times cash earnings by that time. On average, transportation equipment manufacturers receive higher valuations than carmakers, and within this context, the group stands out as the best-valued company due to its profitable activities in industrial winches and spare parts.

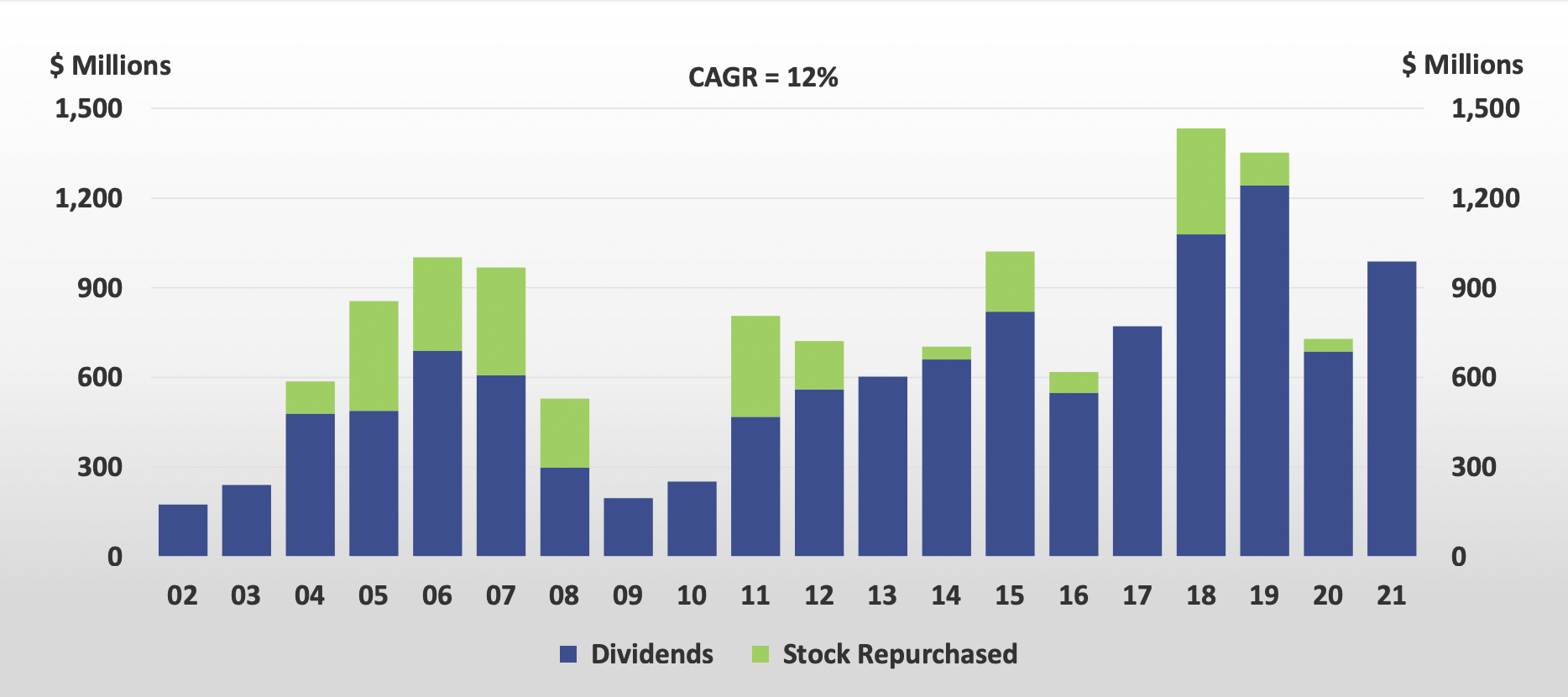

From an operational standpoint, the manufacturer has displayed good performance, with EBITDA and EBIT recording a CAGR of 7.6% and 8.6%, respectively, since 2017, while maintaining operating margins around 10%. Analysts anticipate a 27% increase in EBITDA to $4.3 billion by 2025, with operating margins projected to reach approximately 12.5%. The return on assets (ROA) has fluctuated between 7% and 9% since 2015 (excluding 2020-2021), but it is expected to reach 16.5% in 2023 before declining to 13.2% for 2024-2025. Similarly, the return on equity (ROE) has followed a similar trajectory as the ROA and is expected to reach 29.5% in 2023, decreasing to around 22% for 2024-2025. It is noteworthy that Paccar has been profitable for 83 consecutive years and has paid dividends every year since 1941.

In the first quarter of 2023, it has reported record revenues and excellent net income, with net sales of $8.47 billion (a growth of 30.91% YoY), EBITDA of $1.403 billion (a growth of 109.72% YoY), an operating margin of 16.1% (a growth of 65.3% YoY), and a net income increase of 61% (YoY +22.13%) to $734 million ($1.40 per diluted share).

Paccar, along with its competitors, operates in an environment that is characterized by uncertainties, thereby limiting visibility. The transportation sector is on the verge of undergoing significant transformations in the coming years. However, despite these challenges, its current valuation appears attractive. This assessment is based on several factors, including the company's strong fundamentals, robust business operations, and the targets set by analysts for 2025.

By

By